Want an easier way to protect sensitive data and meet privacy laws without heavy tech costs? Tokenization as a Service (TaaS) might be your solution.

In 2024, over 93% of companies faced at least one data privacy regulation. More than 60% are planning to invest in tokenization services and data security tools this year. The demand for tokenization finance is rising.

In this guide, you’ll learn how Tokenization as a Service works, where it’s used, why it matters, and how it can protect your digital operations now and into the future.

What Is Tokenization as a Service (TaaS)?

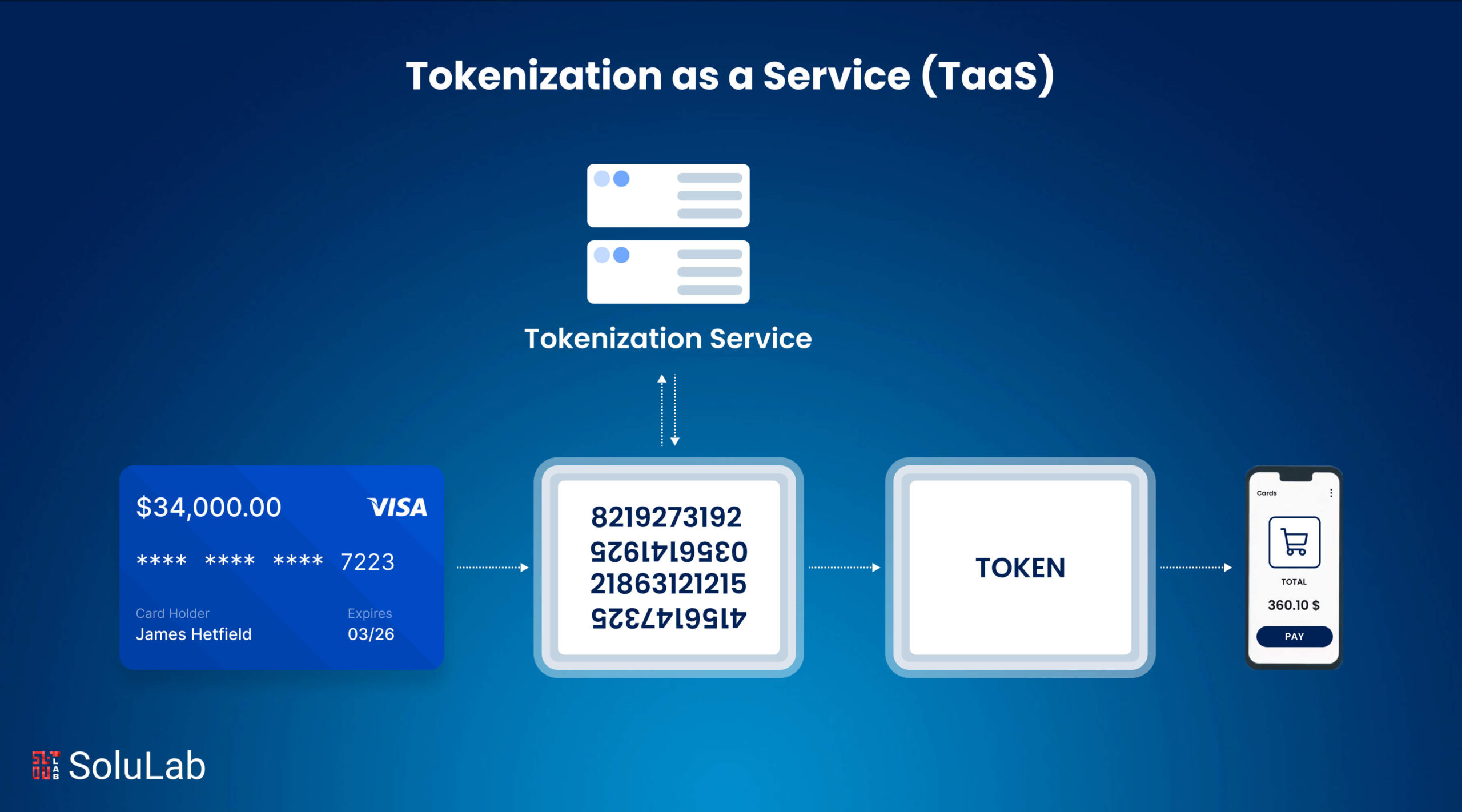

Tokenization as a Service (TaaS) is a simple, cloud-based solution that helps businesses protect sensitive data. It works through APIs to turn private information like credit card numbers or names, into special codes called tokens. These tokens look like real data but are useless if stolen. This keeps the data safe while still letting systems use it for day-to-day operations.

At the core of TaaS is a system that swaps real data for tokens. These tokens can’t be turned back into real information unless someone has access to a secure token vault. This makes data security stronger, especially in areas like compliance, digital payments, and customer privacy.

How Is TaaS Different from Traditional Tokenization?

Old methods of tokenization often needed businesses to build their own systems, manage hardware, and keep up with security rules. That took time, money, and technical skill.

Tokenization as a Service, on the other hand, is outsourced and cloud-based. You don’t need to build anything from scratch. It’s easy to set up, works with your existing systems, and keeps up with compliance requirements automatically. That means lower costs and faster results.

| Feature | Tokenization as a Service (TaaS) | Traditional Tokenization |

| Infrastructure | Fully cloud-native, no hardware required | On-premises setup, complex infrastructure |

| Deployment Speed | Rapid deployment with ready-to-use APIs | Slower setup with manual configurations |

| Scalability | Instantly scales with your business | Limited scalability, hardware dependent |

| Cost Efficiency | Lower upfront cost, flexible pricing | High setup and maintenance costs |

| Compliance Updates | Auto-updated to meet the latest regulations | Requires manual audits and updates |

| Maintenance & Support | Handled by expert TaaS providers like SoluLab | Requires in-house teams and expertise |

| Ease of Integration | Simple API/SDK-based integration | Complex and resource-heavy integration |

| Security Standards | Uses modern vaults, encryption, and access controls | Varies, may lack the latest protections |

| Innovation Potential | Built for AI, Web3, and multi-cloud compatibility | Hard to adapt to modern digital needs |

| Long-Term Flexibility | Designed to evolve with your tech stack | Rigid systems, difficult to upgrade |

Why Is TaaS Becoming So Popular in 2025?

Today, businesses face growing threats from data breaches and new rules like GDPR and PCI DSS. At the same time, more companies are moving to cloud-native platforms and apps.

Because of this, Tokenization as a Service is becoming a smart and affordable choice for managing sensitive data. It’s especially useful in fast-moving industries like e-commerce and healthcare, where safety, speed, and flexibility are key. It is also helping accelerate the adoption of tokenization in financial services.

How Tokenization as a Service Works?

Tokenization as a Service (TaaS) simplifies the process of converting real-world assets into digital tokens on the blockchain. Businesses choose the asset, and the TaaS provider handles everything—from smart contract development and compliance checks to secure token issuance and integration with digital wallets or trading platforms. This plug-and-play model allows you to tokenize assets quickly, securely, and at scale, without needing deep blockchain expertise.

Key Components of a TaaS Platform

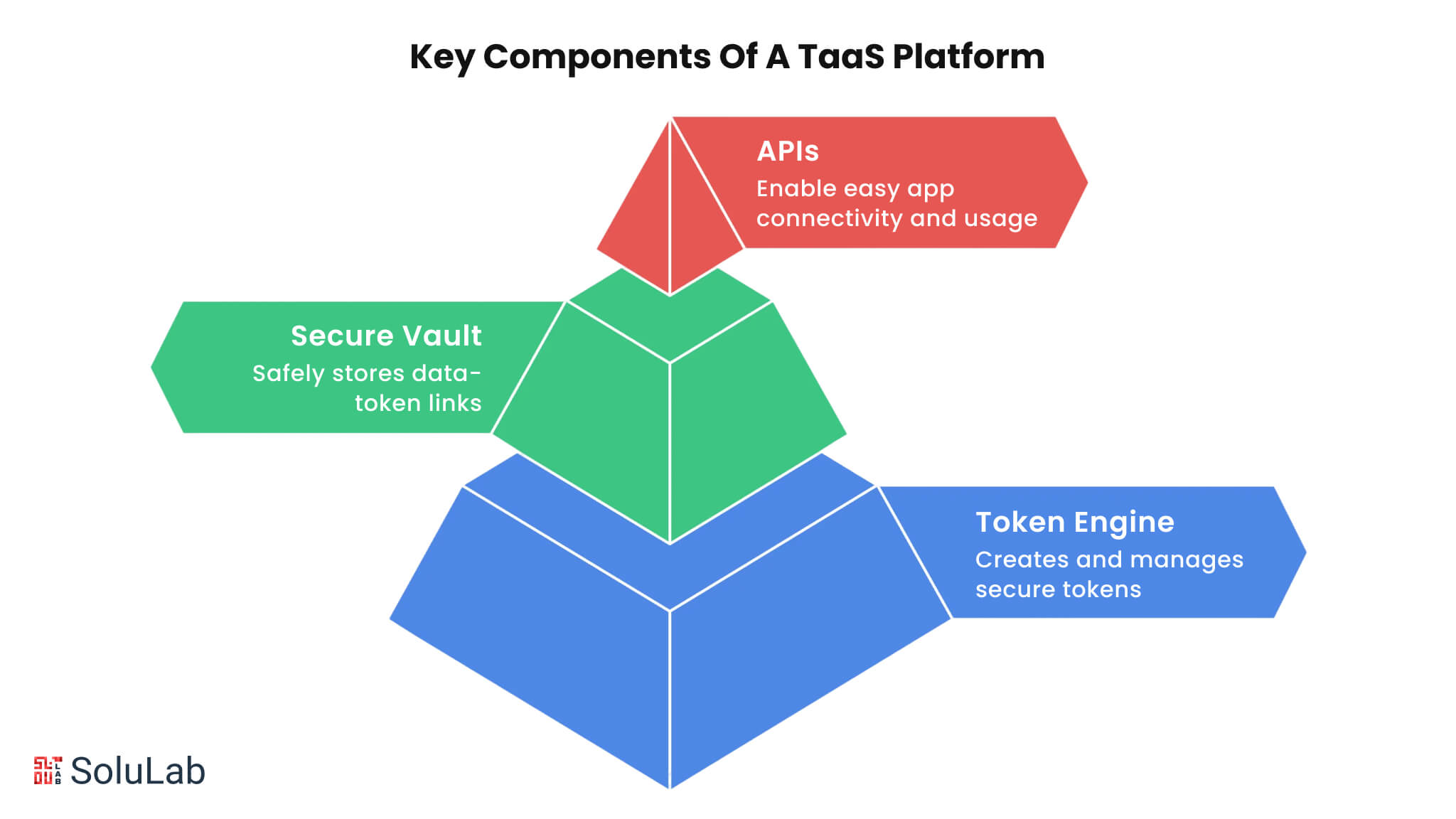

A good Tokenization as a Service platform has three main parts:

- Token Engine – This creates and manages secure tokens.

- Secure Vault – This stores the link between the real data and the token safely.

- APIs – These let different apps connect and use the system easily.

These tools work together to keep your data safe and meet compliance standards across different networks and tokenization platforms.

Data Flow and Token Generation

Here’s how the tokenization process works step-by-step:

1. Data is sent through secure APIs

2. It gets turned into a token using encryption

3. The token and real data are stored in a secure token vault

4. Only approved users or apps can access the real data

This setup helps businesses meet rules like PCI DSS, GDPR, and other data security laws. Tokenization frameworks ensure this entire process is modular and secure.

API Integration and Deployment Options

Tokenization as a Service is designed to be flexible and easy to use. Tokenization platforms often offer:

- REST APIs – Simple tools for connecting apps quickly

- SDKs and middleware – For easy setup with different software

- Deployment choices – Run on-premises, in the cloud, or both

These options make it easy for companies to protect data in real time, grow quickly, and stay compliant with privacy rules.

Use Cases of Tokenization as a Service

Tokenization as a Service enables businesses to digitize and trade real-world assets with ease. Common use cases include:

-

Payment Data Security

With Tokenization as a Service, businesses can safely replace credit card numbers with tokens right when the data is collected. This lowers their PCI DSS requirements and makes regulatory compliance easier and cheaper to manage.

-

Healthcare and HIPAA Compliance

In healthcare, TaaS helps protect private patient data (PHI) by turning it into secure tokens. This keeps information safe and still easy to access, helping organizations follow HIPAA rules without hurting the patient experience.

-

Tokenization in Cloud and SaaS Applications

Cloud-native and SaaS businesses can use TaaS to protect user data without changing how their apps work. It adds strong data security without slowing down development or complicating systems.

-

Blockchain and Digital Assets Tokenization

Using tokenization services on the blockchain makes it easier to buy, sell, or own parts of things like real estate, art, or digital collectibles. It improves liquidity and lets more people invest through fractional ownership. This includes RWA tokenization of traditional physical assets.

Read Also: Silver Tokenization Platform Development

Benefits of Tokenization as a Service

Tokenization as a Service offers a fast, secure, and scalable way to digitize assets. It reduces time-to-market, lowers development costs, enhances asset liquidity, enables fractional ownership, and ensures regulatory compliance—all without needing deep blockchain expertise. Some of them are:

-

Enhanced Security and Compliance

TaaS helps protect sensitive data using strong encryption, access controls, and a secure token vault. This boosts data security and makes it easier for businesses to meet compliance rules in different countries.

-

Scalability for Enterprises

TaaS platforms are designed to handle millions of transactions at once. This means businesses can grow fast without slowing down or facing system issues.

-

Reduced PCI DSS Scope

By using TaaS, companies don’t need to store sensitive information themselves. This lowers their PCI DSS compliance requirements and reduces the risk of data leaks.

-

Faster Setup and Lower Costs

TaaS is easy to set up and doesn’t need heavy tech infrastructure. It cuts down development time and costs, letting businesses focus on what they do best. You can rely on a token development company or asset tokenization development company to support integration and scaling.

Key Players and Platforms Offering TaaS

Some of the top companies offering enterprise-ready Tokenization platforms include:

1. AWS and Azure-based solutions

2. Microsoft Azure

3. Stripe

4. Very Good Security (VGS)

5. TokenEx

These providers offer strong data security, reliable performance, and help with compliance standards like PCI DSS and GDPR.

Open-Source vs Proprietary Solutions

There are two main types of tokenization frameworks:

- Proprietary solutions (like Stripe or VGS) give you full support, better security, and ongoing updates.

- Open-source platforms are more flexible and often lower in cost, but they require more setup and tech skills.

How to Choose the Right TaaS Provider?

When picking a platform, look at:

- Compliance support (like PCI DSS and GDPR)

- Easy API integration

- Flexible deployment (on-prem or cloud-native)

- Cost and ability to grow with your business (scalability)

Choose a provider that fits your needs today and can scale as you grow. A reliable token development company can help you evaluate each option.

Read Also: AI Tokenization For Asset Ownership

Regulatory and Compliance Considerations

Tokenization must align with local and international regulations. Key considerations include:

-

GDPR and Data Privacy

TaaS helps businesses follow GDPR rules by reducing how much personal data they collect and store. It supports privacy by design, which means privacy is built into every step of your process.

-

PCI DSS Requirements

With Tokenization as a Service, sensitive payment data is stored securely by the provider, not your system. This makes PCI DSS compliance easier and lowers your security risks.

-

Regional Compliance Challenges

Each country has its data privacy laws. TaaS gives you flexible tools to meet different compliance needs across industries and regions, especially where tokenization in financial services is in focus.

The Future of Tokenization as a Service

Tokenization as a Service is set to revolutionize asset ownership, making markets more accessible, liquid, and efficient. As blockchain adoption grows, TaaS will drive innovation across real estate, finance, and supply chains, offering seamless integration, cross-border compliance, and broader investor participation.

-

AI-Powered Tokenization

New TaaS platforms are using artificial intelligence to automate token generation and assess risks in real-time. This makes systems smarter and more secure, especially when these AI insights are fed directly into a centralized SIEM for holistic threat management.

-

Evolving Regulatory Standards

Data protection laws are always changing. Top TaaS providers stay updated on compliance across different regions and help your business keep up.

-

Interoperability Across Platforms

Future-ready systems will support token exchange between Tokenization platforms. This makes it easier to integrate TaaS across your tech stack.

Conclusion

Tokenization as a Service gives you a secure, flexible, and low-cost way to protect sensitive data. It works well for industries like eCommerce, healthcare, and tokenization in financial services where data security and compliance are a must.

SoluLab, a leading name for tokenization platform development, is a professional service provider with a proven track record. The team of financial and blockchain experts is working 24/7 to render market-driven solutions. Not just development, there are consulting and strategy development experts to analyze your business for successful yet easy integration.

Looking to add AI agents or smart automation to your online store? SoluLab can help you set up easy!

FAQs

1. What kinds of assets can my business tokenize?

Almost anything of value can be tokenized: real estate, commodities, intellectual property, equity, invoices, and even loyalty points or revenue streams.

2. Who should use Tokenization as a Service?

Ideal for e-commerce, healthcare, finance, and cloud-native apps handling private or payment data.

3. Is TaaS easy to integrate?

Yes, most providers offer simple API integration that works with both old and new systems.

4. Can Tokenization as a Service support large enterprise workloads?

Yes. Most modern tokenization platforms scale for enterprise-level needs with the help of an experienced asset tokenization development company.

5. Can small or medium businesses use Tokenization as a Service?

Absolutely. TaaS is scalable and cost-effective, making it ideal for startups, SMEs, and enterprises looking to digitize and monetize assets efficiently.