What if every dollar you invested could help fight climate change and grow your wealth?

That’s exactly the promise of green finance, a rapidly expanding movement reshaping global financial systems. As the world races toward net-zero targets, investors, governments, and corporations are turning to sustainable funding models that strike a balance between profit and purpose.

By 2026, green finance is no longer a niche concept; it’s becoming the foundation of responsible economic growth. From AI-powered ESG assessments to tokenized carbon credits and climate-linked bonds, technology and policy reforms are driving a new era of eco-conscious investment.

In this blog, we’ll explore the key green finance trends for 2026, the innovations, frameworks, and opportunities that are redefining how money moves toward a sustainable future.

Why 2026 Is a Pivotal Year for Green Finance?

The year 2026 marks a critical turning point for global finance systems as sustainability shifts from being an optional strategy to a core financial priority. The momentum toward green finance, which supports environmentally responsible investments, is accelerating due to several key global and regional developments.

1. Stricter Global ESG Regulations

Governments and financial regulators across the EU, UAE, and Asia-Pacific are enforcing tighter ESG (Environmental, Social, and Governance) compliance standards. By 2026, major economies are expected to align their corporate disclosure norms with IFRS Sustainability Standards, making transparent sustainability reporting mandatory for both public and private institutions.

2. Post-COP28 Commitments Coming into Effect

The outcomes of COP28 are translating into actionable finance targets in 2026. Countries are channeling more funds into renewable energy, climate adaptation, and carbon neutrality projects, creating massive opportunities for green bonds, sustainability-linked loans, and climate-focused fintech innovations.

3. Technology and Finance Converge

With the AI integration, blockchain, and data analytics, financial institutions are developing smarter, traceable, and verifiable sustainability models. By 2026, these technologies will be standard tools for measuring carbon impact, assessing ESG risks, and tokenizing green assets for greater transparency. Financial automation platforms like AccessPay are playing a key role in bridging legacy banking systems with modern ESG-compliant infrastructure.

4. Investor Behavior Is Changing Fast

Institutional and retail investors are demanding ethical and climate-conscious portfolios. This shift is pushing banks, asset managers, and fintech startups to embed sustainability into their products. As a result, green investing is becoming a mainstream growth driver rather than a niche segment.

5. Transition from Pledges to Measurable Impact

Unlike the previous decade, where green finance often revolved around voluntary goals, 2026 focuses on accountability and impact measurement. The emphasis is on quantifying results, carbon reduction achieved, biodiversity preserved, and energy efficiency improved, turning sustainability into a tangible financial metric.

Top Green Finance Trends Shaping 2026 Ahead

Trend #1. Tokenized Green Bonds & Blockchain Transparency

Businesses are using blockchain technology to issue digital green bonds. This creates tamper-proof records and faster secondary trading, key benefits for investors and regulators. This innovation is driving major trends in green finance and reducing transaction costs for institutional players. For businesses, it’s a practical way to raise capital while proving sustainability commitments.

For example, over $10 billion in tokenized bonds have already been issued globally by mid-2025. Settlement costs are reduced by up to 80% through smart contract automation, and major institutions like BlackRock and Abrdn are actively exploring blockchain-based issuance.

A standout case is Hitachi’s 10 billion yen ($69 million) digital green bond issued in 2023, which featured real-time ESG metrics streaming to investors and instant settlement capabilities.

Trend #2. AI-Driven ESG Scoring

Artificial Intelligence can scan huge ESG (Environmental, Social, Governance) data sets in real time and deliver accurate risk reports. Companies that adopt AI will stay ahead of the top green finance trends and build stronger trust with investors.

Leading platforms include:

- Persefoni for end-to-end emissions tracking

- Sylvera for AI-powered carbon credit ratings

- Planet Labs for satellite-based forest carbon monitoring using machine learning

Collectively, the top 15 SMEs in AI-driven carbon management have raised over $160 million, with Planet Labs alone securing $95 million in Series C funding.

For enterprises, AI tools make compliance easier and help identify profitable, climate-friendly investments.

Trend #3. Carbon Credit Marketplaces

Voluntary carbon markets are expanding quickly, making them a highlight of the latest trends in sustainable finance. Digital MRV (measurement, reporting, verification) tools let businesses buy, sell, and retire carbon credits. This is central to any sustainable green finance strategy and gives companies a new way to offset emissions or create new revenue streams.

Platforms like Xange combine satellite data, blockchain, and AI to offer fully transparent carbon credit systems that meet the highest ESG standards for monitoring and verification.

Trend #4. Embedded Green Finance

New fintech APIs now add “green by default” features directly into enterprise software. With these integrations, clients can automate compliance, track ESG goals, and launch new services faster. This is becoming one of the most important green and sustainable finance opportunities for software providers and financial institutions alike.

Real-world example includes Tide UK, whose business banking app shows the carbon footprint per transaction.

Technology Enablers for Sustainable Finance

For modern enterprises aiming to lead in green finance trends, the right technology stack is critical. Modern infrastructure is the backbone of green, sustainable finance and drives measurable impact. Here are the key enablers explained in straightforward terms:

1. Cloud & Edge Computing

- Provides real-time carbon tracking and energy-use monitoring across multiple facilities or trading desks.

- Scales easily so global green finance companies can process ESG data without latency or heavy on-prem costs.

- Microsoft Azure Cosmos DB supports containerized, climate-resilient financial apps.

2. Smart Contracts on Blockchain

- Automate compliance for ESG-linked loans, green bonds, and carbon credit trades.

- Reduce manual audits and human error, vital for sustainable and green finance projects where transparency builds investor trust.

3. API-First Platforms

- Offer seamless integration with banking systems, trading engines, and third-party ESG data sources.

- Enable quick rollout of new sustainable finance trends such as tokenized green bonds or carbon-offset marketplaces.

By combining these elements, scalable cloud infrastructure, blockchain-based smart contracts, and flexible APIs, enterprises can implement green and sustainable finance solutions that are both cost-effective and audit-ready.

Opportunities for Enterprises & Financial Institutions

Companies that act early on green finance trends 2025 and the broader green finance trends shaping 2026 can win investor trust, meet stricter regulations, and stand out in a crowded market. Acting now provides three key advantages:

New Revenue Streams:

Offer ESG-as-a-service, launch white-label carbon marketplaces, or create platforms for sustainable and green finance trading. These solutions attract climate-focused investors and corporate clients seeking measurable impact.

- Lower Capital Costs: Early adoption of sustainable finance trends makes it easier to qualify for sustainability-linked loans and green bonds, reducing borrowing costs while meeting compliance standards.

- Brand Leadership: Companies that integrate green and sustainable finance solutions signal long-term commitment to ESG goals and can secure premium partnerships with banks, asset managers, and large green finance companies. Companies like UPS and SIDBI in India demonstrate how sustainability drives premium partnerships.

While established green finance companies set the pace, agile mid-market firms can leapfrog them by partnering with technology agencies that specialize in blockchain, AI, and API development.

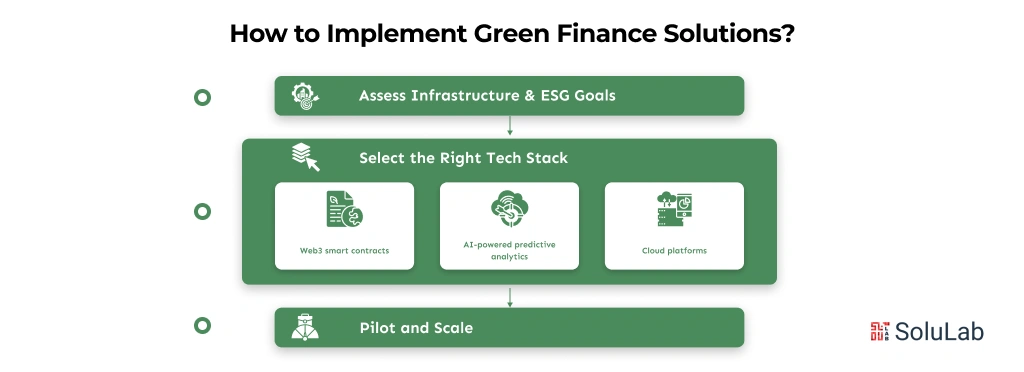

How to Implement Green Finance Solutions in 2026?

As global finance shifts toward sustainability, the next challenge for businesses, investors, and governments is implementation, turning green finance concepts into measurable impact. Here’s a step-by-step look at how organizations can practically integrate green finance strategies and technologies in 2026:

1. Assess Infrastructure & ESG Goals

Begin by reviewing your current finance systems, reporting processes, and sustainability targets. Conduct a gap analysis to identify areas where green finance trends and sustainable finance trends can create the most impact. Look for opportunities to integrate tools like carbon accounting platforms, automated ESG reporting dashboards, or blockchain-based transaction tracking.

This step ensures your enterprise aligns with regulatory expectations and global ESG standards, while also identifying quick-win areas for ROI.

2. Select the Right Tech Stack

Choose technologies that are proven, scalable, and compliant with evolving trends in green finance. For example:

- Web3 smart contracts for automated ESG compliance and real-time verification of green bonds.

- AI-powered predictive analytics to score ESG risks, track sustainability KPIs, and forecast carbon impact.

- Cloud platforms and APIs to capture, store, and share real-time carbon data across your enterprise systems.

These solutions not only make your green and sustainable finance operations more efficient but also position your company as a leader in sustainable and green finance adoption.

3. Pilot and Scale

Deploy a pilot for a single product or service line, such as a tokenized green bond platform or an AI-driven ESG dashboard. Measure performance, calculate ROI, and refine workflows. Once validated, scale across multiple products or geographies.

This phased, data-driven approach keeps you ahead of trends in sustainable finance, reduces operational risk, and builds confidence with investors, regulators, and corporate partners.

How Our Development Agency Accelerates Adoption?

Our leading blockchain development company helps enterprises implement the latest trends in green finance with scalable technology. We deliver:

- Custom Blockchain Platforms for issuing and managing tokenized assets like green bonds and verifiable carbon credits.

- AI-Powered ESG Dashboards that automate reporting and provide real-time analytics aligned with global standards.

- Secure API Integrations that embed sustainable green finance capabilities, such as automated carbon tracking, into your existing banking or trading systems.

This combination of blockchain, AI, and cloud architecture ensures your business can adopt top green finance trends quickly while maintaining enterprise-grade security and compliance.

Conclusion

2026 is set to shape the future of green finance companies and business innovation. From AI-powered ESG analytics to blockchain-enabled carbon trading, technology is driving faster, smarter, and more transparent finance solutions.

Companies that focus on green finance trends, sustainable finance trends, and green and sustainable finance now will be best positioned to attract investors, reduce risk, and stay ahead of competitors.

For business enterprises, adopting these trends is not just about compliance; it’s about growth, efficiency, and leading the market in sustainability-driven finance.

FAQs

1. How Can Startups and SMEs Enter the Green Finance Space?

Startups can integrate sustainability metrics into their business models early — through carbon-tracking APIs, green payment gateways, or tokenized funding models. Partnering with fintech or blockchain developers can help them build compliance-ready green finance platforms at scale.

2. How Can Companies Prevent Greenwashing in 2026?

By adopting data-backed verification systems such as blockchain-based ESG ledgers, AI-driven performance audits, and third-party sustainability scoring. Authenticity and verifiable proof of impact are the only ways to maintain compliance and trust.

3. How Can My Business Benefit from Adopting Green Finance Practices?

Green finance practices help businesses attract eco-conscious investors, qualify for government incentives, and enhance brand reputation. They also lead to operational savings through energy-efficient processes and stronger access to ESG-aligned funding opportunities.

4. How Can Enterprises Measure the Impact of Their Green Finance Strategy?

Enterprises can track performance using carbon accounting systems, AI-based ESG dashboards, and blockchain analytics. Measuring reductions in emissions, energy usage, and waste output helps calculate both environmental and financial returns.

5. How Can SoluLab Help Implement Green Finance Solutions?

SoluLab develops AI and blockchain-powered platforms that enable ESG tracking, green asset tokenization, and transparent carbon credit systems. Our solutions help financial institutions, fintechs, and enterprises align their business goals with sustainability and compliance standards.