Gold has been one of the most dependable value stores for ages. Having real gold, however, might be difficult because it must be kept safely, and purchasers must be located later (liquidity). Gold tokenization, a creative approach that changes how individuals purchase and sell gold, is the result.

According to Coindesk data, the market capitalization of gold tokenization has surpassed $2 billion. This suggests that tokenized gold is becoming more and more popular. By using blockchain technology to digitally represent gold, tokenization offers a more effective way to invest in and acquire gold.

In this blog, we’ll explore what tokenized gold is, how it works, important factors to be considered, and more.

What is Tokenized Gold?

The process of producing digital tokens on a blockchain that represent ownership rights to actual gold is known as “gold tokenization.” Since these tokens are usually backed by real gold reserves, each one is equivalent to a certain quantity of real gold token development that is kept in a vault by a third party.

Additionally, ERC20 token development facilitates the integration of these tokenized assets on the blockchain. This makes it possible for investors to hold fractions of gold, exchange them online, and even exchange them for real gold.

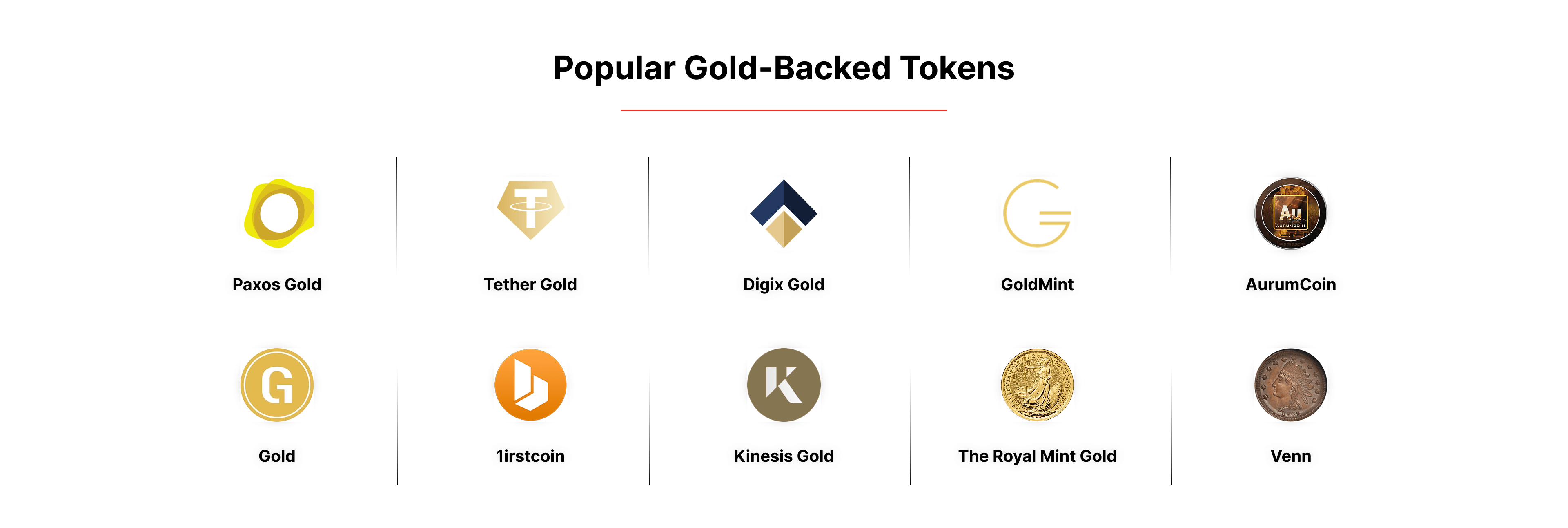

Here are some examples of tokenized gold:

- Paxos Gold (PAXG)

- Tether Gold

- Digix Gold Token (DGX)

- GoldMint (MNTP)

- Aurum Coin

- Gold

- 1irstcoin

- Kinesis Gold

- The Royal Mint Gold

- Venn

How Does Gold Tokenization Work?

Gold tokenization follows a process similar to that used for any real-world asset, though specific steps may vary depending on the project’s unique needs, use cases, and the issuer involved. Here’s a typical breakdown of how gold standard tokenization works:

-

Selecting the Gold Asset

The first step involves choosing the physical gold to be tokenized. This can range from small items like a 1 oz American Gold Eagle coin to larger assets like a 1 kg gold bar.

-

Defining the Token Type

Next, it’s crucial to determine the type of token to be used, such as ERC-20 or ERC-721. The token type dictates how the digital asset will function, how the tokens will be minted, and how many tokens will initially be created.

-

Choosing the Blockchain

The blockchain on which the tokens will live is another important decision. Options include public blockchains, private networks, Layer1 vs. Layer2 blockchain solutions, or other Distributed Ledger Technology (DLT)-based networks. Platforms like Ethereum are often favored for their established smart contract capabilities, making them a popular choice for tokenization projects.

-

Enriching the Token with Data

For HSBC gold tokenization or other large-scale projects, it’s important to back the token with essential data such as proof of reserves, identity verifications, and on-chain market data. This transparency builds trust with investors.

-

Ensuring Blockchain Interoperability

To enhance the liquidity of tokenized gold assets, it’s essential to ensure interoperability across different blockchain networks. This allows the tokens to be easily transferred across various chains, improving access and market reach.

-

Token Issuance

Once everything is in place, the token smart contract is deployed on the blockchain. The minting process begins, creating the tokenized gold assets that will be made available to investors.

-

Distribution

After the tokens are minted, they need to be distributed to markets and users. This involves providing access to trading platforms, exchanges, and other ecosystems where investors can buy, sell, or trade the tokens.

-

Synchronization Across Networks

Even after the tokenized gold has been distributed, it’s critical to keep the smart contracts in sync. This ensures that the tokens can be tracked and updated as they move across different blockchain networks within the multichain environment.

This process makes gold standard tokenization an efficient and secure way to convert physical gold into digital tokens, allowing for increased liquidity, accessibility, and transparency for investors worldwide.

Why Physical Gold Tokenization Is Beneficial for All?

Tokenizing real gold benefits companies and gives investors a new way for diversification. This method is working for everyone because experts expect the tokenized gold market to grow. Here are some benefits of gold tokenization:

- Enhanced Liquidity: By permitting smaller transactions, tokenizing gold enables more liquidity. Large volumes of gold are typically exchanged, which may be a hurdle for investors wishing to acquire or sell lesser quantities. Tokenized gold investment makes micro-sized transactions possible, which facilitates trading and investing in gold.

- Fractionalization of Gold: Due to blockchain technology, it is now possible to purchase even very small amounts of gold, less than a gram, through the tokenization of gold. These blockchain-based tokens function as physical reserves, removing the need for gold storage and providing unchangeable documentation to confirm the gold’s authenticity.

- Decreased Transaction Expenses: Purchasing and selling physical gold typically entails several additional, add-on middleman expenses. However, these expenses are greatly reduced when gold tokens are used using blockchain technology. Effective blockchain networks lower the costs of exchanging tokenized gold investments.

- Increased Security and Transparency: The use of blockchain technology guarantees extremely transparent and safe transactions involving tokenized gold. Public blockchains provide strong security features and openness between investors and businesses by allowing transactions to be verified without disclosing critical information.

- Improved Efficiency: By eliminating obstacles like storage problems and logistical security, decentralized networks accelerate and enhance the efficiency of gold token transactions. The financial market’s acceptance of tokenized gold must proceed quickly because of its efficiency.

- Integration with the DeFi Space: Decentralized finance (DeFi) apps can increase tokenized gold’s use cases. Gold-based tokens can be used as collateral for DeFi loans since gold has a stable value, which helps solve some of the ecosystem’s challenges.

Blockchain technology in gold investments can increase security, liquidity, cost, and integration into the DeFi ecosystem for businesses and investors. Optimizing flexibility and interoperability across blockchain networks with Multi-Chain vs. Cross-Chain solutions will boost market utilization and growth. Additionally, gold tokenization development services play a crucial role in creating robust solutions.

Important Factors to Consider for a Gold-based Token Project

Creating a gold-based token project involves more than just tokenizing physical gold; it requires careful planning, compliance, and technical execution to ensure success. Whether you’re building a platform or investing in gold standard tokenization, here are key factors to consider:

1. Asset Custody and Security: The first step is ensuring that the physical gold is securely stored. Trusted third-party vaults with insurance coverage are essential to instill investor confidence. The gold tokenization development services you choose should provide robust custodial solutions that guarantee the backing of tokens with real gold reserves.

2. Regulatory Compliance: Every jurisdiction has different regulations regarding asset tokenization. You’ll need to ensure that your project complies with local and international laws governing the issuance and trading of gold-backed tokens. Collaborating with legal advisors who specialize in tokenization can help navigate this complex landscape.

3. Blockchain Selection: The underlying blockchain network is critical to the project’s success. Consider factors like scalability, transaction costs, and security when choosing the blockchain. Public blockchains such as Ethereum, with its established ecosystem, are often used for gold standard tokenization, but private or permissioned blockchains might also be suitable depending on your needs.

4. Tokenization Model: Define the type of tokens your project will use, such as fungible tokens (ERC-20) or non-fungible tokens (ERC-721). This decision impacts how the gold can be fractionalized and traded. Many gold tokenization development services offer customizable token models to suit different project requirements.

5. Transparency and Auditability: A major appeal of tokenizing gold is transparency. Your project should provide clear and easily accessible proof of gold reserves, such as regular audits or real-time verification through blockchain records. This increases trust among investors and improves market credibility.

6. Liquidity and Market Accessibility: Ensuring that tokenized gold can be easily bought and sold is crucial for project success. To achieve this, it’s essential to list tokens on decentralized exchanges (DEXs) or integrate them with other digital assets within decentralized finance (DeFi). This improves liquidity and makes the asset accessible to a broader range of users.

7. Transaction Costs: High transaction fees can deter investors, especially when dealing with fractionalized gold tokens. Choose an efficient and low-cost blockchain solution, or even consider layer-2 solutions that reduce transaction costs while maintaining security.

By keeping these factors in mind, you can design a successful gold tokenization platform that not only facilitates efficient and secure trading but also adheres to global standards, ensuring long-term viability in asset tokenization development.

The Role of Blockchain in Gold Investment

Here’s a quick overview of the role of blockchain in gold investment:

- Blockchain technology is changing gold investing, creating new opportunities for individuals and corporations. Blockchain digitizes physical gold, making investment more transparent, secure, and efficient. Blockchain allows investors to tokenize gold and buy, sell, and keep fractions of gold digitally while enjoying gold’s stability and value.

- Immutable records are one of blockchain’s biggest benefits, making tokenized gold transactions visible and verifiable. This openness eliminates fraud and verifies each token’s gold. Blockchain gives digital evidence of ownership, eliminating the risk of counterfeit gold or contaminants.

- Micro-transactions enabled by blockchain in gold investment boost liquidity. Instead of buying or selling vast amounts of actual gold, tokenization lets investors trade small fractions, making it more accessible. This fractionalization provides portfolio diversity and short-term trading opportunities.

- Blockchain eliminates the need for physical storage and security, saving money. Investors can own gold-backed tokens without renting vaults or fearing theft. A gold tokenization development company can also integrate these tokens with DeFi platforms, allowing them to be used as collateral for loans, enhancing their financial ecosystem utility.

- Blockchain has improved security, liquidity, and entry barriers in the gold market, making it a more adaptable and modern investment.

Read Also: Silver Tokenization Platform Development

Investment Opportunities of Gold Tokenization

Gold tokenization has transformed the way investors can interact with and capitalize on the value of this precious metal. By converting physical gold into digital tokens stored on a blockchain, new avenues for investment are opening up, creating more flexibility, security, and accessibility. Let’s explore some of the key investment opportunities that gold tokenization offers.

1. Fractional Ownership

Gold tokenization allows investors to purchase fractions of gold rather than entire bars or coins, making it accessible to those who may not have the means to buy large amounts of physical gold. Even small portions, such as grams or milligrams of gold, can be bought and sold digitally, democratizing gold investment for retail investors.

2. Enhanced Liquidity

In traditional gold markets, selling physical gold can be a slow process that requires finding a buyer, transferring fractional ownership, and dealing with intermediaries. With gold tokenization, investors can trade tokenized gold instantly on digital platforms, increasing liquidity. This allows for quicker buying and selling, making gold a more dynamic asset in an investor’s portfolio.

3. Global Accessibility

Tokenized gold can be bought and sold across borders without the need for physically transporting the gold. Investors from any part of the world can invest in tokenized gold through online platforms, expanding market access and increasing the potential for broader participation in the gold market.

4. Lower Storage and Security Costs

Owning physical gold requires secure storage, such as in bank vaults or safety deposit boxes, which incurs additional costs. With tokenized gold, ownership is stored securely on the blockchain, eliminating the need for physical storage and reducing the associated costs. Blockchain’s inherent security features further protect investors from theft or loss.

5. Integration with Decentralized Finance (DeFi)

Gold-backed tokens can be integrated into the growing Decentralized Finance (DeFi) ecosystem, where they can be used as collateral for loans, yield farming, or liquidity provision. This opens up new financial opportunities that were previously unavailable with physical gold. Tokenized gold can now be part of automated financial strategies, adding another layer of value for the investor.

6. Real-Time Market Exposure

Investors holding gold tokens can enjoy real-time market exposure without waiting for traditional processes to take place, such as shipping or certifying physical gold. This instant exposure allows for more strategic market plays, especially in times of economic volatility, where gold typically acts as a haven asset.

Gold tokenization is not only making the precious metal more accessible and flexible but also paving the way for innovative financial strategies. With opportunities for fractional ownership, enhanced liquidity, and integration into modern finance platforms like DeFi, investors have more ways to capitalize on gold’s stable value and historic reputation as a safe asset.

Conclusion

The idea of gold tokenization services is no longer simply theoretical; several progressive businesses are actively putting it into practice. These illustrations show how tokenized gold is becoming more and more popular as a safe, liquid, and accessible investment.

More platforms and creative solutions will probably appear as gold tokenization develops further, providing investors with even more chances to trade in the virtual gold market.

These solutions’ transparency, liquidity, and reduced costs are changing the way that individuals invest in precious metals and creating new opportunities for both traditional and online investors.

SoluLab, a gold tokenization development company, can help you harness the power of gold tokenization and improve investors’ engagement with it. Contact us today.

FAQs

1. What is gold tokenization?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain. Each token represents a specific quantity of gold, allowing for fractional ownership and easier trading. This innovation enhances liquidity and accessibility for investors, making buying, selling, or holding gold as a digital asset simpler.

2. What blockchain platforms are used for gold tokenization?

Gold tokenization services are typically done on blockchain platforms like Ethereum, Binance Smart Chain, and other secure decentralized networks.

3. Are there any fees associated with gold tokenization?

Yes, fees may be involved in token purchases, transactions, and redemptions, including storage fees for the physical gold backing the tokens.

4. Can I sell or trade my gold tokens?

Yes, gold tokens can be traded on various cryptocurrency exchanges or within specific platforms offering gold-backed tokens, often built and managed by a gold tokenization development company specializing in secure and compliant blockchain solutions.

5. How can I get started with gold tokenization?

To get started with gold tokenization, you can consult with our company SoluLab, which offers gold tokenization development services. We can guide you through the entire process, from strategy development and platform selection to smart contract creation and regulatory compliance, ensuring a successful and compliant gold tokenization project.