Gold in Dubai is not what it used to be. Earlier, investing in gold meant big money upfront, worrying about where it’s stored, and waiting around to move it. That way of doing things is slowly fading.

With gold tokenization, you don’t need to buy a full bar anymore. You can own a small piece, trade it right away, and access it from anywhere. Dubai sees this shift early, and that’s why it’s quietly mixing its gold market with blockchain.

The speed of growth is what really matters here. In 2024, real-world assets on blockchain were already at $15.2B. By 2030, projections point to $500B. Moves like that don’t give much time to think. Around the same time, tokenized gold crossed $3B in 2025. That tells you people aren’t just curious, as they’re already using these platforms.

For businesses, this opens a clear door. Teams that start building RWA tokenization platforms, solid blockchain systems, and compliant digital asset products in Dubai now can move ahead while the space is still forming.

Key Takeaways

- With VASP licenses issued in three to six months, VARA and DMCC now support regulated gold tokenization, making Dubai the fastest jurisdiction to launch compliant platforms.

- While Comtech Gold operates live on DMCC Tradeflow, demonstrating institutional adoption, Paxos Gold (PAXG) oversees more than $750 million in tokenized gold.

- Platforms that handle $500 million to $1 billion in assets earn $2 million to $12 million through licensing, DeFi spreads, custody, and transaction fees.

- There has been a shift in demand from passive storage to institutional-grade digital gold platforms, and tokenized gold is currently yielding 3-8% through DeFi.

Why Gold Tokenization Is a Smarter Way to Own and Trade Gold?

Gold tokenization is indeed a smarter way to deal with gold today. Instead of buying physical gold and worrying about storage, paperwork, and timing the market, the gold is locked in a certified vault and turned into digital tokens on a blockchain. Each token stands for a fixed amount of real gold, sometimes 1 gram, sometimes even less.

From an investor, this removes most of the friction. There’s no vault management, insurance headaches, or waiting for market hours to open. With gold tokenization solutions, gold can be bought, sold, or moved anytime, day or night, directly on-chain, without any middlemen slowing things down.

Behind the scenes, the process is strict. A trusted custodian checks the gold before anything goes live, like weight, purity, and quality, which are verified first. Only after that does the gold get tokenized, so every digital token is actually backed by real gold sitting in a vault.

Once tokenized, these gold-backed tokens can be traded, transferred, or even redeemed for physical gold if needed. Instead of buying large bars, people can now own small portions and scale up over time. That’s what makes digital gold more flexible, more accessible, and far better suited for today’s online and Web3 financial markets.

Why Is Gold Tokenization Development in Dubai Growing So Fast?

Gold tokenization platform development is picking up speed in Dubai, and it’s not because of marketing noise. It’s growing because the setup makes sense. The rules are clear, big players are already involved, and real platforms are live today.

By late 2025, the global tokenized gold market crossed $2 billion, and Dubai became one of the easiest places to actually build in this space. For founders thinking about launching a gold-backed digital asset, Dubai removes many of the problems teams face elsewhere. Here’s why that matters:

1. Clear rules make things simpler

In most countries, teams get stuck early. You want to tokenize gold, but no one gives a straight answer on what is allowed. That slows everything down.

Dubai took a different path. VARA laid out clear rules for digital assets and real-world assets. In mid-2025, they updated these rules to cover trading, custody, lending, issuance, and AML. It’s not perfect, but it’s clear enough to move forward.

DMCC also plays a big role here. In late 2025, DMCC and VARA launched a framework focused on tokenized gold and precious metals, with real pilot programs. This wasn’t just paperwork. Platforms like DMCC SafeGold and Comtech Gold are already operating under these rules.

Because of this, teams don’t waste months guessing. Many compliant platforms now go live in 2 to 4 months, with build costs usually between $50K and $250K. New projects like AuCan Gold are using this setup to reach global users faster.

2. Institutions are already active

This market isn’t being pushed by retail hype. Institutions are already here. By December 2025, Paxos Gold (PAXG) passed $1.6 billion in market value. At the same time, gold prices hit a record $4,573, which brought more attention to tokenized gold as a safer way to get exposure.

Dubai had been preparing for this earlier. In 2024, it ran a $400 million RWA tokenization pilot. Once that worked, moving gold on-chain was the next step. In 2025, this grew alongside Dubai’s $16 billion real estate tokenization push, with new pilots for gold and diamonds.

When you see partnerships like Crypto.com working with DMCC on gold and green energy tokenization, it’s a sign that real money is involved. By 2025, the wider RWA market had reached $29.4 billion, and gold had become one of its stronger segments.

3. Tokenized gold can actually earn

Traditional gold just sits in a vault. It’s safe, but it doesn’t grow. Tokenized gold changes how people use it. Some platforms now let users lend gold-backed tokens in DeFi and earn 3–8% a year without selling the gold. Protocols like Morpho and Kamino are already testing this.

In 2025, more ideas showed up.

- Gold Park Token has launched staking with returns of 5–7%.

- Dubai-based Libertum offers 8%+ yields through property-linked RWAs that include gold.

- Bybit added Tether Gold (XAUT) to the TON network, running earn programs through late 2025.

For builders, this changes the business model. Revenue doesn’t have to come only from trading fees anymore. Lending, liquidity, and institutional integrations are becoming real income lines.

4. Dubai’s position keeps pulling people in

Dubai’s global role adds another layer. Events, partnerships, and cross-border deals keep bringing builders and capital into the ecosystem.

The DMCC Precious Metals Conference in November 2025 focused heavily on Precious metal tokenization and introduced DMCC FinX, a platform for tokenized commodities. At Binance Blockchain Week 2025, gold was openly discussed as a regulated alternative to Bitcoin for long-term value storage.

With 400+ crypto companies registered under VARA, active pilots, and growing global interest, Dubai is slowly becoming a main access point for on-chain real-world assets. Many expect this momentum to push the RWA market toward $18.9 trillion by 2030.

How Rising Gold Prices are Creating New Opportunities for Gold Tokenization in Dubai?

Gold prices hit record highs in 2024, crossing $2,600 per ounce, creating a strong business opportunity for gold tokenization in Dubai. As gold becomes more expensive, owning physical gold also becomes harder due to rising storage, insurance, and logistics costs; a vault holding $1 billion in gold can spend nearly $500,000 a year just on safekeeping.

This is where Dubai precious metal tokenization platforms gain a clear advantage. By using blockchain-based gold tokens, platforms can cut these costs by 60–80%, making gold ownership more efficient, scalable, and investor-friendly

This shift is pushing tokenized gold from a nice idea to a must-have financial product. From a platform and business point of view, the opportunity grows fast:

- Retail investors want gold exposure but do not want to buy or store physical bars.

- Higher activity leads to more transaction fees for tokenization platforms.

- Funds and enterprises prefer blockchain-native settlement instead of slow traditional systems.

- Tokenized gold becomes strong collateral for lending, staking, and yield products.

The numbers make sense for top gold tokenization development companies. If a platform charges just 0.50% in transaction fees and processes $100 million in yearly trading volume, that alone brings $500,000 in revenue. This does not include minting fees, redemption fees, or DeFi integration income.

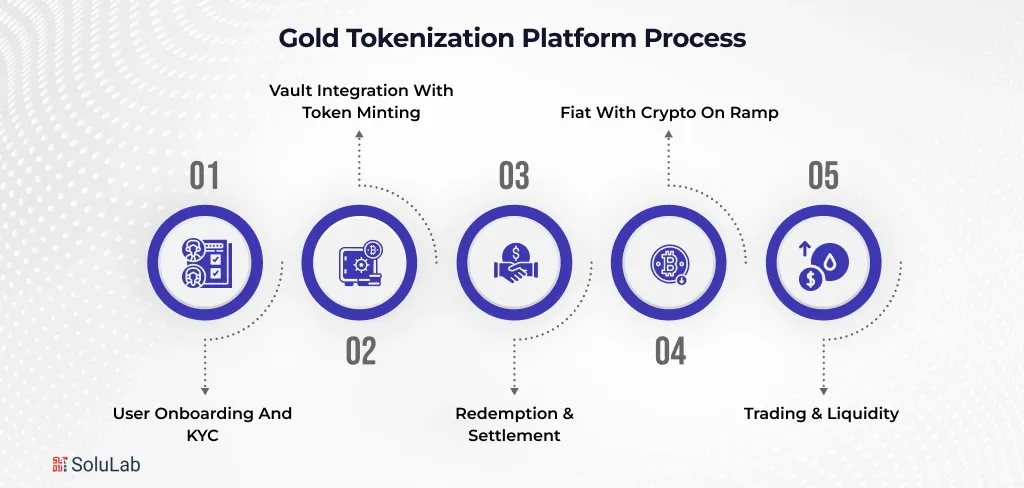

How Gold Tokenization Platforms Work in Dubai?

If you’re thinking about building or investing in a gold tokenization platform, it helps to know how things really run. In Dubai, the systems are smooth, but it’s the small details that make them work security, compliance, and liquidity are key.

1. User Onboarding

Every user has to be checked. Big money doesn’t move without trust. That’s why most platforms do this automatically:

- IDs checked with AI

- Screened for sanctioned people

- Proof of funds verified

- Activity monitored

It’s simple, but it makes big investors feel safe.

2. Funding the Account

People need easy ways to put money in. A few options usually include:

- Bank transfers in AED, USD, or local currency

- Credit cards (with fraud checks)

- Stablecoins like USDC or DAI

- Crypto deposits converted to tokens

Even tiny fees add up, so a half-percent on millions can mean serious revenue.

3. Vaults and Token Minting

Gold goes into a secure vault. Then they are:

- Checked for purity and authenticity

- Weighed with digital scales

- Tokens minted 1:1 on the blockchain

So if you redeem gold, Tokens are burned, or if you add gold, then new Tokens are minted. Which is Simple, transparent, and trustworthy.

4. Trading and Liquidity

Tokens aren’t just digital certificates. They move:

- Trade on the platform with small fees

- List on exchanges like Binance, Bybit, Kraken

- Use in DeFi lending or as collateral

- Offered through APIs for fintechs to sell without touching the vault

Liquidity is what makes them function like real money.

5. Redemption and Settlement

Investors can cash out in 2 ways:

- Physical gold: tokens burned, gold shipped (usually 1 kg minimum)

- Cash: tokens sold at spot price, money in account within 24 hours

For this, Vaults, blockchain, and settlement systems have to sync perfectly as mistakes cost trust.

When everything works together, it goes beyond technology. You end up with a live investment ecosystem, which is safe for users, scalable for builders, and positioned right in the middle of a market that’s growing fast.

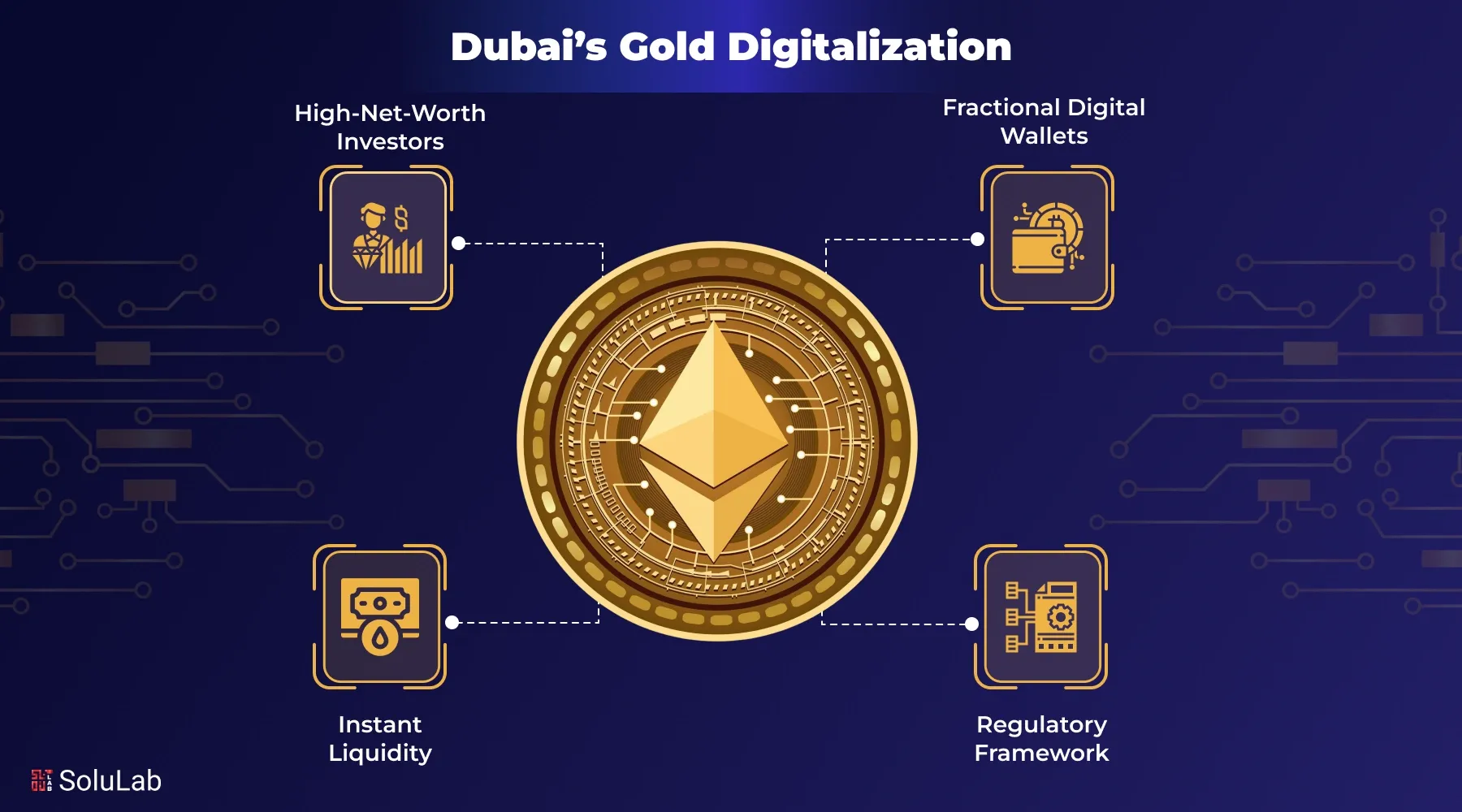

What Investors Really Look for in Digital Gold Platforms in Dubai?

If you want serious investors, you can’t just have a shiny website. Especially in Dubai, people care about trust, security, and returns. That’s why you need these 6 essential things in your project:

1. Prove the Gold is Real

Investors need to know the tokens are backed by actual gold, and that’s it. That’s why good platforms show:

- Which vault holds it

- Weight and purity

- Dashboards so anyone can check anytime

- Audit reports from big accounting firms

2. Compliance and Licensing

Rules really matter, as Investors like knowing you’re not some random startup. So if you are building in Dubai, look for:

- VARA license for virtual assets

- DMCC authorization for Tokenized commodities

- Insurance from Lloyd’s or similar

- Separate custody accounts

It doesn’t just look good, as it makes people feel safe putting millions in, and you have liquidity.

3. Security

Security is huge because no one will invest if your platform can be hacked. So basic must-haves are:

- Multi-signature wallets provide multiple approvals

- Cold storage for most tokens

- Hardware key management

- Pen tests and bug bounties

- Big insurance coverage

Even the best asset tokenization platform idea fails without this, so you need to take these measures seriously.

4. Yield Options

Gold sitting idle isn’t exciting as Investors want it to earn daily. That’s why as a platforms you can:

- Lend through DeFi for 3–8% returns

- Add liquidity to DEXs like Uniswap or Curve

- Offer staking or yield farming

If you provide no yield options, then the Investors will just go somewhere else where they can make money.

5. Low and Transparent Fees

Fees matter to Investors, that’s why you need to keep them simple:

- Minting fees: 0.10–0.25% per token

- Annual custody: 0.15–0.35%

- Trading fees: 0.25–0.50% per transaction

- Redemption fees: 0.10–0.25% to convert back to physical gold

If you charge more than 1% in total, you’ll see investors look elsewhere. That’s why platforms lead by keeping things simple and predictable.

6. Global Access

Modern investors don’t want gold sitting idle in a vault. They want to trade anytime, not just during market hours. That means your project needs to work and provide:

- 24/7 trading

- Multiple fiat and crypto options

- Major exchange integrations

- Real-time spot prices

If users can’t see prices instantly or move fast, they move on.

When a platform gets this right, gold stops feeling old-school. It becomes liquid, usable, and alive, and that’s exactly what investors in Dubai are looking for right now.

How Gold Tokenization in Dubai Makes Money?

Gold token platforms aren’t just digital vaults, as they’re real money-makers if you know what you’re doing. The main ways they earn come from fees, custody, DeFi, and partnerships.

1. Transaction Fees

Every time someone trades, transfers, or uses DeFi with their tokens, the platform earns. Typical fees are small, like trades might be 0.25–0.5%, transfers 0.15–0.25%, and lending protocols take 5–15%. But if you add it all up, then it’s serious money.

For example, a platform handling $500 million in annual trades at a 0.4% fee makes around $2 million just from trading. It’s basically money for letting people move gold around.

2. Custody and Minting Fees

Holding gold isn’t free; that’s why platforms charge accordingly. Users have to pay annual custody fees, usually around 0.2%, minting new tokens 0.15%, and redemption at about 0.1%. So, if you’re managing $1 billion in gold, a simple 0.25% custody fee gives about $2.5 million a year. This is one of the backbone revenue streams because it scales with the assets under management.

3. DeFi Integration and Spreads

The platforms that plug into DeFi can really boost earnings with ease, like by lending out tokens, providing liquidity, or enabling margin trading, they make money on spreads and interest. Even something like $200M flowing through DeFi at a 1% spread can quietly turn into $2M a year, but it adds up fast and grows as the platform’s user base grows.

4. White Label Licensing and Partnerships

Not every platform only serves individual investors. Many of them sell their tech, APIs, or white-label solutions to fintechs and brokers. Fees can range widely like $50k–$500k per year per partner, and big enterprise clients can pay $10k–$50k per month. Even if you have ten partners, averaging $150k each would already bring in $1.5 million in recurring revenue without touching retail users. It’s predictable, stable money that scales.

The key takeaway is that if you run it right, like transparent, compliant, and connected, then digital gold in Dubai can be a serious, scalable business.

Real-World Gold Tokenization Use Cases in Dubai

The idea of gold tokenization is exciting, but real-world examples show why it matters. Right now, Dubai is leading the way with multiple operational models that are already proving the value of tokenized gold. Here are three notable use cases:

1. DMCC-Comtech Gold Partnership

So, back in 2024, DMCC teamed up with Comtech Gold. They put gold on the blockchain with Comtech Gold tokens (CGO), where you can trade them on DMCC’s Tradeflow platform.

Here is how it really works:

- The gold sits in DMCC-approved vaults

- Each token is 999.9 purity gold

- Tokens are Shariah-compliant, so Islamic investors can use them

- Trade them on Tradeflow or other exchanges

- You can redeem physical gold anytime

This shows how traditional exchanges can go digital without messing things up, and having DMCC backing it makes investors feel safe.

2. Tokenized Islamic Sukuks Use Case

Dubai Islamic Bank and Crypto.com worked together to test Shariah-compliant Sukuks and crypto payments across the UAE and GCC.

How this works in practice:

- Banks issue Islamic Sukuks as digital tokens on the Cronos blockchain

- Users can buy and trade these tokens directly through the Crypto.com app

- All payments and deposits follow Shariah-compliant rules

- Crypto.com handles custody, trading, and OTC support behind the scenes

What this really means is that Islamic finance is slowly moving on-chain. Platforms that support tokenized Sukuks can unlock a massive, underserved market in the Middle East and offer Shariah-compliant investors something like easy access, better liquidity, and modern digital rails.

Conclusion

Dubai is fast becoming a hub for gold tokenization. Thanks to VARA and DMCC rules, there is a huge interest growing from major financial players and DeFi protocols looking for real-world assets. It’s not just hype, as companies are launching, investors are funding, and revenue is already starting to flow. The question is, will you step in now, or watch others take the lead?

At SoluLab, as a gold tokenization development company, we help businesses build and launch gold tokenization platforms to capture this opportunity. You can also read our gold and silver tokenization case study, where we helped a client launch a fully compliant platform in under six weeks, with DeFi integration and early investor traction. We believe that platforms that are building now, with strong compliance and institutional-grade reliability, are the ones most likely to lead the market.

FAQs

Yes, it’s fully legal. As VARA allows tokenizing gold and other commodities, and DMCC even helps through their Tradeflow platform. You still need a VARA license and have to follow KYC/AML rules, so don’t skip compliance.

ETFs are slow and stuck in traditional finance, with fees and limits, but Tokenized gold runs 24/7, settles instantly, and you can buy tiny pieces, even 0.01 grams. On top of that, you can plug it into DeFi to earn extra yield from day 1.

It depends on the size, as a small MVP development might be just $40k, a full enterprise product around $250k, just add licensing and compliance, which will cost around $20 to 50k more. That’s why planning your budget well is key.

Ethereum is the standard which is trusted and liquid by the web3 community, Polygon is cheaper for transactions, and BSC gives more liquidity options. It completely depends on what is your use case and outlook to your project.

You’ll need a VARA license, solid KYC/AML systems, and partnerships with DMCC-approved custodians. Also, Insurance and regular audits are part of the game too. Most teams work with an experienced dev partner like SoluLab, so they don’t learn these lessons the hard way and lose money.

If your platform is looking after $1B in assets, you’re probably looking at $5–12M a year in revenue. Most of that comes from transaction fees and custody services, and then you have extra from DeFi solutions and white label deals. The good thing is, as more assets flow in, your earnings just grow on their own.