Crypto derivatives are growing faster than ever, and startups need to act now. Decentralized Perpetual Exchange platforms, or perpetual DEX platforms in decentralized finance, are changing how derivatives are traded. They let founders and builders create scalable, efficient, and fully decentralized trading platforms without relying on traditional exchanges.

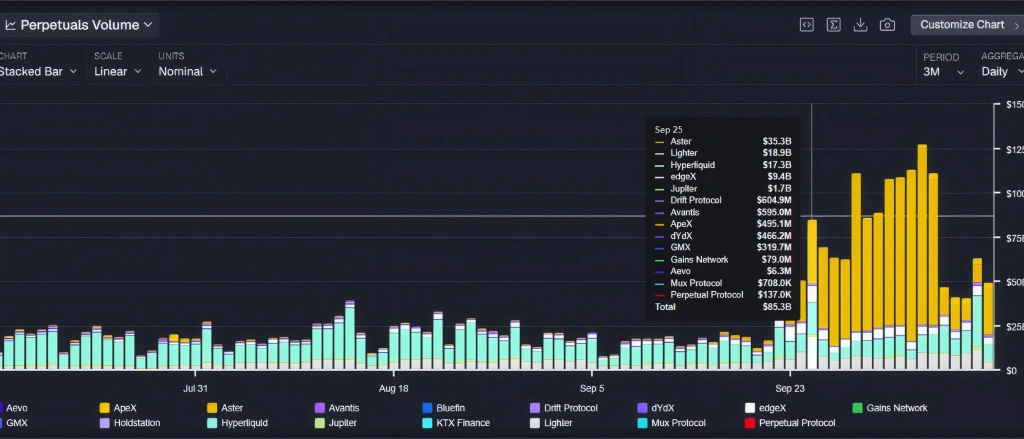

In Q2 of 2025, the total perpetual trading volume on DEXs hit about $898 billion, marking a record high.

For businesses exploring perpetual dex crypto projects, these platforms provide transparency, efficiency, and a competitive edge in the evolving crypto derivatives market. Let’s delve deeper to know more!

What is a Perpetual DEX?

A Decentralized Perpetual Exchange is a blockchain-based platform that enables users to trade perpetual contract derivatives without expiry dates. Unlike traditional spot trading, where assets are exchanged directly, perpetual DEXs allow traders to take leveraged positions while retaining full control over their wallets.

These platforms operate on smart contracts, eliminating the need for centralized custodians. This decentralized approach enhances security, transparency, and accessibility, creating a truly open environment for derivatives trading.

Notably, platforms like Hyperliquid have seen substantial volume surges. Before its token generation event in November 2024, Hyperliquid processed between $25 billion and $35 billion in monthly volume. Post-event, its monthly volume has ranged between $160 billion and $315 billion.

This surge in popularity underscores the growing demand for decentralized, non-custodial trading solutions in the crypto derivatives market. Even the Founders of CEX are building their own Perp DEX.

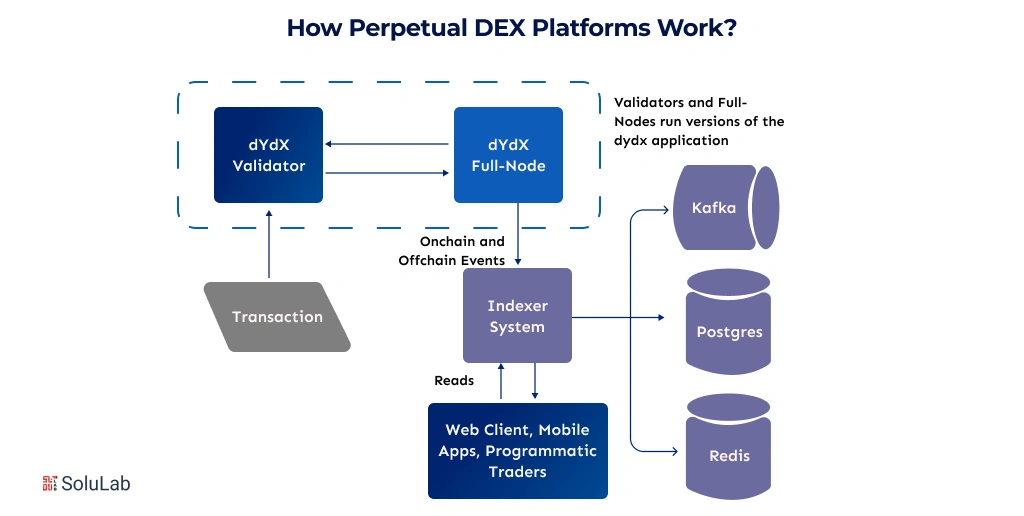

How Perpetual DEX Platforms Work?

Understanding how Perpetual DEX platforms operate is essential for businesses aiming to enter the decentralized finance space and capture value from crypto derivatives. Here’s a detailed breakdown of their key mechanisms:

1. User Deposits Collateral

At the foundation of any perpetual dex crypto platform is collateral management. Traders deposit digital assets, typically stablecoins like USDC or Ethereum (ETH), which serve as security for their positions.

- Collateral ensures that traders can enter leveraged positions safely without relying on centralized entities.

- Businesses benefit from transparent on-chain custody, minimizing counterparty risk.

- Leading platforms, such as dYdX and GMX, report that over $1.5 billion in collateral is locked across perpetual contracts at any given time, demonstrating significant liquidity potential.

2. Smart Contracts Issue Perpetual Positions

Once collateral is deposited, smart contracts automatically create perpetual positions for users. Unlike traditional derivatives, these contracts never expire, allowing traders to hold positions indefinitely.

- Non-custodial smart contracts remove the need for intermediaries.

- The contracts encode all rules for margining, funding, and liquidation, ensuring transparent and automated risk management.

- This automation allows platforms to scale efficiently, handling thousands of simultaneous trades without human intervention.

3. Dynamic Funding Rates

Perpetual contracts maintain alignment with the underlying asset prices through dynamic funding rates.

- Funding rates are periodic payments between long and short position holders.

- If the perpetual contract trades above the index price, longs pay shorts, and vice versa.

- This mechanism ensures that perpetual contracts closely track the spot market, preventing price divergence.

On platforms like dYdX, funding rates can adjust every 8 hours, and misalignment of even 0.5% can trigger significant trading arbitrage opportunities.

4. Leverage Options

A defining feature of Perpetual DEX platforms is the ability to provide leverage, sometimes up to 100x, allowing traders to amplify exposure to price movements.

- Traders can choose leverage based on risk appetite and collateral.

- Platforms use automated margin checks to prevent excessive risk-taking.

- Leveraged trading drives higher trading volume, which is essential for liquidity and protocol revenue.

5. Automated Risk Management

Risk management is entirely automated, reducing the need for manual oversight:

- Liquidations: Positions that fall below the maintenance margin are automatically closed.

- Margin calls: Users receive alerts when collateral is insufficient.

- Insurance funds: Some platforms maintain safety funds to cover extreme volatility events.

During high volatility in 2024, GMX reported over $50 million in liquidations in a single week, highlighting the importance of robust risk systems.

6. Advanced Technological Integration

Modern Perpetual DEX platforms are leveraging advanced tech to enhance scalability, speed, and cost-efficiency:

- Zero-Knowledge Proofs (ZKPs): Enable private and verifiable transactions while maintaining on-chain transparency.

- Layer-2 Rollups: Reduce gas fees and increase throughput, making high-frequency trading feasible.

- Oracles: Reliable price feeds from oracles like Chainlink ensure contracts are always aligned with real-world market prices.

7. Liquidity Management

Liquidity is the lifeblood of perpetual dex crypto platforms:

- Platforms often use AMMs (Automated Market Makers) or hybrid order books to ensure seamless trading.

- Liquidity providers earn fees and rewards, incentivizing participation.

- Strong liquidity reduces slippage, making the platform more attractive for high-value traders.

dYdX and GMX collectively handle over $1 billion in daily trading volume, powered by deep liquidity pools.

How Traditional DEX is Different then Perpetual DEX?

For founders and startups, choosing the right decentralized exchange type can directly impact user adoption and trading volume. Comparing traditional exchanges with perpetual DEX platforms in decentralized finance makes it clear why many builders are moving toward decentralized solutions.

| Feature | Centralized Exchange | Spot DEX | Perpetual DEX |

| Custody | Centralized custody | Non-custodial | Non-custodial |

| Product Expiry | Fixed expiry | No derivatives | No expiry, perpetual contracts |

| Leverage | Yes (varies) | Usually none | Programmable via smart contracts |

| Permissionless Access | No | Yes | Yes |

| Fees & Transparency | Opaque, often higher | Transparent, lower | Transparent, competitive |

| Regulatory Censorship Risk | High | Low | Very low |

DEX perpetuals let founders and traders offer advanced financial instruments while keeping full control and transparency. In fact, according to Dune Analytics (2025), total trading volume on perpetual DEXs exceeded $150 billion per month, highlighting the rapid adoption and growing trust in these platforms.

Perp DEX Benefits for Founders and Builders

The demand for perpetual DEX development services is driven by clear benefits:

- Scalable liquidity through AMMs and order-book models

- Programmable risk management and margin handling

- Lower barriers to entry for new protocols

- Interoperability with lending platforms and yield aggregators

- Streamlined onboarding, margining, and liquidation processes

With the rise of Perpetual DEX Platforms, startups now have the tools to create innovative financial products, differentiate themselves in the market, and attract both retail and institutional investors.

Accenture notes that decentralized derivatives platforms, particularly DEX development solutions, are becoming “the next battleground for financial services, potentially representing over 10% of the global derivatives market in the next decade.

How Startups And Protocols Are Leveraging Perpetual DEX?

The market for perpetual dex crypto solutions is growing rapidly, with multiple startups and protocols leading the way. These platforms provide Perpetual DEX use that combines scalability, security, and advanced trading features, making them ideal examples for founders and businesses looking to build their own decentralized derivatives solutions.

1. dYdX:

One of the pioneers in the space, dYdX has transitioned to a Cosmos-based appchain to handle higher throughput and lower fees. With over $500B in trading volume in 2024, it attracts both retail and institutional traders. Their perpetual DEX crypto platform demonstrates how decentralized contracts can scale to meet high demand while maintaining security and transparency.

2. GMX

Built on Arbitrum, GMX processes $100M+ in daily volume. Its model focuses on real-yield distribution for liquidity providers, allowing users to earn rewards while trading perpetual contracts. GMX’s best perpetual dex approach shows how integrating innovative financial models with Decentralized Perpetual Exchange platforms can enhance both user retention and protocol growth.

3. Gains Network (gTrade)

This platform uses a hybrid synthetic-asset system, enabling diverse perpetual trading across Polygon and Arbitrum. With automated risk management and leveraged positions, it highlights how perpetual DEX platforms in decentralized finance can offer sophisticated products without requiring centralized oversight.

4. Perpetual Protocol

Known for its virtual AMM model and decentralized insurance features, Perpetual Protocol ensures safer trading for users while allowing startups to explore dex perpetual innovations. This platform demonstrates how a focus on automated risk mitigation and composable DeFi products can drive adoption and market confidence.

Why Your Startup Should Build a Perpetual DEX in this Bull Run?

Building your own exchange on a perpetual dex crypto stack gives your business a strong edge. Here’s why it matters for startups and founders:

- Access high-demand markets: Serve both retail and institutional traders actively looking for decentralized trading options.

- Reduce exchange risk: Unlike centralized exchange platforms, perpetual DEX platforms let users trade without risking custody of their funds.

- Integrate easily with DeFi products: Your DEX can work with lending protocols, NFTs, and liquidity mining, opening new revenue opportunities.

- Leverage proven features: Implement trading mechanisms already tested on successful Perpetual DEX Platforms, saving development time and ensuring reliability.

The numbers speak for themselves: global crypto derivatives trading hit $60 trillion in 2024, with perpetual contracts accounting for nearly 80% of all on-chain derivatives trades. For startups, this is a clear signal. Building on a perpetual dex crypto framework positions you to capture a massive, growing market.

How SoluLab Can Help You Build a Perp DEX?

SoluLab is a trusted DEX development company that offers perpetual DEX development services designed for startups and founders who want to launch fast and scale efficiently.

Our services include:

- Smart contract development and audits to ensure secure, reliable trading

- AMM or order book DEX launch solutions for smooth deployment

- Advanced Oracle integrations for accurate pricing and market data

- Custom trading dashboards that are easy to use and professional

- Compliance and onboarding tools to meet regulatory standards

By partnering with SoluLab, your team can speed up go-to-market, reduce risks, and leverage proven frameworks from top perpetual DEX platforms, giving your startup a competitive edge in the decentralized derivatives space.

Conclusion

The growth of Decentralized Perpetual Exchange platforms is changing how crypto derivatives are traded. For founders and startups, this is a chance to build scalable, secure, and innovative trading platforms that meet market demand.

Partnering with a reliable DeFi exchange development company like SoluLab ensures your business can launch efficiently, stay competitive, and leverage proven expertise in perpetual dex crypto and Perpetual DEX Platforms. For companies serious about capturing opportunities in decentralized finance, this partnership is a strategic advantage, not just an option.

Contact us for more information!

FAQs

1. How can a Perpetual DEX benefit my startup compared to a traditional exchange?

It offers non-custodial trading, automated risk management, composability with DeFi, and access to both retail and institutional traders.

2. Which platforms are considered the best perpetual DEX today?

dYdX, GMX, Gains Network, and Perpetual Protocol are top-performing platforms with strong liquidity and features.

3. What are the main technical features of a perpetual DEX?

Smart contracts, funding rates, leverage control, automated liquidations, and oracle integrations.

4. Why should I choose a perpetual DEX development company like SoluLab?

They provide end-to-end development, security audits, dashboard UX/UI, and compliance support.

5. How difficult is it to launch my own perpetual DEX?

With the right development team, founders can launch faster, reduce risk, and access ready-made protocols for liquidity and trading.

6. How do perpetual DEX platforms integrate with other DeFi services?

They can connect with lending protocols, yield aggregators, and NFT marketplaces, creating new revenue and growth opportunities.