What if accountants could predict financial trends before they happen, automate tedious tasks, and make decisions backed by real-time data? That’s not a distant dream — it’s the reality AI is creating for today’s Certified Public Accountants (CPAs).

In an industry where accuracy, efficiency, and compliance are everything, AI-driven accounting tools are transforming how CPAs work. From automating bookkeeping to offering predictive insights for better financial planning, artificial intelligence is helping accountants move beyond manual data crunching into strategic advisory roles that add real business value.

The market is poised for growth, as the AI accounting market is projected to be worth approximately $6.7B in 2025 and could reach $67B by 2035.

Forward-thinking CPAs aren’t just adopting AI to keep up with technology, they’re using it to gain a competitive edge, reduce costs, and deliver smarter client outcomes. This guide will show why AI for accounting matters, where to start, and how to get results fast without overwhelming your team.

Why AI for CPAs Matters in 2025?

The accounting industry is entering a new phase where AI tools for accounting and AI-powered bookkeeping automation are necessities. Firms that integrate AI tools for accounting firms are seeing measurable ROI in efficiency, accuracy, and advisory value.

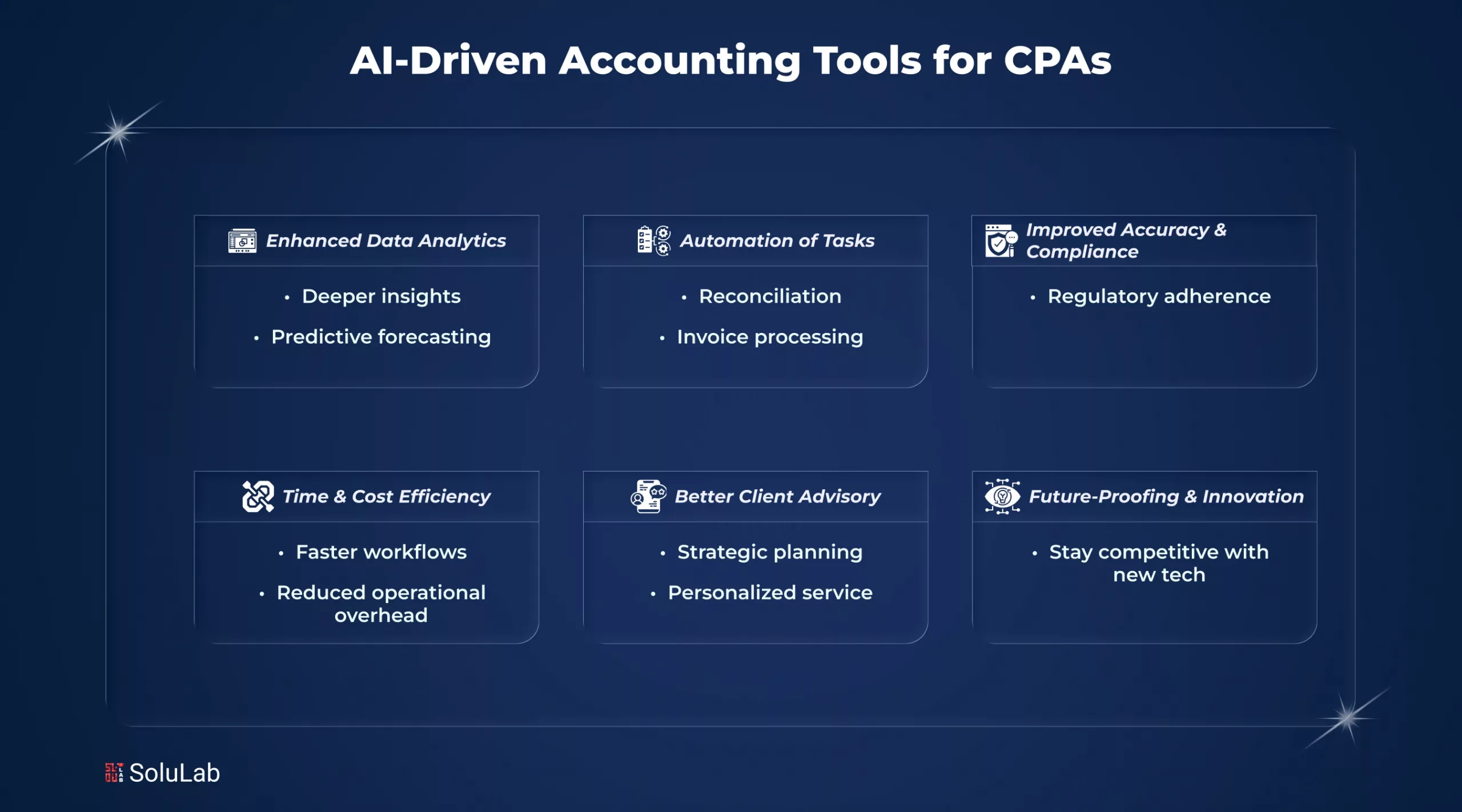

1. Efficiency and Scalability

AI automation cuts hours of manual bookkeeping, reconciliation, and tax prep. With AI in accounting and finance, firms handle more clients without expanding headcount, directly improving profit margins.

2. Accuracy and Compliance

AI bookkeeping tools minimize human error and ensure every transaction aligns with tax and audit standards. For CPA firms, this means stronger compliance and lower risk, key in maintaining long-term client trust.

3. Smarter Client Advisory

Beyond automation, AI for CPA firms enables real-time forecasting, expense analysis, and predictive cash flow management. This turns accountants into strategic advisors, not just service providers.

4. Competitive Advantage

Early adopters of AI-powered bookkeeping automation already lead the market. Firms using these tools report higher client retention and faster decision-making, positioning them as forward-thinking financial partners.

So, AI transforms CPA firms from reactive to proactive. It’s not about replacing people, it’s about scaling intelligence, service quality, and revenue potential. But first you need to understand what is right for you.

Should You Build Custom AI Solution or Buy Off-the-Shelf?

When it comes to using AI for CPAs, you have two paths: use ready-made white label tools or build something custom. If your firm wants quick results, off-the-shelf AI tools for CPAs are usually the best starting point. These tools already handle common work like invoice coding, bank reconciliation, audit prep, and tax notes. They are fast to set up and your team can learn them without stress.

For firms with unique workflows or advanced needs, building a custom layer that integrates accounts payable automation AI helps manage multiple entities and complex reports efficiently.

The key is to keep it simple.

- One workflow

- One team

- One goal

- One month to test

This gives you a safe trial run where partners can see real results without overwhelming the staff. It also helps your firm learn how to use AI for CPA firms in a steady, confident way..

Top AI Use Cases for CPA Firms That Deliver Quick ROI

If you’re a CPA firm looking to make work faster, smarter, and more profitable, this is where AI in accounting shows real results. These are practical ways to cut costs, save time, and deliver better client service starting this quarter.

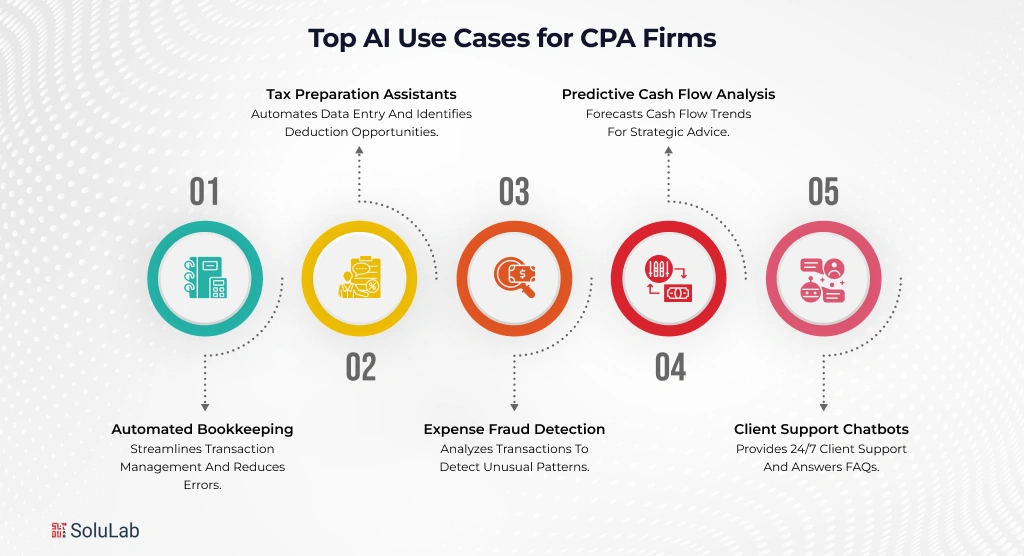

1. Automated Bookkeeping

AI bookkeeping tools can now handle most of the repetitive work in bookkeeping like categorizing transactions, matching invoices, and reconciling accounts. This reduces manual errors and saves teams hours every week. For firms that manage multiple clients, automation can directly translate into more billable hours and faster turnaround time.

2. Tax Preparation Assistants

Preparing taxes can be one of the most time-consuming parts of accounting. With AI tax preparation tools, CPAs can automate data entry, detect missing forms, and even check for deduction opportunities. In 2025, top firms report up to 85% of repetitive tax work automated, freeing teams to focus on review and client strategy instead of routine paperwork.

Read Our Blog: Generative AI in the Tax Industry

3. Expense Fraud Detection

AI-powered fraud detection systems analyze transactions in real time, flagging unusual spending patterns or suspicious claims. This helps CPA firms protect clients from compliance issues while building trust. Even a small firm can use this to offer “AI-backed audit checks” as a premium service, a clear competitive edge.

4. Predictive Cash Flow Analysis

Machine learning tools can now predict cash flow trends weeks or even months ahead. For CPA firms, this means giving clients proactive advice like when to delay expenses or secure funding. Predictive insights help you move from being just an accountant to becoming a financial advisor clients rely on for strategic planning.

5. Client Support Chatbots

AI-powered chatbots are changing how firms handle client communication. They can answer FAQs, share document links, and schedule calls 24/7. This improves client satisfaction and saves your team from answering repetitive questions. The best part is that Chatbots can be integrated directly into your firm’s website or client portal within days.

Each of these AI use cases for CPA firms brings immediate returns, lower costs, faster turnaround, and happier clients. Firms that start with even one of these solutions often see ROI within the first 60–90 days.

How to Implement AI Solutions for CPAs?

Most CPA firms hear about AI for CPAs and think it’s complicated or takes months to get working but it doesn’t have to. A simple and proven process to help firms use AI integration for accounting firms in just a few weeks. It’s fast, secure, and designed to give you measurable ROI from day one.

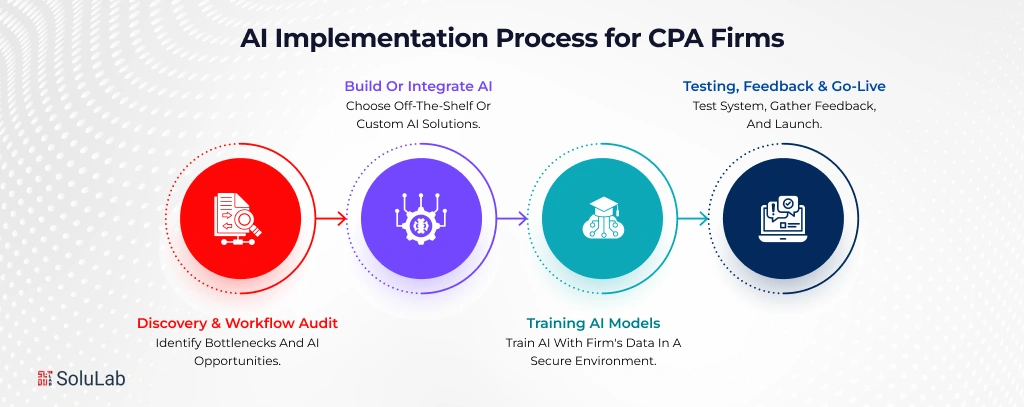

Step 1: Discovery & Workflow Audit

Every firm has its own way of working. That’s why its good to start with AI strategy consulting for workflow audit and understanding of how your team handles bookkeeping, audits, and tax operations.

Then map out every process and identify where AI applications can deliver quick wins. Common areas include:

- Repetitive data entry

- Manual reconciliations

- Delays in financial reports

- Tax compliance tracking

Once you know where the bottlenecks are, match each task with the best AI tools for CPAs or plan a custom AI solution if your needs are unique.

Step 2: Build or Integrate AI

Now you have to choose between off-the-shelf AI tools or a custom AI CPA system, whichever fits your goals and budget. Best Off-the-shelf tools work great for quick automations like:

- Invoice scanning

- Document sorting

- Chatbots for client support

Custom-built AI systems are perfect if you want proprietary tools that learn from your client data and workflows. An experienced AI app development company can handle both, building from scratch or connecting existing tools to your systems.

Step 3: Training the AI Models

Once tools are selected, train your AI in accounting and finance models with your firm’s real data. This is what makes your AI truly intelligent, it learns your processes, tone, and financial logic. Train each CPA AI model to:

- Understand how your team categorizes transactions

- Follow your firm’s reporting style

- Learn from past client data for better predictions

Everything runs in a secure, encrypted environment, so your data is protected end-to-end.

Step 4: Testing, Feedback & Go-Live

Before launch, every system goes through a full testing and feedback cycle with your team. Test accuracy, run real scenarios, and fix edge cases. Once everything is stable, go live and train your team to use the new tools.

AI Security & Compliance to Follow for CPA Firms

When it comes to AI for CPA firms, security isn’t optional, it’s essential. Your clients trust you with their most private financial data. That’s why every AI system should follow strict data protection and compliance standards to keep your firm safe and audit-ready.

Core Security Practices

Don’t take shortcuts safely. Every system must include:

- End-to-end encryption for all data transfers and storage

- SOC 2 and ISO 27001 aligned frameworks for full compliance

- Optional on-premise hosting for large CPA firms that prefer full data control

- Continuous audit trails and access logs so every action is traceable

Compliance You Can Trust

Meet the highest standards required for AI in finance and accounting, including:

- IRS Publication 4557 (Data Protection for Tax Professionals)

- AICPA SOC compliance

- GDPR for firms with international clients

An expert AI deployment company works as your AI security and compliance partner, making sure every automation layer remains safe, transparent, and aligned with your firm’s regulations. That’s why modern firms hire AI developers for helping them grow with confidence and compliance.

How CPA Firms Are Winning with AI in 2025?

Across the world, top accounting firms are already using AI tools for CPAs to save time, detect errors early, and grab new revenue opportunities. Here are three real stories showing how AI in accounting and finance is transforming the way firms work, win clients, and grow profits, all without increasing staff.

1: Cherry Bekaert LLP – AI Audit Cuts Time by 66%

Challenge:

Cherry Bekaert, a top CPA firm, spent weeks manually testing transactions and spotting fraud. Manual reviews were slow and missed key risks.

Solution:

They used MindBridge AI Auditor, an AI audit tool that checks 100% of transactions and flags unusual activity in real time.

Result:

- 66% less sampling time

- 35% faster audits

- Detected fraud attempts within the first month

- Full ROI in one year

- Positioned as an AI leader in accounting

2: Ohio CPA Firm – AI Boosts Revenue 42%

Challenge:

A small Ohio CPA Firm spent 40% of staff time entering invoices manually, leading to slow operations and unhappy clients.

Solution:

They adopted Vic.ai, an AI accounting automation platform that handled invoice processing and approvals. The firm then used the saved time to offer AI-powered advisory services like cash flow forecasting and business insights.

Result:

- 42% increase in advisory revenue

- 75% faster invoice processing

- 90% fewer data entry errors

- ROI in 9 months

- Moved from compliance work to strategic business advisory

3: Big Four Firm – Generative AI Saves 89,000 Hours

Challenge:

A big Four accounting firm spent hours preparing client briefs. Thousands of hours were lost to repetitive manual work.

Solution:

They built a custom Generative AI solution using Azure Cognitive Services and Large Language Models (LLMs) to auto-create proposals from data and past projects.

Result:

- 89,000 staff hours saved yearly

- Task time cut from 4 hours to under 7 minutes

- Deployed to 40,000 employees

- Improved proposal quality and speed

- Became a model for AI in accounting firms

How Much Does AI for CPAs Cost in 2025?

Many firms think AI is too expensive, but that’s not true. The cost really depends on your firm’s size, the kind of work you do, and how deeply you want to use AI for accounting. Here’s a simple view of what to expect:

| AI Solution Type | Estimated Cost (USD) | Best For |

| Off-the-Shelf AI Tools | $50–$300/month | Small firms or solo CPAs who want quick automation. |

| Custom AI Integration | $2,000–$5,000 (one-time setup) | Growing firms with 10–50 clients that want to connect AI with their existing software. |

| Full AI System Build | $10,000–$25,000+ | Established firms that need a complete AI accounting system across departments. |

A CPA firm investing $5,000 in automation saved more than $20,000/year in manual work costs. That’s a full return in just 3 months and pure profit after that. So whether you start small with ready-made tools or go all in with a custom AI solution providers, you’ll see value fast.

Conclusion

It’s no longer a question of if it’s about when and how fast you adopt AI for CPAs. Today, AI in accounting is a real tool that helps firms work smarter, not harder. CPA firms that use AI tools for CPAs are already seeing big improvements.

SoluLab, a renowned AI development company, holds much experience catering to the finance business needs with custom solutions. Backed by top notch technology, our solutions can offer you multiple benefits like:

- They complete client work faster.

- They manage more clients with the same team.

- They cut down on errors and improve accuracy.

- They offer high-value advisory services that increase revenue.

It helps automate your daily tasks, boost client satisfaction, and free up your team to focus on strategy instead of data entry.

If you’re a firm owner, it’s the right time to explore AI for CPA firms. Contact us today!

FAQs

1. How do I calculate ROI and time savings from adopting AI tools in my practice?

Track time spent on manual tasks pre- and post-implementation, monitor reduction in errors, and calculate cost savings versus software investment. Most firms report ROI within 6–12 months and see staff hours freed up for billable advisory work.

2. How do I choose between off-the-shelf and custom AI development for my firm’s needs?

Off-the-shelf solutions work best for standard workflow automation, while custom builds suit unique integrations and proprietary services. Agencies help by mapping requirements, comparing costs, and guiding pilot decisions for best-fit solutions.

3. How can AI improve client communication, advisory services, and overall value delivery?

AI-powered chatbots, document summarization, and predictive analytics provide clients with faster responses, deeper insights, and more personalized advice, freeing accountants for strategic conversations.

4. What ongoing support and updates should I expect after deploying AI solutions in my CPA firm?

Regular platform updates, cybersecurity monitoring, vendor-led training, and periodic workflow optimization are essential. At SoluLab, we offer post-launch support, troubleshooting, and best practices for continuous improvement.