The market is filled with experimental protocols and fleeting hype. Every minute, people are looking for updates, innovations, especially in trading. Trillions of digital dollars are flowing in the world economy. This is why exchange platforms are gaining traction.

Aster DEX development is also one of them that grew with clarity and ambition. As its CEO, Leonard shared, “Our mission is not just another DEX launch; it is to bring CEX-level performance to decentralized infrastructure.”

The idea gained strength after the merger of Astherus and APX Finance, both well-known for their liquidity innovation and perpetual trading technology. This article explores how Aster DEX works, why traders are shifting towards such decentralized perpetual exchanges, and what makes it stand out among other major players like Hyperliquid.

What is Aster DEX, and How is It Unique?

Aster DEX is a decentralized exchange (DEX) that combines spot and perpetual trading. It is designed for both beginners and professionals, featuring dual trading interfaces, Simple Mode, and Pro Mode. The project emerged through a 1:1 token exchange from APX to ASTER, marking its Token Generation Event (TGE) with record-breaking volumes.

The exchange supports cross-chain trading across BNB Chain, Ethereum, Solana, and Arbitrum. Users can trade without switching networks or bridging assets manually. This level of multi-chain flexibility and unified liquidity is what gives Aster its edge.

Backed by YZi Labs and publicly endorsed by CZ, Aster DEX has become one of the fastest-growing names in the decentralized trading world. With over $2 trillion in total trading volume and 3 million active users, it is redefining what a professional-grade DEX exchange should look like.

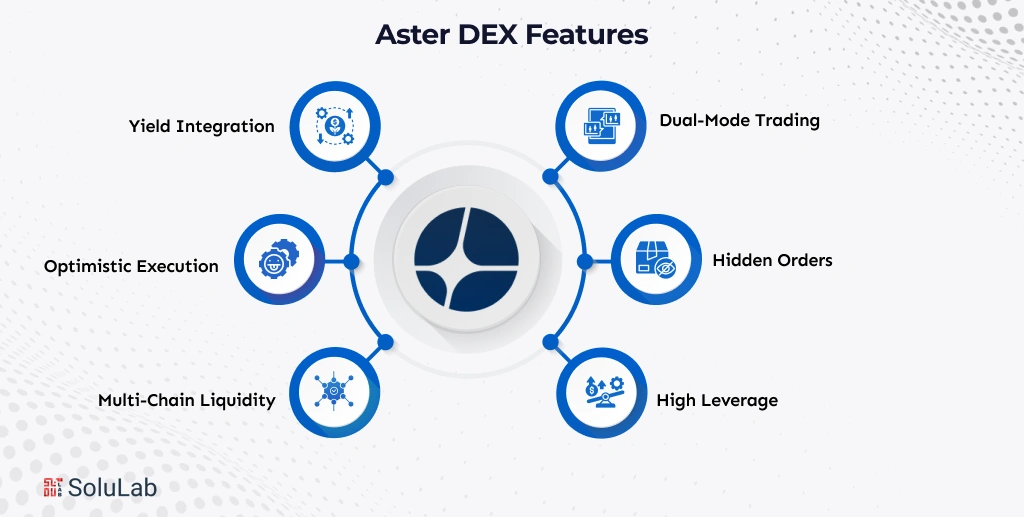

Key Features That Define Aster DEX

Each component of the Aster dex exchange reflects precision and market insight. Below are the features that define its core identity:

1. Dual-Mode Trading: Simple Mode supports quick trades, while Pro Mode offers professional tools and advanced order types.

2. Hidden Orders: Orders stay invisible until execution, reducing front-running and ensuring private trading.

3. High Leverage: Up to 1001× leverage on select pairs, including crypto and stock perpetual contracts.

4. Multi-Chain Liquidity: Unified access to liquidity pools across major blockchains.

5. Optimistic Execution: Transactions execute instantly and are later verified through fraud proofs for accuracy.

6. Yield Integration: Collateral assets generate passive yield while being used for margin.

Each of these features reflects the exchange’s focus on efficiency, transparency, and fairness, traits often missing in typical perpetual DeFi exchange environments.

Core Architecture Behind Aster DEX

The Aster DEX development needs an expert team to build its architecture around three main pillars: speed, security, and scalability.

-

Optimistic Execution and Fraud Proofs

Aster processes trades under an optimistic assumption model. Transactions are validated later, and any incorrect batches are flagged through fraud proofs. This mechanism increases throughput and maintains a low-latency environment suitable for professional traders.

-

Multi-Chain Liquidity Aggregation

Liquidity from BNB Chain, Ethereum, Solana, and Arbitrum flows into a single order book. Therefore, traders can execute large orders without price slippage or liquidity fragmentation.

-

Aster Chain Integration

Aster is building its own blockchain, Aster Chain, to enhance native execution and optimize transaction settlement. The chain will include on-chain governance and native staking opportunities for ASTER token holders.

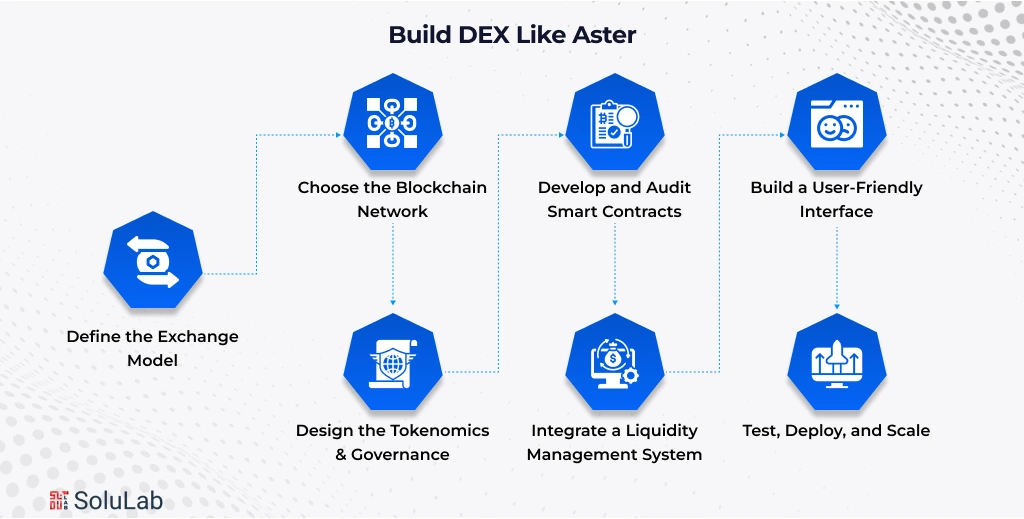

Process to Build a DEX Like Aster

Building a decentralized exchange (DEX) like Aster requires a combination of blockchain architecture, smart contract precision, and liquidity optimization. Here’s a streamlined process from ideation to deployment:

Step 1: Define the Exchange Model

Decide whether you’re building an AMM-based DEX (like Uniswap), an order book-based system, or a hybrid exchange model. This determines your blockchain architecture, liquidity strategy, and user experience.

Step 2: Choose the Blockchain Network

Select the blockchain that aligns with your scalability, speed, and transaction goals. Popular choices include Ethereum, Solana, Polygon, or BNB Chain. Multi-chain compatibility ensures broader liquidity and accessibility.

Step 3: Design the Tokenomics & Governance

Create a native token to power your DEX ecosystem. Define its utility, governance rules, staking rewards, and transaction fee model. This helps attract users and incentivize participation.

Step 4: Develop and Audit Smart Contracts

Write and deploy smart contracts to manage swaps, liquidity pools, staking, and yield farming. Perform third-party security audits to ensure no vulnerabilities or exploits exist.

Step 5: Integrate a Liquidity Management System

Design liquidity pools and incentivization mechanisms for liquidity providers (LPs). Implement automated market-making algorithms for efficient price discovery and minimal slippage.

Step 6: Build a User-Friendly Interface

Create an intuitive frontend with real-time charts, wallet integration (MetaMask, WalletConnect, etc.), and fast transaction execution. The UI should offer smooth onboarding for both new and expert traders.

Step 7: Test, Deploy, and Scale

Run extensive testnet trials to ensure performance and reliability. After deployment, focus on scaling through cross-chain integrations, DeFi partnerships, and DAO-driven governance models.

Why Developers and Traders Are Turning to Perpetual DEXs Like Aster?

Perpetual DEXs have gained rapid adoption as traders seek transparency and control. Aster’s success proves this shift is real.

- Over $32 billion in daily trading volume and $4 billion in open interest show that decentralized platforms can now match centralized ones in activity and liquidity.

- Developers prefer building on such frameworks because perpetual exchanges provide higher trading frequency, sustained liquidity, and flexible monetization through protocol fees and governance models.

- Traders, on the other hand, choose Aster for its 1001× leverage, multi-chain execution, and hidden order protection.

- According to internal data, more than 3 million traders have executed positions worth over $2 trillion since launch.

Moreover, the introduction of stock perpetuals has expanded Aster’s audience beyond crypto traders to traditional equity speculators exploring decentralized finance (DeFi) markets.

How Aster DEX Compares to Other Leading Platforms?

Understanding how Aster fits into the broader decentralized trading ecosystem means looking at its design philosophy alongside platforms like Hyperliquid and CoinFutures. Each has evolved with distinct priorities, from infrastructure choices to trading experiences.

-

Integration Across Multiple Chains

Aster’s structure emphasizes interoperability. It integrates with chains such as BNB, Ethereum, Solana, and Arbitrum, enabling users to access liquidity from multiple ecosystems. Hyperliquid, in contrast, runs on a custom Layer 1, while CoinFutures operates through an internal application layer. This difference shapes how users move capital and manage exposure across assets.

-

Leverage and Order Execution

Leverage remains a defining feature of perpetual trading platforms. While Aster offers higher limits, its focus lies in maintaining precision with flexible order types, including hidden and conditional orders. Hyperliquid prioritizes execution speed, achieving near-instant finality below 100 ms. CoinFutures keeps things simple, offering a straightforward leverage model suited for early-stage traders.

-

Asset and Collateral Diversity

Aster supports stablecoins, yield-bearing tokens, and synthetic assets as collateral. This broad base allows greater capital mobility across DeFi ecosystems. Hyperliquid’s model centers on stablecoin-based margining, offering consistency but less variety. CoinFutures maintains a closed-loop collateral system using its internal tokens, which streamlines usability but limits flexibility for diversified traders.

-

Trading Accessibility and Network Reach

When it comes to participation, Aster combines multi-chain access with a steadily growing trader base. Hyperliquid attracts institutional-grade users focused on liquidity depth and low latency. CoinFutures appeals more to retail participants who value simplicity over customization. Together, they represent three distinct layers of the decentralized trading landscape.

What’s Next for Aster DEX

Aster’s roadmap shows a strong focus on sustainability and product depth. The next steps include:

1. Zero-Knowledge Proof Integration: Further improving order privacy and reducing verification overhead.

2. Aster Chain Public Launch: Expanding the beta version into a full ecosystem chain with staking and governance.

3. New Product Lines: Tokenized equities and yield-bearing derivatives will expand market participation.

4. Enhanced Incentive Models: New staking rewards and liquidity programs to attract both traders and developers.

Conclusion

Now you know the why Aster Dex is gaining popularity. It’s not just another platform for trading; it’s gaining people’s interest because of the innovative ideas and software. If you are also looking to build a DEX like Aster, Solulab is here to help.

We at SoluLab, a top decentralized exchange development company, build lightning-fast and gas-optimized DEXs. We help you to create robust, secure, and future-ready decentralized exchanges. Our expert team is always there to provide you with DEX solutions. Recently, we built a DLCC platform for fast automated crypto trading, lending, and borrowing, simple, transparent, and secure. With this, we increased 70% in loans and borrowing.

For more details on DEX platform building, contact us today!

FAQs

1. What makes Aster DEX an out-of-the-box concept?

Aster DEX blends centralized exchange-level performance with DeFi transparency using hidden orders, yield-based collateral, and multi-chain trading, creating a seamless, privacy-focused decentralized exchange experience.

2. How does Aster DEX ensure data security?

It uses optimistic execution, fraud proofs, and hidden orders to protect user data, prevent front-running, and maintain transparent yet secure on-chain trade validation.

3. What trading data shows Aster DEX’s performance?

Aster DEX has recorded over $2 trillion in total trading volume and 3 million active users, reflecting strong adoption and deep market liquidity.

4. How can SoluLab help build a DEX like Aster?

SoluLab offers end-to-end DEX development, smart contracts, liquidity modules, and UI/UX to create secure, fast, and scalable decentralized exchange platforms.

5. Why are traders moving toward perpetual DEXs like Aster?

Traders prefer perpetual DEXs for non-custodial control, transparency, high leverage, and 24/7 access, making trading safer, faster, and more efficient.