If you’ve been around blockchain long enough, you’ve probably heard about atomic swaps and trustless exchanges. But when you dig deeper, most of the conversation stops at how they work and never really dives into why they matter for your business or product.

That’s where HTLC smart contracts come in. They’re solving real, production-level problems like trust, settlement finality, cross-chain friction, and that nasty feeling you get when you realize you don’t actually know if a payment will go through or not.

We have found that most founders don’t fully understand what is hashed timelock contract? or more importantly, what it prevents from going wrong? They know it exists, but they don’t realize that it’s the backbone of trustless crypto payment getaway infrastructure that’s running in production right now, handling swaps on platforms like 1inch, Komodo Wallet, and Connext.

This article is different. We’re going to walk through the exact problems HTLC smart contract technology solves, show you where it’s already being used in real products, and help you figure out if building with HTLCs makes sense for what you’re trying to do.

Key Takeaways

- HTLC removes the need for custodians in crypto payments by using cryptographic commitments and time-based conditions

- They solve the simultaneous settlement problem, making sure both sides of a trade happen atomically or neither does go wrong.

- HTLCs let two parties on different blockchains, swap directly without relying on third-party infrastructure with ease

- Smart contract security is critical, even audited contracts can fail if access controls, timeouts, or refund logic break down.

Why Crypto Payment Infrastructure Breaks Without Smart Contract Security?

Let’s start with the problem nobody wants to admit – crypto payments fail, usually a lot. And when they do, it’s scary and messy.

You’re trying to swap 10 ETH for USDC across chains. The DEX quotes you a price, and you click send. But then what –

- Does your ETH actually leave your wallet?

- Does the USDC show up?

- What if the validator goes offline?

- What if someone front-runs you and the price tanks mid-transaction?

In traditional finance, a bank guarantees the settlement, but in crypto, there’s nobody. Usually, you’re trusting a smart contract, and the contract needs to have no bugs. The biggest payment failures in crypto come down to a few recurring events we see:

1. Lack of Atomicity

You send funds on chain A, but the corresponding transaction is not visible on chain B. Your money is locked, or it goes to an attacker, which is much worse. According to Chainlink’s research, cross-chain bridges suffered $2.8 billion in losses as of May 2024, with 47% of all blockchain exploit losses tied to bridge failures.

2. No Built-In Refund Mechanism

If something goes wrong, your funds get stuck. You can’t get them back unless the contract explicitly gives you that option, and most contracts weren’t designed with this in mind. The Nomad Bridge hack in August 2022 happened because the contract accepted a default root value (0x00), letting anyone drain funds because there was no safeguard.

3. Trust Requirements

Most cross-chain solutions require you to trust validators, custodians, or relayers. One compromised key, and your funds are gone. The Ronin Bridge hack happened when 5 out of 9 private keys were compromised, which is enough to drain $625M in a few sec.

4. MEV and Front-Running

Even if the contract works perfectly, attackers can easily exploit transaction ordering. Uniswap did research that shows that large swaps face 80% adversarial slippage probability, and attackers can sandwich your trade and extract value.

HTLC smart contracts were usually designed to address these problems. They don’t eliminate all risk, but they change the game on what’s possible without trusted intermediaries.

What Is a Hashed Timelock Contract (HTLC) in Blockchain?

At its core, an HTLC smart contract is deceptively. It’s a contract that locks funds under two specific conditions:

1. Hashlock:

You can only unlock the funds if you provide the original value that hashes to the contract’s locked hash. It is like a cryptographic password, except once it’s revealed on one chain, it’s visible to everyone. This is the best part about HTLC.

2. Timelock:

If nobody claims the funds within a certain time window, then it automatically refunds the amount to the owner. This prevents funds from getting stuck forever if someone goes offline or abandons the trade, which usually happens in the web3 ecosystem.

Here’s how the hashed timelock contract (HTLC) mechanic works:

Alice wants to swap her Bitcoin for Bob’s Ethereum. They agree on the contract. Alice creates an HTLC on the Bitcoin blockchain that says Bob can take my BTC if he provides the correct secret before 24 hours expire. Otherwise, I get my Bitcoin back. Alice generates a random secret, hashes it, and puts that hash in the contract. She does not reveal the secret yet to Bob.

Bob, seeing that hash, creates a mirror HTLC on Ethereum that says that Alice can take my ETH if she provides the secret that matches this hash, within 24 hours. Now here’s where it gets brilliant: Alice claims Bob’s ETH by revealing the secret. The moment she does that on the Ethereum chain, the secret is visible to everyone, including Bob. Bob then uses that same secret to claim Alice’s Bitcoin on the Bitcoin chain.

If either party doesn’t act, the funds get automatically refunded. Atomicity is achieved without any custodian needed. This is what hash time lock contracts do at the protocol level, and it’s been battle-tested for years. Even the Lightning Network uses this exact mechanism millions of times per day.

Understanding How Hashed Timelock Contracts (HTLCs) Work at the Smart Contract Level

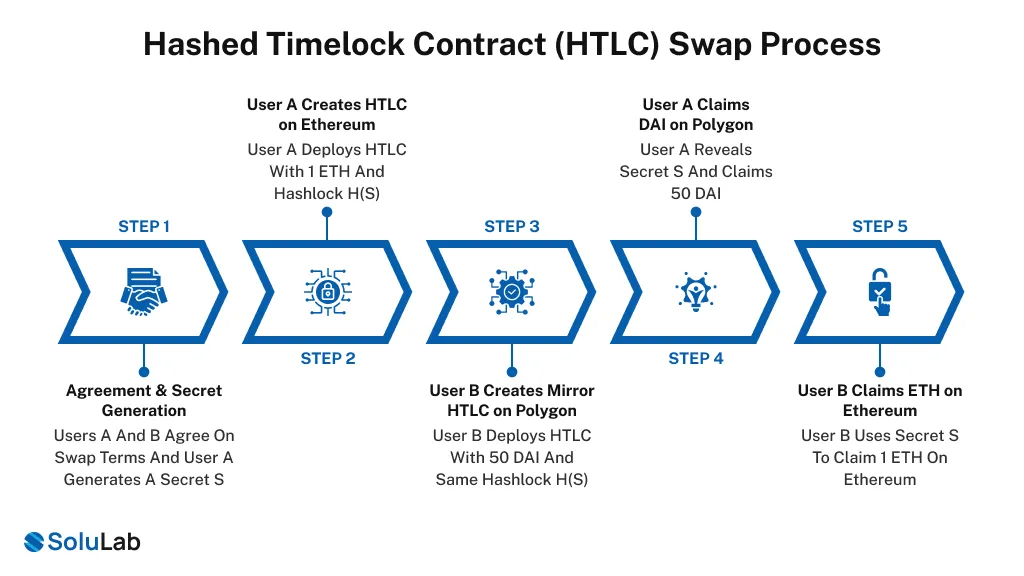

Let me explain this with a scenario. Let’s assume that you are building a DEX, and you want to support cross-chain swaps without deploying a bridge or relying on external validators. Here is the exact 5 steps you need to follow

Step 1: Setup and Agreement

- User A and User B agree on the terms:

- User A will send 1 ETH on Ethereum

- User B will send 50 DAI on Polygon

- Exchange rate is locked

- Time window is 12 hours

User A will be the initiator, and he can generate a random secret, let’s call it S. This can be any large random number.

User A then computes generated secret S, the hash of that secret using SHA-256 or similar.

Step 2: User A Creates the HTLC on Ethereum

On Ethereum, User A deploys or calls a contract with:

- recipient: User B

- hashlock: H(S)

- timelock: 12 hours from now

- amount: 1 ETH

- refund_address: User A

The contract locks 1 ETH. User A is now waiting for User B to act.

Step 3: User B Creates Mirror HTLC on Polygon

User B, having seen the hash H(S), creates a corresponding HTLC on Polygon:

- recipient: User A

- hashlock: H(S) (the same hash)

- timelock: 6 hours from now which is shorter than User A’s, this is important.

- amount: 50 DAI

- refund_address: User B

Notice User B’s timelock is shorter. This is intentional, as it gives User B time to reclaim their funds if User A doesn’t complete the swap.

Step 4: User A Claims User B’s DAI

User A now reveals the secret S on Polygon and claims the 50 DAI. The secret is now public on the chain and now everyone can see it.

Step 5: User B Claims User A’s ETH

Bob observes the revealed secret on Polygon as it is publicly visible in the transaction, and uses that same secret to claim the 1 ETH on Ethereum. HTLC guarantee that either both transactions should be complete, or both will be refunded. There is no middle ground.

- If User A reveals the secret but User B fails to act within their timelock window, User B’s DAI will be refunded automatically.

- If User B never creates their HTLC at all, User A’s timelock expires, and the ETH will be refunded.

This is why HTLC smart contract technology is such a breakthrough, as it guarantees atomicity without any trusted third party verifying the swap.

Why HTLC Smart Contracts Are Preferred Over Custodial Models for Atomic Swaps?

If you understand the mechanism above, then understanding why people use HTLC smart contract technology becomes really obvious. But let’s spell it out, because the business implications matter.

The Problem HTLCs Solve:

In traditional finance, settlement is handled by clearinghouses. They make sure both sides happen but in crypto without custody, there’s no clearinghouse.

So how do you guarantee both sides execute, as you can’t, unless you use what is a hashed timelock contract and Atomic swaps powered by HTLCs are the only way to achieve true peer-to-peer cross-chain trading without:

- Wrapping tokens, which adds custodial risk

- Bridging, which adds bridge risk

- Relying on validators, which adds governance risk

- Trusting a DEX, which adds operational risk

For a user, it matters as it:

1. Reduced Liability:

If your platform uses HTLCs for cross-chain swaps, funds are never held by you. They’re held in a smart contract with transparent, cryptographic logic. If something goes wrong, it’s not your company’s capital at risk.

2. Increases User Confidence:

Users know that if they initiate a swap, either they get exactly what was promised, or their funds come back to their wallet. No freezing or slippage surprises, which are beyond normal market slippage. This is huge for user retention on our web3 product.

3. Composability:

Platforms like 1inch use HTLCs as part of their Fusion+ protocol to enable intent-based cross-chain swaps where Users sign an order, solvers compete to fill it asap, and HTLCs guarantee the settlement on the chain.

4. No Counterparty Risk During Settlement:

Even if the other party disappears, the timelock ensures refunds with ease. You’re not waiting on a support ticket or governance vote to recover funds.

How Web3 Products Use Hashed Timelock Contract for Secure Cross-Chain Transfers?

HTLC is a real innovation, as for years, cross-chain transfers required one of three things:

1. Wrapped tokens: Lock BTC on Bitcoin, mint wrapped BTC on Ethereum, hope you can redeem it, or you might not.

2. Validators: Trust 51% of a validator set to not collude, as they sometimes do – see Ronin, Harmony, etc.

3. Custodians: Trust a company to hold your funds, see FTX or Celsius

HTLCs offer a fourth path, which is cryptographic guarantees.

The Architecture of HTLC

- When you want to do a cross-chain swap using HTLC smart contract technology:

- Initiator locks funds on Chain A in an HTLC with hashlock H and timelock T1

- Responder locks funds on Chain B in an HTLC with hashlock H and timelock T2, where T2 < T1

- Initiator reveals secret on Chain B, claims funds

- Responder sees the secret, uses it to claim funds on Chain A

- If either party goes offline, timelocks ensure an automatic refund

Why This Works Without Custodians?

Each HTLC is a smart contract, not a wrapped token. The contract holds the funds directly. The contract’s logic is transparent and immutable. Nobody can freeze your funds or change the terms mid-transaction.

Studies on cross-chain bridges found that as of May 2024, $2.8 billion in losses occurred due to bridge exploits. Most of those exploits came from:

- Logic errors in the bridge code

- Private key compromises of validators

- Insufficient rate limiting

HTLCs don’t eliminate all risk, but they eliminate the specific risk of custodial misbehavior. Your funds are in escrow under cryptographic conditions, which are not held by a person or company.

How HTLC Smart Contracts Differ From Lightning Network in Production Systems?

Here’s where a lot of confusion lives as people lump the HTLC smart contract and the Lightning Network together, as if they’re the same thing but in reality, they’re not.

HTLCs Are the Primitive, and Lightning Is the Application!

An HTLC smart contract is the low-level building block, a single contract that holds funds under hashlock and timelock conditions. It works on any blockchain that supports smart contracts.

And the Lightning Network takes that primitive and chains multiple HTLCs together to create a network of payment channels. You open a channel with someone else, they open a channel with someone, and messages hop through the network using multi-hop HTLCs. By the time a payment reaches its destination, it is passed through dozens of HTLCs in sequence.

Lightning Network was one of the first mainstream applications of what is a hashed timelock contract technology at scale. So people hear HTLC, they think Lightning, and assume HTLCs only work for payments or Bitcoin.

Which is Wrong, as HTLCs are far more general. They work on any blockchain like Ethereum, Polygon, Solana, etc. They’re being used for cross-chain swaps, intent settlement, yield farming coordination, and even NFT trading.

Here is the basic difference in table format

| Aspect | HTLC Contract | Lightning Network |

| Scope | Single transaction | Network of channels |

| Participants | Two parties | Arbitrary multi-party paths |

| Settlement Time | Depends on blockchain | Milliseconds (off-chain) |

| Cost | Gas fees (on-chain) | Minimal routing fees |

| Custody | Scriptable in smart contract | Keys held by participants |

| Use Case | Atomic swaps, cross-chain | Payments, micro-transactions |

How a Smart Contract Development Company Secures HTLC Smart Contracts?

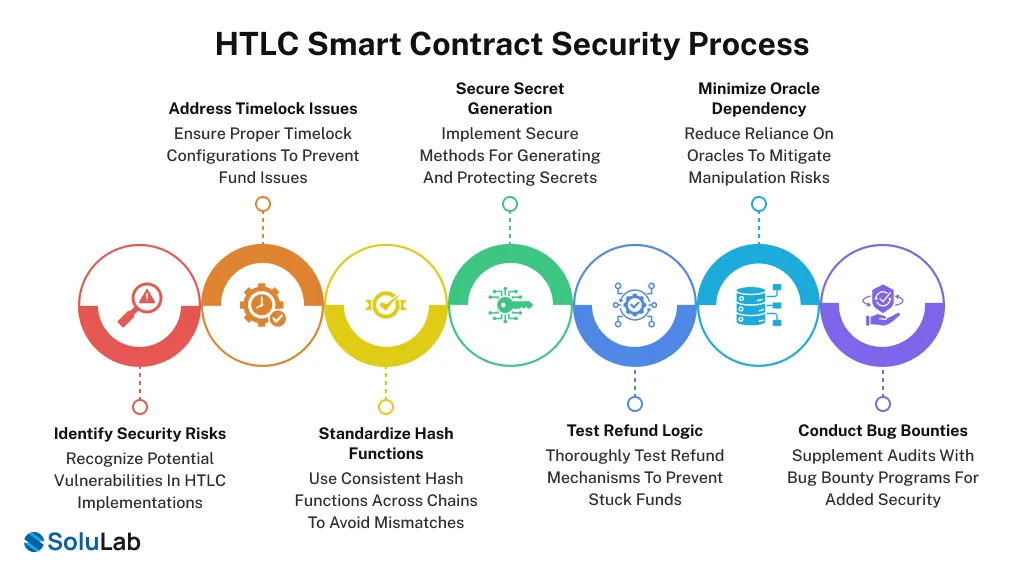

Here’s the uncomfortable truth you should know that contract security is hard, and even audited smart contracts fail. The Nomad Bridge was audited, Ronin had security reviews and yet billions were lost. The security issues with HTLC implementations typically fall into a few categories like:

1. Timelock Misconfigurations

If your timelock is set wrong, funds can get stuck or refunded prematurely in your wallet. If User A’s timelock is shorter than User B’s, User A might get a refund before User B can claim. If both have the same timelock, and if the network gets congested, both parties might miss the window.

We suggest that The initiators timelock should be 2 times longer than the responder’s. This gives the responder time to reveal and claim, even if the network slows down.

2. Hash Function Mismatches

If the two HTLCs on different chains use different hash functions like SHA-256, Keccak, or something else, the preimage that works on one chain would not work on the other, and the funds get locked forever.

This seems obvious, but it’s a human problem as developers on different chains sometimes use different standards. So we suggest using SHA-256 or Keccak-256 chain-wide and document it explicitly.

3. Secret Leakage

The whole mechanism depends on the secret being unknown until the moment of redemption. If the initiator accidentally broadcasts the secret before deploying the HTLC, or if there’s a bug in secret generation, for example, insufficient randomness, an attacker can front-run the entire transaction and get the funds.

Here is a Real example, from reddit where A user lost $1.1M in LINK tokens because they didn’t properly protect their secret, and an attacker sandwiched the transaction.

So we suggest that Secrets should be generated using cryptographically secure random sources, test on testnet extensively, and implement front-running protection like slippage limits.

4. Refund Logic Bugs

The refund mechanism needs to be bulletproof. If there’s an off-by-one error in the timelock calculation, or if the refund transaction fails silently, funds could get stuck forever. OWASP done a Smart Contract research in 2025, where the Top 10 lists access control vulnerabilities and logic errors as the top two attack vectors, responsible for over $1 trillion in combined losses historically.

We suggest that the refund logic should be tested exhaustively. Use formal verification if possible and include fallback mechanisms.

5. Oracle Manipulation

Some HTLC variations use oracles to find exchange rates or verify prices, but Oracles can be a notorious vulnerability. A misconfigured Oracle caused $34 million in losses for Compound once.

We suggest that you please Minimize oracle dependency. If you must use oracles, use decentralized alternatives like Chainlink, which has high confidence intervals and rate limits.

The smart contract audit industry has significant gaps as Auditors often face tight deadlines, miss economic exploits, and cannot predict new attack vectors. As of 2025, only about 2,000 security specialists globally focus on blockchain. So, if you’re in production, consider bug bounties on Immunefi or Code4rena as a supplement to formal audits.

Read More: How Much Does it Cost to Build a Crypto Payment Gateway?

Live Products Built Using HTLC Smart Contracts for Payments and Swaps

It’s easy to talk about HTLC smart contract technology in the abstract, but where is it actually running in a production environment? Let’s have a look –

1. 1inch Fusion+

1inch launched Fusion+, an intent-based protocol that uses HTLCs to enable cross-chain swaps across Ethereum, Polygon, Arbitrum, Base, Optimism, and other chains. In here, Users sign an order specifying swap X tokens for Y tokens, and resolvers compete to fill it. HTLCs ensure that if a resolver takes your source tokens, they must deliver on the destination chain or their escrow gets locked as a penalty. Currently, 1inch processes swaps in the billions of dollars using HTLC.

2. Komodo Wallet

Komodo has been running HTLC smart contract-based atomic swaps since 2015, before they were mainstream swaps. Their wallet supports swaps across Bitcoin, Litecoin, Dogecoin, and dozens of other chains, all without bridges or custodians. They’ve completed millions of swaps with a strong security track record. Which shows thatthe HTLC smart contract is a battle-tested technology running for a decade.

3. Connext

Connext uses a variation of HTLCs, along with other mechanisms to enable cross-chain transfers without wrapped tokens. In Connext, Routers lock the liquidity on destination chains and facilitate transfers using HTLC-like escrow mechanisms to guarantee settlement on the chain.

4. Lightning Network

While Lightning is its own application, it’s worth mentioning as billions of dollars flow through Lightning payments daily, which is powered by HTLCs chaining together across the network.

Why Hiring a Smart Contract Development Company Matters for HTLC Implementation?

Building HTLC smart contract systems is not trivial, as you need expertise in:

- Solidity and blockchain development

- Cryptography and hash functions

- Cross-chain coordination

- Smart contract security and auditing

Most founders don’t have this in-house expertise; that’s why you need an experienced hand.

Conclusion

HTLC smart contracts solve real, specific problems in crypto payments like atomic settlement, cross-chain interoperability, and custodian elimination. They’re not new, as they’ve been running reliably for over a decade, but they’re still underutilized because most people don’t fully understand what they do.

If you’re building a fintech product, DEX, or cross-chain infrastructure, understanding HTLCs is really essential. They’re the cryptographic foundation that makes trustless trading possible without bridges or centralized intermediaries. If you’re ready to build with HTLCs, start with a pilot project and test it extensively on the testnet. Get your smart contract security and audit process locked in before going live. And partner with experienced smart contract development companies like SoluLab, which understand the nuances.

The future of trustless finance depends on primitives like these and understanding them now can put you ahead.

FAQs

It completely depends on the reequipment because both require on-chain transactions. HTLCs have the advantage on bridges, as it is a peer-to-peer or resolver-based, so they don’t require consensus from a large validator set.

Yes, but with complexity as Multi-party swaps work when the dependency graph is reuniclus, which is a specific mathematical structure. Most practical applications are two-party only using HTLCs.

They can front-run it and stole the funds locked in the contract, that’s why always use cryptographically secure random sources for secret generation.

No, as HTLC value proposition is cross-chain. So for single-chain operations, please use standard smart contracts, as they are simpler and cheaper.

HTLC smart contracts are only conditionally reversible. If the hash condition isn’t met before the timelock expires, funds are automatically refunded in the wallet. So there is no manual reversal.

HTLCs are mostly used in crypto payments, cross-chain DeFi solutions, atomic swap platforms, blockchain escrow services, and cross-border settlement systems where trustless execution is required without manual or custodian support.