- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

What if you could invest in diamonds sitting at home with the same ease and speed as doing online shopping?

Yes… It’s happening!

In today’s fast-paced digital economy, diamond tokenization is coming up as a game-changing investment opportunity. By converting real, certified diamonds into digital tokens on a blockchain, this innovation allows investors to own fractional shares of precious gems, without actually needing to store or trade them physically.

As the demand for alternative, asset-backed investments grows, after gold tokenization, tokenized diamonds are drawing attention for their transparency, security, and accessibility. In this blog, we’ll explore how diamond tokenization works, why it’s gaining traction among investors, and what makes this sparkling new asset class worth watching.

Let’s begin!

Why Do Diamonds Need Tokenization?

The diamond business has long been perceived as elite, dominated by high-net-worth people, premium brands, and closely set dealer networks. While diamonds have inherent worth and cultural importance, the investing experience has not even changed with the times. Trust gaps, inefficiencies, and access concerns make diamond investment difficult and hazardous for the typical investor. That is precisely why tokenization has become a game-changing solution.

Blockchain technology is breaking down the obstacles that earlier made diamond investment difficult, allowing individuals all across the world to invest in tokenized diamonds with confidence, security, and transparency.

Here’s why the conventional diamond market needs tokenization more than ever:

- Lack of Standardization: Unlike gold and silver, diamonds do not have a standard price formula. Tokenization generates uniform value frameworks based on recognized grading reports, increasing investor clarity and confidence.

- Opaque Supply Chain: A diamond’s journey from mine to showroom might be difficult to follow due to its opaque supply chain. Blockchain-based tokens provide traceability and evidence of provenance, therefore preventing conflict diamonds from entering the market.

- Unreliable Resale Market: Selling a diamond without experiencing significant price decreases or hidden costs is difficult. Tokenized assets, on the other hand, provide a more efficient exit strategy via P2P marketplaces or DeFi-based platforms.

- No Real-Time Market Access: Traditional diamond markets do not function in real time, and information is sometimes outdated or difficult to get. Tokenization transforms diamonds into digital assets, allowing pricing, demand, and transactions to be tracked in real time.

- Custody & Insurance Hassles: Keeping physical diamonds requires dealing with storage, insurance, and theft issues. With diamond tokenization services, these responsibilities are transferred to certified custodians while investors retain safe digital evidence of ownership.

- Exclusivity vs. Inclusivity: Until now, diamond investing was restricted to individuals with enormous resources. Tokenization reverses the concept, allowing ordinary investors to enter previously untapped territory and invest in tokenized diamonds without any hassle.

How Does Diamond Tokenization Work?

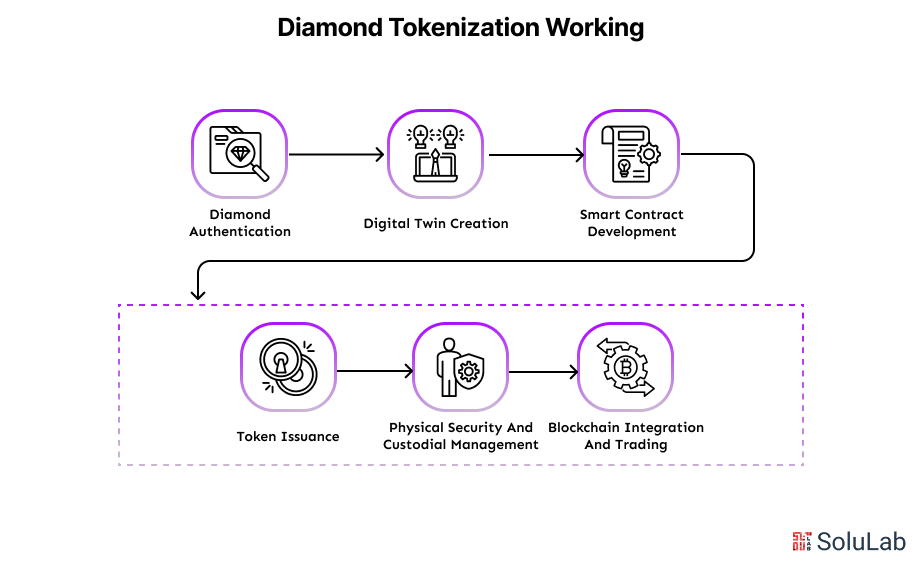

Tokenizing a diamond encompasses more than just affixing a digital identifier to a tangible gemstone. It is a safe, multi-faceted procedure that integrates professional authentication, sophisticated imaging, and blockchain technology to create a reliable digital asset. From physical vaults to digital smart contract development, each phase is engineered to preserve the diamond’s integrity while facilitating ownership, trading, and investment.

Let’s walk through the entire diamond tokenization procedure:

1. Diamond Authentication

The procedure starts with the authentication of the diamond’s validity. Prominent gemological organizations such as GIA (Gemological Institute of America) and IGI (International Gemological Institute) do comprehensive assessments based on the 4Cs—Carat, Cut, Color, and Clarity. In addition to laboratory certification, professionals conduct a physical check to verify the absence of inconsistencies. Each diamond is thereafter allocated a distinct identification number, serving as its digital fingerprint all over the tokenization process.

2. Digital Twin Creation

Upon authentication of the actual diamond, a digital twin is created. This includes:

- 3D scanning of the diamond to create an exact virtual copy.

- Acquiring high-resolution photos and details, including shape, grading data, and origin.

- Documenting all relevant information, including certification and history, inside a secure system.

- Issuing authentication certificates that validate the digital twin’s association with the physical diamond.

- The digital twin assures that each token is explicitly linked to an individual diamond with transparent, verifiable information.

3. Smart Contract Development

The blockchain layer is now implemented. A smart contract is programmed to delineate the behavior of the tokenized asset. This contains:

- Provenance tracking to demonstrate the whole ownership history.

- Protocols for ownership transfer facilitate smooth P2P transactions.

- Security measures that safeguard against fraud or illegal modifications.

- Custodial arrangements specify the location of the physical diamond and its management protocols.

These smart contracts function as the regulatory framework, ensuring that transactions are carried out automatically, clearly, and enforceably.

4. Token Issuance

Upon the implementation of a smart contract, a digital token is generated on the blockchain. The main elements of this phase are:

- Choosing a token standard such as ERC-721 (non-fungible) or ERC-1155 (semi-fungible) according to the investment model.

- Associating the token with its information, including diamond specifications, photos, and certifications.

- Enabling digital signatures for safe traceability.

- Registering the token on NFT marketplace platforms, preparing it for trade or investment.

The token now serves as a digital certificate of ownership for the underlying diamond.

5. Physical Security and Custodial Management

The tokens are exchanged digitally, but the real diamonds are securely stored in insured vaults monitored around the clock. These fortified establishments offer:

- Third-party verification to confirm the existence of the diamond and its correspondence with the token data.

- Asset-backed insurance protects the value of the diamond against theft or damage.

This ensures that your diamond-backed cryptocurrency token is consistently linked to a tangible, safely held item.

6. Blockchain Integration and Trading

The currencies are ultimately implemented on prominent blockchain networks like Ethereum, Polygon, or Solana, contingent upon considerations including scalability, gas costs, and compatibility. Investors may transact these tokens on dedicated markets, and systems may provide fractional ownership, enabling the acquisition of a share in a high-value diamond without requiring a substantial financial outlay.

Thus, diamond tokenization converts a premium asset into a liquid, safe, and accessible investment. It is a harmonious integration of tangible assets and digital advancements, facilitating a more inclusive diamond economy.

How Blockchain-Based Tokenization Transforms Diamond Investing?

Tokenization enables diamonds to be accessed, held, and sold as digital assets—swiftly, transparently, and securely. Being able to buy tokenized diamonds is solving issues and transforming wealth accumulation through precious stones, regardless of whether one is an experienced investor or just starting.

Here’s how this transformation of diamond tokenization is taking place:

- Democratized Investment Access: Tokenization enables anyone to invest in fractionalized diamonds, eliminating the necessity to purchase a whole stone, with investments beginning at only a few dollars.

- Perpetual Marketplaces: In contrast to conventional jewelers or auction houses, tokenized diamonds may be transacted continuously on blockchain systems, offering unparalleled flexibility and simplicity.

- Immutable Ownership Verification: Each transaction is permanently documented on-chain, providing purchasers with incontrovertible proof of ownership and minimizing the likelihood of disputes.

- Portfolio Diversification: Investors may now incorporate diamonds into their digital portfolios alongside stocks, cryptocurrencies, and real estate, facilitating a balance between conventional assets and contemporary investments.

- Augmented Trust via Audits: Verified third-party certifications and routine audits are included in token information, enabling investors to trust their purchases without requiring expertise in gems.

- Seamless Estate Transfer: Digital tokens facilitate the transfer of ownership across generations or accounts, eliminating the need for tedious documentation or appraisal delays.

Read Also: Tokenized US Treasury Platform Development

The Perks of Investing in Tokenized Diamonds

Diamonds have long been considered a store of value, but most people cannot afford them due to their high price, complex pricing, and storage problems. Currently, diamond investment is entering the contemporary age through blockchain-enabled tokenization.

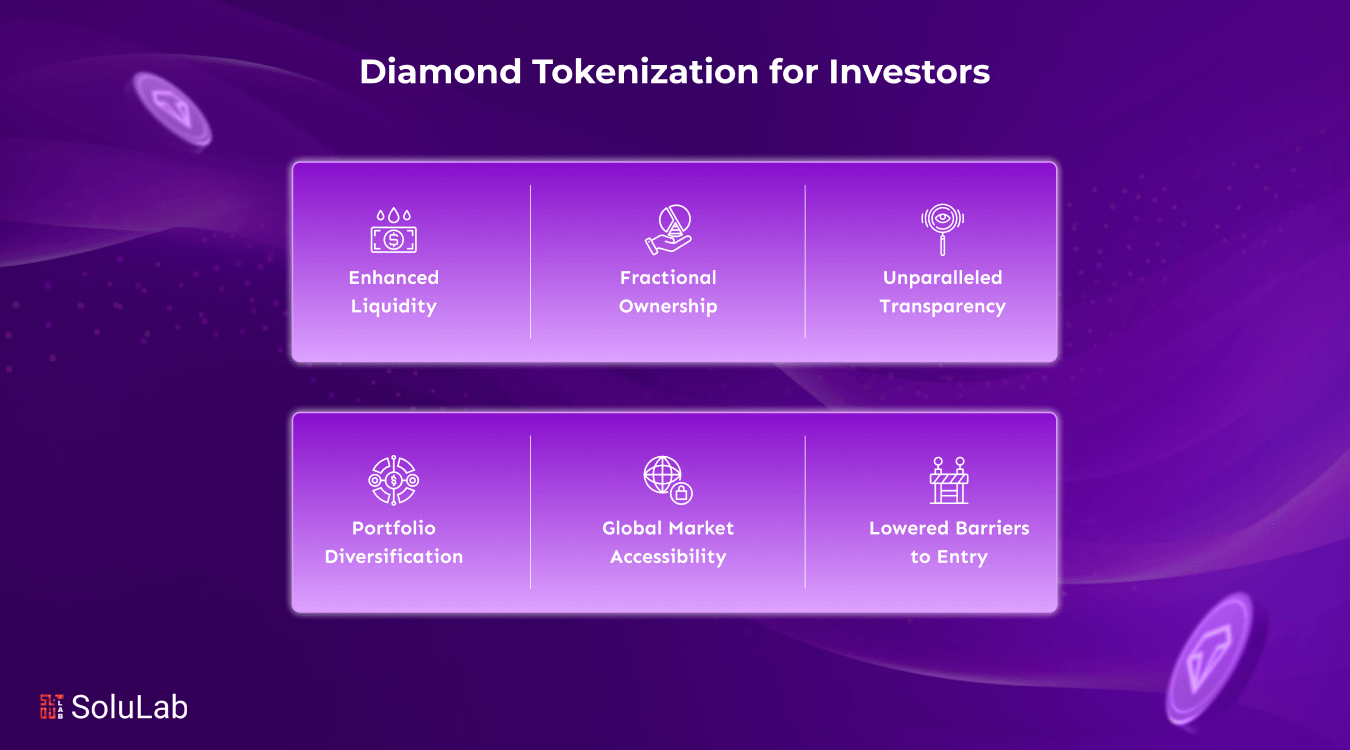

Here are some standout benefits of diamond tokenization:

- Facilitates Micro-Investment in Luxury Assets

Tokenization enables investment in micro-shares of high-value diamonds, allowing individuals to incrementally accumulate wealth in luxury goods, much like purchasing fractional shares of blue-chip stocks.

- Integrated Liquidity Pools for Instant Liquidation

Certain platforms include integrated liquidity pools that facilitate immediate buybacks or peer-to-peer transactions, allowing you to liquidate your tokens at your discretion without awaiting a buyer.

- Real-Time Asset Valuation and Pricing Data Streams

Blockchain oracles and sophisticated connections enable tokenized diamonds to be connected to real-time market data, providing dynamic values rather than obsolete evaluations.

- Verification of Carbon Offsetting and Ethical Sourcing

As environmental and ethical concerns escalate, blockchain facilitates the certification of ethically sourced diamonds, enabling eco-conscious investors to match their portfolios with their principles.

- Facilitated Collateralization for Decentralized Finance Loans

Upon tokenization, diamonds may serve as collateral for cryptocurrency loans or DeFi lending platforms, facilitating liquidity without the necessity of liquidating the physical asset, an impossibility under conventional diamond ownership.

- Potential of Gamification and Collectibles

NFTs and diamond tokens provide gamified experiences, diamond-backed collectibles, and branded luxury experiences associated with ownership, adding an emotional and engaging dimension to investing.

- Effortless Inheritance and Digital Bestowing

Diamond tokens provide seamless transfer to heirs, cross-border gifting, and division among numerous beneficiaries, hence streamlining legacy planning and personal asset transfers.

Tokenization is revolutionizing investment by converting diamonds into programmable, shareable, and tradable digital assets, therefore altering our interaction with value itself.

Future of Diamond Investment Through Tokenization

The future of diamond investing is undeniably digital. Diamonds are no longer only luxury items as blockchain technology develops; they are becoming dynamic, tradeable financial tools. Being able to invest in tokenized diamonds just as readily as one might in equities or cryptocurrency appeals to investors all over.

The rising need for transparency, liquidity, and fractional ownership drives diamond asset-backed tokens to take the front stage in diverse investment portfolios. Offering both security and flexibility—qualities modern investors yearn for—they link timeless real assets with innovative digital finance.

Tokenization platforms should be used more broadly, institutional engagement should increase, and even incorporation into DeFi ecosystems should result as legal clarity increases and tokenization platforms develop. One digital token at a time is turning a formerly elite, illiquid market into a borderless, easily accessible asset class.

Conclusion

As the investment structure is evolving in 2026, tokenized diamonds are emerging as a compelling asset class. Their ability to combine the timeless value of diamonds with the leading-edge potential of blockchain solutions makes them an attractive option for investors seeking liquidity, transparency, and diversification. As the market continues to grow, it’s clear that tokenized diamonds will play a pivotal role in the future of digital investment portfolios.

At SoluLab, a top asset tokenization development company, we specialize in providing custom solutions that empower businesses to capitalize on the growing tokenization trend. From smart contract creation and blockchain integration to secure platforms for trading tokenized assets, SoluLab provides tailored solutions that align with your unique business goals.

Whether you’re a jeweler, investor, or startup aiming to launch a diamond-backed token, SoluLab delivers the technical expertise and strategic guidance to bring your vision to life. Let’s connect!

FAQs

1. Why are investors interested in tokenized diamonds?

Tokenized diamonds provide a new approach to gain access to a formerly restricted asset class. They provide fractional ownership, high liquidity, transparent pricing, and secure blockchain-based records, which appeal to both individual and institutional investors.

2. How can I invest in tokenized diamonds?

To invest in tokenized diamonds, purchase diamond-backed tokens from a reputable tokenization platform or launchpad. These tokens are often sold on blockchain exchanges, where investors may purchase full or partial ownership with fiat or cryptocurrency.

3. What is the minimum investment required in tokenized diamonds?

Fractional ownership makes diamond investing more accessible than traditional diamond investing since it allows investors to begin with a significantly smaller initial investment than what is needed to buy an entire diamond.

4. How liquid are tokenized diamond investments?

There is a lot more liquidity than with conventional diamond investing. Investors have the freedom to acquire or sell tokens as needed because they can be sold on supported marketplaces.

5. Can my token be redeemed for the physical diamond?

In most circumstances, the answer is yes. Some systems allow users to swap their digital tokens for genuine diamonds, subject to conditions like minimum holding periods, KYC compliance, and custody verification. Always verify with the tokenization platform development company before investing.

6. How to tokenize diamond assets?

To tokenize diamond assets, a physical diamond is first verified and appraised, and then its details are recorded on a blockchain. A smart contract is created to issue digital tokens representing ownership or shares of the diamond, allowing investors to buy, sell, or trade these tokens securely.