By 2030 digital securities might hold over $16 trillion in hard-to-trade assets. This change isn’t just theory. It has real backing from technology companies, governments, and large institutions.

The driving force behind this shift is Real-World Asset (RWA) tokenization. This process turns physical things like real estate, debt, bonds, or even carbon credits into digital tokens supported by blockchain. Tokens make it easier to buy, sell, and split ownership across the globe. It’s fast, safe, and works anywhere.

This guide is here to help whether you’re in fintech managing assets, or running an enterprise that wants to digitize your investments.

What Is Real-World Asset Tokenization and How Does It Work?

RWA tokenization turns real-world assets, like properties or private bonds, into a collection of digital tokens stored on a blockchain. These tokens act as ownership shares that investors can purchase.

Take a $10 million real estate project as an example. Businesses can break it into 10,000 tokens priced at $1,000 each. This approach allows fractional ownership. Investors have the choice to buy, trade, or hold these tokens while companies raise more funds.

Our role as an expert RWA Tokenization Company involves creating platforms to digitize assets, generate secure tokens, use smart contracts to simplify compliance and connect with third-party custody solutions or wallets.

This process is fast and scalable. It simplifies legal challenges, cuts costs, and lets a wider audience access investment opportunities.

Which Assets Will Be Tokenized by 2025?

Breaking out of just real estate, tokenization is spreading to different asset types in the U.S. and Canada.

Some common examples are:

1. Real Estate

Still, the most widely preferred asset is tokenized real estate, continues to dominate the tokenization space. Both residential and commercial properties are being fractionalized, allowing investors to purchase small shares in properties from across the world.

2. Precious Metals and Commodities

Gold, silver, oil, and even carbon credits are now being tokenized to enable digital trading and real-time settlement. For example, countries like Switzerland and Singapore are facilitating gold-backed token launches, while carbon credit tokenization is booming in climate-focused markets across Europe and Southeast Asia.

3. Equities and Private Company Shares

Equity tokenization allows investors to gain access to company shares, especially in the private sector or early-stage startups. This opens up traditionally illiquid assets to global capital. The U.S., Canada, and the UK are seeing increased interest in equity-backed tokens regulated under security token offerings (STOs).

4. Art and Collectibles

Tokenizing fine art, luxury watches, and rare collectibles makes them tradable to a wider audience. Platforms in Europe and Asia are offering fractional ownership of artwork from Picasso to Banksy, turning exclusive assets into globally accessible investment products.

5. Intellectual Property (IP) and Royalties

Music rights, film licenses, and patents are being tokenized to allow creators to directly monetize their work while investors enjoy passive income through royalty-sharing tokens. Countries like South Korea and the U.S. are pioneering entertainment tokenization platforms.

6. Carbon Credits & ESG Assets

With a global focus on sustainability, the tokenization of carbon credits, green energy tokenization, and other ESG-linked assets is booming. Countries like Canada, the Netherlands, and Australia are already piloting tokenized carbon markets, helping companies trade verified credits with transparency and traceability.

Why Is RWA Tokenization Picking Up Speed in 2025?

Here’s what’s driving massive interest in tokenizing assets and in creating tokenization platforms:

1. Market engagement:

Firms such as BlackRock, and Franklin Templeton, and real estate leaders like DAMAC have launched tokenized products.

2. Supportive regulations worldwide:

Rules like MiCA in Europe and Executive Order 14178 in the USA have brought more clarity and trust to help institutions join.

3. Retail participation:

Blockchain-powered platforms have made people ask how to invest in tokenized assets more than ever before.

4. Tech stack maturity:

Secure wallets, Layer 2 scaling, and cross-chain platforms have reached a level that enterprises can rely on.

What Are the Benefits of RWA Tokenization for Businesses?

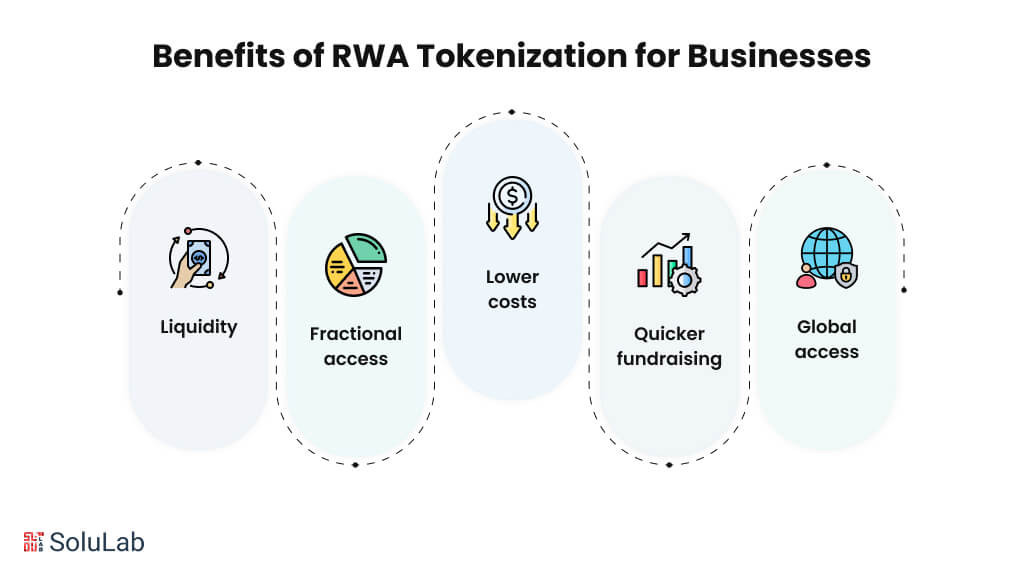

When it comes to RWA tokenization benefits, businesses gain access, speed, and liquidity on a global scale. These are key factors valued by enterprises and financial clients.

- Liquidity: Free up funds from assets like private shares or buildings that are hard to sell

- Fractional access: Allow more people to invest by offering small asset shares creating new ways to earn money.

- Lower costs: Smart contracts handle tasks like compliance, reporting, and issuing, making processes cheaper.

- Quicker fundraising: Raise funds faster, reducing the timeline from months to just weeks.

- Global access: Blockchain makes it easier to reach investors from any part of the world.

Exploring Trends and Potential Uses for 2025 and Beyond

Tokenization isn’t just growing; it is reshaping the way financial infrastructure is created. Here is what lies ahead:

- AI-based tools to calculate asset values

- Cross-chain systems enabling token movement between Layer 1 and Layer 2

- Zero-knowledge proof tech to follow privacy and KYC laws worldwide

- DeFi solutions to borrow or lend using tokenized bonds or property

- Pilot programs by governments and institutions in places like the UAE, Singapore, and Canada

Examples like Franklin Templeton’s tokenized treasury fund and DAMAC’s $1 billion real estate tokenization effort show that this isn’t a future trend; it is already here.

Conclusion

How real-world asset tokenization is transforming investments has become an essential discussion. It presents a pressing chance for businesses to act fast and gain:

- Quicker access to funding

- Reduced compliance expenses

- Increased investor confidence

- Advanced digital systems for the future

If expanding or starting your tokenized ecosystem sounds like your goal, get in touch with SoluLab, a top RWA Tokenization Company, and we’ll support you through every step.

FAQs

1. What does a U.S.-based RWA tokenization company do?

An asset tokenization company in the U.S. helps businesses turn physical assets like real estate, commodities, or financial instruments into digital tokens. These tokens are traded and owned on a blockchain. The company works on smart contracts, compliance with regulations, user-friendly platforms, and system integrations.

2. Why work with an asset tokenization development company?

Tokenizing assets requires handling technology legal rules, and financial systems together. A professional team with expertise in blockchain and finance can create a platform that’s secure, scalable, and ready for the future.

3. What helps a strong RWA Tokenization Company excel?

Choose a company that has implemented projects in real-world scenarios, has partnerships within the financial sector, and understands token standards like ERC-1400. Top companies also provide tools to verify identity and prevent fraud, offer support across multiple blockchains, and design simple interfaces that are easy for users to handle.

4. Why is real estate tokenization investment booming in 2025?

Tokenizing real estate allows individuals to invest in large properties by owning smaller portions. The U.S. Canada, and UAE are seeing increased growth in 2025 because of high interest in assets that generate passive income and easier ways to invest in them.

5. How can you invest in tokenized assets?

Use trusted platforms that comply with local security regulations. Look for tokenized assets tied to actual value with proven custody and clear ownership details. Stick to secure wallets and stay away from shady platforms that lack openness.