You know how Stripe changed Web2 payments forever, and still many founders today are asking a new question that will do the same in Web3. The good news is, you can. The crypto payments industry is still early, growing fast, and full of gaps that new platforms can fill.

Even the traditional payments have too many gatekeepers. Banks, processors, and third parties decide how your money moves, but crypto changed the rules. Today, more businesses want to accept crypto payments directly, without restrictions and the shift is already happening.

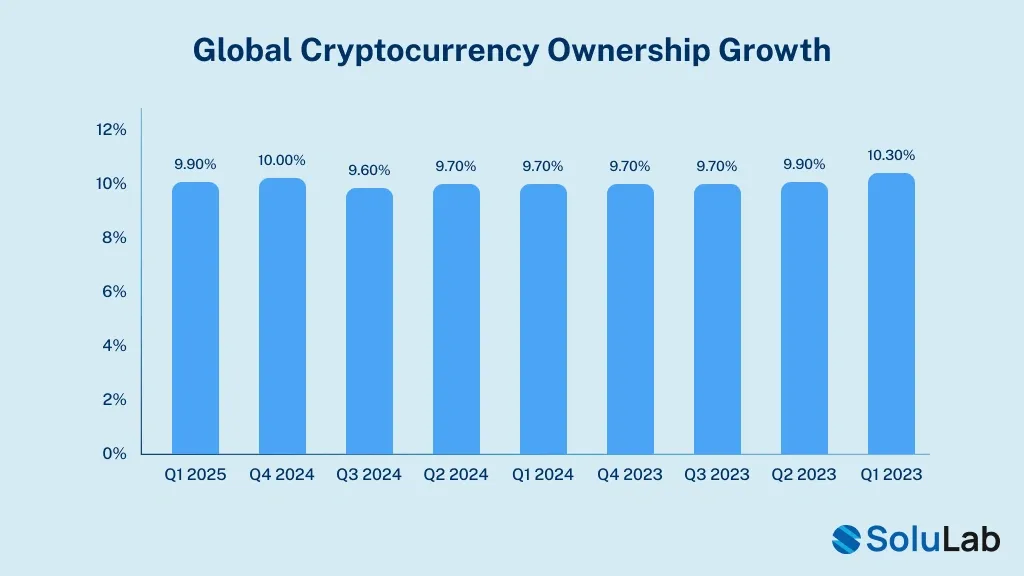

| There are 425M+ crypto users worldwide, and 46% of global merchant now accept crypto payments. |

Startups and enterprises are investing fast in crypto payment gateway development. Many are raising funds, growing revenue, and entering new markets. And most of them began exactly where you are, wondering if they could build a system that works. In this guide, you’ll learn the full roadmap to build a crypto payment gateway like Stripe, but for the blockchain era.

Key Takeaways

- The global crypto payment gateway market is growing from $1.7B in 2025 to $8.8B by 2035, driven by explosive stablecoin volumes and pressure on outdated payment rails.

- Stablecoins now power trillions in yearly settlements, making instant, global, low-cost payments that businesses expect.

- Building a serious gateway typically costs $60K–$120K+, but earns like 0.5–2% fees, SaaS tiers, white-label licensing, and treasury services.

Why Crypto Payment Gateways Are Becoming the Next $10B Industry?

If you look at the market today, one thing becomes obvious fast: the whole ecosystem has matured, and most of the Big companies now use blockchain, and every day, businesses are simply tired of waiting for banks that move slowly, charge high fees, and block global customers. Just look at the numbers.

- The global crypto payment gateway market hit $1.7B in 2025, and will reach $8.8B by 2035, a 17.8% CAGR.

- Stablecoin payments hit $9T in 2025, an 87% jump from last year.

- In September 2025 alone, stablecoin transactions hit $1.25T, more than half of Visa’s entire annual volume.

The adoption shift is even bigger as 100M+ people already hold crypto, and U.S. crypto payment users will grow 82% by 2026. But the real opportunity is that 75% of merchants want to accept crypto, but only 5–10% do it today. That’s a huge 70% gap.

This is the space where strong crypto payment gateways win big.

And the timing has never been better. Regulations are clearer and Businesses finally have rules to follow, and the tech is mature as stablecoins now power 30% of all on-chain payments, and reliable APIs and L2 chains make it easier than ever to build global systems that work.

But the biggest driver is cross-border payments. B2B crypto payments provides instant settlement, and 82% of merchants say the main reason they accept crypto is to remove middlemen completely.

And every month you wait, another company launches a gateway, signs merchants, and captures the market. The opportunity is here, and the demand is real. The only question left is whether you will build for it or watch someone else do it.

Why Build a Crypto Payment Gateway Like Stripe?

Building a crypto payment gateway is one of the highest-value products you can launch today. The market is massive, fast-growing, and still open for new winners. Here are the 4 things that will explain why –

1. Core Enterprise Infrastructure

A crypto payment gateway becomes a critical part of your business operations. Once integrated, it provides reliable, compliant, and scalable payment rails that enterprises depend on for global transactions.

2. Recurring Revenue & Monetization

By processing payments, your platform generates continuous revenue from transaction fees. Even fractional percentages on large volumes create predictable, high-margin income streams for enterprises.

3. Actionable Business Intelligence

Access to real-time payment and transaction data gives enterprises strategic insights. Track merchant performance, emerging markets, and transaction trends to inform product decisions and growth strategies.

4. Competitive Advantage & Market Defensibility

Payment infrastructure is sticky. Once deployed, it’s hard for competitors to replace, creating a defensible position. Enterprises benefit from reduced churn, enhanced compliance, and scalable market reach.

Core Features Your Crypto Payment Gateway Must Have

Building a successful crypto payment gateway is about getting the essentials right. These core capabilities separate a basic solution from a platform merchants actually love and trust.

1. Multi-Blockchain Support

Merchants don’t just want Ethereum, they want Polygon for low fees, Arbitrum for speed, and even Bitcoin for credibility. A white-label crypto payment gateway limited to one blockchain starts handicapped. Modern libraries like ethers.js and web3.py make multi-chain support straightforward. Your platform should be blockchain-agnostic and future-ready.

2. Instant Settlement Options

Speed is the game-changer. While traditional payments take days, a crypto payments gateway can settle in seconds or minutes. Some merchants prefer stablecoin settlements for predictable fiat value, others accept volatile tokens if volume justifies it. Your platform should offer both options seamlessly.

Read Also: How to Use Stablecoins for B2B Payments?

3. Merchant Dashboard

A clean dashboard is about clarity and control. Merchants need Real-time transactions, revenue analytics, Wallet management, payout controls, API access, and webhook integrations. Sophisticated merchants using your payment gateway platform will value speed, transparency, and reliability over flashy visuals.

4. Comprehensive API

Developers shouldn’t need a PhD to integrate. Your API must be intuitive, well-documented, and align with industry standards. Look at Stripe, their dominance comes from a clean API that just works. Your crypto payment gateway should deliver the same experience.

5. Automated KYC/AML Integration

Compliance is non-negotiable. Integrate KYC/AML workflows via trusted providers so merchants can enable them instantly. Flip a switch, and the system handles verification without adding friction or risk.

6. Conversion & Rate Locking

Merchants accepting crypto but settling in fiat need rate protection. Rate locking ensures the price at payment matches the settled value. Behind the scenes, your platform handles oracles, DEX integrations, and hedging, but merchants see only a simple, reliable interface.

7. Multi-Currency Support

Not every merchant works in USD. European clients want EUR, and emerging markets want local stablecoins. Your Stripe-like software development solution must support multiple currencies and make settlements effortless worldwide.

8. Webhooks & Real-Time Notifications

Systems must respond instantly. Webhooks fire events that the merchant’s backend consumes, updating inventory, confirming orders, or triggering automations. Dropped events mean lost trust. Reliability is key.

9. Dispute Resolution

Even crypto has disputes. Transactions fail, chargebacks happen, and customer conflicts arise. Your platform needs structured dispute management to protect merchants and maintain confidence. This builds trust, retention, and long-term loyalty.

The Architecture Behind Modern Crypto Payment Gateways

Building a payment gateway is creating a seamless, secure system where blockchain, traditional finance, and enterprise-grade security come together. Let’s walk through the architecture layer by layer.

1. API Layer

This is the front door for your merchants and apps. Every request, from payment initiation to notifications, flows through this layer. It exposes REST or GraphQL APIs and supports webhooks for real-time alerts. Here is what you should remember –

- Build with Node.js, FastAPI (Python), or Go for high throughput and low latency.

- Secure endpoints with JWT authentication, OAuth2, and rate-limiting.

- Version APIs early to prevent integration breaks during upgrades.

- Use gRPC for internal microservices to reduce latency and improve scalability.

This layer is the bridge between your platform and every merchant or partner in your ecosystem. It’s the first impression, and it has to be flawless.

2. Blockchain Integration Layer

Here’s where your gateway talks to blockchains. This layer abstracts all the complexity, like connecting to multiple networks via RPC nodes, interacting with smart contracts, handling cross-chain transfers, and optimizing gas fees. Here is what you should do to keep the security aspect –

- Manage keys with HSMs or MPC solutions

- Use audited smart contracts and secure signing protocols

- Ensure every transaction is validated before execution

A single error here could compromise funds, so treat this as the secure engine powering every on-chain transaction.

3. Database Layer

Every transaction, merchant record, and audit log must be safely stored. You can choose –

- SQL (PostgreSQL/MySQL) for strict transaction accuracy

- NoSQL (MongoDB) for flexible, high-volume data

- Blockchain-optimized databases (BigchainDB, Fireblocks DB) for immutable logs

All data should be encrypted at rest and in transit, replicated for disaster recovery, and fully auditable for regulators. This layer is the backbone, as every decision, report, or settlement relies on accurate, verifiable data that is stored on this layer.

4. Settlement Engine

The settlement engine is the brain of the gateway. It helps you to –

- Validates transactions and reconciles accounts

- Handles currency conversion (crypto ↔ fiat)

- Calculates fees and optimizes settlement paths

- Processes transactions in batches or real-time

To get this functional, you need to take care of these specifications :

- Event-driven systems (Kafka, RabbitMQ) for high throughput

- Idempotent processing to prevent double settlements

- Smart contract-triggered disbursements for automated payouts

This layer is where traditional finance and blockchain meet, and errors here are costly, so precision is non-negotiable.

5. Compliance and Monitoring Layer

Regulation isn’t optional for crypto payment gateways. This layer should –

- Integrates KYC/AML providers like Jumio, Onfido or SumSub.

- Performs sanction checks and risk scoring

- Monitors for suspicious activity in real time using ML algorithms

- Stores immutable audit logs for regulators

Compliance runs alongside every transaction as an invisible guardian keeping your platform safe.

6. Reporting and Analytics

Beyond transactions, merchants and your team need insights, so you need:

- Dashboards showing transaction volume, settlement times, and fees

- On-chain reporting for regulatory compliance

- Business intelligence to detect fraud and optimize operations

- AI-driven analytics to forecast liquidity needs and predict settlement bottlenecks.

7. Admin Dashboard

The Admin dashboard allows you to:

- Monitor transactions and merchant activity

- Control payouts and settlements

- Track system health and latency

- Detect fraud and intervene in real time

Use React/Next.js frontend with Node.js backend, WebSocket real-time updates, and API gateway integration for maximum control.

Read More: Why Crypto-as-a-Service is the Easiest Way to Launch Crypto Products?

How to Build a Crypto Payment Gateway Platform Like Stripe?

Building a crypto payment gateway like Stripe means creating a platform that is simple for merchants, secure for users, and scalable for global transactions.

Below are the key steps involved:

Step 1. Define the Payment Model

Start by deciding how your gateway will operate. Will it support crypto-to-crypto payments, crypto-to-fiat settlements, or both? This decision affects wallet design, liquidity management, and integration with banks or exchanges.

Step 2. Choose the Right Blockchain Infrastructure

Select blockchains that offer low fees, fast confirmation times, and strong developer support. Many platforms support multiple chains to give merchants flexibility and reduce transaction costs.

Step 3. Build Secure Wallet & Payment Processing

At the core of the platform is a secure wallet system that manages deposits, withdrawals, and settlements. This includes:

- Multi-signature or MPC wallets

- Real-time transaction monitoring

- Automated payment confirmations

Security and reliability here directly impact user trust.

Step 4. Integrate Compliance and Risk Controls

A Stripe-like crypto gateway must meet regulatory expectations. This includes:

- KYC and AML checks

- Transaction screening and fraud detection

- Audit logs and reporting tools

Built-in compliance helps merchants adopt crypto payments with confidence.

Step 5. Design Merchant-Friendly APIs and Dashboards

Ease of integration is key to adoption. Provide simple APIs, SDKs, and dashboards that allow merchants to:

- Accept crypto payments quickly

- Track transactions in real time

- Manage settlements and refunds

The experience should feel as smooth as using Stripe.

Step 6. Enable Smart Settlements and Automation

Automate settlements, fee calculations, and conversions using smart contracts or backend logic. This reduces manual work and ensures faster, more accurate payouts.

Step 7. Test, Launch, and Scale

Before launch, test for security, performance, and edge cases. Once live, focus on scalability, monitoring, and adding new payment methods, chains, and regions as demand grows.

Compliance & Security Requirements for Crypto Payment Gateways

Launching a crypto payment gateway requires navigating a complex global regulatory landscape. Here are a few regulations you should know

- US – FinCEN guidance, state-level Money Transmitter Licenses (MTL), and SEC oversight for securities tokens.

- EU – MiCA (Markets in Crypto-Assets Regulation) standardizes rules for stablecoins, wallets, and exchanges.

- Singapore – Payment Services Act (PSA) regulates exchanges, wallets, and payment services.

- UAE / UK / Switzerland – Local licensing frameworks for crypto exchanges and custodial services.

KYC and AML remain central to compliance worldwide. Platforms must verify merchant and user identities, monitor transactions for suspicious patterns, report to regulators, and maintain long-term audit-ready records. Security standards are equally rigorous. Platforms must use

- Cold storage for most funds

- Multi-signature authorization for fund transfers

- 24/7 real-time monitoring for unauthorized access

- Regular penetration testing and security audits

- Cyber liability insurance to mitigate risks

Combined, these steps meet the expectations of regulators, investors, and auditors, ensuring trust and long-term sustainability. Adopting robust global compliance practices, from MiCA in the EU to FinCEN in the US and PSA in Singapore, along with strong operational security, positions your crypto gateway as reliable, transparent, and investor-ready, giving your business the foundation to scale internationally.

Cost to Build a Crypto Payment Gateway

Let’s break down the real costs so you can plan your budget wisely. The cost to develop a crypto payment gateway depends on the features, complexity, and scale. Here’s a clear guide:

| Package | Key Features | Price Range | Timeline |

| MVP | – Single blockchain support (Ethereum) – Basic merchant dashboard – Payment & settlement API – Core transaction processing – Proof of concept deployment | $45,000 – $85,000 | 2 months |

| Solid Product | -Multi-blockchain support – Advanced merchant dashboard – Real-time analytics & reporting – KYC/AML integration – Enhanced security infrastructure – Scalable transaction processing | $100,000 – $180,000 | 3–5months |

| Enterprise-Grade Platform | – White-label platform – Multi-currency & advanced settlements – Enterprise reporting & dashboards – Regulatory compliance across US, EU, UAE, UK – Institutional-grade security & audits – Fully custom development for enterprise clients | $250,000 – $450,000 | 6–9 months |

Monetization & Business Model for Crypto Payment Gateways

Building a crypto payment gateway platform is one thing. Monetizing it effectively is another. Here are proven revenue models that developers and fintech companies use to generate sustainable income while delivering value to merchants and investors.

| Revenue Stream | How It Works |

| Transaction Fees | Charge a small percentage (0.5–2%) on each transaction processed through your platform. Aligns revenue with merchant success. |

| Merchant Subscription Tiers | Monthly subscription plans with different limits and features. – Starter: $99/month, up to $100K volume – Professional: $499/month, up to $1M volume – Enterprise: Custom |

| Hybrid Model | Combine subscription fees and transaction fees. Reduce the transaction percentage if a merchant pays upfront. |

| White-Label Licensing | License your platform to other companies. They brand it, you manage the backend. High-margin revenue with minimal additional cost. |

| Settlement & Liquidity Services | Monetize transaction flow by offering: – Spread on settlement rates – Advanced merchant payout options (different blockchains, timing) – Treasury services – Lending against merchant balances |

| Data & Analytics | Aggregate, anonymized transaction data can be packaged as: – Industry reports – Market benchmarking – Merchant insights |

| Developer Tools & SDKs | Offer premium developer resources: – Code libraries – Documentation & tutorials – Testing environments – Analytics dashboards |

Building a crypto payment gateway is just the start, but making it profitable is key. The core model is transaction fees around 0.5–2%, which scale as merchant volume grows. Platforms also use subscription tiers or a hybrid model combining fees and subscriptions for predictable revenue.

Advanced revenue streams include white-label licensing, letting other companies brand your platform while you handle the backend, and settlement or liquidity services, such as multi-chain payouts, treasury services, or lending against merchant balances.

Additional income comes from data analytics and developer tools, offering insights, dashboards, SDKs, and support. Together, these models let fintech and crypto companies scale efficiently while delivering high-value crypto payment gateway solutions.

Enterprises That Built Their Own Crypto Payment Systems

1. PumaPay – Custom P2P Crypto Payment Gateway

Traditional payment processors were slow, costly, and struggled with global crypto transactions. PumaPay needed a system that could handle high transaction volume, low latency, and global scalability.

So, they developed a custom peer-to-peer crypto payment gateway with DeFi integration, multi-layer encryption, cross-chain support across 12+ networks, and white-label capabilities for merchants.

The Impact:

- Achieved 85% user adoption within 6 months.

- Expanded revenue through wider merchant acceptance.

- Built a scalable and secure blockchain payment platform capable of handling high-volume transactions.

2. The Rug Republic – Proprietary In-House Crypto Payment System

Relying on third-party crypto platforms like WazirX and Binance was costly and limiting. The company wanted full control, lower fees, and a branded crypto payment experience for global customers.

So, they designed a proprietary in-house crypto payment gateway capable of handling direct Bitcoin and stablecoin payments without intermediaries. The system includes instant settlements and custom merchant tools.

The Impact:

- Removed third-party fees, improving customer conversion from crypto holders.

- Expanded to international markets without banking restrictions.

- Currently transitioning to a fully-owned, scalable crypto payment infrastructure.

Conclusion

Building a crypto payment gateway like Stripe used to feel impossible but not anymore. The market has shifted, Merchants want faster global payments, users trust digital wallets, and regulations are finally catching up and everything is moving toward crypto-native payments, and the next 24 months will decide who becomes the category leaders. If you start now, you don’t just build a product; you claim early trust, early users, and a real competitive edge.

And if you’re serious about launching your own crypto payment gateway, you don’t have to do it alone. As a dedicated crypto payment gateway development company, SoluLab helps founders turn ideas into secure, compliant, and scalable payment platforms built for real-world use. The tech, market and the demand are already here. Now the only question left is whether you’re ready to build what comes next.

FAQs

Building a crypto payment gateway depends on your features and team size. A simple MVP takes around 2–4 months, a stable market-ready platform takes 5–7 months, and a large enterprise-grade system can take 7-12 months. The more chains, security layers, and compliance checks you need, the longer the build.

Not really. It helps, but it’s not a must. What you need is a team like SoluLab that can learn fast, understand Web3 docs, and work with modern blockchain libraries. These tools already handle most of the complex blockchain logic for you.

The hardest part is security and compliance, not coding. You must protect user funds, secure wallets, prevent fraud, and follow KYC/AML rules. Strong tech matters, but a safe and compliant system matters more if you want real merchants to trust your payment gateway.

Don’t try to beat them everywhere. Win in a small niche first, like gaming, NFTs, global e-commerce, creator platforms, or high-fee regions. If your crypto payment gateway solves one problem better than the big players, merchants will switch.

Rules depend on the country, but most markets require money transmitter licenses and mandatory KYC/AML systems. It’s smart to work with compliance lawyers early, so your gateway is safe to launch in the regions you target.

If you have a strong technical co-founder, an MVP costs around $45K–$85K. A polished, market-ready crypto payment gateway costs $100K–$180K, and a large enterprise product usually needs $250k+. Most serious teams raise a seed round for this.

Yes. Demand is rising fast as more businesses want crypto payments, regulations are getting clearer, and high-fee regions want cheaper options. The timing is strong for founders who move quickly.