- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

Stablecoins were always in the news in 2025. From new regulations to adoptions in various regions, stablecoins have attracted several industries. The top companies, like Circle, also brought several changes to their payment system by the inclusion of stablecoins. Unlike Bitcoin (BTC) and Ethereum (ETH) rules crypto under market fluctuations, stablecoin development solutions maintain their stability under global pressures.

As of 2025, the global stablecoin market has grown to roughly $225 billion in circulation, and monthly settlement volumes regularly exceed $1 trillion. These numbers put stablecoins among the most actively used financial modes in crypto.

Therefore, we are here to know about what stablecoins are, why there is this hype, and what factors are driving them to grow. Additionally, you can explore types of stablecoins and how industries are implementing them in their platforms. Let’s check these details in the following discussion.

What Are Stablecoins and Their Benefits? How Are They Dominating Global Finance?

A stablecoin is a cryptocurrency designed to maintain a stable value relative to an external asset, most commonly a fiat currency like the US dollar. Unlike Bitcoin or Ethereum, whose prices fluctuate based on market demand, stablecoins are engineered to minimize volatility.

Stablecoin stability depends on multiple factors working together.

- Reserve Quality and Transparency

High-quality reserves such as cash and short-term treasuries inspire confidence. Clear disclosures and regular attestations matter more as scale increases.

- Market Confidence and Track Record

Stablecoins that have survived stress events build credibility. Trust compounds over time, while uncertainty spreads quickly.

- Liquidity and Adoption

Widely used stablecoins benefit from deep liquidity. Large, active markets make it easier for arbitrage to correct price deviations.

- Technical Reliability

Smart contracts, custody systems, and blockchains must function under load. Technical failures can disrupt redemptions and undermine stability even if reserves are sound.

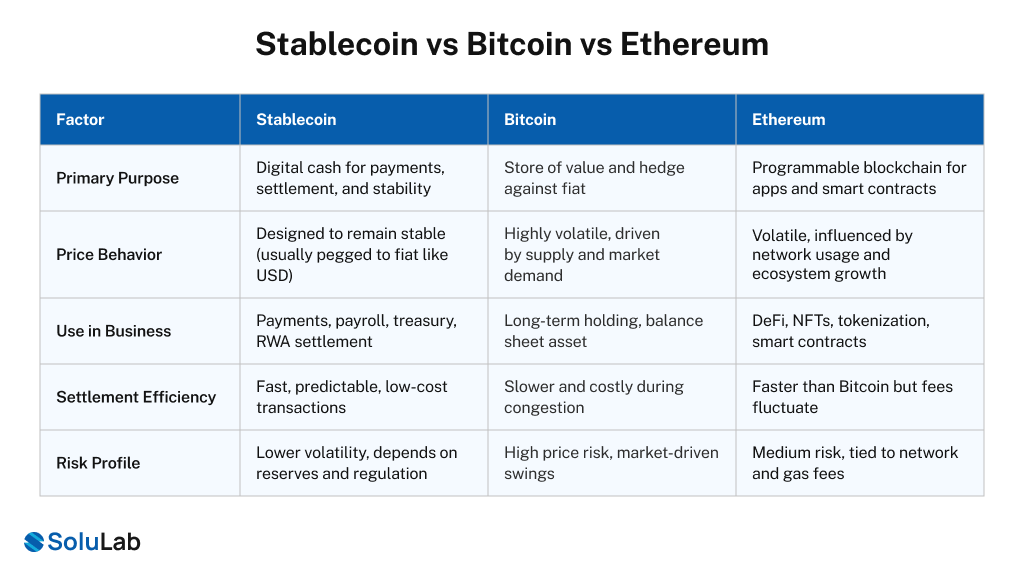

Stablecoin vs Bitcoin vs Ethereum

Bitcoin and Ethereum were never designed to be stable. Their value is driven by scarcity, network adoption, and market sentiment. This makes them powerful as investment assets or settlement layers, but unreliable as day-to-day money.

Stablecoins, by contrast, are designed for usability. They prioritize predictability over price appreciation, which is why they have become the preferred medium of exchange across crypto markets and increasingly beyond them.

Why Did Stablecoin Volumes Surge In 2024–2025?

The growth of stablecoins in 2024 and 2025 marks a structural shift rather than a short-term trend.

- Today, US dollar–denominated stablecoins account for roughly 99% of the global stablecoin market, with total market capitalization reaching $225 billion.

- This represents about 7% of the broader $3 trillion crypto ecosystem, according to J.P. Morgan Global Research.

More importantly, growth has remained consistent even during periods of broader crypto market volatility. Stablecoin market capitalization has posted multiple consecutive months of positive growth, signaling sustained demand rather than speculative spikes.

Looking ahead, J.P. Morgan Global Research projects the stablecoin market could grow to $500–750 billion over the next few years. While projections of a $2 trillion market by 2028 may be optimistic, a two-to-three-fold expansion from current levels appears realistic.

That said, top stablecoins’ adoption is still in its early stages. Conservative liquidity investors may take time to treat stablecoins as true cash equivalents, and new infrastructure must continue to mature. Growth is expected to continue, but in a more measured and sustainable way.

Check Out Our Blog Post: Stablecoin Development in Real Estate Transactions

What Types Of Stablecoins Businesses Must Know In 2026?

Stablecoins have moved far beyond their early role as trading pairs on crypto exchanges. By 2026, they will become a core financial primitive for payments, treasury management, tokenized assets, and cross-border settlement. For businesses, understanding how different stablecoins work is no longer optional. The design of a stablecoin directly affects risk, compliance, liquidity, and long-term usability, as mentioned in the above sections.

At a high level, all stablecoins aim to keep their value stable. What differs is how they achieve that stability and what trade-offs they introduce. Let’s check all these details in the discussion below and figure out which stablecoin you want in your business.

1. Asset-Backed Stablecoin

Fully reserved asset-backed stablecoins are the most widely used and the most familiar to regulators and enterprises. In this model, the issuer creates stablecoins only when it holds an equivalent value of assets in reserve.

These reserves are usually made up of:

- Cash held in regulated banks

- Short-term government securities such as US Treasury bills

- Highly liquid, low-risk equivalents

For every $1 stablecoin in circulation, there should be $1 worth of real assets backing it.

How is stability maintained in practice?

If the stablecoin trades below its peg, traders can buy it at a discount and redeem it with the issuer for full value. If it trades above the peg, the issuer mints new coins and sells them at par. This arbitrage loop pulls the price back toward $1.

This system works because:

- The assets are liquid

- Redemptions are honored quickly

- Users trust the issuer’s balance sheet

When any of those conditions weaken, even reserve-backed stablecoins can briefly lose their peg.

Why businesses prefer a fully reserved stablecoin model?

Compared to other top stablecoin models, reserve-backed stablecoins are easier to explain to auditors, regulators, and treasury teams. They resemble money market instruments more than experimental crypto assets. This is why most enterprise payment flows, stablecoin payroll systems, and tokenized cash products rely on this model.

2. Algorithmic Stablecoin

Another one in the list of stablecoins, Algorithmic stablecoins attempt to maintain price stability without holding full reserves. Instead, they rely on smart contracts and economic incentives to manage supply.

When the price falls below the peg:

- The protocol reduces the circulating supply

- Users may be incentivized to lock or burn tokens

When the price rises above the peg:

- New tokens are minted

- Additional supply pushes the price back down

In theory, this mimics how central banks manage money supply. In practice, it depends heavily on market confidence.

Where algorithmic models struggle?

Algorithmic systems have no hard assets to fall back on during stress. When confidence breaks, selling accelerates, incentives stop working, and the peg can collapse quickly. Past failures showed that once belief disappears, code alone cannot restore stability.

Business relevance in 2026

For most businesses, algorithmic stablecoins remain unsuitable for treasury or payments. They may still appear in experimental DeFi environments, but they are rarely chosen for enterprise use cases where capital preservation matters more than efficiency.

3. Commodity-Backed Stablecoin

Commodity-backed stablecoins are pegged to physical assets such as gold or other commodities. Each token represents a claim on a specific quantity of the underlying asset.

How they differ from fiat-backed coins?

These stablecoins are stable relative to the commodity, not to fiat currency. A gold-backed stablecoin may hold its value well over time, but its price still moves with gold markets.

Where businesses use them?

They are mainly used as:

- Digital representations of commodities

- Hedging instruments

- Alternatives to holding physical assets

They are less common for payments or settlement because their value is not fixed in fiat terms.

4. Crypto-Collateralized Stablecoin

Crypto-collateralized stablecoins are backed by cryptocurrencies rather than fiat. To manage volatility, they are over-collateralized. Many people nowadays are interested in exploring how to buy stablecoins and monetize 1:1 pegs. This way, trading prospects with stablecoins maintain stability and give factual returns.

For example:

- A user deposits $150 worth of crypto

- They receive $100 worth of stablecoins

- If collateral value falls, positions are liquidated automatically

Strengths and weaknesses

This model reduces reliance on centralized issuers and banks, which appeals to decentralization advocates. However, it introduces complexity, liquidation risk, and regulatory uncertainty.

For businesses, crypto-backed stablecoins are harder to manage from a compliance and risk standpoint, even if they are technically robust.

Why Are Stablecoins Faster Than SWIFT And Cheaper Than Banks?

Traditional global payment systems were built decades ago for a world of local banking hours, batch processing, and heavy manual oversight. While they are reliable, they are not designed for today’s always-on, internet-scale economy. Stablecoins approach payments from a completely different starting point.

1. How Traditional Cross-Border Payments Work

When a bank sends money internationally, the transaction rarely moves directly from sender to receiver.

- Payments pass through multiple correspondent banks, each adding time, cost, and operational complexity to the transaction.

- Settlement usually takes one to five business days due to batching, time zone differences, and reconciliation processes.

- Transactions pause on weekends and public holidays, even though global commerce does not stop.

- Compliance checks such as AML, KYC, and sanctions screening are often manual or semi-automated.

- Limited transparency makes it difficult to track payment status or pinpoint where delays occur.

This structure works at scale but introduces friction that becomes costly for businesses operating globally.

2. How Stablecoin Payments Work

Stablecoin payments are executed directly on blockchains, removing many of the intermediaries that slow traditional systems.

- Funds move peer-to-peer on a shared ledger, without relying on correspondent banks or clearing houses.

- Settlement happens in minutes, sometimes seconds, because transactions are final once confirmed on-chain.

- Blockchain networks operate twenty-four hours a day, including weekends and holidays.

- Fees are generally lower and more predictable, especially for cross-border transfers.

- Balances are verified before transactions execute, reducing settlement and counterparty risk.

Instead of moving messages between institutions, stablecoins move value itself.

| Aspect | Stablecoins | CBDCs | Traditional Bank Rails |

| Issuer | Private institutions with reserve-backed or regulated issuance | Central banks | Commercial banks |

| Settlement Speed | Near-instant, minutes on public blockchains | Near-instant domestically, limited cross-border | One to five business days |

| Availability | 24/7, global, including weekends and holidays | Mostly domestic, policy-restricted | Business hours, weekends and holidays excluded |

| Cross-Border Use | Native, borderless by design | Mostly experimental or bilateral pilots | Heavy reliance on correspondent banks |

| Programmability | High, supports smart contracts and automation | Limited, policy-controlled | Low, mostly manual or semi-automated |

3. Why This Matters for Businesses

For businesses managing international operations, the difference is practical, not theoretical.

- Treasury teams can settle obligations instantly, improving liquidity management and reducing idle capital.

- Cross-border payroll becomes simpler, faster, and more reliable for global employees and contractors.

- Foreign exchange exposure can be reduced by holding and settling in stable-value digital dollars.

- On-chain records improve reconciliation, auditability, and transparency across complex payment flows.

This is why stablecoins are increasingly viewed as tokenized cash, rather than speculative crypto assets.

Why Are Stablecoins Essential For RWA Tokenization?

Real-world asset tokenization only works if there is a reliable, stable settlement layer. Without it, tokenized markets inherit the same volatility problems as traditional cryptocurrencies.

1. The Need for a Stable Unit of Accoun

Tokenized assets can represent many forms of value, including real estate, bonds, funds, trade finance instruments, and commodities.

- Asset prices must be expressed in a unit that does not fluctuate significantly during settlement.

- Stablecoins provide a consistent unit of account that aligns with traditional financial pricing.

- Predictable settlement reduces counterparty risk for both issuers and investors.

- Cash-like stability is essential when large values are settled automatically via smart contracts.

Without stablecoins, pricing and settlement become unreliable at scale.

2. Liquidity and On-Chain Market Functionin

Stablecoins act as the liquidity layer that allows top RWA platforms to operate efficiently.

- Investors enter and exit tokenized asset positions using stablecoins instead of volatile native cryptocurrencies.

- Yield calculations, interest payments, and distributions are denominated in stable value.

- Smart contracts settle trades automatically once conditions are met, without manual intervention.

- Market depth improves because participants are not exposed to unnecessary price volatility.

This liquidity role is critical for institutional participation in tokenized markets.

3. RWA-Backed Stablecoins and the Feedback Loo

A newer model is the rise of RWA-backed stablecoins, where reserves are themselves real-world assets.

- Treasury bills and money market instruments back stablecoin issuance.

- Those stablecoins are then used to settle tokenized asset transactions on-chain.

- Yield from underlying assets flows directly into blockchain-based financial systems.

- Traditional finance instruments and blockchain infrastructure reinforce each other rather than compete.

For businesses, this creates a cleaner bridge between existing financial systems and tokenized markets.

How is Compliance Enhancing Stablecoin Development Solutions Globally?

Compliance is no longer slowing stablecoin adoption. In many regions, it is actively enabling growth by reducing uncertainty and increasing trust.

Why Regulation Strengthens Stablecoins?

Clear regulatory frameworks address the core risks that businesses and institutions care about.

- Defined rules around reserve composition improve confidence in stablecoin backing quality.

- Guaranteed redemption rights reduce the risk of sudden loss of value.

- Governance requirements clarify issuer responsibilities and accountability.

- Auditing and reporting standards improve transparency for users, regulators, and partners.

Stablecoins operating within these frameworks are easier to integrate into enterprise systems.

1. United State

The US is moving toward treating stablecoins as regulated payment instruments, not speculative assets.

- Emphasis is placed on high-quality liquid reserves, such as cash and short-term government securities.

- Federal oversight aims to standardize issuer obligations and consumer protections.

- Mandatory redemption at par strengthens trust during periods of market stress.

- AML and KYC alignment brings stablecoins closer to traditional financial compliance standards.

This signals long-term integration rather than regulatory hostility.

2. European Unio

Under MiCA, stablecoins are regulated consistently across all EU member states.

- Issuers must meet capital, governance, and operational requirements before offering stablecoins.

- Strict transparency and reporting rules apply to reserves and ongoing operations.

- Redemption and reserve obligations are clearly defined across borders.

- Businesses benefit from a single regulatory baseline instead of fragmented national rules.

This clarity is particularly valuable for companies operating across multiple European markets.

3. APAC Market

Singapore and Hong Kong are positioning themselves as regulated hubs for stablecoin innovation.

- Full reserve backing and asset segregation protect users and reduce systemic risk.

- Licensing regimes create clear entry paths for compliant issuers.

- Strong AML and audit requirements align stablecoins with global financial standards.

- Regulators actively support innovation while enforcing financial safeguards.

These frameworks show how regulation can support, rather than suppress, stablecoin development.

How Can Stablecoin Development Be Implemented In Your Business?

For enterprises, stablecoin adoption works best when it follows a proven institutional pattern, not an experimental crypto-first approach. Looking at how leading players operate helps clarify what implementation really looks like in practice.

Industry Case Study: Circle Payments Network (CPN)

Circle has built the Circle Payments Network (CPN) to support enterprise-grade payments and value exchange using regulated stablecoins such as USDC.

CPN is designed to:

- Enable near-instant global payments using regulated, dollar-backed stablecoins

- Support multiple blockchain networks while abstracting blockchain complexity for businesses

- Integrate compliance, transaction monitoring, and reporting directly into payment flows

- Allow enterprises to settle B2B, marketplace, treasury, and cross-border transactions 24/7

The key insight from Circle’s model is that stablecoin infrastructure is not sold as crypto, but as payments and treasury technology. Compliance, reliability, and integration come first. Blockchain is the backend, not the product.

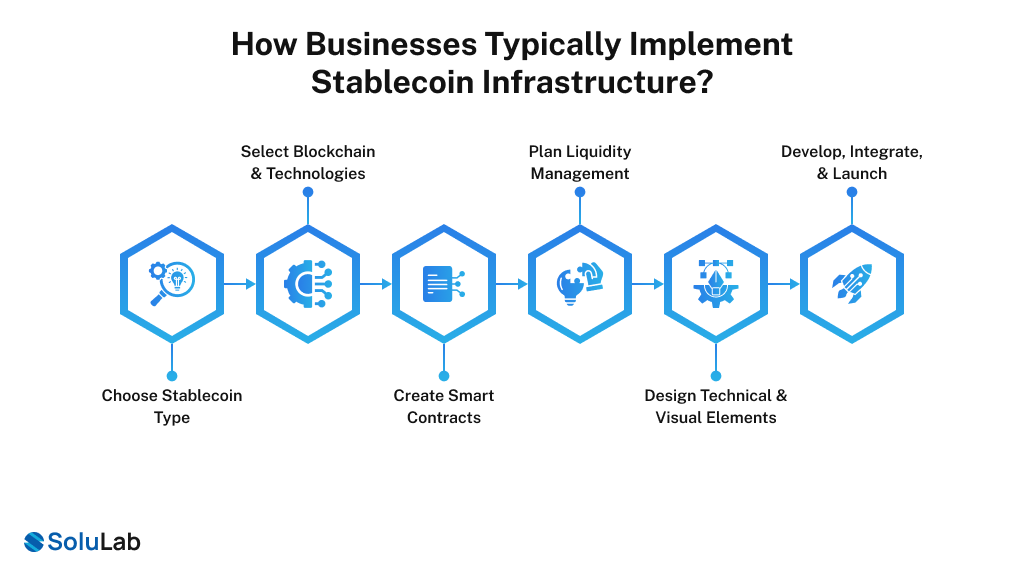

How Businesses Typically Implement Stablecoin Infrastructure?

Businesses usually implement stablecoin infrastructure in phases, starting small and scaling as regulatory clarity, transaction volumes, and confidence grow. Below is the most common approach on how to create a stablecoin that enterprises follow:

1. Strategy and Use-Case Consulting (2 weeks)

Implementation starts with defining why stablecoins are needed.

- Identify use cases such as cross-border payments, treasury optimization, payroll, or RWA settlement

- Assess regulatory exposure by geography and customer base

- Decide between issuing a stablecoin, integrating an existing one (like USDC), or using a payment network

At this stage, most enterprises choose integration over issuance to reduce risk and time-to-market.

2. Compliance and Regulatory Structuring (3-5 weeks)

This is where institutional projects differ from crypto-native ones.

- KYC, AML, sanctions screening, and transaction monitoring requirements are defined

- Reserve management and redemption workflows are clarified

- Custody partners and banking relationships are finalized

For regulated markets, this step determines long-term viability.

3. Technical Integration and Infrastructure Build (2-5 weeks)

This phase focuses on execution.

- Wallet infrastructure and custody solutions are integrated

- Blockchain networks are selected based on cost, speed, and ecosystem support

- Payment APIs, reconciliation tools, and reporting dashboards are built

- Smart contracts are audited and tested

For most mid-sized enterprises, integration costs typically range from $120,000 to $300,000, depending on scope and compliance depth.

4. Pilot, Testing, and Gradual Rollout (4–6 weeks)

Before full launch:

- Transactions are tested in controlled environments

- Liquidity and redemption processes are validated

- Internal teams are trained on operations and risk handling

Only after this phase do companies scale usage across regions or products.

Typical Timeline and What B2B Leaders Should Expect?

From consulting to production launch, most enterprise-grade stablecoin implementations take 2 to 4 months. Faster timelines are possible with an experienced stablecoin development company. Additionally, compliance, banking access, and scope are tightly controlled; the costings also favor you.

The most successful implementations treat stablecoins not as a crypto experiment, but as next-generation financial infrastructure, aligned with existing business, legal, and operational realities.

How Will Institutions Shape Stablecoin Infrastructure In the Future?

Institutional participation is shifting stablecoins from crypto-native tools into global financial infrastructure. What began in trading markets is now expanding into banking, payments, and real-economy use cases. With the addition of AI-powered stablecoin development, the industry’s efficiency increased to 60%.

1. Crypto Markets and Exchange

Institutions will continue using stablecoins as the core settlement asset for crypto trading. Exchanges are moving toward real-time, on-chain settlement using stablecoins to reduce counterparty risk, improve liquidity management, and support 24/7 markets without relying on traditional banking cutoffs.

2. Banking and Payment

Banks and payment providers are increasingly treating stablecoins as tokenized cash. Instead of replacing banks, stablecoins are being integrated into treasury operations, cross-border settlement, and embedded finance. This allows faster reconciliation, lower costs, and programmable compliance.

3. Country-Level Adoptio

Several regions and people are using stablecoins for different purposes. African countries using stablecoins for oil and gas transportation and green technology transactions. Asian countries are using them in payments alongside America.

- South Korea is exploring stablecoins alongside digital asset regulation to modernize payments and capital markets.

- Africa is seeing strong adoption for remittances, trade settlement, and inflation protection, especially where banking access is limited.

- Latin America and Southeast Asia are using dollar-backed stablecoins as practical alternatives to unstable local currencies.

4. Industry Expansion

Beyond finance, stablecoins are expected to play roles in oil and gas trading, commodities settlement, public infrastructure payments, and tokenized government bonds. These sectors benefit from instant settlement and transparent cash flows. From the general public to top industrialists, everyone is now exploring how to invest in stablecoins.

As Jeremy Allaire, Co-founder and CEO of Circle (issuer of USDC), has stated:

“Stablecoins are the first native digital money of the internet.”

His point is that stablecoins are designed to move at internet speed, operate globally, and integrate directly with software and programmable systems.

Conclusion

Finally, it’s confirmed that stablecoins have crossed a critical threshold. What began as a tool for crypto traders has evolved into a core layer for global payments and tokenization. If you are also into the stablecoin development services integration into your platform, SoluLab is all ears.

Discuss your requirements with our expert stablecoin developers and get the latest solutions.

- With over 250 developers, we help you integrate and develop top-notch, industry-leading Stablecoin, AI, and Blockchain services.

- We successfully provided 50+ custom stablecoin solutions across multiple industries.

- You can also avail token and wallet integrations and 24/7 community support, and many more services.

Visit our stablecoin development company page and know more about our services. We are here to bring your vision to reality and enhance your growth to maximum height.

FAQs

Yes, In most regions, stablecoins are legal for business use when they follow local regulations, including reserve backing, redemption rights, and AML compliance. Laws vary by country, so regulatory alignment is essential before adoption.

Stablecoins are issued by private companies and operate on public blockchains, while CBDCs are issued by central banks and usually run on permissioned systems. Stablecoins are currently more practical for global, cross-border business payments.

Stablecoin development typically costs between $120,000 and $300,000, depending on compliance requirements, blockchain selection, integrations, and security audits. Costs increase for regulated issuance compared to simple integration of existing stablecoins.

Yes. Stablecoins can be integrated with existing payment systems, ERPs, wallets, and accounting tools using APIs. Most enterprises integrate regulated stablecoins rather than issuing new ones to reduce complexity and compliance risk.

You can connect with SoluLab by visiting the stablecoin development company page and scheduling a consultation. Our team helps with strategy, compliance planning, development, integration, and long-term support for enterprise-grade stablecoin solutions.