The world of crypto fundraising has changed. In 2025, just having a strong idea or tokenomics isn’t enough. Investors now demand platforms that are fast, secure, and fully compliant. They want tools that protect their money, data, and time, and projects that don’t meet these standards risk being left behind, and the numbers tell the story.

| Crypto fundraising is set to exceed $25 billion in 2025, up from $10 billion in 2021. October alone saw $2.5 billion raised across 27 companies, and the number of crypto millionaires grew 40% this year. |

This surge shows that both institutional and retail investors are ready to back projects with reliable, intelligent infrastructure but only if the platform meets their expectations. That’s where SoluLab’s AI-powered white label crypto launchpad development comes in.

In this article, we’ll break down the core features every modern launchpad needs, share real-world data and case studies, and show how you can launch a professional-grade fundraising platform faster and smarter in 2025–2026.

Why AI Is Essential in White Label Launchpad Development?

Building a crypto launchpad from scratch is expensive and time-consuming. Security audits alone can cost six figures. KYC/AML compliance requires specialists who know both blockchain and fintech regulations. Even after all that, platforms still face constant updates, patches, and competition from established launchpads.

The best launchpads today aren’t winning because of flashy designs; they win because they are predictive, compliant, and frictionless. Even Regulations are tightening globally. The SEC in the US, Europe’s MiCA framework, and evolving rules across Asia mean manual compliance is risky.

AI-based solutions can automate identity verification, AML screening, flag non-compliant projects, and fraud detection in real time. This brings measurable benefits for founders:

- Faster onboarding: KYC verification in minutes instead of days

- Lower costs: Fewer manual reviews and staff overhead

- Better user retention: Quick verification keeps users engaged

- Higher compliance confidence: AI flags risks automatically

- Competitive advantage: Launch faster than competitors stuck on legacy systems

With hundreds of new token projects launching every year, platforms that scale successfully rely on smarter infrastructure, not bigger teams.

Core AI Features Every Modern Launchpad Must Include

These AI capabilities are necessary in 2026 if you are considering a white label launchpad development firm or creating your own AI-powered crypto launchpad. They save time, risk less, and provide your platform with a competitive advantage.

1. Artificial Intelligence-based KYC and Identity Verification.

One of the most massive bottlenecks in crypto launchpad is KYC. Conventional solutions are not fast, they are subject to mistakes and may expose your platform to fines by the regulator. AI fixes this by automating the verification process all the way through, enhancing speed, accuracy, and compliance.

How it works:

- Document Processing: AI provides OCR and machine learning to extract and authenticate information in passports, driver’s licenses, and IDs. It checks counterfeit papers or incorrect information automatically.

- Biometric Verification: Facial recognition and liveness are used to verify that the user is an actual person and not a deep fake or pre-recorded video.

- Sanctions & Risk screening: AI compares users with the global AML, OFAC, EU and PEP watchlists in real time.

- Behavioral Anomaly Detection: AI will monitor trends like an unusually high transaction, speedy account creation, or wallet activities, which are common in fraud or money laundering.

In the case of Business, AI-based KYC saves days to minutes of onboarding, risk of regulation, and enables your team to grow.

2. Anticipatory Fundraising Analytics

Fundraising effectively is concerning a data-driven approach. AI fundraising analytics gives practical suggestions to maximize the sales of your tokens.

Key Capabilities:

- The historical Launch Analysis: AI analyzes thousands of past sales involving tokens and finds patterns that include timing, price, and investor involvement that are associated with success.

- Market Sentiment Tracking: Scrapes social platforms such as Twitter, Telegram, and Discord to gauge the hype, interest, and sentiment amongst the community around a project.

- Investor Profiling & Segmentation: Determines likely involvement of investors in terms of their previous activity, the size of their portfolio, and risk appetite.

- Dynamic Token Pricing: Changes the pricing suggestions according to the demand, investor behavior, and market conditions.

- Best Launch Dates and Times: AI suggests an optimal date of the launch and best time when the majority of people will turn up to maximize on raising funds.

Founders receive data-informed advice, and launchpad operators minimize failed launches and make the most of investment returns.

3. Smart Contract Security through AI.

The failures of smart contracts have resulted in billions of dollars in losses. Audits that are done manually are costly and time-consuming. AI audits smart contracts on a first-time basis and constantly, offering more secure results in a shorter time span.

Key Capabilities:

- Automated Vulnerability Scanning: Identifies typical attack vectors such as reentrancy attacks, integer overflows, or unauthorized access patterns.

- Risk Prioritization: Marks off major vulnerabilities on the spot and records the minor ones to be reviewed.

- Audit Documentation: Prepares detailed reports to comply with and ensure the shareholders.

- Ongoing Post-Launch Surveillance: This identifies suspicious contract activity as it happens in order to prevent exploitation.

Launchpad operators will be able to provide Tier-1 security, decrease the audit expenses, and retain investor confidence.

4. Individualized Investor Experience & Tiering.

Investors are not equal. AI aids launchpads’ segmentation, customization, and retention of investors.

How it works:

- Investor Profiling: AI examines wallet activity, past investments, and portfolio activity.

- Tier-Based Access: Provides unique institutional, middle-tier, and retail investor experiences.

- Personalized Dashboards: Every investor will have access to information that is applicable to their portfolio and level.

- Automated Communication: Dispatches personalized notifications, email messages, and recommendations on projects.

- Investment Recommendations: Recommends investment projects according to user behavior and risk appetite.

In the case of Business, personalization gives results of increased engagement, qualified participation, and retention. Investors are made to feel special and knowledgeable.

5. AI Agent Launchpads

The use of AI agents allows modern launchpads to automate the most important processes, which are quicker, smarter, and safer. These agents can:

- Automate Investor Onboarding & KYC – Real-time verification of identity, wallet behavior and suspicious activity.

- Optimize Fundraising – Estimate the success of the token sale, simulate tokenomics, and recommend the optimal time to launch in the market.

- Improve Smart Contract Security- Conduct automatic vulnerabilities, risk scoring, and real-time audits.

- Support Multi-Chain Operations: Solana, TON, BNB, ETH, Sui, and Aptos Tailor AI functions will guarantee the cross-chain operation.

Using AI agent features, your AI-based crypto launchpad development will be more efficient, compliant, and investor-friendly, which will provide your project with an edge.

Read Also: Why White-Label Crypto Exchange Development Makes Sense for UAE Banks?

6. Live Regulatory Adaptation and Compliance

Crypto regulations change constantly. AI ensures your platform stays compliant without manual intervention.

Key Features:

- Regulatory Monitoring: AI scans updates from SEC, MiCA, Singapore, Hong Kong, UAE, and more.

- Automated Workflow Updates: Adjusts KYC, disclosures, approvals, and documentation automatically.

- Non-Compliance Alerts: Flags projects that don’t meet the latest rules before launch.

- Compliance Reports: Generates all required documentation, terms, and risk warnings per jurisdiction.

Businesses operate globally with confidence, avoid fines, and launch projects faster with minimal regulatory risk using this.

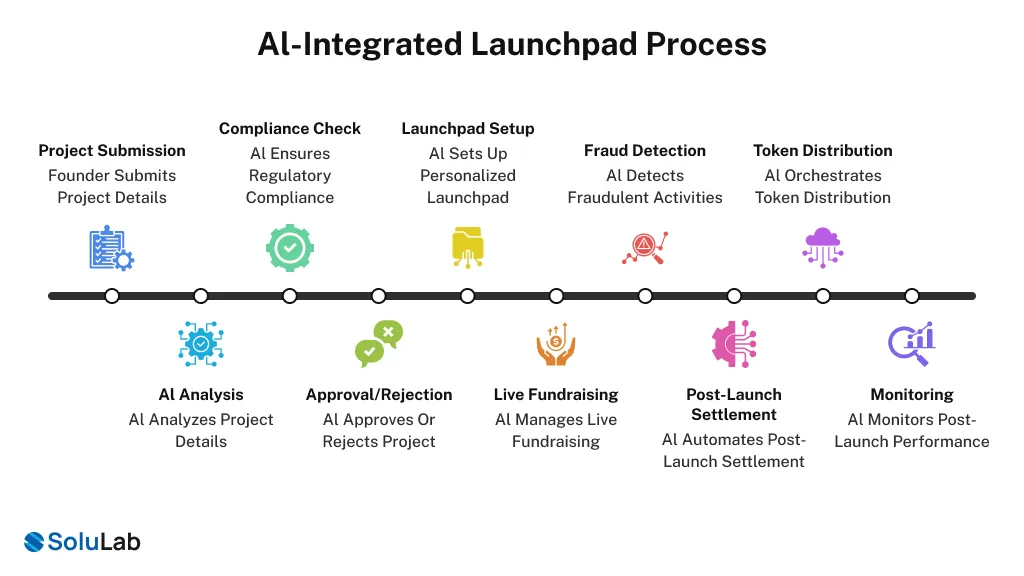

How an AI-Integrated Launchpad Works?

It is important to know the functionality of an AI-powered launchpad so that you can identify whether a white label crypto launchpad development company is actually providing AI solutions or merely using the term as a promotional buzzword.

A founder is required to submit a project, and the AI will process all necessary information, such as team qualifications, previous work, financial history, whitepapers, smart contracts, tokenomics, and marketing indicators. It conducts multi-layered vetting, credibility through experience scoring, smart contract vulnerability scanning, market fit analysis, and social sentiment analysis to gauge the interest of the investors.

At the same time, AI guarantees the conformity of regulation in target jurisdictions. The result is a comprehensive report that contains a risk score and a clear recommendation, such as approve, request changes, or reject it, in a matter of hours rather than in a matter of weeks.

1. Personalized Launchpad Setup

Once approved, the founder receives a customized launchpad page powered by AI intelligence.

The platform recommends investor tiers based on historical success data, defining allocations for institutional, fund, and community investors. AI will optimize the price of tokens to reflect a fair balance between funds raised, returns to the investors, and stability in the market, and will propose the most appropriate timeline of marketing that should be followed to announce and sell.

In the case of projects that do not already have smart contracts, AI will be able to create standard, audited contracts depending on the token supply of the project, vesting schedules, and individual project launch requirements.

2. Live Fundraising with Real-Time AI

In the live-fundraising, AI manages the investor onboarding, which carries out instant KYC and wallet verification, OCR and biometric checks, and sanctions screening. Management of allocations is completely automated so that tier limits are not exceeded and overbooking is avoided.

Fraud detection is facilitated by constant monitoring of suspicious account holders or anomalous transactions, whereas AI predicts the pattern of liquidity or participation and suggests deadline changes or specific marketing promotions to make fundraising targets.

3. Post-Launch Settlement and Issue of Tokens.

Once the fundraising is completed, AI automates the accounting process, allocations, and settles the revenue, as well as implements the vesting schedule. A network-wide multi-chain token distribution is coordinated on Ethereum, Polygon, Arbitrum, and more to coordinate the smart contracts, liquidity pools, and investor claims.

The post-launch monitoring system keeps an eye on the vesting, secondary market performance, and automatically communicates with investors. This is the degree of automation that is efficient in platforms that are involved in hundreds of projects annually.

Why Founders Should Invest in an AI-Powered Launchpad?

Building a white-label crypto launchpad with AI integration is a smart business move. AI helps founders scale faster, reduce costs, and attract more investors while staying compliant. Here’s why it makes sense.

Read Also: How AI Integration Streamlines Operations for Small & Mid-Sized Companies?

1. Revenue Opportunities

An AI-powered launchpad creates multiple income streams:

- Platform Fees: Usually 1–3% of each token sale

- KYC/AML Verification Fees: $5–$20 per verified user

- Premium Tools: Analytics dashboards, investor matching, and smart contract audit reports

- Launchpad-as-a-Service: Licensing your platform to other projects

- Token Staking: Investors stake your platform token, generating recurring fees

For a mid-sized launchpad handling 20–30 projects a year, each raising $2–$5M:

- Platform Fees: $1.2M–$4.5M annually

- KYC Fees: $50K–$200K annually

- Premium Features: $100K–$300K annually

Potential Total Revenue: $1.35M–$5M annually, with low operational costs once AI is in place.

2. Powerful Network Effects

AI launchpads get stronger as they grow:

- Investor Attraction: More projects mean more investors visit your platform regularly

- Project Magnet: More investors make your launchpad the preferred choice for new projects

- Smarter AI: More historical data improves predictions, fundraising advice, and token recommendations

This creates a self-reinforcing cycle, making your platform more profitable and defensible over time.

3. Built-In Compliance

AI-based launchpads are designed to stay compliant by default. Automated KYC, AML, and regulatory checks reduce risk for your projects and protect your platform. With regulations tightening, this becomes a key competitive edge, helping founders attract serious projects without worrying about legal hurdles.

Real Case Studies

1. Virtuals Protocol

Type: AI-Agent Launchpad | Tokenization & Co-Ownership

Why it’s popular: Handles ~14,000 AI agents with strong tokenomics.

How it works:

- Users launch agents using VIRTUAL tokens via a bonding curve.

- Liquidity pools are created on Uniswap after funding goals are met.

Business benefit:

- Tokenized agents enable revenue and value sharing with co-owners and users.

- Turns AI agent infrastructure into a real Web3 economy.

2. Vvaifu.fun

Type: No-Code AI Agent Launchpad | Built on Solana

Why it’s popular: Simplifies building AI agents (trading bots, NFT assistants) with templates, no deep technical skill needed.

How it works:

- Agents can be tokenized via SPL tokens.

- Monetization through subscriptions or usage fees.

Business benefit:

- Enables fast AI-powered launches.

- Unlocks new revenue streams through staking, tokenomics, and usage fees.

Type: AI-Focused Launchpad | Multi-Chain & Smart Contract Integration

Why it’s popular: Ranked top in the AI agent space by market cap.

How it works:

- Supports agent-to-agent interactions.

- Allows multi-chain deployments and LP staking using AI16Z token.

Business benefit:

- Deploy complex multi-modal AI agents on-chain (social bots, trading agents).

- Governance and value tied to token economics, enabling scalable growth.

Conclusion

The world of crypto fundraising is evolving fast. Manual launchpads are slow, costly, and struggle with compliance. The projects winning in 2026 are built on AI-powered crypto launchpad development, enabling faster launches, lower costs, higher scalability, automated compliance, and strong data-driven advantages. Investing in AI at the infrastructure level now sets your platform up to dominate in 2030.

If you want a competitive edge, SoluLab, a trusted white label launchpad development company, can build your platform with end-to-end AI blockchain integration. From predictive fundraising models to automated KYC/AML, smart contract audits, and chain-specific enhancements, we deliver launchpads ready to scale efficiently and securely.

FAQs

With a white-label provider using AI-powered crypto launchpad development, it takes 2–4 weeks. Building custom can take 8–12 weeks, depending on features and team capacity.

Not fully. AI handles 80–90% of compliance tasks, automating KYC/AML checks and monitoring transactions. Humans still manage complex cases and regulatory relationships. This is why AI-based blockchain launchpad solutions work best with human oversight.

Trusted platforms include manual fallback checks. If an investor flags an issue, humans review it. AI handles large volumes efficiently, while humans manage exceptions.

Yes, if implemented correctly. AI can monitor threats 24/7, detect suspicious patterns, and maintain detailed audit trails, often better than manual systems.

With a white-label partner offering white label crypto launchpad development company services, expect $10K–$50K to start. Custom-built solutions can cost $100K–$300K and take 3–6 months.

Start with Ethereum, Solana, TON, and Polygon for the largest user base. Add Arbitrum, Optimism, or Base as you scale. A good AI-powered crypto launchpad development platform lets you add chains without major rewrites.