In today’s fast-moving digital economy, businesses must stay ahead of innovation. Decentralized Exchanges (DEXs) are reshaping the global cryptocurrency market. They are traded, without a middleman, without central control, and with full security.

| The average daily trading volume across some major DEXs ranges between $1-2 billion, depending on volatility. |

For startups and established businesses alike, building a DEX opens new opportunities. However, developing the decentralized platform with advanced features isn’t an easy task. In this guide, we’ll walk you through defining your DEX model, estimating cost, building the platform, and preparing for future trends.

What Is a Decentralized Exchange (DEX)?

A DEX lets people trade crypto directly via smart contracts, without a middleman or custodied funds. Modern DEXs use AMMs like Uniswap, with liquidity pools replacing traditional order books, driving billions in weekly trading and 60%+ of DEX spot volume.

DEXs offer control, transparency, and global access, but face challenges like impermanent loss and front-running. For traders, it’s freedom; for founders, it’s a chance to own infrastructure in the $1.5T+ DeFi market.

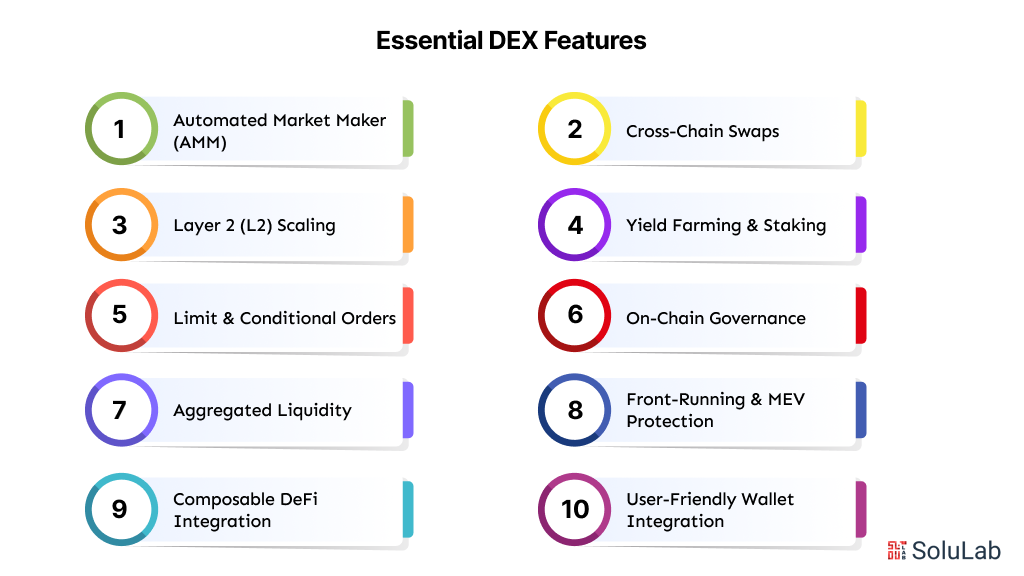

Key Features a DEX Should Have in 2025?

The decentralized exchange (DEX) space is evolving rapidly, driven by growing demand for trustless trading, regulatory considerations, and innovative blockchain technology. To remain competitive and future-proof, a DEX in 2025 should integrate the following must-have features:

1. Automated Market Maker (AMM)

Uses liquidity pools instead of order books, letting users trade instantly while liquidity providers earn fees. It eliminates the need to wait for buyers or sellers, creating continuous liquidity.

2. Cross-Chain Swaps

Enables trading tokens across different blockchains without needing bridges or intermediaries. This opens access to a wider market and more diverse assets in one platform.

3. Layer 2 (L2) Scaling

Speeds up transactions and lowers fees using rollups or sidechains, making trading efficient for everyone. It ensures high-volume trades remain fast and affordable, even during network congestion.

4. Yield Farming & Staking

Users can lock tokens to earn rewards, incentivizing liquidity and increasing platform engagement. This encourages long-term participation and rewards users for supporting the platform.

5. Limit & Conditional Orders

Advanced trading options that let users set specific prices or conditions for trades. It gives traders more control and the ability to execute strategies automatically.

6. On-Chain Governance

Token holders vote on platform decisions, ensuring the community helps shape its future. This creates a decentralized decision-making process that aligns incentives with users.

7. Aggregated Liquidity

Pulls liquidity from multiple DEXs, giving users better prices and less slippage. It reduces trading costs and improves execution quality for all users.

8. Front-Running & MEV Protection

Mechanisms to prevent bots or miners from exploiting transaction order for unfair profit. This protects users from losing value due to transaction manipulation.

9. Composable DeFi Integration

Connects seamlessly with lending, borrowing, and other DeFi protocols for broader financial services. Users can combine multiple DeFi strategies without leaving the DEX ecosystem.

10. User-Friendly Wallet Integration

Supports multiple wallets with simple onboarding, so even beginners can trade easily. It lowers barriers to entry and ensures smooth access for both new and experienced traders.

Why Your Business Should Consider Developing a Decentralized Exchange (DEX)?

If you’re a startup or a business thinking about entering the crypto space, building your own DEX can be a game-changer. Here’s why creating a decentralized exchange makes total sense in today’s digital economy.

-

Full Control Over Your Platform

When you develop your own DEX, you don’t rely on third parties. You control everything, from how fees are structured to the tokens you list. This gives your business full independence and flexibility to grow exactly the way you want.

-

Unmatched Security and Trust

Unlike centralized exchanges, your DEX never holds user funds. Each user connects with their private wallet, keeping sensitive data and assets safe. This builds strong trust with your audience. People care deeply about security these days.

-

Expand Globally Without Restrictions

With a DEX, geographical borders don’t matter. Anyone with an internet connection can use your platform. No lengthy KYC procedures, no paperwork, just easy and instant access to trading.

| As per Coinlaw, DEX trading volume rose by 37% in 2025, with an average monthly volume of ~$412 billion. |

-

Stand Out With Innovation

Building a DEX positions your business as a true innovator. You can offer advanced features like yield farming, staking, or cross-chain swaps. This makes your platform attractive to both crypto newbies and seasoned traders.

-

Create New Revenue Streams

Earn a steady income from trading fees, listing fees, and liquidity incentives. As more users trade or stake assets, your business grows without extra effort. It’s a scalable way to tap into the booming decentralized finance (DeFi) market.

-

Future-Proof Your Business

The DeFi space is booming, and regulations around centralized exchanges are tightening. A DEX keeps your operations decentralized, helping you stay ahead of compliance risks. Plus, integrating features like decentralized governance makes your platform more appealing long-term.

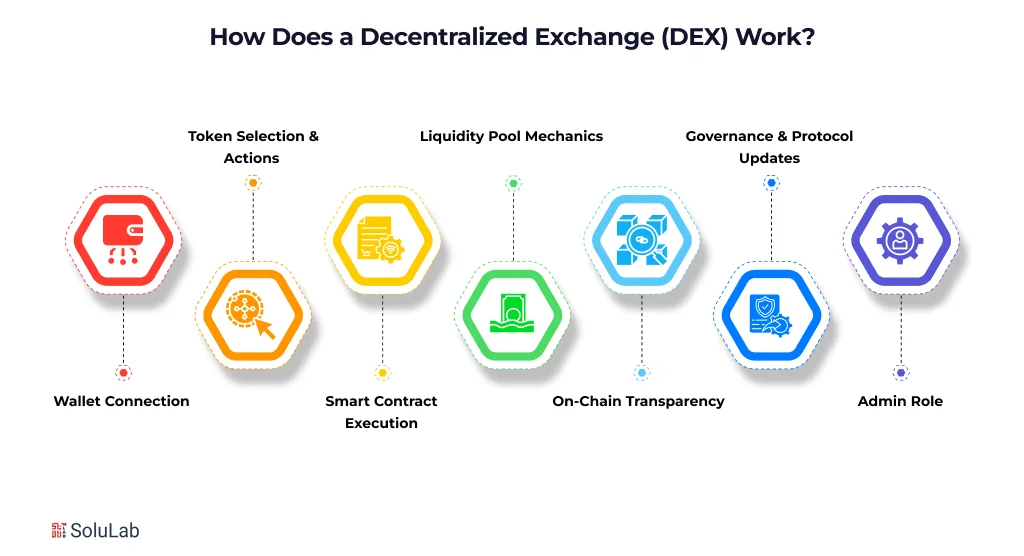

How Does a Decentralized Exchange Work?

A Decentralized Exchange (DEX) allows users to trade cryptocurrencies directly and securely, with smart contracts automating transactions — no middlemen, no delays, and no custody of user funds.

1. Wallet Connection

Users link wallets like MetaMask or Trust Wallet. This ensures full control over private keys and funds, while enabling global access without accounts or KYC.

2. Token Selection & Actions

Traders can swap tokens, provide liquidity, stake, or participate in yield farming. Modern DEXs also offer cross-chain swaps and Layer 2 scaling, enabling faster, cheaper trades and access to multiple blockchain ecosystems.

3. Smart Contract Execution

Once a trade is initiated, smart contracts calculate outputs, apply slippage limits, deduct fees, and update liquidity pools automatically. This ensures trustless execution and prevents human error.

4. Liquidity Pool Mechanics

Users deposit tokens into pools, earning a proportional share of trading fees or incentive rewards. AMM formulas (like x*y = k) automatically balance token ratios and maintain continuous liquidity.

5. On-Chain Transparency

Every trade and liquidity change is recorded on-chain, fully auditable and immutable, letting users and developers monitor activity and verify fairness.

6. Governance & Protocol Updates

Admins or dev teams can deploy upgrades, but critical changes are controlled by token holders through on-chain governance. This ensures that the community approves fee changes, token listings, or new features.

7. Admin Role

Admins manage the platform but never control user funds, ensuring trust and fairness. This makes your DEX reliable, fast, and user-friendly.

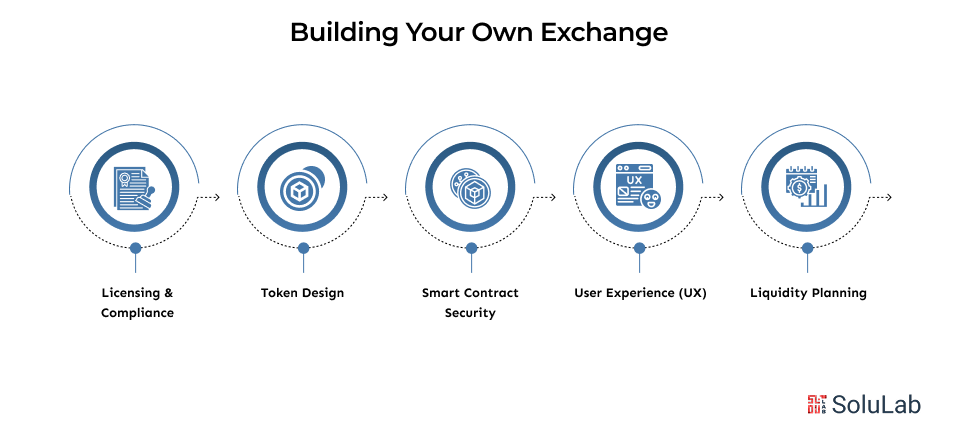

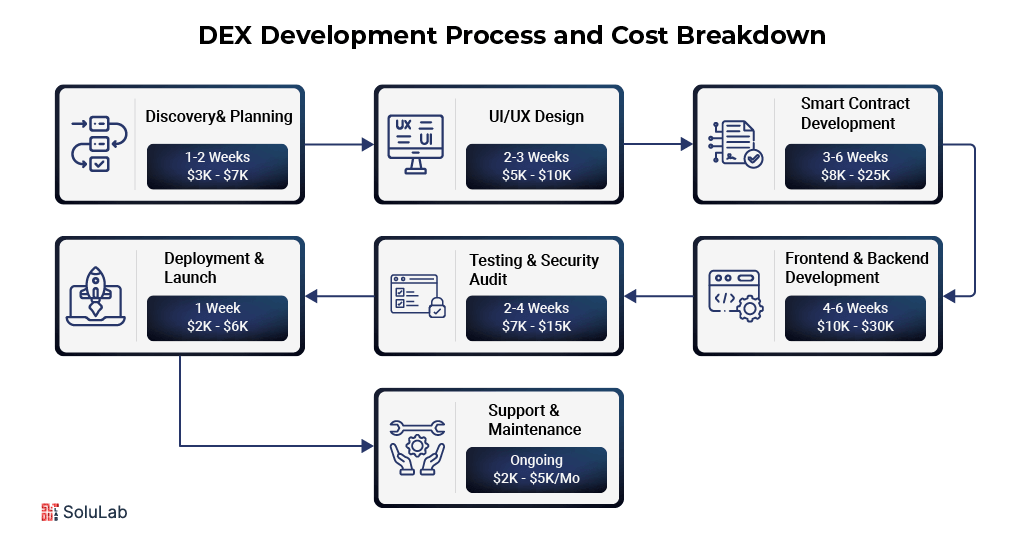

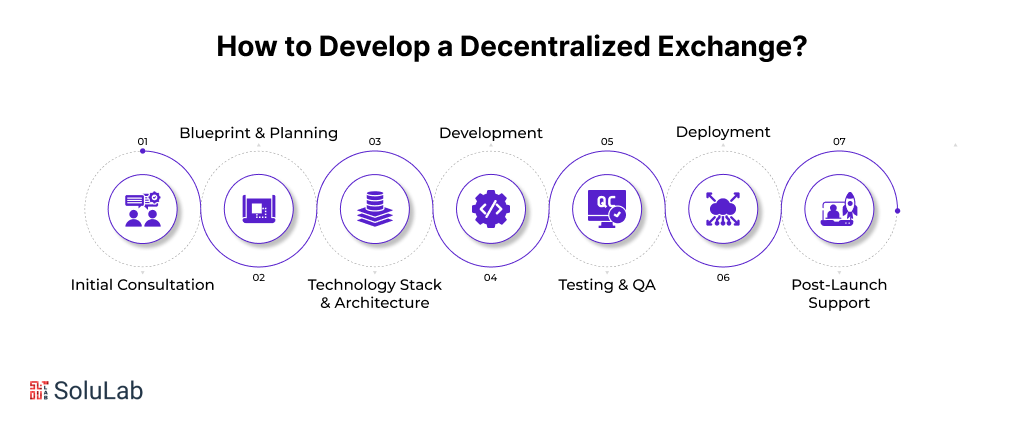

How to Develop a Decentralized Exchange?

Developing a DEX for your business doesn’t have to be complicated. But in-house building can be complicated. So, hire a blockchain developer to make your work simple and efficient. Here’s a simple and clear step-by-step process to help you understand what goes into building a solid, reliable platform.

1. Initial Consultation

First, discuss your business goals and target audience with the third party. Understand what kind of DEX model suits your strategy: AMM, Order Book, or Hybrid. This helps clarify the approach and scope.

2. Blueprint & Planning

Create a detailed project plan and execution roadmap along with your partner. Define features, platform flow, trading logic, and key integrations. Set clear timelines and budgets as per your choice.

3. Technology Stack & Architecture

Choose the right blockchain (Ethereum, BSC, Polygon). If you are not aware, then know the details from your developing partner. Decide on platform designs, database, and smart contract language (Solidity). Plan system architecture for scalability and security.

4. Development

Build the user interface, smart contracts, wallet integrations, and liquidity pool setup. Focus on clean, well-documented code so that in the future, when updates or changes are needed, this can help.

5. Testing & QA

Cross-check the functional tests, load tests, and security audits to ensure accuracy. Ensure every feature works under real conditions.

6. Deployment

Deploy smart contracts to the mainnet of the blockchain. Start with a soft launch or beta version. Gather early feedback and fix issues.

7. Post-Launch Support

Provide continuous support with regular updates, bug fixes, and security patches. Monitor system performance and user issues.

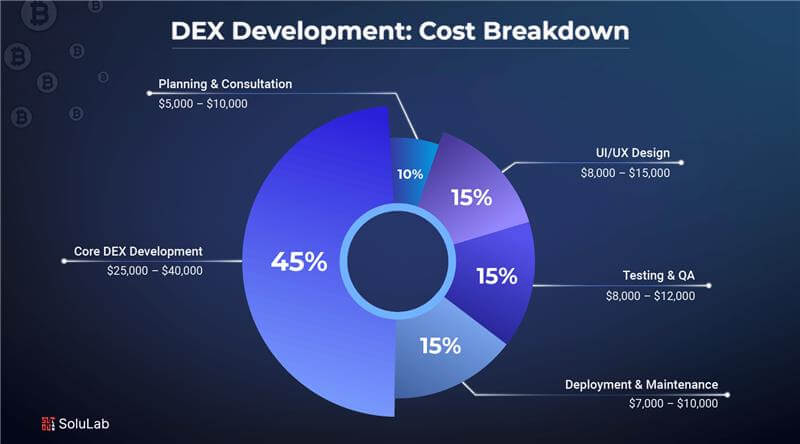

Cost & Timeframe of DEX Development

If you’re wondering how much it takes to develop a Decentralized Exchange (DEX), the answer depends on the type of platform you want to build.

1. A basic DEX with essential features like token swaps and wallet connections can cost $10,000 – $20,000. This usually takes around 1 to 2 months to develop.

2. A custom or advanced DEX with features like Automated Market Maker (AMM), staking, yield farming, and cross-chain support can cost $25,000 – $70,000 or more. Development time in this case stretches from 3 to 5 months, sometimes longer.

3. An AI-powered DEX is a new model in 2025 that includes AI-driven trading insights, predictive analytics, and automated liquidity balancing. These platforms can cost $100,000 – $200,000+ and take 5 to 7 months to build.

4. A white-label DEX uses a ready-made framework with customizable branding. It’s faster to deploy and costs around $15,000 – $45,000, usually taking just 1 to 2 months.

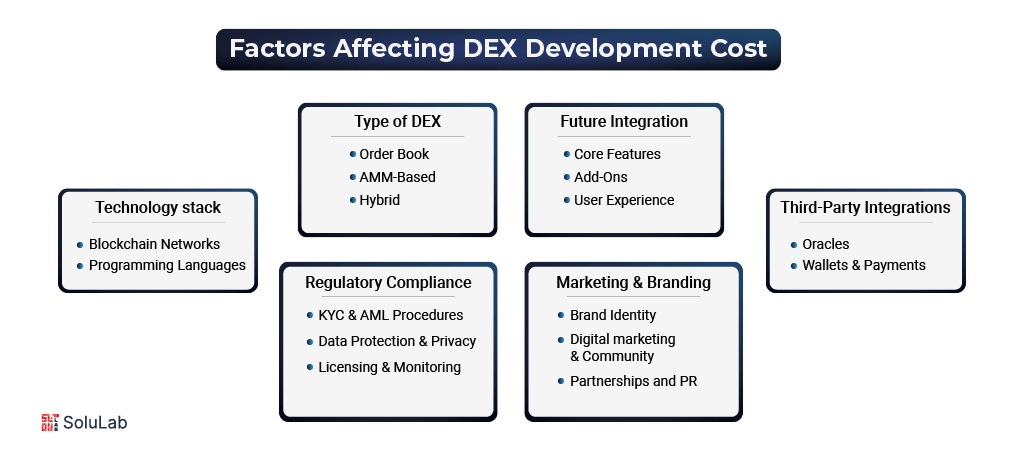

Why Such a Difference in DEX Development Costs?

| Factor | Impact on Cost & Time |

| Advanced Features | AMMs, staking, yield farming, and governance require complex smart contracts and specialized logic. |

| Multi-Chain Integration | Supporting Ethereum, BNB Chain, Solana, etc., adds extra development effort and more testing cycles. |

| Custom Reward Mechanisms | Designing incentives like liquidity mining or AI-driven rewards requires additional coding and tuning. |

| Security Audits | Professional audits and penetration testing increase costs but ensure trust and safety. |

| UI/UX Design | A polished, scalable interface with advanced dashboards takes more design and development time. |

| Rigorous Testing | Stress tests, bug fixes, and cross-chain validations extend the timeline but ensure smooth operations. |

While a basic DEX is quicker and cheaper, investing in advanced features, multi-chain compatibility, and security pays off in the long run by reducing risks and building user trust.

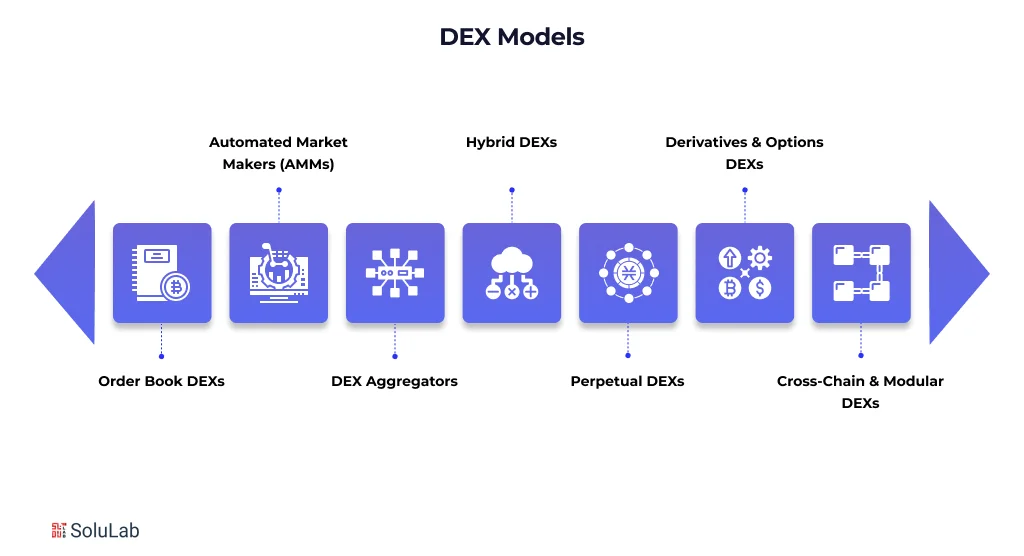

Which DEX Models Fit Your Business?

When building a Decentralized Exchange (DEX), the model you choose determines user experience, liquidity depth, and technical complexity. Each approach has its strengths, from speed and simplicity to advanced trading power.

1. Order Book DEXs

- Works like centralized exchanges: buy and sell orders are matched directly.

- Best for pro traders who want features like limit orders, stop-loss, and margin trading.

2. Automated Market Makers (AMMs)

- Use liquidity pools and formulas (e.g., x*y = k) instead of direct order matching.

- Simple, instant swaps, popularized by Uniswap, PancakeSwap.

- Great for beginner-friendly DEXs, but faces issues like impermanent loss and MEV risks.

3. DEX Aggregators

- Pull liquidity from multiple DEXs (e.g., 1inch, Matcha), giving users the best available price in one place.

- Ideal if your platform focuses on efficiency and arbitrage-proof trading.

- Requires advanced routing algorithms and cross-chain liquidity integration.

4. Hybrid DEXs

- Combine order books for pros and AMM pools for casual traders.

- Attracts both retail users and institutional traders.

- More complex to build, but it provides a balanced trading ecosystem.

5. Perpetual DEXs

- Offer perpetual futures contracts, where traders speculate with leverage (5x, 10x, or higher) without expiry dates.

- Platforms like dYdX and GMX popularized this model.

- By 2025, perp DEXs are among the fastest-growing segments, handling billions in daily derivatives volume, rivaling CEXs.

- Great if your business wants to capture advanced traders looking for leverage and futures.

6. Derivatives & Options DEXs

- Go beyond spot and perpetuals by offering options, structured products, and synthetic assets.

- Riskier but opens doors to institutional DeFi and sophisticated financial instruments.

7. Cross-Chain & Modular DEXs

- Built on Layer 2s, cross-chain bridges, and modular rollups.

Let users swap tokens across multiple chains in one transaction. - This model is becoming essential as liquidity is no longer confined to one chain.

Future of Decentralized Exchanges

The future of Decentralized Exchanges (DEXs) is multi-chain, faster, and more intelligent. As regulations tighten on centralized exchanges and users demand privacy, security, and control, DEXs are becoming the default entry point into DeFi. Here’s where the space is headed:

-

Cross-Chain & Omnichain Trading

Users no longer need to be tied to one blockchain. With cross-chain DEXs and omnichain liquidity protocols (like LayerZero, THORChain, and Wormhole), traders can swap assets across Ethereum, BNB Chain, Solana, Polygon, and even Bitcoin layers, all in a single transaction. This creates deeper liquidity and a unified trading experience.

-

Layer 2 Scaling & Gasless Transactions

Solutions like zk-Rollups, Optimistic Rollups, and Validium are now mainstream. Many DEXs in 2025 also support account abstraction and gasless swaps, meaning users can pay fees in any token. This reduces friction for both retail and institutional traders.

-

Decentralized Governance 2.0

Governance has matured beyond simple token voting. New models use delegated governance, quadratic voting, and reputation-based DAOs, making governance more resistant to whale control. This ensures fairer, more community-driven decision-making.

| More than 9.7 million unique wallets interacted with DEXs by mid-2025, up from ~6.8 million last year. |

-

AI-Powered Trading Assistance

AI tools are being integrated directly into DEX dashboards. They analyze on-chain flows, liquidity movements, MEV patterns, and sentiment data to provide real-time trading insights. This lowers the learning curve for beginners and gives pros a competitive edge.

-

MEV Protection & Fair Ordering

Front-running and MEV (Miner Extractable Value) are used to eat into user profits. In 2025, intent-based trading systems like UniswapX and CoW Swap batch transactions, aggregate liquidity across venues, and execute trades fairly, ensuring best execution without slippage abuse.

-

NFT & RWAs Integration

DEXs are expanding beyond fungible tokens. NFT marketplaces, fractionalized assets, and tokenized Real-World Assets (RWAs) are being swapped on DEX rails, turning them into universal asset exchanges.

-

Composability & Modular DEXs

Instead of monolithic platforms, new DEXs are built as modular protocols where builders can plug in their own liquidity modules, fee models, or settlement layers. This creates ecosystems where projects build on top of DEX infrastructure, not just trade on it.

Conclusion

As of above, you might have understood the growing opportunities and how DEX plays a key role. If you’re ready to step into the future of finance, building your own Decentralized Exchange is the way forward.

At SoluLab, a top decentralized exchange development company, we built a secure, fast, and easy-to-use platform. Our solutions are gas-optimized and built for real-world use, ensuring your business stays ahead of the curve. We focus on intuitive interfaces, strong security, and seamless scalability so your users enjoy a smooth experience.

Whether you’re a startup or an established business, we help turn your DEX vision into reality. Contact us now!

FAQs

1. Do I really need a Decentralized Exchange for my business?

Yes, if you’re planning to enter the crypto space or want to offer financial services without depending on third parties. A DEX gives you full control, enhances security, reduces compliance risks, and attracts users who value privacy.

2. Can I integrate my existing business model with a DEX easily?

Absolutely! A DEX can work alongside your current digital services or stand alone as a new revenue stream. It’s flexible, you can customize features like token swaps, staking, or cross-chain compatibility to suit your business goals.

3. Will my customers need technical knowledge to use the DEX?

No, not at all. We focus on building a user-friendly interface that works smoothly on mobile, tablet, and desktop. Users just connect their wallets, pick tokens, and trade in a few clicks.

4. Is developing a DEX an expensive and complicated process?

It depends on your goals. A basic DEX with essential features costs between $10K-$70K+ and takes 4-12 weeks. The cost varies based on complexity, security audits, and integrations, but investing upfront saves future headaches.

5. Can a DEX survive without active admin control over users’ funds?

In a DEX, admins don’t control user funds directly. Instead, smart contracts handle everything automatically. Your business provides the platform, earns from fees and listings, and ensures smooth operation. This creates trust because users remain in full control of their assets, no middleman needed.