Real-world asset tokenization, which started as controlled pilots and innovation experiments, is now becoming live market infrastructure. Enterprises are no longer asking if RWA tokenization makes sense, but how fast, how compliant, and how scalable it can be.

As we move into 2026, the RWA tokenization platform development market is being shaped by institutional capital, regulated exchanges, and enterprise-grade platforms. From private credit and real estate to carbon credits and funds, real assets are moving on-chain. This is happening in a way that improves settlement speed, liquidity access, and operational transparency by measurable margins. And also, 2025 marked a remarkable year for precious metals (Gold, Silver, Diamond) tokenizations.

Let’s see what the top RWA trends are driving enterprise adoption in 2026.

Key Takeaways

- Tokenized assets are delivering measurable benefits, including 2–3x faster settlement, 30–50% capital efficiency gains, and reduced operational overhead.

- Regulated platforms and exchanges entering tokenized securities are increasing enterprise confidence and adoption.

- Enterprises that plan RWA tokenization development as long-term infrastructure, not short-term experimentation, gain a clear execution advantage.

Market Insights: Where RWA Tokenization Stands Going Into 2026

By the end of 2025, RWA tokenization moved decisively from pilots to production.

According to data from RWA.xyz and RWA.io, tokenized real-world assets crossed $35–50 billion in on-chain value, excluding stablecoins. That figure nearly 3–4x growth within a single year, driven primarily by banks, asset managers, and regulated financial institutions deploying capital on-chain.

What makes this shift important for enterprises is not just scale, but structure.

Major asset categories already tokenized real-world assets include:

- Private credit and debt instruments

- Investment funds and bonds

- Real estate and infrastructure assets

- Commodities and carbon credits

- Public and non-U.S. government debt

The signal is clear. Real World Asset tokenization trends are no longer limited to one asset class or region.

A strong validation point came recently when the New York Stock Exchange announced plans to develop a platform for trading and on-chain settlement of tokenized securities, subject to regulatory approval. The proposed system combines NYSE’s Pillar matching engine with blockchain-based post-trade infrastructure, enabling:

- 24/7 trading

- Fractional ownership

- Dollar-denominated orders

- Near-instant settlement using tokenized capital

- Stablecoin-based funding support

For enterprises, this marks a turning point. When core market infrastructure providers move on-chain, RWA tokenization future planning becomes a strategic priority, not an innovation bet.

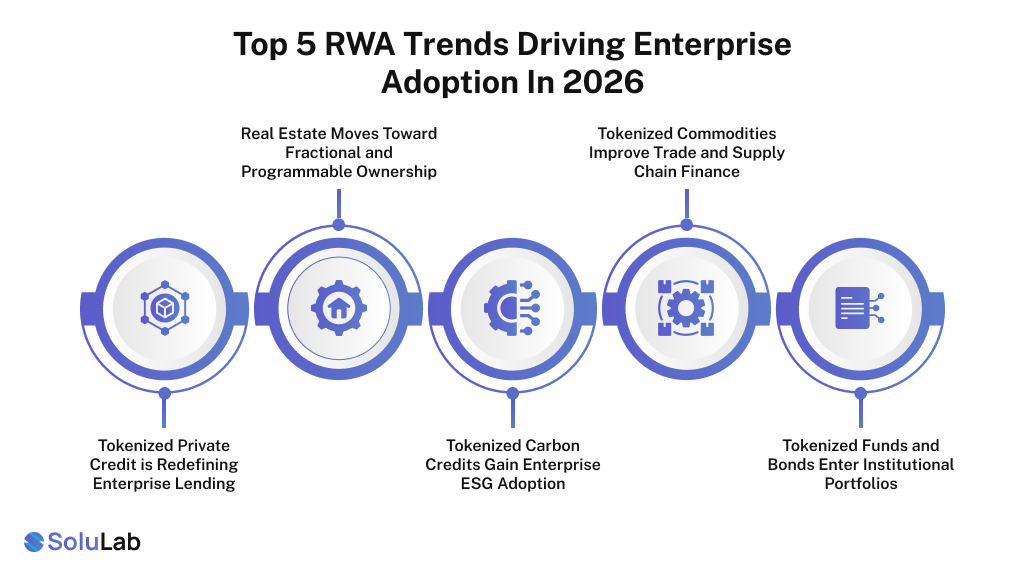

Top 5 RWA Trends Driving Enterprise Adoption in 2026

The following Top RWA Trends reflect where real enterprise demand is emerging, mapped clearly to industries already deploying or preparing to deploy RWA tokenization platforms for enterprises.

1. Tokenized Private Credit Is Redefining Enterprise Lending

Industry: Banking & Financial Services

Private credit has become one of the fastest-growing segments in the RWA tokenization market.

- On-chain credit instruments

Loan agreements, repayment schedules, and interest distributions are now issued as programmable tokens. This reduces documentation friction and improves transparency across lenders, borrowers, and intermediaries.

- Faster settlement and structured yield

Tokenized credit can reduce settlement cycles from days to minutes, improving capital efficiency by 30–50% for institutional lenders. Yield distribution becomes automated, predictable, and auditable.

- Institutional-grade collateral models

Collateralized lending backed by tokenized RWAs improves risk visibility and lowers counterparty exposure, making it suitable for enterprise balance sheets.

This is one of the strongest RWA tokenization enterprise use cases heading into 2026.

2. Real Estate Moves Toward Fractional and Programmable Ownership

Industry: Real Estate & Infrastructure

Real estate remains a cornerstone of Real World Asset trends for enterprises, but the model is changing.

- Asset liquidity without full asset sale

Real estate Tokenization allows enterprises to unlock 20–40% faster liquidity without divesting entire properties. Fractional ownership lowers entry barriers while maintaining asset control.

- Cross-border investor access

Real estate tokens enable compliant access to global capital pools, reducing fundraising timelines and improving deal velocity.

- Income distribution via smart contracts

Rental income and returns can be distributed automatically, cutting administrative overhead by up to 60% compared to traditional structures.

This trend is pushing real estate firms to adopt RWA tokenization on blockchain trends that integrate directly with financial operations.

3. Tokenized Carbon Credits Gain Enterprise ESG Adoption

Industry: Energy, Climate & Sustainability

Carbon markets are becoming one of the most practical RWA investment trends for enterprises.

- Transparent credit issuance and tracking

On-chain carbon credits reduce double-counting and improve trust by offering real-time traceability across issuance, trading, and retirement.

- Audit-friendly ESG reporting

Enterprises can reduce ESG reporting complexity by 30–40% using tokenized carbon assets with verifiable on-chain records.

- Growing demand from regulated enterprises

As ESG scrutiny increases, enterprises prefer tokenized credits that meet compliance, audit, and reporting standards across jurisdictions.

Carbon credit tokenization is moving quickly from sustainability teams to finance and compliance desks.

4. Tokenized Commodities Improve Trade and Supply Chain Finance

Industry: Trade, Logistics & Commodities

Tokenized commodities are reshaping how trade finance operates.

- Faster trade settlement

Commodity-backed tokens can reduce settlement timelines from T+5 to near real time, freeing working capital faster.

- Reduced counterparty risk

Smart contracts enforce delivery and payment conditions automatically, lowering disputes and defaults.

- Real-time asset traceability

From origin to delivery, on-chain tracking improves transparency and compliance across global supply chains.

This is one of the clearest examples of RWA tokenization platforms for enterprises delivering operational ROI.

5. Tokenized Funds and Bonds Enter Institutional Portfolios

Industry: Asset Management & Capital Markets

Tokenized funds and bonds are now moving into mainstream institutional allocation strategies.

- Fund shares on-chain

Asset managers can issue fund units as tokens, improving investor access and lowering operational friction.

- Better liquidity management

Tokenized securities enable fractional ownership and secondary trading, improving liquidity by 2–3x compared to traditional fund structures.

- Integration with regulated marketplaces

With platforms like the NYSE preparing tokenized trading infrastructure, institutional confidence in digital securities is accelerating.

This trend signals that RWAs are becoming part of core portfolio construction.

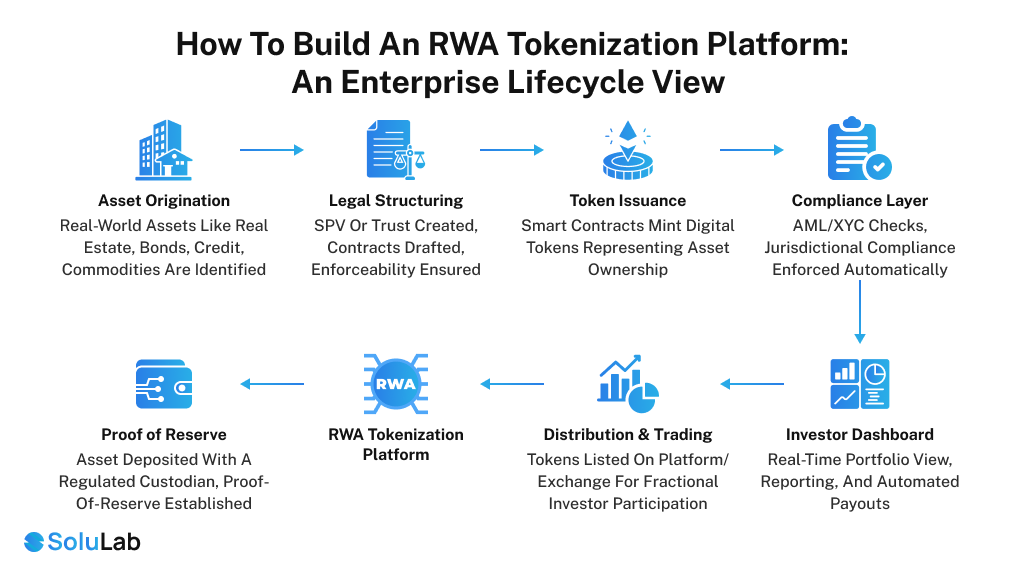

How to Build an RWA Tokenization Platform: An Enterprise Lifecycle View

Building a Real-World Asset Tokenization Platform requires structured execution across business, legal, and technology layers.

Step 1. Asset Identification and Feasibility: Evaluate asset suitability based on liquidity needs, regulatory constraints, and investor demand.

Step 2. Legal Structuring and Ownership Mapping: Define how token ownership maps to real-world rights, cash flows, and governance.

Step 3. Token Design and Compliance Logic: Embed compliance rules directly into tokens, including transfer restrictions, KYC, and jurisdiction controls.

Step 4. Platform Architecture and Blockchain Selection: Choose blockchains that support scalability, security, and interoperability across enterprise systems.

Step 5. Custody, Settlement, and Integration: Integrate custody providers, stablecoin rails, and settlement layers to enable smooth operations.

Step 6. Go-Live, Monitoring, and Scaling: Launch with controlled volumes, monitor performance, and scale across assets and regions.

Enterprises that follow this lifecycle reduce time-to-market by 25–40% compared to ad-hoc builds.

Future RWA Trends by Region: What Different Markets Are Prioritizing

The RWA tokenization future will not look the same everywhere. Regulatory maturity, capital flows, and market needs are shaping very different regional priorities. Enterprises building global RWA tokenization platforms need to factor this in early or risk costly redesigns later.

1. United States

The momentum is clearly building around tokenized securities, private credit, and regulated trading venues. With initiatives like the NYSE exploring on-chain settlement and 24/7 trading models.

The focus is on compliance-first tokenization that mirrors traditional market rights while improving settlement speed by 2–3x.

2. Europe

ESG assets, carbon markets, and tightly regulated frameworks dominate enterprise interest.

Tokenization here is less about speed and more about transparency, auditability, and regulatory alignment, helping enterprises reduce ESG reporting friction by 30–40%.

3. Middle East

People and governments are prioritizing real estate, infrastructure, and sovereign-linked assets.

Government-backed initiatives and large-scale projects are using RWA tokenization to unlock long-term capital and attract global investors.

4. Asia

Especially in Singapore and Hong Kong, the emphasis is on tokenized funds, cross-border finance, and institutional custody.

Meanwhile, emerging markets are leveraging RWAs for infrastructure financing and alternative assets, using tokenization to access capital faster and at lower cost.

Enterprises planning global RWA strategies must align platform design, compliance logic, and asset models with these regional realities from day one.

Conclusion

As the technology grows, there is no stopping the latest trends. All you can do is blend in and update your RWA tokenization platforms according to the requirements. However, during this, you need a well-established asset tokenization development company like SoluLab to make yourself an industry innovator.

SoluLab offers multiple services across different sectors and assets.

- Custom Tokenization Platform Development

- Smart Contract Development

- AI-Powered Tokenization

- Blockchain Integration Services.

Not only this, but from maintaining standards to adding the latest features and working with updated tools, you can bring your ambitious goal to life. Contact us today to know more about our services and discuss your vision.

FAQs

Development cost depends on asset type, compliance needs, and integrations. Enterprise-grade RWA platforms usually start from a mid five-figure range and scale based on features.

Yes. Silver tokenization allows physical silver to be represented on-chain, enabling fractional ownership, easier trading, transparent pricing, and faster settlement for investors and enterprises.

You can reach SoluLab through their website contact form or schedule a direct consultation to discuss your RWA tokenization goals, asset type, and platform requirements.

Yes. Carbon credit tokenization helps enterprises track, trade, and retire credits transparently while improving ESG reporting, auditability, and compliance across regulated markets.

Yes. White-label tokenization platforms are built comparatively fast with the SoluLab specialized team. This allows enterprises to launch faster with branded, customizable RWA infrastructure while maintaining compliance, scalability, and control over asset operations.