In 2025, Real Estate Tokenization is no longer a future concept; it’s already changing how the world buys, sells, and invests in real estate. According to Deloitte, tokenized real estate transactions are expected to surpass $4 billion by 2026, showing how fast the industry is growing.

Many developers, real estate firms, and investment companies are turning to tokenization of real estate assets to increase liquidity, reduce entry barriers, and attract global investors. With the right platform and strategy, property owners can fractionalize real estate and open up new revenue streams while staying compliant with evolving global regulations.

Whether you’re a real estate developer, a proptech startup, or an institutional investor, this guide will help you understand the opportunity and how to tap into it with the right tech and partners.

Why is Real Estate Tokenization Transforming Global Markets?

Real estate tokenization is changing the way businesses and investors handle property ownership. Instead of buying an entire property, investors can now own small digital shares of it. This approach, known as fractional ownership, makes it possible to invest in high-value real estate with much smaller amounts.

Through asset tokenization, real estate is turned into digital tokens on a blockchain. These tokens can be bought, sold, or traded, helping previously illiquid properties become easy to access and transfer.

This shift also boosts transparency and liquidity. Every transaction is recorded securely on the blockchain, giving businesses and investors more confidence.

More importantly, blockchain ensures compliance. Built-in KYC/AML processes verify users and track funds, making transactions safer and aligned with global regulations.

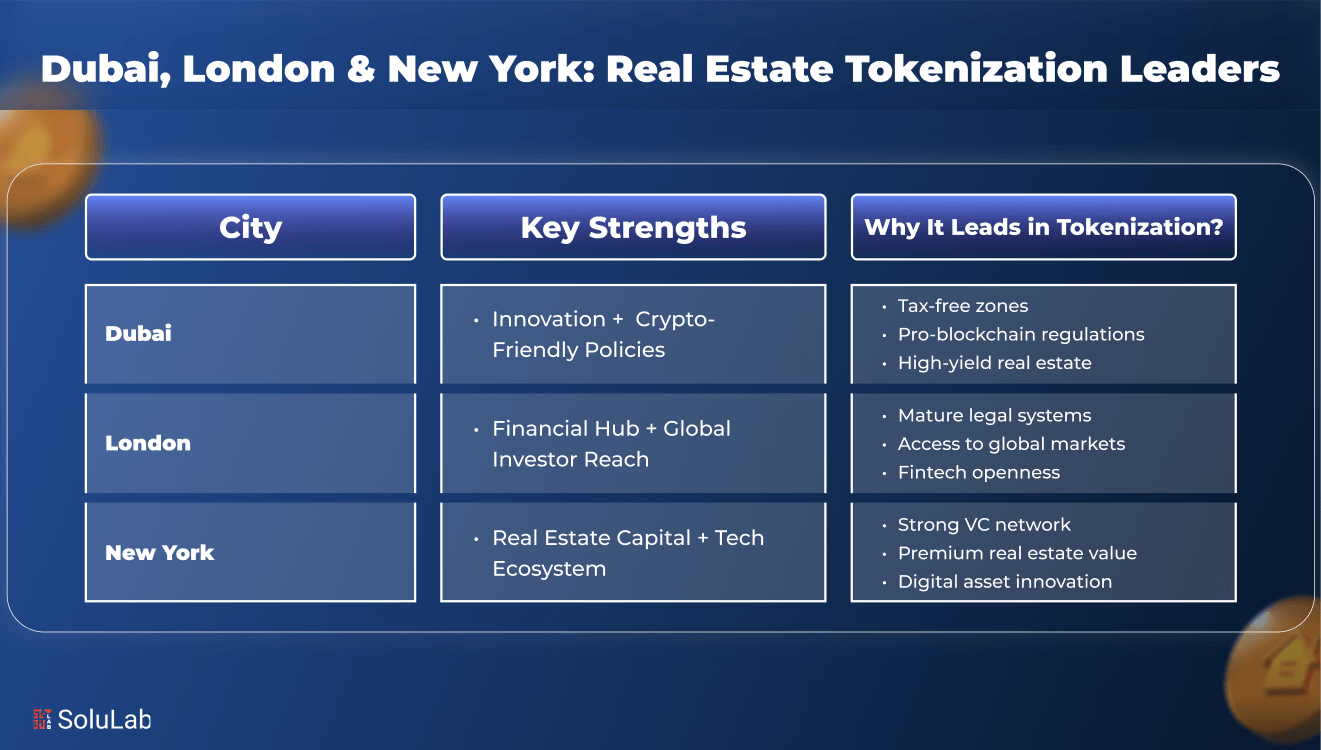

Why Dubai, London & New York Are the Top 3 Cities for Real Estate Tokenization?

Choosing the right city to launch your real estate tokenization platform matters. Regulation, investor demand, and technology support play key roles. Here’s why Dubai, London, and New York lead the way in this fast-growing space.

1. Dubai

Dubai is leading the region in the tokenisation of real estate in the UAE. Government bodies like DIFC and ADGM have created regulatory sandboxes and clear frameworks that support digital assets. If you’re planning tokenized real estate developments in Dubai, this is one of the safest and most innovative environments.

Working with an experienced asset tokenization company in Dubai helps you stay compliant while reaching both local and global investors. Dubai is especially ideal for developers, investment firms, and proptech startups exploring fractional ownership and global liquidity.

2. London

London remains a stronghold for global finance, and now it’s blending that strength with blockchain and Web3. Leading tokenization companies in London are creating hybrid models that meet institutional standards while integrating modern digital infrastructure.

The city’s financial ecosystem supports an enterprise-grade real estate tokenization platform, making it a top pick for launching or expanding in the UK and Europe. Our team offers full support through our in-house Web3 development company and smart contract development company, so your platform can scale securely and legally.

3. New York

New York is where traditional finance and blockchain truly converge. Wall Street firms are already investing in real estate on-chain. Many are actively working to develop your real estate tokenization platform in New York as part of their digital transformation strategies.

Partnering with experienced tokenization companies in New York City ensures your platform meets U.S. legal standards and connects with high-value investors. Whether you’re building for commercial, residential, or REIT-based assets, New York offers both reach and trust.

| Factor | Dubai | London | New York |

| Regulatory Support | Strong government backing via DIFC & ADGM sandboxes; pro-crypto stance | Clear guidance evolving through the FCA; crypto is regulated under broader financial laws | Strict but clear compliance under SEC, FinCEN, and state-level rules |

| Innovation & Technology | Blockchain-first policies; early mover in tokenisation of real estate in the UAE | Mature Web3 landscape with strong ties to legacy tech stacks | Rapidly advancing with tech investments from Wall Street and large institutions |

| Access to Investors | Growing global and regional investor interest, especially from Asia & GCC | Access to institutional capital, VCs, and European property investment funds | Home to high-net-worth investors, REITs, and U.S.-based funds |

| Ease of Market Entry | Sandbox frameworks simplify testing and compliance | Supportive but requires local partners for full compliance | High legal barriers; requires strong local legal and compliance advisors |

| Ideal For | Developers, tokenization startups, mid-sized real estate firms | Institutional players, family offices, fintech, and proptech firms | Large platforms, REITs, and established real estate investment funds |

| Tokenization Use Cases | Fractional ownership, cross-border real estate investment | Institutional-grade asset tokenization, cross-asset platforms | Digitized securities, REITs, and commercial real estate tokenization |

| Local Expertise Availability | An asset tokenization company in Dubai and a crypto-friendly talent pool | High-quality tokenization companies in London, Web3, and legal experts | Access to leading tokenization companies in New York City with finance and tech experience |

| Regulatory Speed & Flexibility | Agile and proactive | Balanced, evolving regulations | Structured but less flexible; strict U.S. laws |

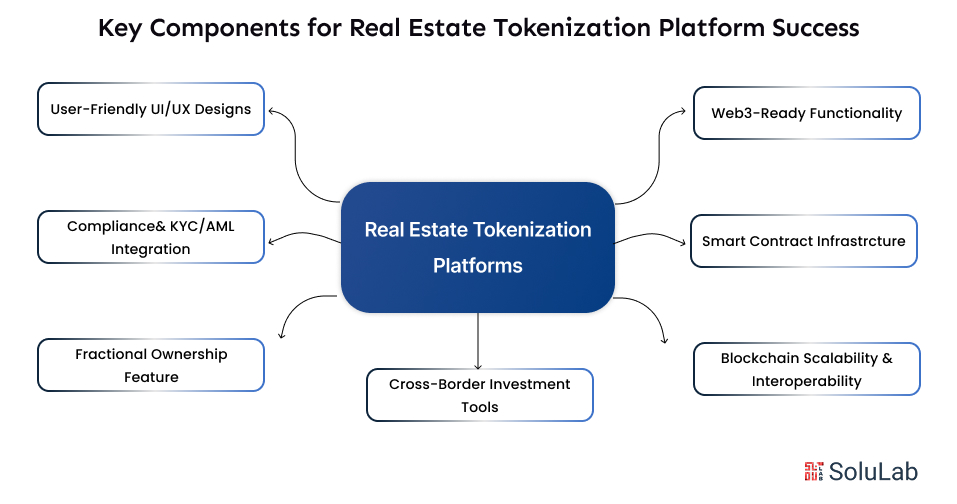

What a Tokenization Platform Needs to Succeed in Dubai, London & New York?

If you’re planning to build a real estate tokenization platform, success in global cities like Dubai, London, or New York requires more than just a great idea. You need a solid foundation with the right technology, compliance features, and investor-friendly tools. Here’s what your platform must include:

1. Compliance & KYC/AML Integration

To operate in these cities, your platform must include KYC/AML processes that meet local regulatory standards. These help build trust with investors and ensure you meet legal requirements in Dubai, the UK, and the US.

2. Smart Contract Infrastructure

Operate with an experienced smart contract development company to create secure, transparent contracts that automate property transfers, dividends, and investor rights. Smart contracts are the backbone of safe and reliable real estate tokenization.

3. Blockchain Scalability & Interoperability

Your platform should be able to scale and operate across multiple blockchains. A trusted Blockchain Development Company can build a multi-chain architecture that supports a wide range of blockchains in the Real Estate ecosystem, making it future-ready and flexible.

4. Fractional Ownership Features

Integrate fractional ownership so users can buy and sell smaller portions of high-value properties. This opens access to more global investors and boosts liquidity on your platform.

5. User-Friendly UI/UX Design

A clean and easy interface matters. Work with a team that ensures smooth onboarding, dashboard navigation, and seamless property browsing for both issuers and investors. A good real estate tokenization development company will offer this as part of its service.

6. Web3-Ready Functionality

Partner with a Web3 development company to include wallet integration, DAO governance, staking, or even NFT support if needed. Web3 features can increase engagement and future-proof your platform.

7. Cross-Border Investment Tools

For platforms targeting Dubai, London, or New York, it’s critical to include multi-currency support, local compliance layers, and access to regional property databases. This makes your platform adaptable to different jurisdictions.

So, if you are looking for a solution, let’s build a platform that your investors trust and your competitors can’t match.

Read Also: How to Select the Best Crypto Development Company in the UAE?

What Is the Cost of Entering These Markets?

Building a successful real estate tokenization platform involves both technology and compliance costs.

- Platform development: Typically starts from USD 50,000 and beyond, depending on features like smart contracts, investor dashboards, secondary market support, and wallet integration.

- Regulatory & legal setup: Jurisdictions like the UAE, UK, and USA each have different licensing, KYC/AML processes, and legal frameworks.

- Timeline to launch: On average, it takes 6 to 12 months to go from MVP (Minimum Viable Product) to full go-live.

Partnering with a proven real estate tokenization development company ensures faster execution, reliable compliance, and seamless integration. Teams that also specialize as a DeFi development company can help you enable token liquidity, secondary trading, and fractional investment, all crucial for scaling your tokenized assets globally.

For best results, work with a full-stack team that covers everything from smart contract development, blockchain infrastructure, and real estate tokenization services to platform deployment and investor onboarding.

Read Blog: Daos in Real Estate Tokenization

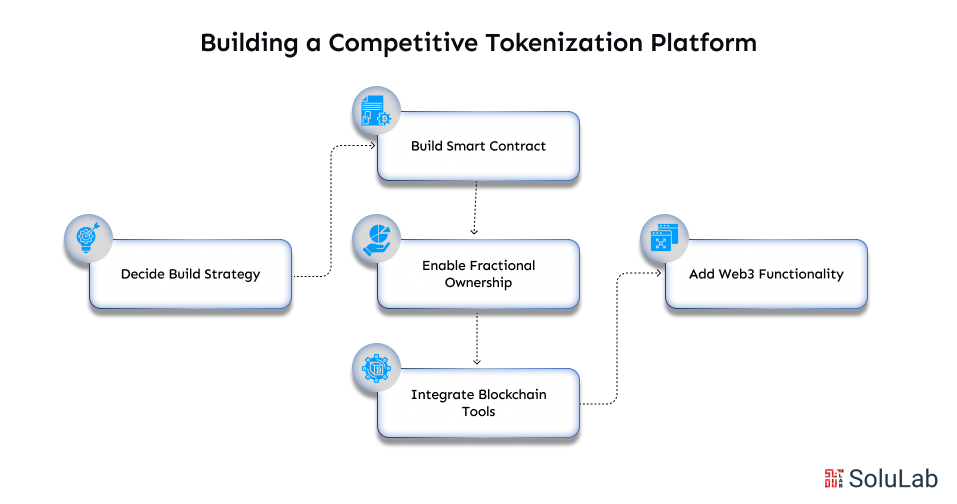

How to Build a Competitive Real Estate Tokenization Platform?

If you’re looking to enter the growing digital property investment space, building a solid and compliant real estate tokenization platform is key. Here’s how to do it right, especially if you’re a business looking to scale fast and attract global investors.

1. Decide Your Build Strategy

You have two options:

- White-label: Faster and more affordable. Good for MVPs or pilot projects.

- Custom Build: Ideal if you need advanced features, branding, or regulatory flexibility.

Work with an experienced tokenization platform development company that understands real estate compliance, tech scalability, and security.

2. Build Secure Smart Contracts

Smart contracts are the backbone of any tokenized platform. They handle asset issuance, ownership transfers, payouts, and more. Partner with a smart contract development company to write, test, and deploy these contracts on the right blockchain.

3. Enable Fractional Ownership

Fractional Ownership lets multiple investors own shares in a single property. This lowers the entry barrier and expands your investor pool. Your platform should allow users to buy, sell, and manage their fractions easily, with clear ownership records on-chain.

4. Integrate Blockchain Tools for Real Estate

Use tools that apply Blockchain in Real Estate, such as:

- Title deed management

- Real-time compliance tracking

- Transparent property records

- In-app trading UI

These tools reduce fraud, improve trust, and speed up transactions.

5. Add Web3 Functionality

To stay competitive, your platform should offer:

- Web3 wallets for secure logins and payments

- Secondary market support so investors can trade tokens

- Built-in governance tools for investor voting and compliance changes

All the aforementioned steps will render you a fully functional and infallible platform. Though doing it on your own can be a bit risky and tricky as well, so it’s better to take professional assistance for a market-driven solution that ensures minimal effort but unmatchable ROI.

Read Also: How Rising Gold Prices Are Accelerating Gold Tokenization in Dubai?

Conclusion

Dubai, London, and New York stand out because of their strong regulations, high liquidity, and fast adoption of new technology. To succeed in these markets, your business needs a trusted blockchain development company that provides complete solutions, from building your real estate tokenization platform and creating secure smart contracts to managing the tokenization of real estate assets and ensuring full KYC/AML processes compliance.

At SoluLab, we specialize in delivering end-to-end real estate tokenization development services that combine technology, strategy, and regulation. Partner with us to create a smooth, secure, and scalable platform that meets global standards and helps you lead in the tokenized real estate market.

Have a unique idea on your mind? Let’s connect today!

FAQs

1. Is real estate tokenization legal in Dubai?

Yes. Clear laws back tokenized real estate developments in Dubai. The government supports the Tokenization of Real Estate in the UAE, making it safe for businesses to operate. Work with a licensed Asset tokenization company in Dubai to ensure compliance.

2. What services do tokenization platforms offer?

A Real Estate Tokenization Platform helps you create and manage tokens, onboard investors, and stay compliant. Features often include KYC/AML processes, dashboards, and wallet integration.

3. What does it cost to build a tokenization platform?

Costs range from $100K to $500K, depending on features and regulations. Whether you’re doing real estate tokenization development in London or want to develop your Real Estate Tokenization Platform in New York, pricing depends on your scope.

4. Can one platform work for Dubai, London, and New York?

Yes, but you need market-specific KYC/AML processes and compliance tools. A well-built platform can work across Dubai, London, and New York when customized for each region.

5. What makes a tokenization platform competitive?

Top platforms offer easy onboarding, compliance tools, and real-time asset management. If you’re in a tokenized real estate development in Dubai or real estate tokenization development in London, work with a firm that offers full support.