DEX aggregators play an important part in the evolution of decentralized finance, which is transforming cryptocurrency trading. As the DeFi industry grows quickly, these platforms give users better rates, faster transactions, and less slippage by combining liquidity from numerous decentralized exchanges.

According to DeFi Llama, the total value locked (TVL) across DeFi protocols currently stands at approximately $45 billion, showing steady growth despite market fluctuations.

The development of DEX aggregators has streamlined the trading process in an otherwise fragmented and intricate industry. Traders may now execute swaps more effectively due to access to an expanded liquidity pool and real-time pricing comparisons.

The ongoing advancement of DeFi DEX aggregator solutions is providing crypto traders with a more efficient and smooth trading experience. In this blog, we will look at how DEX aggregators are transforming the market for crypto traders and why they are becoming important in the current trading ecosystem.

Let’s begin!

What are DEX Aggregators?

A DEX aggregator functions as a super-smart search engine, scanning numerous decentralized exchanges at the same time to locate the best bargains for your cryptocurrency trades. Instead of traveling between several crypto trading platforms, the aggregator performs the work for you and gets you the greatest pricing and liquidity all in one place.

Many of these aggregators also integrate with other DeFi products, such as DeFi lending platforms, providing a simple method to borrow, lend, and trade without switching between applications. This makes maintaining your cryptocurrency portfolio easier and more efficient.

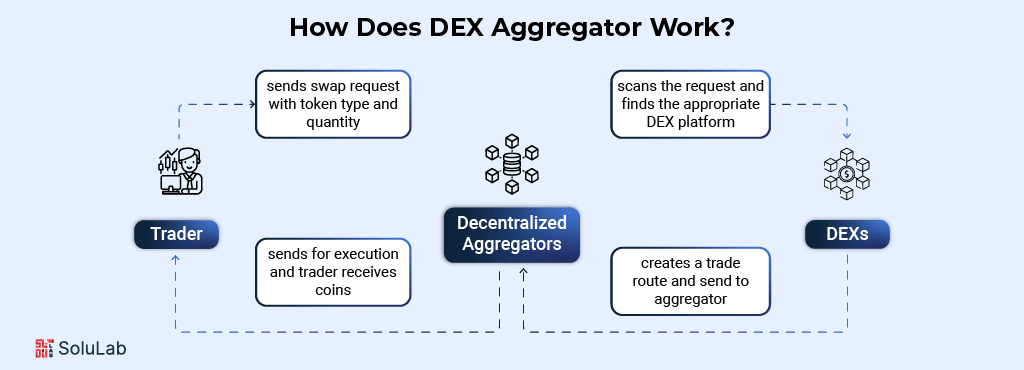

How DEX Aggregators Work?

A DEX aggregator is a smart application utilizing blockchain technology that collects and consolidates real-time trade data from many decentralized exchanges (DEXs) into a singular, user-friendly interface. Rather than individually accessing several crypto trading platforms, customers may input their preferred token swap or trade once, and the aggregator promptly examines numerous DEXs to identify the most favorable rates, minimal costs, and ideal liquidity. This not only streamlines trading but also guarantees that consumers maximize the value of their transactions by utilizing numerous sources concurrently.

1. Data Collection: The fundamental aspect of any DeFi DEX aggregator software is its capacity to retrieve real-time data from several decentralized exchanges. By consolidating this information, the aggregator provides consumers with an extensive market overview on a single platform.

2. Search and Trade Matching: Upon a trader entering the tokens for exchange, the aggregator’s system activates by examining all linked DEXs. It analyzes several routes and trade pairs to determine the most economical and efficient method for executing the deal, hence saving users’ time and effort.

3. Algorithmic Route Optimization: Advanced algorithms are essential as these assess many variables, including transaction costs, market prices across exchanges, slippage tolerance, and liquidity depth. The goal is to find a strategy that maximizes trader return while minimizing risk and cost.

4. Smart Contract Execution: Upon identifying the optimal route, the aggregator engages with the blockchain to execute the deal via smart contracts. This removes the need for middlemen and lowers the chance of failure while ensuring that the transaction is quick, transparent, and safe.

5. Streamlined User Experience: DEX aggregators allow traders to perform swaps without manually engaging with each DEX. This simplifies trading and lowers the learning curve for decentralized finance beginners.

6. Real-Time Monitoring: Users receive immediate information on token prices, trade advancements, and order statuses from the aggregator’s interface. This transparency enables traders to make informed decisions and respond swiftly to market fluctuations.

7. Liquidity Aggregation: DEX aggregators increase the available trading volume by combining liquidity from many exchanges, which minimizes slippage and improves overall price execution. In periods of market volatility, liquidity pooling is especially beneficial.

Businesses aiming to build or improve such platforms can utilize DeFi DEX aggregator development solutions, which provide customized services emphasizing the creation of scalable, secure, and efficient aggregator software.

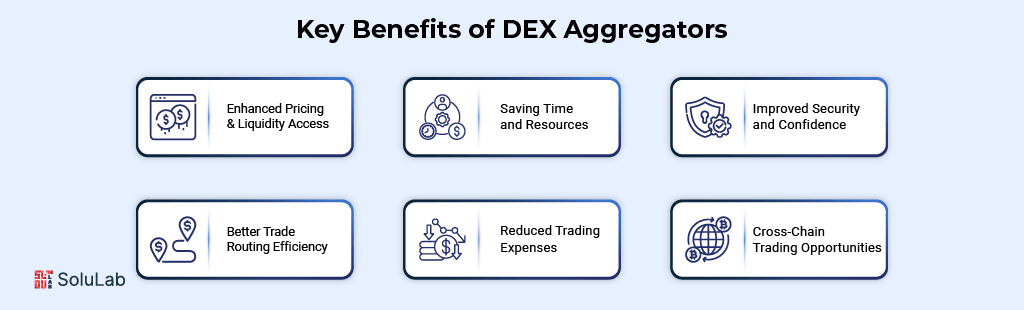

Key Benefits of DEX Aggregators for Crypto Traders

DEX aggregators transformed the interaction of crypto traders with decentralized exchanges by facilitating access and enhancing trading results. These potent instruments have several advantages. For individuals engaged in decentralized market trading, understanding these benefits is essential.

- Enhanced Pricing and Liquidity Access

DEX aggregators consolidate liquidity from many decentralized exchanges to ensure traders’ optimal pricing. Users profit from an extensive aggregated pool rather than being confined to a solitary exchange’s order book, hence minimizing slippage and enhancing transaction execution. This is a fundamental benefit provided by modern DEX aggregator solutions.

- Saving Time and Resources

Manually comparing token values across several crypto trading platforms may be laborious and time-intensive. DEX aggregators streamline this process by integrating data from several sources into a unified interface. Traders may swiftly conduct swaps without transitioning between applications or exchanges, therefore enhancing user convenience and efficiency.

- Improved Security

Transactions conducted using DEX aggregators often utilize smart contracts that are visible and immutable on the blockchain. This diminishes dependence on centralized middlemen and mitigates the danger of hacking or fraud. The use of stringent DeFi protocol requirements inside these systems enhances user confidence and security.

- Better Trade Routing Efficiency

Advanced algorithms allow these aggregators to distribute orders among various DEXs as necessary, guaranteeing optimal execution pathways. This indicates that substantial trades can be segmented into smaller portions and sent via several liquidity pools to mitigate market effects. This dynamic trade routing is a crucial element offered by DeFi Dex aggregator development platforms to enhance user results.

- Reduced Trading Expenses

DEX aggregators facilitate cost savings for customers by identifying the most economical trading routes, particularly those with reduced fees or petrol expenses, for each transaction. This is particularly crucial during periods of network congestion when gas fees on blockchains such as Ethereum may surge.

- Opportunities for Cross-Chain Trading

Certain powerful DEX aggregators provide cross-chain swaps, enabling users to exchange tokens effortlessly across several blockchain networks. This compatibility expands trading opportunities and access to other liquidity pools, a feature that is gaining popularity in growing DeFi protocol ecosystems.

- Transparency and Real-Time Data Analysis

Users gain transparent views on trade execution routes, fees, and token valuations via the aggregator’s interface. Real-time updates enable traders to monitor their orders meticulously and modify their strategy promptly. This degree of transparency is a distinguishing feature of high-quality decentralized trading solutions that prioritize user empowerment.

Impact of DEX Aggregators on Trading

DEX aggregators have improved the decentralized trading ecosystem by facilitating quicker, more efficient, and more economical cryptocurrency exchanges for traders. Before their emergence, customers frequently needed to manually examine many decentralized exchanges to identify optimal pricing and adequate liquidity, a process that was both time-consuming and sometimes expensive owing to slippage or elevated fees. DEX aggregators simplified this by serving as an intelligent conduit that links many exchanges and autonomously directs trades through the most efficient channels.

This innovation has democratized access to superior pricing and enhanced liquidity pools, enabling traders of all sizes to profit from attractive prices previously accessible only to high-volume or institutional traders. Consequently, the comprehensive trading experience has evolved to be more frictionless and user-centric, enhancing confidence in decentralized finance.

DEX aggregators, as a crucial component of the broader DeFi platform ecosystem, facilitate increased adoption by rendering decentralized trading more accessible to a larger audience and enhancing the overall vitality of cryptocurrency markets.

How to Develop Your Own DEX Aggregator?

Creating your own DEX aggregator calls for combining clever software design with deep blockchain technology knowledge. Users should be given everything in one place, the finest trade paths, ideal pricing, and a seamless trading experience. To create scalable, safe, and feature-rich solutions, businesses frequently connect to a reputable DEX aggregator development company for guidance.

Key Steps to Develop a DEX Aggregator

1. Research and Understand the Market: Start by looking at current DEX aggregators and crypto trading platforms to see spaces you may be able to cover and traits that perform effectively.

2. Integrate Multiple DEX APIs: Connect your aggregator to many distributed exchanges via their APIs or smart contracts to compile real-time price, liquidity, and order book data.

3. Develop a Smart Routing Algorithm: Create algorithms that assess trade pathways between exchanges, accounting for fees, slippage, and liquidity, thereby identifying the most effective swap paths.

4. Implement Secure Smart Contracts: Use verified smart contracts to guarantee safe on-chain trade execution, therefore safeguarding user cash and preserving transparency.

5. Plan a User-friendly Interface: Make sure users can quickly enter their token swaps, find the best pricing, and follow their transactions on an understandable front-end.

6. Test for Performance and Security: Before release to guarantee a flawless and safe user experience, carefully evaluate your platform for speed, dependability, and vulnerabilities.

7. Continuous Monitoring and Updates: Maintaining competitiveness requires constant updating of the aggregator with fresh DEX integrations, market developments, and performance enhancements.

Top 3 DEX Aggregators in the Market

By integrating price and liquidity from several decentralized exchanges into a single platform, DEX aggregators have radically changed decentralized trading and made it simpler and more affordable for users. Here are the top 3 DEX aggregators to look for:

- 1inch: Considered a pioneer in the field, 1inch divides trades across many DEXs using an advanced smart routing algorithm to get the best pricing and lowest costs. It is a flexible tool for both inexperienced and seasoned traders, including features like limit orders and liquidity mining in addition to basic swaps.

- Matcha: Developed on top of the 0x protocol, Matcha is a great tool for consumers who desire simple and quick token swaps because of its user-friendly UI. Matcha offers a smooth and seamless trading experience while reducing slippage and guaranteeing competitive pricing by combining liquidity from many decentralized exchanges.

- Paraswap: Well-known for its transparency, Paraswap helps traders make wise choices by providing real-time pricing comparisons and an understandable charge schedule. In addition to integrating a large number of DEXs, it offers developers an open API, allowing for bespoke solutions and encouraging creativity within the DeFi ecosystem.

The Future of DEX Aggregators

As distributed finance grows, DEX aggregators will continue to become increasingly important. These platforms will streamline trading by giving seamless access to the greatest liquidity and pricing across many blockchains, therefore facilitating more distributed exchanges and DeFi protocols’ development.

Developments in smart contracts and routing techniques will lower slippage and costs, hence improving trading efficiency and affordability. Real-time data and tools that fit both novice and seasoned traders will help to enhance user interfaces. DEX aggregators may also include compliance procedures when rules change, therefore preserving decentralization.

Final Words

To sum up, DEX aggregators have truly made crypto trading simpler and affordable by helping users find the best deals across various decentralized exchanges. They continue to shape how people engage with decentralized finance, offering greater control and smoother experiences.

SoluLab, as a DeFi development company, builds practical blockchain solutions that meet real-world needs. For example, our recent work with E-Motive showcases how blockchain can create a decentralized automotive marketplace that cuts out middlemen, lowering costs for buyers while supporting sustainable, eco-friendly practices.

If you’re curious about how blockchain or DeFi can benefit your business, get in touch with the experts!

FAQs

1. How do DEX aggregators improve my crypto trading experience?

DEX aggregators simplify trading by gathering prices and liquidity from multiple decentralized exchanges all at once. This means you spend less time searching and more time trading with confidence, knowing you’re getting a good deal.

2. Is trading through a DEX aggregator safe?

For the most part, yes. Since trades happen through smart contracts on the blockchain, you don’t hand over your funds to a middleman. Still, it’s smart to stick with well-known aggregators and be cautious with how much you trade at once.

3. How do these aggregators actually save me money?

They look at prices and fees across different platforms and figure out the cheapest way to make your trade. Sometimes, they even split your order across multiple exchanges to get you the best overall rate.

4. Can I swap tokens from different blockchains using these tools?

Some of the newer ones let you do just that. They handle the complex process of moving assets between blockchains behind the scenes, so you don’t have to worry about managing bridges or wallets manually.

5. What’s important to check before picking a DEX aggregator?

Make sure it covers the exchanges and tokens you’re interested in, has a user-friendly design, reasonable fees, and a good reputation. Also, look for real user feedback—nothing beats hearing from people who’ve used it firsthand.