Traditional banking has long struggled with slow settlements, limited liquidity, and high operational costs. These inefficiencies frustrate institutions and delay services for customers.

What if you could have a system where transactions settle instantly, assets are easily tradable, and records are tamper-proof? That’s exactly what tokenization in banking does!

By converting real-world assets like bonds, real estate, or credit into digital tokens on a blockchain, banks can improve their operations. It enables cross-border payments, better asset management, and access to previously illiquid markets.

In this blog, let’s explore how RWA tokenization is transforming traditional banking models and why it could be the key to a more efficient, transparent, and inclusive financial system.

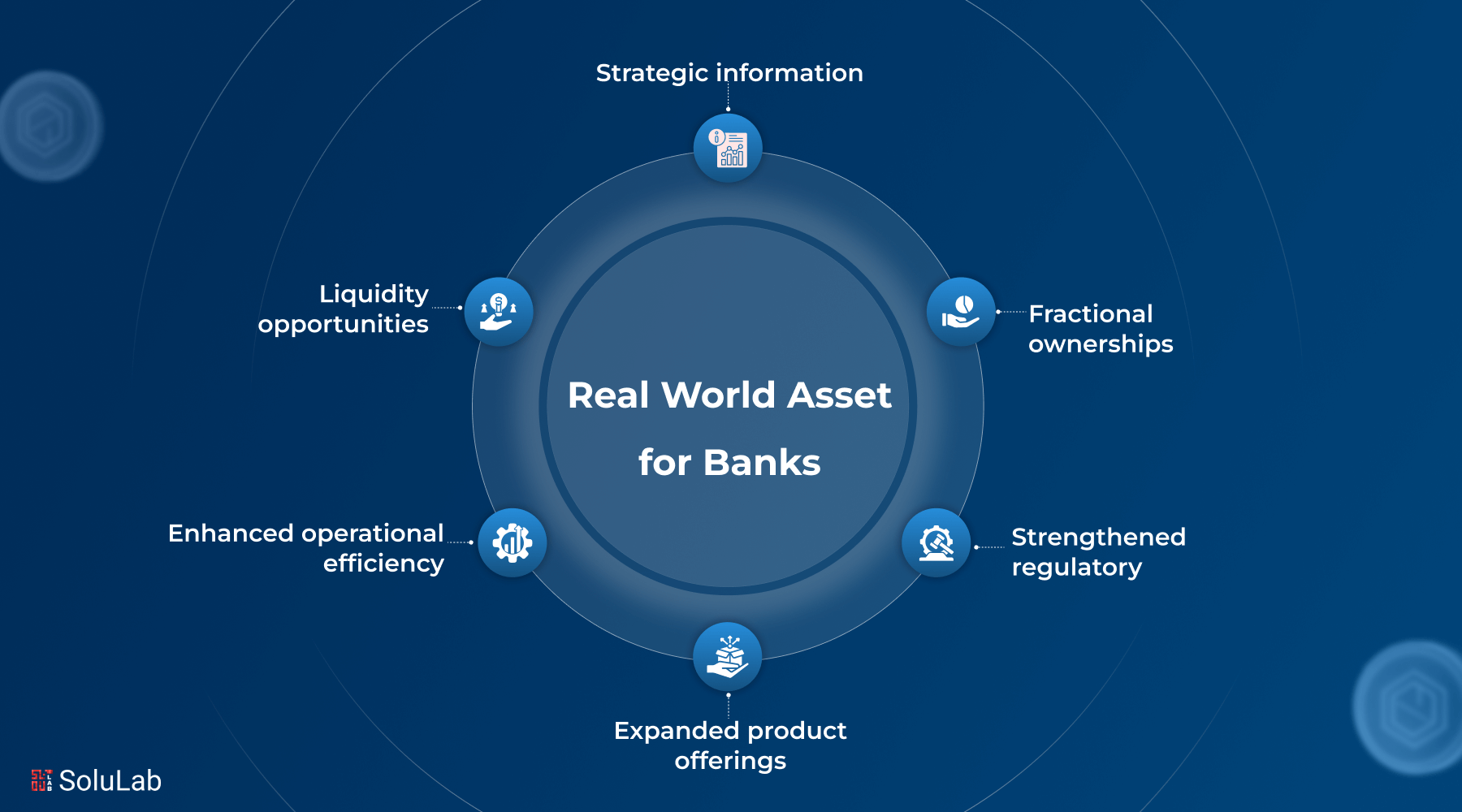

Why RWA Tokenization Matters for Banks in 2026 and Beyond?

RWA tokenization in the banking sector is no longer optional for banks—it’s a strategic move that can reshape how assets are managed, traded, and monetized.

- Liquidity Opportunities: Tokenizing real-world assets enables banks to convert illiquid assets, such as real estate or private equity, into tradable tokens, thereby opening access to a broader investor base and facilitating faster capital flow.

- Improves Asset Tracking: With blockchain-powered tokenization, every asset transaction is traceable and verifiable, enhancing trust, reducing fraud, and simplifying compliance in asset management and reporting.

- Enables Fractional Ownership: Banks can now offer fractionalized investments in high-value assets, making wealth management more accessible to a wider range of clients without compromising on returns.

- Enhances Operational Efficiency: Smart contracts automate manual processes such as settlement and compliance checks, cutting down on costs and time while increasing accuracy across transactions.

- Expands Product Offerings and Innovation: RWA tokenization enables banks to create new financial products such as tokenized bonds or token-backed loans, appealing to tech-savvy and next-gen investors.

- Strengthens Regulatory Readiness: As regulators move towards digital asset frameworks, adopting tokenization positions banks ahead of the curve and ensures they can adapt quickly to future compliance standards.

Read Also: Blockchain in Banking

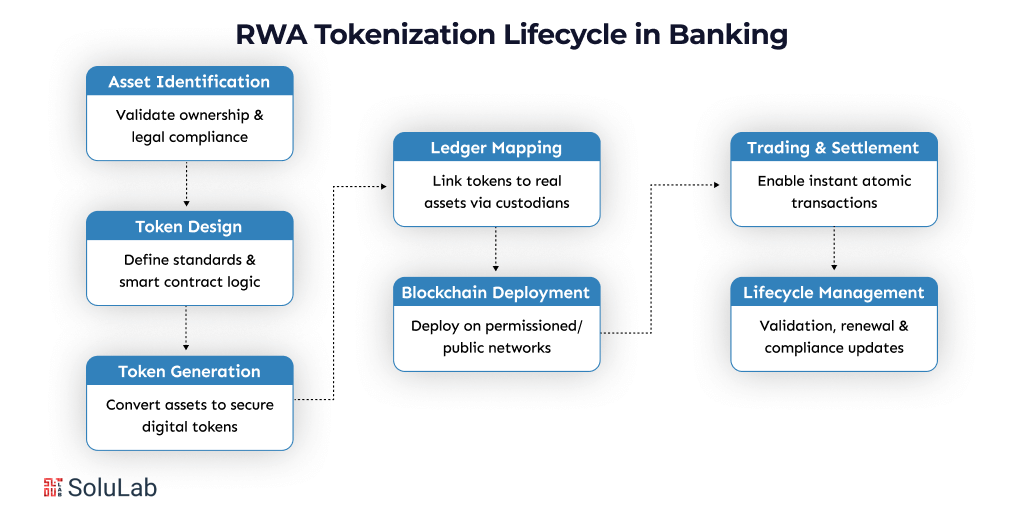

The RWA Tokenization Lifecycle in Banking

The tokenization of real-world assets (RWAs) in banking is changing how physical and financial assets are managed, traded, and secured. From asset discovery to lifecycle management, each stage plays a crucial role in ensuring transparency, efficiency, and compliance in the blockchain-enabled financial ecosystem.

1. Asset Identification and Due Diligence

This is the foundation of the RWA tokenization lifecycle. Banks identify suitable assets—like real estate, bonds, or invoices—and conduct thorough legal, financial, and compliance checks. The goal is to validate ownership, value, and risk factors, ensuring only credible, token-worthy assets move forward in the process.

2. Token Design and Framework Definition

Here, institutions decide how the asset will be represented digitally. They define the token’s structure—whether fungible or non-fungible, divisible or whole—and its compliance framework. This stage also includes regulatory mapping, smart contract protocols, and setting governance rules for how the token operates across platforms.

Read Also: Top RWA tokenization Companies

3. Token Generation

Once the framework is set, the actual creation of digital tokens begins. Smart contracts are deployed to mint tokens that represent ownership or rights to the physical asset. Each token is coded with the asset’s metadata, including legal ownership details, valuation, and usage restrictions, ensuring traceability and security.

4. Ledger Mapping and Custodianship

The tokens are then mapped onto a distributed ledger (blockchain). Meanwhile, the physical or legal representation of the asset is handed to a custodian or a regulated entity. This ensures a strong link between the digital token and the real-world asset, maintaining trust and accountability in the ecosystem.

5. Deployment and Interoperability

Tokens are deployed on public or private blockchains, depending on the use case. Ensuring interoperability across platforms is key to liquidity and scalability. APIs and blockchain bridges are often used to allow tokens to interact with different DeFi applications, wallets, and marketplaces securely.

6. Trading, Settlements, and Secondary Markets

This phase opens up asset trading on licensed exchanges or DeFi platforms. Settlements become faster with near-instant blockchain confirmation. The token can now be traded in secondary markets, offering increased liquidity, transparency, and accessibility to a wider pool of investors, including those with smaller capital.

7. Token Renewal and Lifecycle Management

Ongoing asset valuation, audits, and token maintenance are essential to keep the system compliant and updated. In case of asset maturity, legal disputes, or corporate actions, tokens may need to be renewed, modified, or even burned. Lifecycle management ensures the asset remains trustworthy over time.

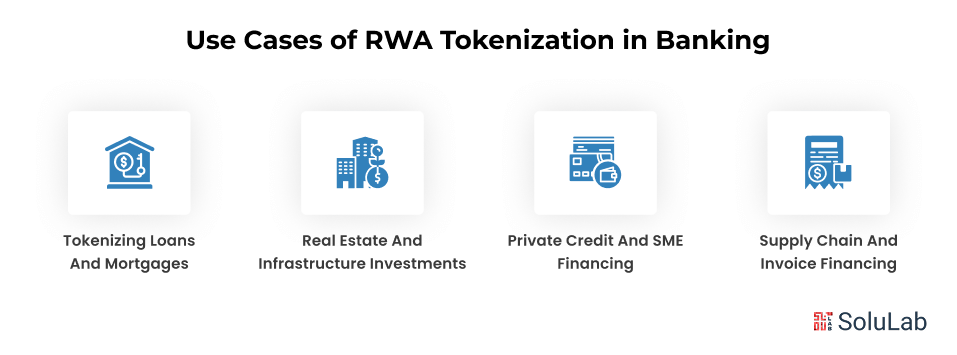

Use Cases of RWA Tokenization in Banking

To provide quicker, more effective, and secure transactions, RWA tokenization is changing the way banks handle and release liquidity from conventional financial assets.

- Tokenizing Loans and Mortgages: Banks can tokenize home loans or business mortgages into digital tokens. This allows for fractional ownership, easier transfer, and improved liquidity while reducing administrative burdens and settlement times.

- Real Estate and Infrastructure Investments: By tokenizing large real estate or infrastructure projects, banks make it easier for investors to buy fractions of high-value assets. This increases accessibility and creates new avenues for capital inflow.

- Private Credit and SME Financing: Tokenizing private debt or SME loans enables banks to offer flexible financing options and distribute risk more effectively. It also helps attract investors seeking higher yields from underbanked sectors.

- Supply Chain and Invoice Financing: Banks can tokenize invoices and receivables, turning them into tradeable assets. This helps businesses get faster access to working capital while improving transparency and reducing fraud in supply chains.

Read More: RWA Tokenization Challenges: How a Development Partner Helps

Real-World Examples of Banks Using RWA Tokenization

RWA (Real-World Asset) tokenization is actively changing global banking. Major institutions like JPMorgan, HSBC, and Societe Generale are leading the charge by digitizing traditional assets using blockchain. Here’s how they’re turning this innovation into real-world impact:

1. JPMorgan’s Kinexys Platform

JPMorgan launched the Kinexys platform to tokenize assets like U.S. Treasury bonds and money market shares. Through Kinexys, they created JPM Coin, enabling instant settlement and 24/7 payments between institutions. This real-time infrastructure helps reduce counterparty risk, speed up settlements, and improve transparency, making legacy banking faster, cheaper, and more secure.

2. HSBC’s Digital Bond Issuance

HSBC issued a $100 million digital bond on a blockchain platform, showing how RWA tokenization can modernize traditional securities. This move allowed real-time settlement, minimized middlemen, and improved liquidity. It also made bond trading more accessible, with the potential to reduce transaction costs and enable fractional ownership for smaller investors.

3. Societe Generale’s Blockchain-Based Assets

Societe Generale used Ethereum to tokenize €100 million worth of covered bonds and structured products. By doing this, they tested compliance with European regulations during the issuance and settlement processes. The use of public blockchains highlights a future where transparency, auditability, and interoperability between financial institutions become the norm.

Conclusion

Banking asset tokenization opens the way to a more effective, safe, and open financial system. Banks can increase accessibility for international investors, save operating expenses, and expedite settlement procedures by turning physical assets into digital tokens.

Its potential is not solely theoretical, as shown by real-world application cases from significant institutions. The banking industry’s use of asset tokenization will change how organizations handle and distribute value as its uptake increases.

Asset tokenization banking is poised to transform conventional methods in a variety of financial products, including bonds and real estate, by introducing creativity, speed, and inclusivity to the foundation of global banking operations.

SoluLab, a RWA tokenization development company, can help banks build secure, compliant, and scalable platforms tailored for real-world asset tokenization in banking. Contact us today to discuss further.

FAQs

1. Is RWA tokenization safe for banks?

It offers transparency, traceability, and compliance when developed with secure tokenization services, making its use by banks secure and dependable.

2. What are tokenization development services?

Tokenization development services offer tech solutions for creating, issuing, and managing digital tokens of real-world assets securely on blockchain networks.

3. How does RWA tokenization tie into wealth management?

By expanding access to premium assets, RWA tokenization in wealth management enables wealth managers to provide clients of all skill levels with diverse, blockchain-based investment portfolios.

4. How does this help in cross-border banking?

By removing the delays brought on by conventional SWIFT-based clearing systems, tokenized solutions can facilitate cross-border payments more quickly and affordably.

5. How does RWA tokenization support risk management?

It helps banks make data-driven decisions and lessen their exposure to high-risk situations by improving transparency and real-time asset monitoring.