In the era of blockchain technology, the development of strong ecosystem protocols is increasingly important. These protocols serve as the foundation for a variety of decentralized apps (dApps), providing developers and users with a safe, transparent, and fast way to connect with blockchain networks. In this blog, we look at the Top 10 Blockchain Ecosystem Protocols that are influencing the development of decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and more.

The significance of choosing the best crypto ecosystem cannot be emphasized, as blockchain technology continues to upend established markets and open the door for creative solutions. Every protocol has its own distinct collection of characteristics and capabilities, ranging from sustainability and governance to scalability and interoperability. Regardless of your level of experience with blockchain technology or your interest in decentralized platforms, this curated blockchain ecosystem list will provide you with valuable information on the top protocols propelling the subsequent stage of blockchain development and advancement.

So, without any further ado, let’s get started!

What is the Role of Blockchain Platforms and Protocols in Fostering Innovation?

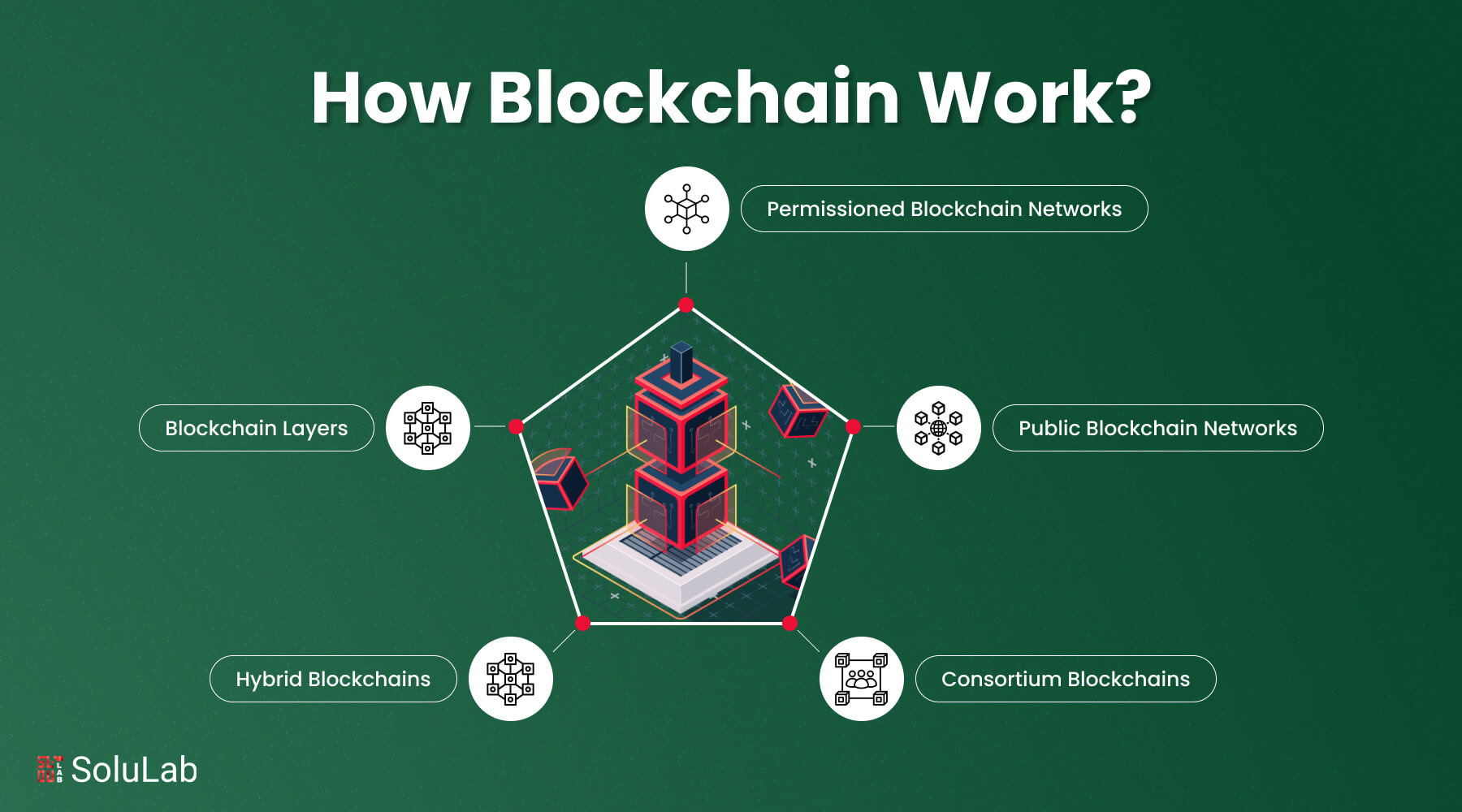

Blockchain platforms and protocols play a dual role in fostering innovation within the blockchain ecosystem.

1. Enabling Diverse Applications

By offering a standardized infrastructure, these platforms and protocols empower developers to focus on creating innovative applications and services without having to reinvent the underlying blockchain technology. This encourages experimentation and creativity in various sectors, ranging from finance and supply chain to healthcare and gaming.

2. Cross-Platform Collaboration

Interoperability between different blockchains is vital for achieving the full potential of blockchain technology. Blockchain platforms and protocols that prioritize interoperability allow data and assets to move seamlessly between distinct blockchain networks. This opens doors for collaborative efforts and the creation of complex, decentralized ecosystems that span multiple platforms.

3. Efficiency and Scalability

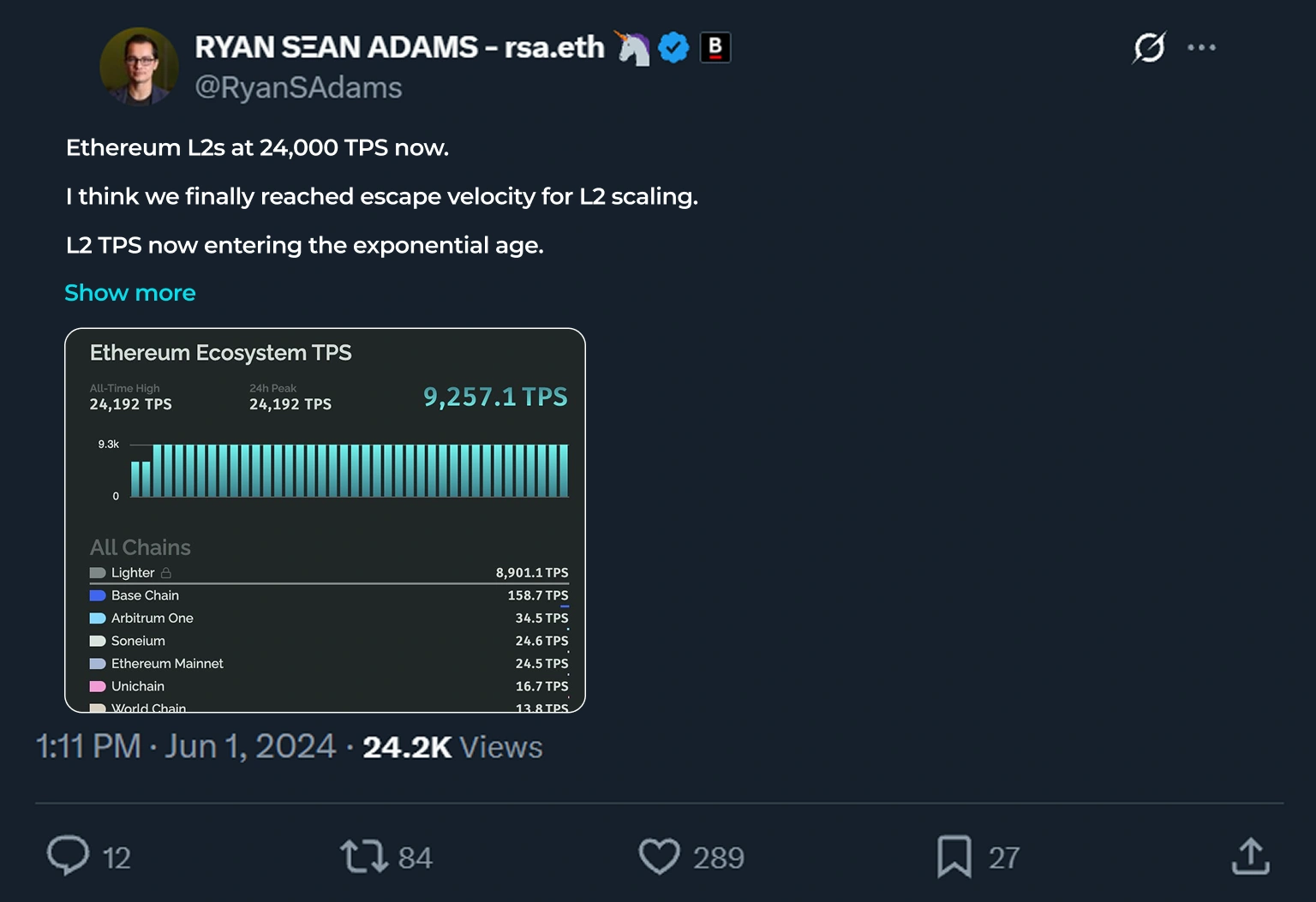

Innovative blockchain protocols are continuously working to address scalability and efficiency challenges that have been associated with earlier blockchain versions. By implementing novel consensus mechanisms, sharding techniques, and off-chain solutions, these protocols are paving the way for blockchain systems that can handle a higher volume of transactions without compromising speed or security.

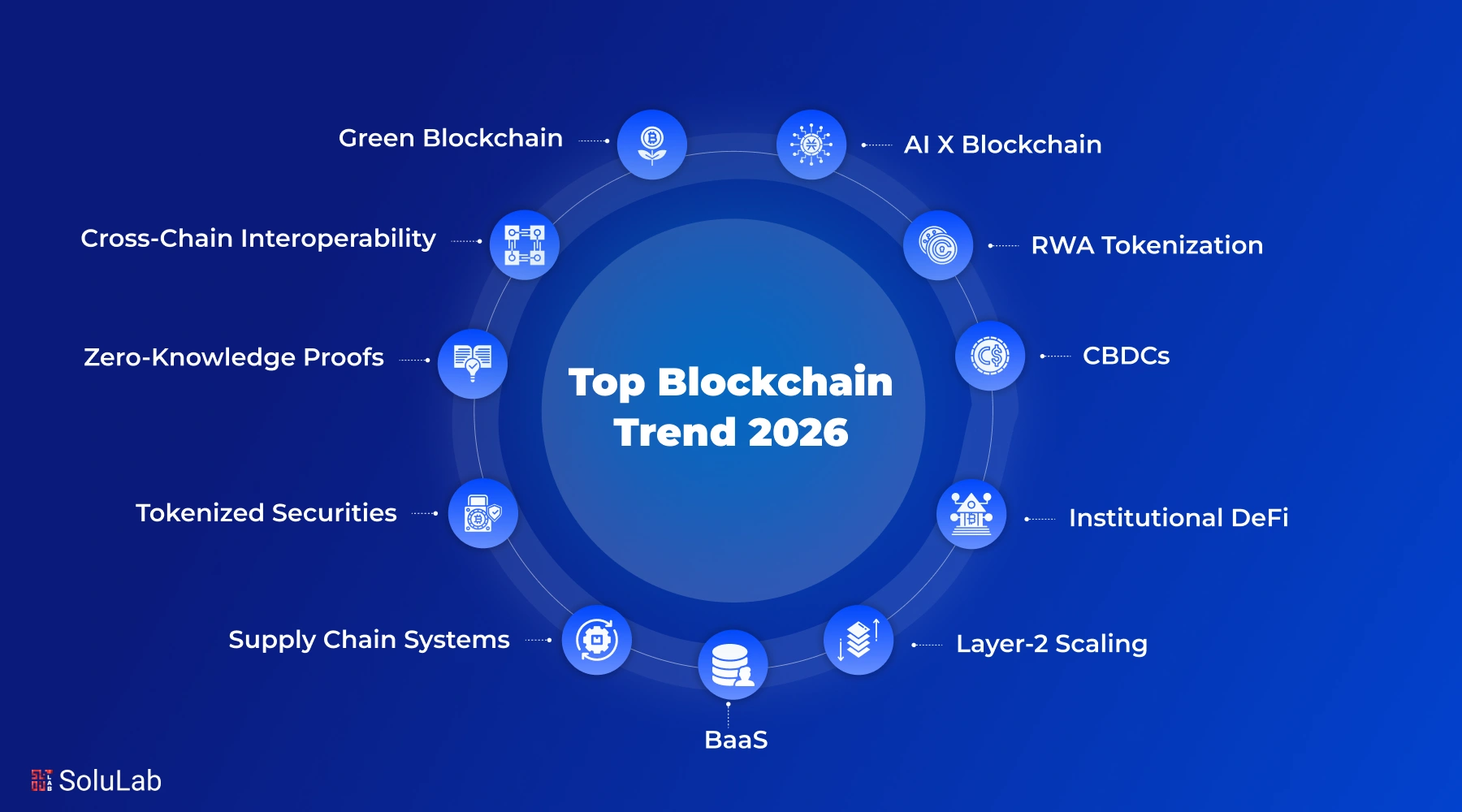

Why Do Top Blockchain Protocols Hold Immense Significance in the Year 2026?

In 2026, top blockchain protocols hold immense significance for the industry due to their transformative impact on various sectors. These protocols not only facilitate efficient and secure transactions but also enable the development of complex decentralized applications, fostering innovation in industries such as finance, supply chain, healthcare, and more. Top blockchain protocols provide:

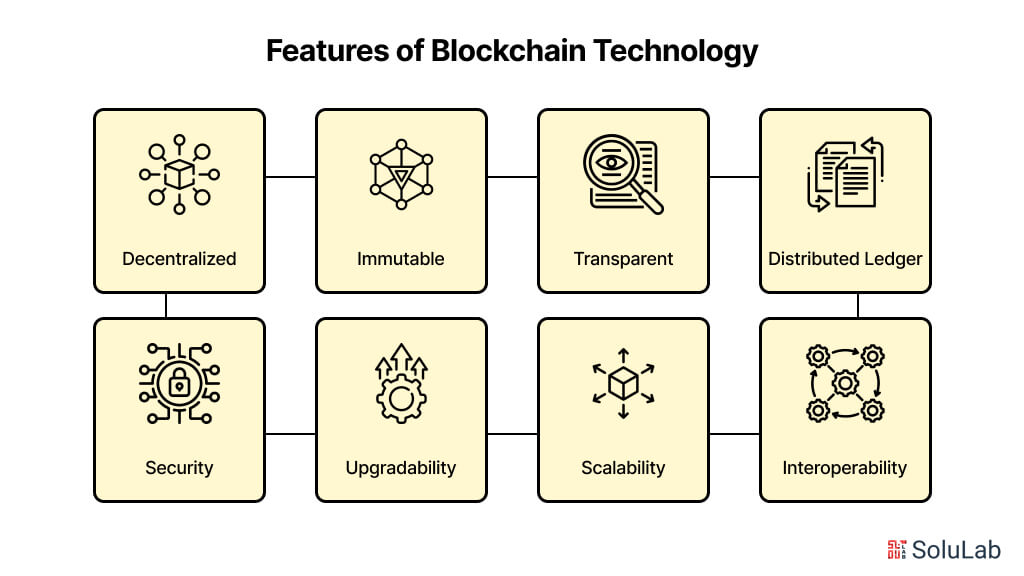

- Security: Leading protocols integrate advanced cryptographic techniques to ensure data integrity and protect against unauthorized access. This level of security is crucial for applications that deal with sensitive data or valuable digital assets.

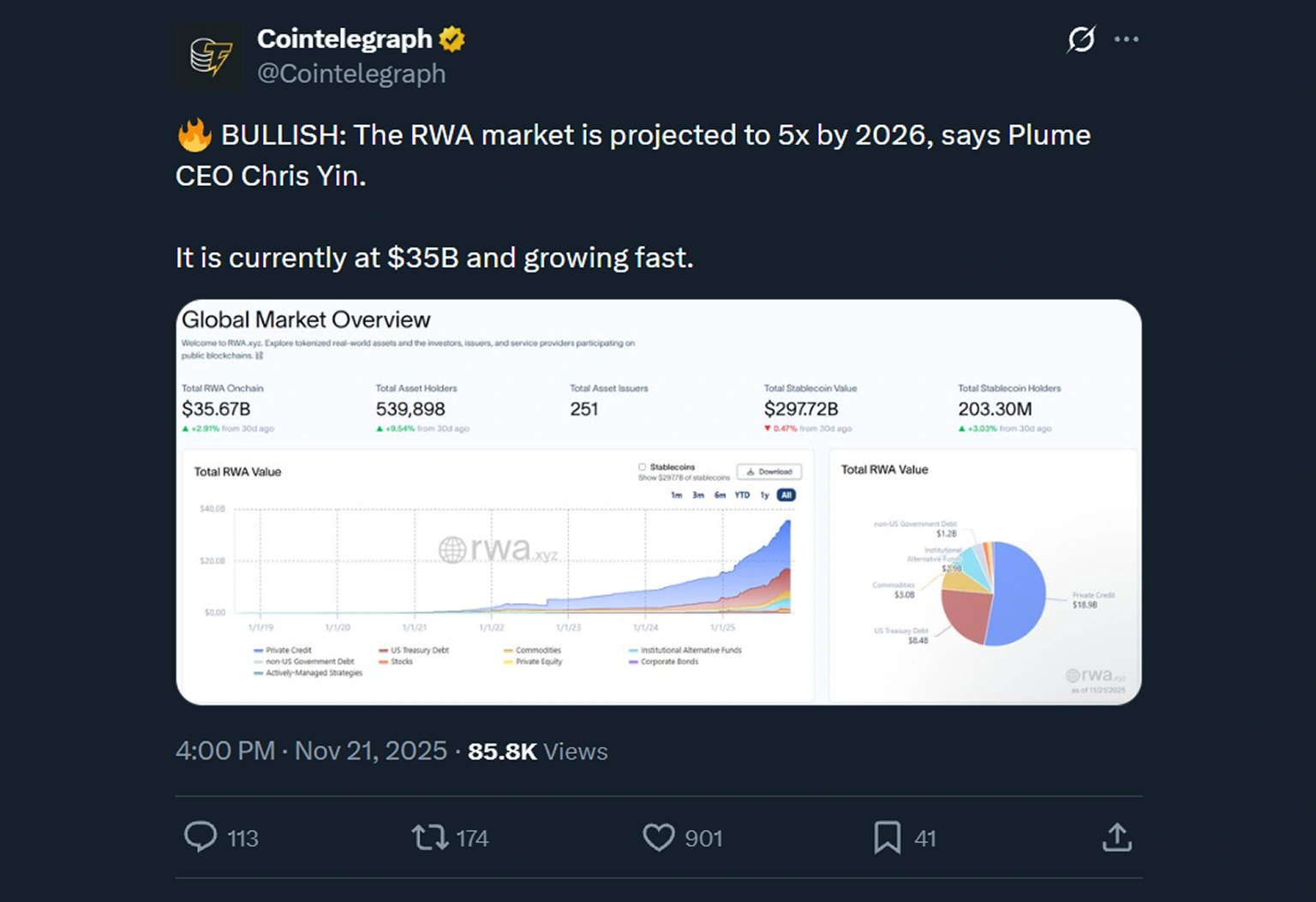

- Scalability: Many contemporary protocols focus on scalability solutions to address the bottleneck issues that early blockchain networks faced. By optimizing consensus mechanisms and introducing techniques like sharding and layer-2 solutions, these protocols aim to accommodate a high volume of transactions without sacrificing speed or security.

- Interoperability: Recognizing the importance of collaboration between different blockchain networks, top protocols emphasize interoperability. They enable seamless data and asset transfer between diverse platforms, contributing to the development of cross-chain applications and services.

- Decentralization: Blockchain protocols prioritize decentralization, ensuring that no single entity has excessive control over the network. This democratic nature enhances trust, transparency, and resilience in the ecosystem.

Top 10 Blockchain Ecosystem Protocols of 2026

1. Stellar

In the era of blockchain ecosystem protocols, Stellar has emerged as a formidable player, offering groundbreaking solutions that revolutionize cross-border transactions and financial services. Recognized as one of the best crypto ecosystems of 2026, Stellar’s significance is underscored by its remarkable features and substantial contributions to the field.

Stellar stands as an open-source blockchain protocol meticulously crafted to streamline cross-border transactions and asset issuance with unparalleled speed, security, and affordability. Rooted in the ethos of inclusivity and financial accessibility, Stellar seeks to bridge the gap between conventional financial frameworks and the realm of blockchain innovation. Its unique ability to facilitate instant transactions across various currencies and networks distinguishes it from traditional approaches, which often involve protracted processes and intermediary entities.

2. Ethereum

Ethereum has long been hailed in blockchain technology, primarily celebrated for its innovative smart contract capabilities. Now, with the transition to Ethereum 2.0, the platform has honed its focus on bolstering scalability and energy efficiency, effectively tackling previous scalability challenges. This upgrade positions Ethereum as a frontrunner in the crypto ecosystem list, poised to offer enhanced performance and sustainability, thus attracting both developers and users seeking advanced blockchain solutions.

Moreover, Ethereum’s ecosystem stands out for its versatility and support for a vast array of decentralized applications (dApps). Notably, Ethereum has emerged as a leader in the burgeoning non-fungible token (NFT) space, providing a robust infrastructure for the creation, exchange, and management of digital assets. This solid foundation cements Ethereum’s position as one of the top crypto ecosystems, offering unparalleled opportunities for innovation and development across various sectors. As Ethereum continues to evolve and innovate, its ecosystem remains a cornerstone of the blockchain industry, driving forward the adoption and integration of decentralized technologies.

3. Tezos

Tezos distinguishes itself with its modular architecture and unique self-amendment protocol, setting it apart from other contenders in the list of top blockchain ecosystem protocols. This innovative approach enables Tezos to implement protocol upgrades seamlessly, eliminating the need for contentious hard forks that can disrupt the network. Moreover, Tezos’s commitment to formal verification methods ensures the utmost security and accuracy of smart contracts, providing developers with a reliable and trustworthy platform to build upon.

Another key aspect that elevates Tezos within the blockchain ecosystems is its governance model. Tezos embraces a democratic approach to network upgrades and changes, empowering stakeholders to participate in decision-making processes. This inclusive governance structure fosters community engagement and consensus-building, further solidifying Tezos’s position as one of the top blockchain ecosystem protocols. Through its modular architecture, self-amendment protocol, and democratic governance model, Tezos continues to pave the way for innovation and advancement in the blockchain space, offering a robust foundation for developers and users alike.

4. Polkadot

A key player in the blockchain ecosystem, Polkadot stands out for its unique scalability and interoperability strategies. Founded on the premise of a heterogeneous multi-chain framework, Polkadot enables seamless communication and data sharing between diverse blockchains. This interoperability empowers developers to create specialized parachains tailored to specific use cases while maintaining compatibility with the broader Polkadot network, fostering a cohesive and interconnected ecosystem of decentralized applications (dApps).

Moreover, Polkadot’s innovative consensus mechanism, known as Nominated Proof-of-Stake (NPoS), ensures a secure and efficient network operation. Through NPoS, token holders can nominate validators to secure the network, enhancing decentralization and resilience against potential attacks. With its focus on interoperability, scalability, and robust security, Polkadot continues to shape the blockchain landscape, offering a platform that facilitates the development of scalable and interoperable decentralized applications across various industries.

5. Hedera Hashgraph

Hedera Hashgraph takes security to a new level with its innovative use of asynchronous Byzantine fault tolerance (aBFT). This means that it can maintain network integrity even in the presence of malicious actors or network partitions. By creating a system where consensus is reached based on the order of events, Hedera Hashgraph achieves an unprecedented level of fairness and tamper resistance, making it highly attractive for applications requiring the utmost security and trust.

Hedera Hashgraph’s design emphasizes interoperability, allowing it to seamlessly integrate with existing systems and platforms. This makes it an attractive option for businesses and developers looking to leverage blockchain technology without disrupting their current operations. Its ability to support smart contracts and decentralized applications (DApps) further extends its utility across diverse industries, including finance, supply chain, healthcare, and more.

6. Klaytn

Klaytn is a blockchain protocol that combines the strengths of both public and private blockchains, offering a hybrid design that optimizes for both transparency and scalability. Developed by Ground X, a subsidiary of South Korea’s internet giant Kakao, Klaytn aims to streamline blockchain adoption by providing an accessible platform for businesses and developers to create and deploy applications.

Klaytn is designed for high throughput and low latency, enabling it to handle a significant number of transactions per second. This scalability is a crucial factor for applications that require fast and efficient processing of data and transactions. Klaytn’s strategic partnerships with various real-world businesses have helped bridge the gap between traditional industries and the blockchain ecosystem. These partnerships provide practical use cases and foster innovation in sectors such as finance, gaming, and more.

7. Tron

Tron has made a significant mark in the entertainment sector by offering a decentralized ecosystem for content creators and consumers. Its blockchain-based infrastructure facilitates direct connections between content producers and their audiences, bypassing intermediaries and empowering creators with a fairer revenue distribution model.

Recognizing the scalability challenges faced by many blockchain protocols, Tron has invested in innovative solutions. Its delegated proof-of-stake (DPoS) consensus mechanism and dynamic bandwidth allocation allow for higher throughput and faster transactions, making it more practical for real-time applications like gaming and streaming. Tron’s support for smart contracts has enabled the creation of decentralized applications, expanding its utility beyond financial transactions. DApps built on Tron’s platform span domains such as finance, entertainment, and social networking, enhancing user experiences and driving broader adoption of blockchain technology.

8. Dogetti

Dogetti’s innovative decentralization strategy makes it stand out in the world of crypto ecosystems. In contrast to conventional distributed ledgers, Dogetti employs a multifaceted approach that prioritizes governance and decision-making in addition to data decentralization. This all-encompassing strategy fosters inclusion and transparency by creating a fully democratic blockchain environment in which users actively participate in protocol updates and modifications.

Dogetti’s Adaptive Proof-of-Cooperation (APoC) consensus mechanism is the heart of its invention and the main factor of its success. To match the demands of the network, APoC dynamically modifies the consensus process, improving scalability during periods of high transaction volume and bolstering security during crucial processes. Applauded for its capacity to achieve a nuanced equilibrium between robustness and speed, APoC confirms Dogetti’s position as a blockchain pioneer.

9. Cardano

Cardano’s journey began with a vision to address the limitations of existing blockchain protocols, particularly in terms of scalability, interoperability, and governance. This vision has translated into tangible achievements, propelling Cardano into the ranks of the top 10 blockchain ecosystem protocols of 2026.

Unlike many blockchain projects that emphasize speed to market, Cardano took a meticulous approach by involving a global network of researchers and experts. This rigorous academic input has led to peer-reviewed research and a solid foundation for technological advancements. Cardano utilizes the Ouroboros consensus algorithm, which is a proof-of-stake (PoS) protocol designed for scalability and security. Cardano has been designed to facilitate seamless communication between different blockchains. This feature enables the creation of multi-chain applications and opens avenues for collaborative development across blockchain networks.

10. EOS

In the top blockchain ecosystem protocols, EOS stands out as a dynamic and influential platform that continues to shape the landscape in 2026. EOS, short for “Enterprise Operating System,” has established itself as a prominent player in the blockchain space, offering a range of innovative features and capabilities that contribute to its status as a top 10 blockchain ecosystem protocol.

EOS is characterized by its commitment to scalability, speed, and usability, all of which are critical factors in driving the adoption of blockchain technology across industries. Its unique approach to consensus and governance has garnered attention and admiration from developers and businesses alike. One of the standout features of EOS is its Delegated Proof of Stake (DPoS) consensus mechanism. Unlike traditional Proof of Work (PoW) mechanisms that consume substantial energy, EOS’s DPoS enhances energy efficiency while maintaining security and decentralization. Through DPoS, EOS achieves remarkable transaction speeds, making it suitable for applications that require high throughput.

Conclusion

In the ever-evolving landscape of blockchain technology, the significance of robust blockchain ecosystem protocols cannot be overstated. As 2026 unfolds, it becomes evident that these protocols form the backbone of innovation, driving the development of groundbreaking blockchain platforms.

Solulab has positioned itself at the forefront of this transformative era, solidifying its reputation as a premier blockchain development company. With an array of top blockchain ecosystem protocols under its belt, Solulab continues to redefine the parameters of possibility. Their team of adept blockchain developers handpicked to harness the potential of these protocols, is a testament to their commitment to excellence.

In a realm where staying ahead of the curve is imperative, Solulab’s proficiency in crafting bespoke blockchain solutions sets them apart. Organizations seeking to harness the power of blockchain can confidently turn to Solulab to access cutting-edge blockchain development services. The option to hire blockchain developers through Solulab ensures a journey guided by expertise and innovation. For unparalleled blockchain solutions, contact SoluLab today.

FAQs

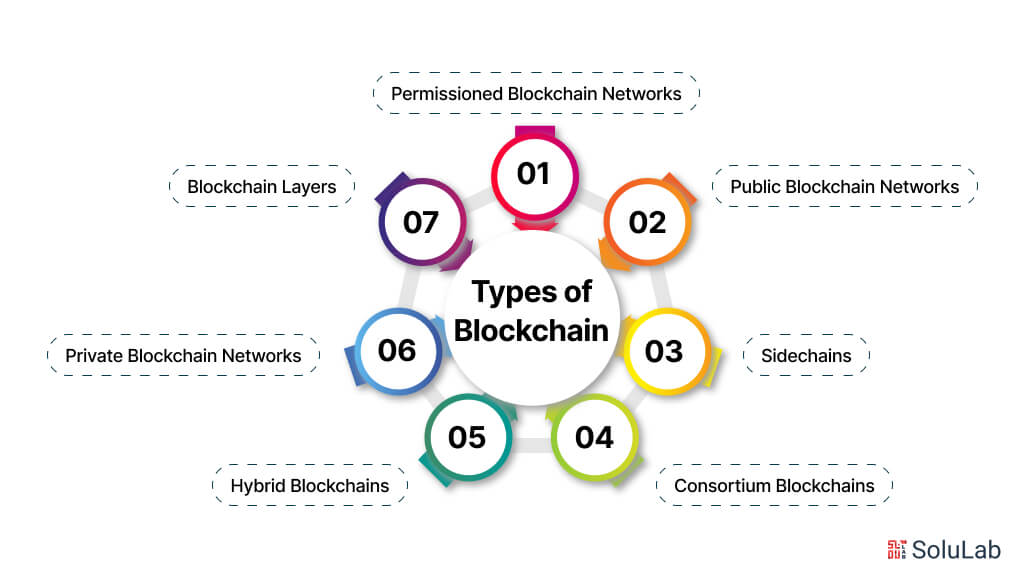

1. What are blockchain ecosystem protocols?

Blockchain ecosystem protocols refer to a set of rules, standards, and technologies governing the functioning and development of blockchain platforms. These protocols determine how transactions are verified, data is stored, and consensus is reached within a blockchain network.

2. How do blockchain ecosystem protocols contribute to blockchain development?

Blockchain ecosystem protocols provide a foundation for developers to build and deploy decentralized applications (DApps) on various top blockchain platforms. They offer predefined structures that developers can leverage to create innovative solutions while ensuring compatibility with the underlying blockchain technology.

3. Can you name some of the top blockchain ecosystem protocols in 2026?

Certainly! Some of the top blockchain ecosystem protocols of 2026 include Ethereum 2.0, Binance Smart Chain, Solana, Cardano, Polkadot, Avalanche, Tezos, Cosmos, Algorand, and Flow.

4. How can businesses benefit from these top blockchain ecosystem protocols?

Businesses can leverage these protocols to build decentralized applications, streamline processes, enhance transparency, and create new revenue streams. They can tap into the capabilities of these protocols to develop solutions that cater to their specific industry needs.

5. Are there specialized blockchain development services for these protocols?

Yes, many blockchain development companies offer specialized services tailored to each of these protocols. They provide expertise in developing DApps, smart contracts, and other solutions that utilize the unique features of the chosen protocol.