Would you return to a website or app after a frustrating payment or refund experience? Chances are, most people won’t.

That’s why integrating generative AI into payment processes is becoming essential. With generative AI, businesses can enhance fraud detection, deliver personalized customer interactions, and streamline operations. Relying on manual processes or outdated fraud detection methods not only drives up operational costs but also erodes customer trust.

In this blog, we’ll explore what generative AI in payments really means, how it benefits businesses, key use cases, and more. Let’s dive in!

What is Generative AI in Payments?

Generative AI in payments means utilizing AI and machine learning algorithms to make different parts of financial transactions and payment procedures easier and better. AI-powered payment systems don’t use set rules and human checks as traditional payment methods do.

Instead, they learn from transaction data all the time to find fraud, tailor consumer experiences, and automate activities. This method makes things safer, more efficient, and accurate by changing to new patterns and risks as they happen.

Key Advantages of Using Generative AI in Payment Systems

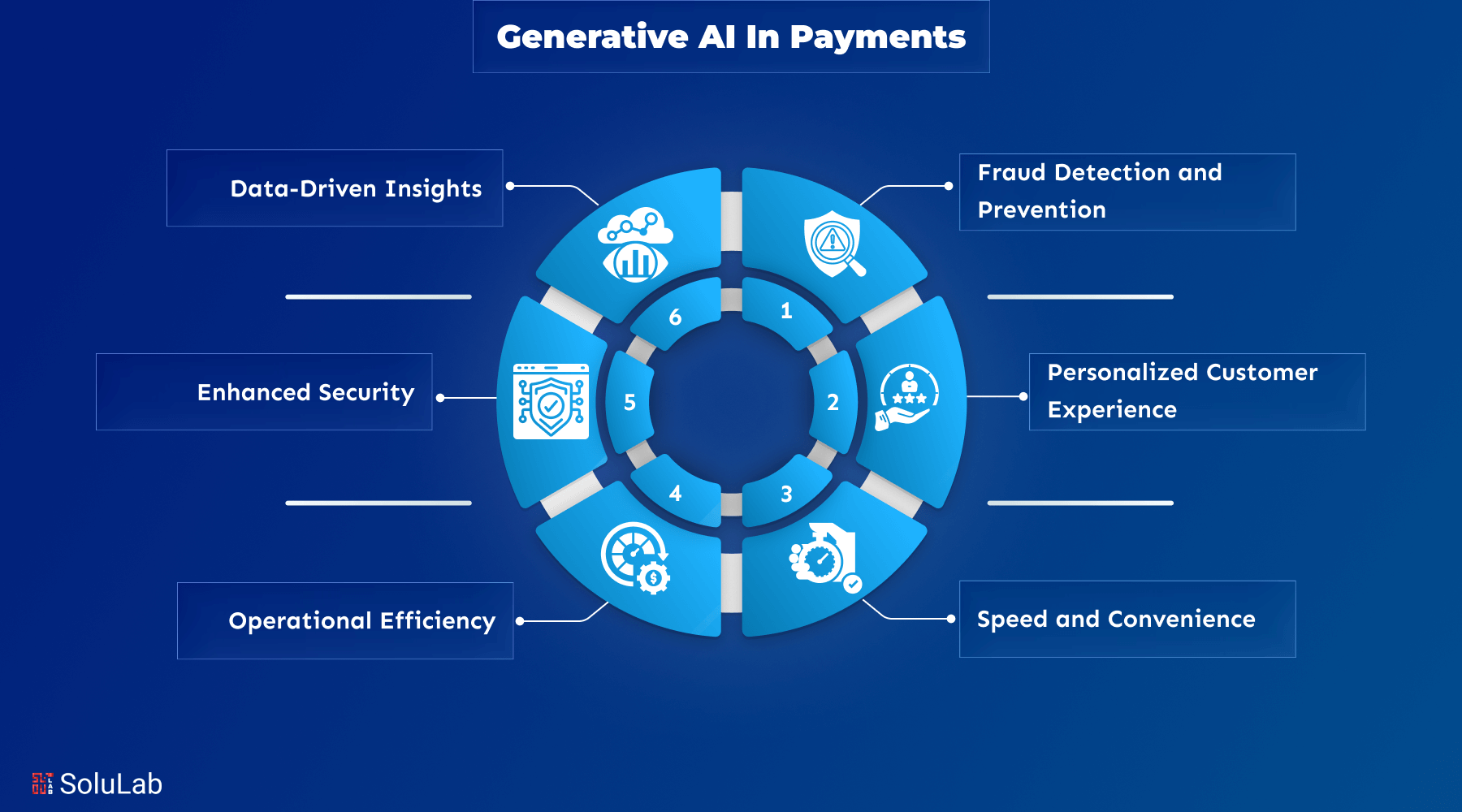

Generative AI is revolutionizing various industries, and the payments sector is no exception. There are several benefits to integrating AI technology into payment systems, including increased effectiveness, security, and user experience. Here are some AI payment benefits for businesses:

1. Fraud Detection and Prevention: Generative AI can analyze vast amounts of transaction data to identify patterns indicative of fraudulent activity. By continuously learning from new data, AI systems can detect anomalies in real time, significantly reducing the risk of fraud. This proactive approach not only protects consumers but also saves financial institutions billions of dollars annually.

2. Personalized Customer Experience: AI can provide tailored experiences by analyzing user behavior and preferences. For instance, AI-driven chatbots can offer personalized support, answer queries, and guide users through payment processes. Additionally, AI can recommend products or services based on past transactions, enhancing customer satisfaction and loyalty.

3. Operational Efficiency: Automation of routine tasks is one of the major AI payment benefits. Generative AI can streamline processes such as invoice management, transaction reconciliation, and customer support. By automating these tasks, companies can reduce operational costs and allocate resources to more strategic initiatives.

4. Enhanced Security: AI enhances the security of payment systems through advanced encryption techniques and biometric authentication methods like facial recognition and fingerprint scanning. These technologies ensure that only authorized individuals can access sensitive financial information, thereby reducing the risk of data breaches.

5. Speed and Convenience: Generative AI can process transactions faster than traditional methods. For example, AI-powered payment gateways can approve or decline transactions in milliseconds, leading to quicker checkouts and improved customer satisfaction. This speed and convenience are crucial in today’s fast-paced digital economy.

6. Data-Driven Insights: AI can analyze transaction data to provide valuable insights into consumer behavior and market trends. Financial institutions can leverage these insights to make informed decisions, optimize pricing strategies, and develop new products that meet customer needs. This data-driven approach can lead to increased revenue and market competitiveness.

7. Cost Reduction: Implementing Payment AI solutions can significantly reduce costs associated with manual processing and error rectification. AI systems can handle large volumes of transactions accurately, minimizing the need for human intervention and reducing the likelihood of costly mistakes.

8. Scalability: AI systems can easily scale to handle increasing transaction volumes, making them ideal for growing businesses. Unlike traditional systems that may require significant upgrades to accommodate growth, AI solutions can adapt to changing demands with minimal disruption.

9. Regulatory Compliance: Generative AI can help financial institutions stay compliant with regulatory requirements by continuously monitoring transactions for suspicious activities and ensuring adherence to legal standards. This capability is particularly important in the context of anti-money laundering (AML) and know-your-customer (KYC) regulations.

10. Innovation and Competitive Advantage: Companies that adopt AI technologies in their payment systems can gain a competitive edge by offering innovative solutions that meet the evolving needs of consumers. AI-driven payment systems can enable new business models and services, fostering a culture of innovation and growth.

Thus, the integration of generative AI into payment systems brings a multitude of benefits, including enhanced security, personalized experiences, operational efficiency, and data-driven decision-making. As technology continues to evolve, the role of Payment AI in shaping the future of financial transactions will only become more significant, driving the industry towards greater innovation and customer-centricity.

Which Businesses are Getting Benefits of AI-Powered Payments?

AI-powered payments are improving industries by reducing fraud and improving customer experiences across diverse business models worldwide. Here are some businesses that will benefit from using generative AI in payments:

- B2B (Business-to-Business): AI simplifies complex invoicing, automates reconciliation, and minimizes payment delays. This ensures smoother vendor relationships and stronger cash flow management for enterprises.

- E–commerce: AI enhances checkout speed, reduces cart abandonment, and strengthens fraud detection. It creates shopping experiences while protecting merchants from costly chargebacks.

- SaaS (Software-as-a-Service): AI enables subscription billing automation, personalized payment reminders, and smarter churn prediction. This ensures reliable recurring revenue for SaaS businesses while improving user satisfaction.

- Retail: AI improves in-store and online payment systems with personalized offers, faster checkouts, and fraud protection to make online transactions secure for retail and hospitality, boosting both customer loyalty and higher sales.

- Fintech & Banking: AI increases security with fraud monitoring, predictive credit scoring, and automated settlements, making financial transactions faster and more reliable.

Top Use Cases of Generative AI in Payments

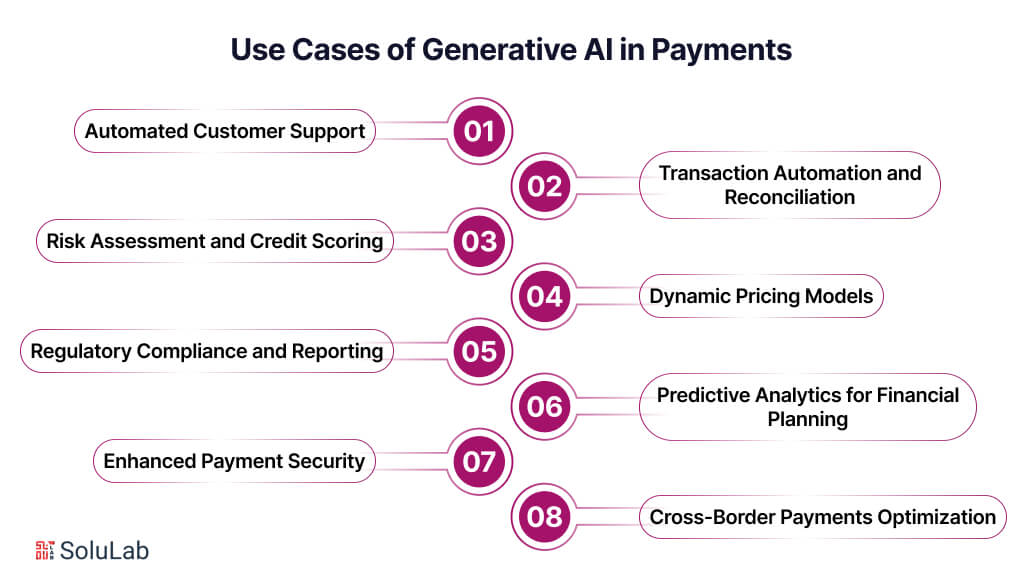

Generative AI is rapidly transforming the payments landscape by introducing innovative solutions that enhance security, efficiency, and customer experience. Here are some practical generative AI use cases in banking and payments:

- Automated Customer Support: Generative AI can power virtual assistants that handle customer inquiries and support requests efficiently. These AI-driven chatbots can assist with tasks such as resetting passwords, checking account balances, and processing payments, providing 24/7 support without the need for human intervention.

- Transaction Automation and Reconciliation: AI can automate repetitive tasks like transaction processing and reconciliation. By streamlining these processes, banks and financial institutions can reduce operational costs and minimize human errors, leading to more efficient and accurate payment systems.

- Risk Assessment and Credit Scoring: Generative AI can enhance risk assessment by analyzing a wide range of data points to predict a customer’s creditworthiness. This allows banks to make more informed lending decisions, offering loans and credit products that align with the borrower’s financial situation.

- Regulatory Compliance and Reporting: AI can help banks and payment processors stay compliant with regulatory requirements by monitoring transactions for suspicious activities and generating reports for regulatory authorities. This ensures adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, reducing the risk of fines and legal issues.

- Enhanced Payment Security: AI can improve payment security through advanced techniques like biometric authentication and anomaly detection. For instance, AI can use facial recognition or fingerprint scanning to verify a customer’s identity, ensuring that only authorized individuals can access sensitive financial information.

- Dynamic Pricing Models: Generative AI can help develop dynamic pricing models by analyzing market trends, customer behavior, and competitive data. This enables banks and payment providers to adjust their pricing strategies in real time, optimizing revenue and staying competitive in the market.

- Predictive Analytics for Financial Planning: AI can offer predictive analytics that help customers manage their finances better. By forecasting income and expenses, AI tools can provide insights and suggestions for budgeting, saving, and investing, empowering customers to make informed financial decisions.

- Cross-Border Payments Optimization: AI can streamline cross-border payments by optimizing currency conversion and reducing transaction times. By analyzing exchange rates and payment routes, AI can ensure that international transactions are processed quickly and cost-effectively, benefiting both businesses and consumers

These generative AI use cases in banking and payments highlight the transformative potential of AI in creating more secure, efficient, and user-friendly financial services. As technology advances, we can expect even more innovative applications of AI in the payments industry, driving further improvements in how we conduct financial transactions.

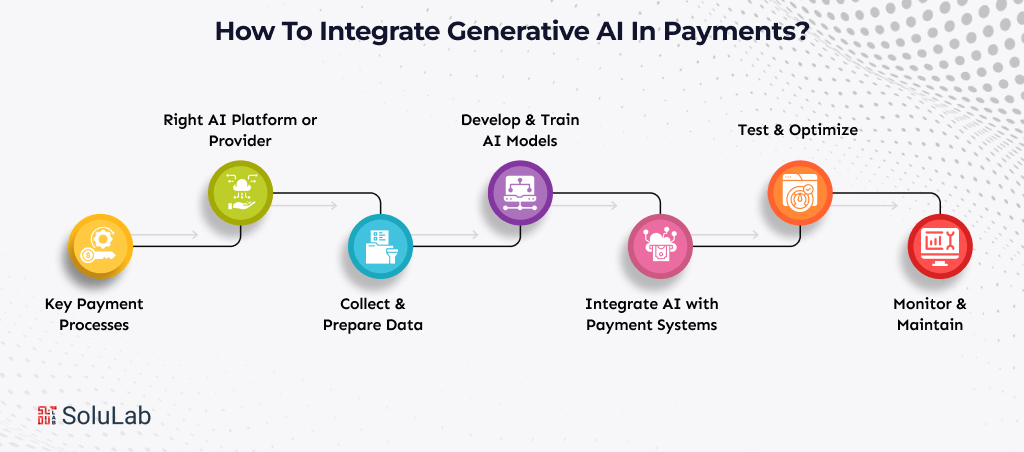

How to Integrate Generative AI in Payments?

Integrating generative AI into your payment systems can improve fraud detection, automate processes, and enhance customer experiences. Here’s a step-by-step approach to implement it effectively.

Step #1: Identify Key Payment Processes

Analyze your payment workflow to pinpoint areas where AI can add value—such as fraud detection, customer support, refunds, or transaction personalization.

Step #2: Choose the Right AI Platform or Provider

Select a generative AI solution or fintech partner that aligns with your business needs and supports secure payment processing. Look for APIs or platforms that integrate seamlessly with your existing system.

Step #3: Collect & Prepare Data

Gather historical transaction data, customer interactions, and fraud records. Clean and structure this data to train the AI model effectively while ensuring compliance with data privacy regulations.

Step #4: Develop & Train AI Models

Create AI models for your selected payment processes. Use generative AI to simulate scenarios, predict fraudulent activity, and generate personalized customer insights.

Step #5: Integrate AI with Payment Systems

Embed the AI models into your payment gateway, app, or backend systems. Ensure smooth communication between AI, transaction systems, and customer interfaces.

Step #6: Test & Optimize

Run pilot tests to evaluate the AI’s performance. Monitor metrics like fraud detection accuracy, processing speed, and customer satisfaction. Continuously optimize the models for better results.

Step #7: Monitor & Maintain

Once deployed, continuously track performance, update AI models with new data, and maintain security protocols to keep your payment system efficient and trustworthy.

Real World Examples of Generative AI in Payments

Here are successful examples of how well-known brands have used the technology to their advantage.

-

Visa

Visa is betting big on GenAI, deploying over $100 million toward startups to reimagine payments, while piloting AI agents that can autonomously make purchases within user-defined budgets.

-

Stripe

Stripe uses AI-powered chatbots and virtual assistants to manage payment queries and initiate refunds efficiently. Generative AI enables these systems to produce human-like responses, automating support without losing the personal touch.

-

PayPal

PayPal leverages AI to offer personalized recommendations and promotions based on users’ spending habits. Generative AI can generate tailored insights, improving customer engagement and loyalty.

-

Mastercard

Mastercard uses AI models to monitor transactions in real-time, identifying unusual patterns and preventing fraudulent payments. Generative AI enhances this by predicting suspicious activity faster and more accurately than traditional systems.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

Conclusion

Traditional systems struggle with fraud detection, slow approvals, and manual reconciliation, leaving businesses and users frustrated. Generative AI intensifies the opportunity gap—if ignored, companies risk falling behind competitors already leveraging AI in operations and enhancing experiences.

Integrating generative AI into payment processes enables smarter fraud prevention, real-time personalization, automated workflows, and faster transaction approvals.

SoluLab, a top generative AI development company, can help you integrate AI into your payment processing system to reduce the chances of fraud. Get in touch with us today!

FAQs

1. Is integrating generative AI into payments expensive?

Costs vary based on the solution, scale, and complexity of integration. However, the ROI from reduced fraud, improved efficiency, and enhanced customer experience often outweighs the initial investment.

2. How quickly can generative AI be integrated into existing payment systems?

Integration time depends on system complexity and data readiness. Simple setups can take weeks, while larger enterprises may need a few months for full deployment.

3. Can small businesses benefit from generative AI in payments?

Absolutely. Even small e-commerce stores or subscription services can use AI for fraud prevention, automated support, and personalized offers without heavy infrastructure.

4. Does generative AI work with all types of payment methods?

Generative AI can be applied to credit/debit cards, digital wallets, bank transfers, cryptocurrencies, and other digital payment methods as long as the transaction data is accessible.

5. Can generative AI predict payment trends?

Yes. AI can analyze historical and real-time data to generate forecasts, helping businesses make informed decisions about promotions, pricing, and risk management.