What if you could access healthcare, banking, travel, and even education, all with a single digital ID?

That’s the vision behind the EU’s Digital Identity Wallet (EUDI Wallet), a unified, secure, and user-controlled way to verify identity across borders. As Europe fast-tracks its rollout for 2026, this initiative isn’t just transforming how citizens interact with governments and businesses; it’s setting new global standards for digital trust, privacy, and interoperability.

Across Europe, more than 400 million citizens will soon use the EU digital identity wallets under the new eIDAS 2 regulation. This initiative marks a major change in how digital identities operate across borders. With this system, users control personal information, access services securely, and verify identities without paper documents.

The EUDI framework is not only about convenience but also about trust, interoperability, and secure digital applications. This blog gives you the details on EU digital identity wallets use cases and why they are gaining popularity in 2025.

What is the EU Digital Identity Wallet, And How Does It Work?

The EU digital identity wallet (EUDI wallet) is currently gaining popularity among users. Its secure systems enable citizens and businesses to verify identity, store credentials, and access services across Europe. It comes under the EU digital identity wallet regulation authority, which gives full access to the individual on their personal data. This wallet system follows EU standards to ensure cross-border interoperability. The EUDI Wallet replaces fragmented identity verification systems with a unified digital framework.

The digital identity wallet providers and the European Digital Identity Wallet Consortium ensure that all wallets comply with privacy, security, and interoperability rules. Each user’s credentials, like ID, driver’s license, or academic degree, are stored digitally and shared selectively when needed.

The digital identity wallet EU solution operates through secure verification layers and standard APIs.

- Users register with a national identity provider.

- The wallet connects to trusted service providers using secure communication protocols.

- Identity verification happens in real time, using multi-factor authentication.

- The verified credentials are stored locally in encrypted form.

The European Commission adopted a new round of seven implementing regulations in July 2025, detailing technical specifications for trust services and electronic attestations to ensure interoperability across the EU.

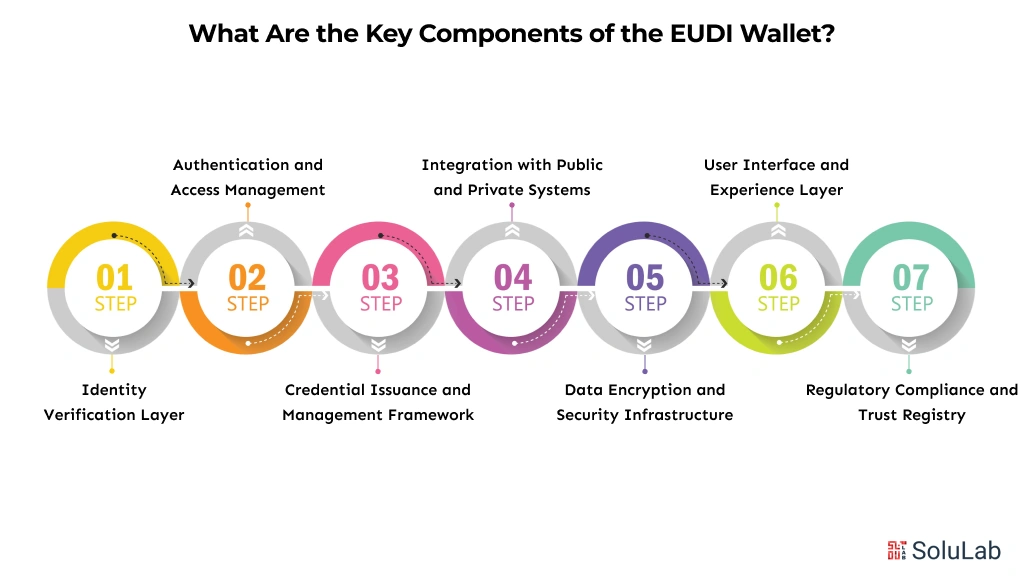

What Are the Key Components of the EUDI Wallet?

The EUDI Wallet consists of multiple interconnected layers that ensure secure operation, compliance, and user control. Each layer performs a specific function for safe and reliable identity management using blockchain.

-

Identity Verification Layer

This layer handles identity validation through government-issued digital credentials and biometric checks. Verification occurs using data from national ID systems, passports, or driving licenses. The EU digital identity wallet regulation defines how this data should be validated and stored.

-

Authentication and Access Management

Authentication makes sure that the user credentials in the EU digital identity wallet app are valid. It uses multi-factor authentication, ie, biometrics, pins, making it secure and trustworthy. Similar way, enterprises also use this layer for authentication and wallet integration to validate the customer and employee.

-

Credential Issuance and Management Framework

This framework allows trusted authorities to issue and revoke credentials. Each credential, such as a health record, tax certificate, or professional qualification, is digitally signed and stored securely. The digital identity wallet providers follow EU-defined protocols for data exchange and verification.

-

Integration with Public and Private Systems

The EUDI Wallet supports seamless integration through standardized APIs. It connects with e-government portals, banks, healthcare systems, and educational institutions. This integration allows businesses and governments to authenticate users without storing sensitive personal data directly.

-

Data Encryption and Security Infrastructure

All stored data is encrypted both in transit and at rest. The system relies on blockchain-based identity management and advanced cryptographic protocols. Security infrastructure includes public key cryptography, digital certificates, and tamper-proof logs. Moreover, compliance with EU GDPR standards ensures strong data protection.

-

User Interface and Experience Layer

The EU digital identity wallet app includes a unified, easy-to-navigate interface. This design ensures quick access to identity credentials, digital signatures, and verification records. For businesses building similar platforms, emphasis lies on simple user flows, secure authentication screens, and easy credential sharing options.

-

Regulatory Compliance and Trust Registry

All operations in the wallet are backed by the EU trust registry, which lists certified providers and services. This registry ensures that only verified institutions issue or accept credentials. It maintains transparency, legal compliance, and traceability of all digital interactions.

Business and User Benefits of the EUDI Wallet

The EU digital identity wallet offers a secure place to store and use identity details such as ID cards, driver’s licenses, bank cards, and academic records. Let’s see how EUDI wallets are used in different industries that help both businesses and citizens of Europe.

-

Healthcare and Cross-Border Access

In healthcare, EUDI wallets allow citizens to store medical records, prescriptions, and health insurance information. When traveling across EU countries, patients can easily share the required data with hospitals or pharmacies without lengthy paperwork.

This helps citizens receive medical services faster and ensures their data stays private. Businesses such as healthcare providers and insurers save time and cost in patient verification and claim processing. Governments gain better coordination of cross-border healthcare services and stronger fraud prevention systems.

-

Travel and Transport

The wallet simplifies travel by allowing users to carry digital versions of passports, driving licenses, and tickets. Whether booking a flight or renting a car, verification becomes seamless and paper-free. Travelers can move freely without worrying about lost documents or long verification lines.

This benefits citizens by offering convenience and security during cross-border travel. Businesses, including airlines and rental agencies, experience faster check-ins and reduced identity verification costs. Governments achieve improved border management and stronger digital authentication across systems.

-

Education and Academic Verification

The EU digital identity wallet supports digital academic credentials, making it easier for students and professionals to prove qualifications across member states. Universities can issue verified diplomas and certificates directly into the wallet, which can be instantly shared with employers.

This helps citizens manage and share credentials without delays or paperwork. Businesses benefit from quick and reliable background checks during hiring. Governments support mobility, transparency, and mutual recognition of qualifications across Europe’s education systems.

-

Financial Services and Online Transactions

The wallet brings greater trust to financial services and e-commerce. Citizens can use it to verify identity during online banking, payments, or digital contract signing. The process becomes secure and compliant with EU data protection rules.

This benefits citizens by reducing the risk of fraud and simplifying secure digital payments. Businesses, including banks and fintech firms, save costs on KYC and customer onboarding while speeding up transactions. Governments gain better oversight, lower financial fraud, and stronger enforcement of digital identity regulations.

-

Public Services and e-Governance

Through the EU digital identity wallet, citizens can log into multiple government platforms, whether for tax filing, social benefits, or vehicle registration, using one verified digital identity. This eliminates repeated logins and long verification steps.

It benefits citizens by offering faster, easier access to essential public services. Businesses can handle government tenders or compliance filings without delays. Governments gain operational efficiency through integrated systems and accurate citizen data management.

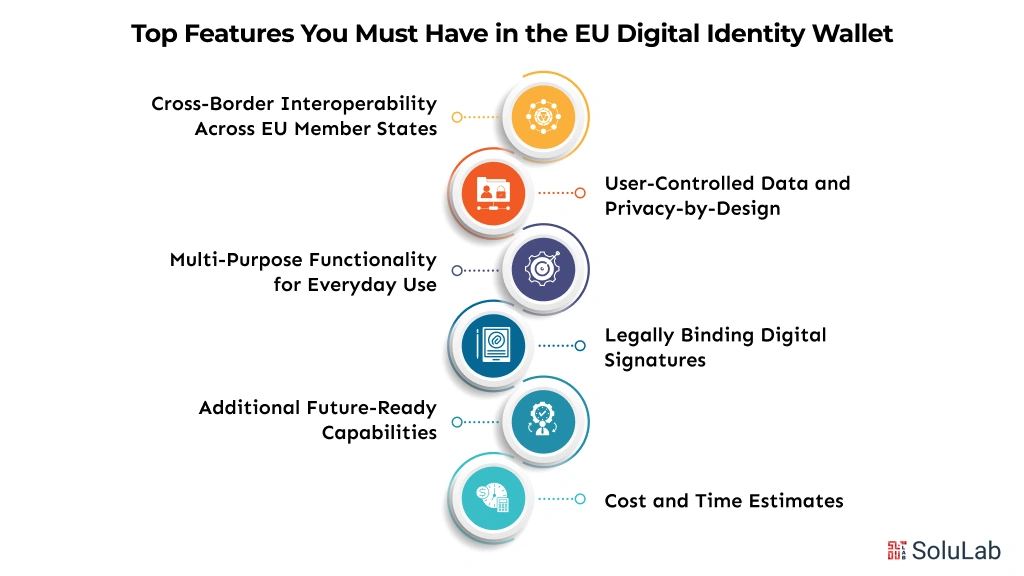

Top Features You Must Have in the EU Digital Identity Wallet

The digital identity wallet European Commission framework defines several features that ensure security, trust, and usability.

1. Cross-Border Interoperability Across EU Member States

The wallet must function in all member states without additional integration work. Businesses developing secure digital applications must ensure compatibility with EU interoperability standards.

Interoperability promotes smooth digital operations and simplifies international trade.

2. User-Controlled Data and Privacy-by-Design

Users decide what data to share. This approach aligns with the self-sovereign identity model. Each wallet logs every transaction, allowing users to monitor where and when their information is shared.

Privacy-by-design remains a core requirement for any digital identity wallet EU project.

3. Multi-Purpose Functionality for Everyday Use

The EUDI Wallet supports diverse use cases: accessing e-government services, verifying professional qualifications, or signing agreements.

Businesses can integrate the wallet into their digital workflows, reducing the need for multiple logins or identity systems.

4. Legally Binding Digital Signatures

The wallet includes digital signature capabilities. These signatures hold legal validity across all EU states.

This feature allows users and businesses to sign contracts, approve transactions, or submit documents without paper processes. It ensures compliance with the EU eIDAS regulation.

5. Additional Future-Ready Capabilities

The EUDI Wallet roadmap includes several futuristic developments that enhance scalability and innovation:

- AI-based credential verification for faster processing.

- Blockchain-backed transparency for audit trails.

- Open API ecosystem for third-party integrations.

- Offline functionality for secure verification without the internet.

- Advanced biometric security ensures strong identity assurance.

6. Cost and Time Estimates

If you’re also looking to build EUDI wallet frameworks, then going for a partner is the best idea. Let’s see the expenses and time frame.

- Building an EU digital identity wallet typically costs between €60,000 and €150,000, depending on features and integrations.

- Third-party blockchain development companies can build a secure, compliant wallet in a cost-efficient way within 8 to 16 weeks.

Integration of advanced services, such as biometric verification or cross-border identity checks, can increase both cost and timeline.

Conclusion

As per the above details, you should have gained a comprehensive understanding of EUDI wallets’ usage and how they are fostering trust among people. If you are looking to integrate a wallet or build from scratch, SoluLab is here to help in every step.

We, at SoluLab, a top blockchain development company, build secure and simplified platforms for your business goals. Our expert team seamlessly integrates blockchain into your existing infrastructure or migrates to a more advanced blockchain network. For more information, contact us today.

FAQs

1. What makes the EU Digital Identity Wallet different from any other ID app?

Unlike typical ID apps, it’s built on EU-wide regulations and blockchain-backed security, allowing users to verify, sign, and access services securely and instantly anywhere across Europe.

2. How secure is the EUDI Wallet really?

It uses advanced encryption, blockchain technology, and multi-factor authentication to protect your data, making identity theft or fraud nearly impossible across EU digital platforms.

3. Who can use the EU Digital Identity Wallet?

Any EU citizen or resident can use it to access government, finance, healthcare, and travel services, all under one secure, verified digital identity framework.

4. How can SoluLab help in building an EU Digital Identity Wallet?

SoluLab specializes in blockchain app development solutions, helping enterprises design and deploy secure, regulation-compliant digital identity wallet systems customized for EU and global frameworks.

5. Could the EUDI Wallet someday replace physical passports or ID cards?

Maybe soon! The EU aims for digital IDs to become valid across borders, meaning your digital wallet could eventually serve as a full replacement for physical documents.

![Top 10 Digital Identity Wallet Development Companies [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Digital-Identity-Wallet-Development-Companies.webp)