The global digital asset market has crossed three trillion dollars, and institutions are moving fast to claim their share of it. More than 560 million people now hold crypto, and the number keeps growing every year. Dubai has become one of the most active hubs in this shift.

Strong regulations, high adoption, and institutional interest shape a new financial landscape. Banks in the UAE now explore white label crypto exchange solutions to enter this market without delays or high costs. Let’s see how this turn going to make changes to the UAE’s businesses.

How Can White Label Crypto Exchange Empower Dubai Banks?

Recent developments show how fast the UAE embraces digital assets. Emirates NBD became the first major state-owned bank to offer crypto trading through its Liv X app. This move reflects a growing push to give customers access to regulated virtual asset services. The Virtual Asset Regulatory Authority (VARA) sets clear rules, giving banks confidence to explore crypto.

White Label Crypto Exchange Development services help banks launch market-ready platforms without building complex systems. These platforms offer fast deployment, deep customization, and compliance support. They also help banks reduce technical load and accelerate their digital transformation.

Below are three clear reasons these platforms empower UAE banks. We will explore them further in the upcoming sections:

- They offer faster entry into the crypto market with ready systems.

- They reduce compliance risks through VARA-aligned frameworks.

- They unlock new revenue opportunities with trading and custody services.

Not only banks, but now airlines are also adopting crypto, which is why banks are after security and innovation. Emirates, the UAE’s flagship airline, has taken its first formal step toward accepting crypto payments.

On July 9, the company signed a memorandum of understanding (MoU) with Crypto.com, a major crypto platform, to explore integrating Crypto.com Pay into its booking and payment systems.

Why UAE Banks Are Embracing Digital Assets?

Banks across the UAE see digital assets as a natural extension of modern finance. Customers want faster services and more control over their money. Fintech companies already offer crypto trading, staking, and cross-border transfers. Traditional institutions must match these services to stay competitive.

Here are the major reasons behind this shift:

- Growing customer demand: Millennials and Gen Z prefer digital money and transparent systems.

- Faster cross-border payments: Blockchain cuts costs and speeds up international transfers.

- High crypto adoption: UAE residents downloaded around fifteen million crypto apps in 2024.

- New revenue channels: Banks earn through trading fees, custody services, token listings, and premium features.

- Regulatory clarity: VARA gives banks a trusted foundation to launch crypto services.

- Competitive pressure: Early adopters like Emirates NBD now set the benchmark for innovation.

- Smarter Security: AI-powered fraud detection systems will become standard in crypto banking operations.

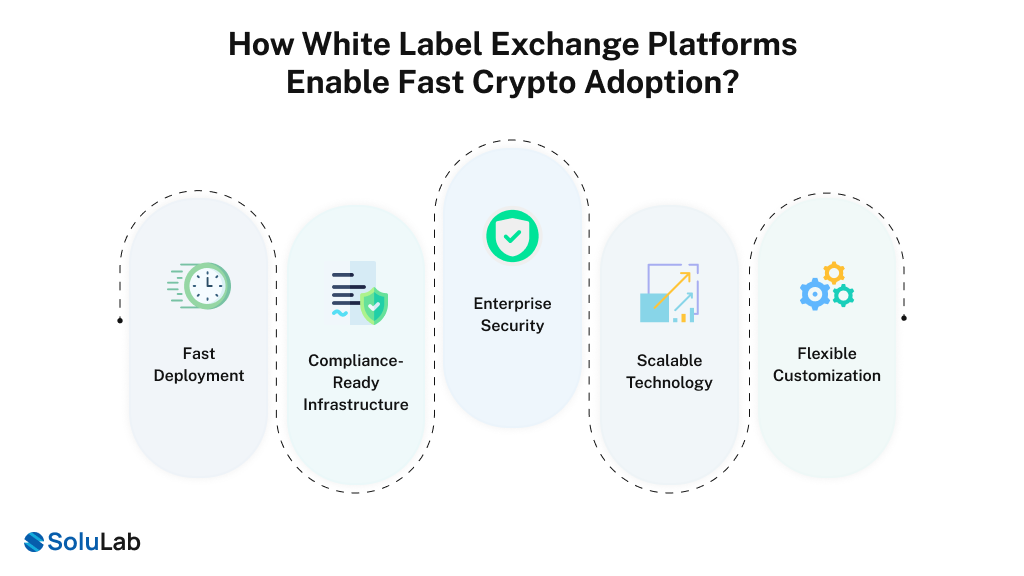

How White Label Exchange Platforms Enable Fast Crypto Adoption?

White label crypto banking solutions let banks enter the market without building systems from scratch. These platforms reduce development time and lower operational costs. They come with trading engines, security layers, liquidity connections, and user interfaces already in place.

1. Fast Deployment

Banks can launch a branded platform within weeks. They avoid long development cycles and high engineering costs. This helps them capture rising demand quickly.

2. Compliance-Ready Infrastructure

A white label crypto banking platform comes with built-in KYC, AML, and audit trails. This helps banks meet VARA, FATF, and GDPR rules with ease.

3. Enterprise Security

The platforms offer cold storage, two-factor authentication, encryption, and fraud detection. These features protect customer assets and reduce security risks.

4. Scalable Technology

Banks get high TPS trading engines, auto-scaling servers, and multi-chain support. This ensures smooth performance during peak trading hours.

5. Flexible Customization

Banks can add new tokens, design custom interfaces, or plug in new payment rails. They can also integrate with digital wallets and existing banking systems.

Can Banks Launch Crypto Exchange Services Without Heavy Risks?

Banks must manage compliance, security, and operational risks. White label crypto bank services give them a safe middle path. These platforms handle the most complex challenges so banks can focus on customer experience and growth.

1. Regulation and Compliance Management

White label crypto exchange software includes automated KYC and AML workflows. Banks can verify users, monitor transactions, and generate audit logs with minimal manual work. Built-in rules help them avoid penalties and maintain trust.

2. Security That Meets Banking Standards

Security remains the biggest concern for institutional crypto adoption. These platforms use cold storage, multisig wallets, hardware security modules, and encryption. AI systems track unusual behavior and block suspicious activity. This matches the safety level expected by central banks.

3. Smooth Integration With Legacy Systems

Banks often operate on old systems not built for blockchain workloads. White label platforms offer APIs and connectors that integrate with banking cores. They support fiat-crypto flows, liquidity management, and on-chain settlement. This reduces technical risk and avoids system disruptions.

4. Operational Efficiency

Banks avoid hiring large blockchain teams or building new infrastructures. Ready-made systems reduce cost, speed up testing, and prevent downtime. This approach keeps operations stable while expanding digital services.

5. Cost and Time

Developing a crypto exchange software platform from scratch demands a high budget. However, based on your requirement, the costs start from $15k and take 3 to 5 weeks. You can rely on trusted third-party providers that are experts in crypto exchange development. This cut the costs and time.

What the Future Holds for UAE Crypto Banking?

Crypto banks in the UAE will shape the next phase of financial innovation. VARA sets clear rules for virtual assets and attracts global businesses. Banks will use White Label Crypto Exchange Development services to build products that meet customer expectations and strengthen their market position.

Here is what the future will likely include:

- Broader Banking Services: Banks will expand into custody, tokenization, lending, and staking services.

- Secure Digital Identity: DIDs will support faster onboarding and safer user verification.

- Advanced Trading Platforms: DEX Exchange Development companies will gain traction as banks explore hybrid models.

- Cross-Border Innovation: Blockchain will improve trade settlements, remittances, and instant payments across regions.

- Stablecoin Adoption: Banks may issue regulated stablecoins backed by local assets.

- Institutional Trading Desks: More banks will set up trading arms for digital assets.

- Integrated Investment Products: Traditional wealth services will include crypto portfolios, ETFs, and tokenized assets.

- Higher Market Trust: VARA’s framework will attract global investors and enterprises seeking safe banking partners.

- Growth of White Label Solutions: Demand for white label exchange crypto platforms will grow as banks choose fast, safe, and compliant models.

Conclusion

As discussed above, white label crypto exchange platforms are reshaping how banks and enterprises enter the digital asset space. With fast deployment, built-in compliance, and strong security frameworks, these solutions remove the usual barriers. Businesses no longer need huge budgets or long development cycles to launch a reliable platform.

If your bank or enterprise plans to introduce crypto services, a white label approach offers the safest and most efficient path. SoluLab delivers scalable, regulation-aligned white label crypto exchange development services. That supports seamless onboarding, enterprise security, and future-ready features. Stay competitive with a partner that understands the evolving needs of digital finance.

Contact us today, and let’s start building a secure, compliant, and high-performance crypto exchange platform tailored to your goals.

FAQs

White label platforms remove the need for custom engineering. Banks get ready trading engines, security modules, and compliance workflows, allowing them to launch faster with lower cost and technical effort.

Most white label exchanges start around $15k and take three to five weeks to launch. The timeline depends on branding, features, integrations, and compliance checks.

We, at SoluLab, deliver compliant, scalable, and secure white label crypto banking platforms. Our team handles architecture, integrations, and support, helping businesses enter the market faster with reliable infrastructure.

Banks prefer white label platforms because they reduce regulatory risk, improve speed to market, and offer enterprise security. This approach helps institutions meet growing customer demand without complex development.

VARA provides clear rules for custody, trading, and consumer protection. Banks adopt crypto services more confidently because operational requirements, reporting standards, and risk controls are already defined for virtual asset providers.