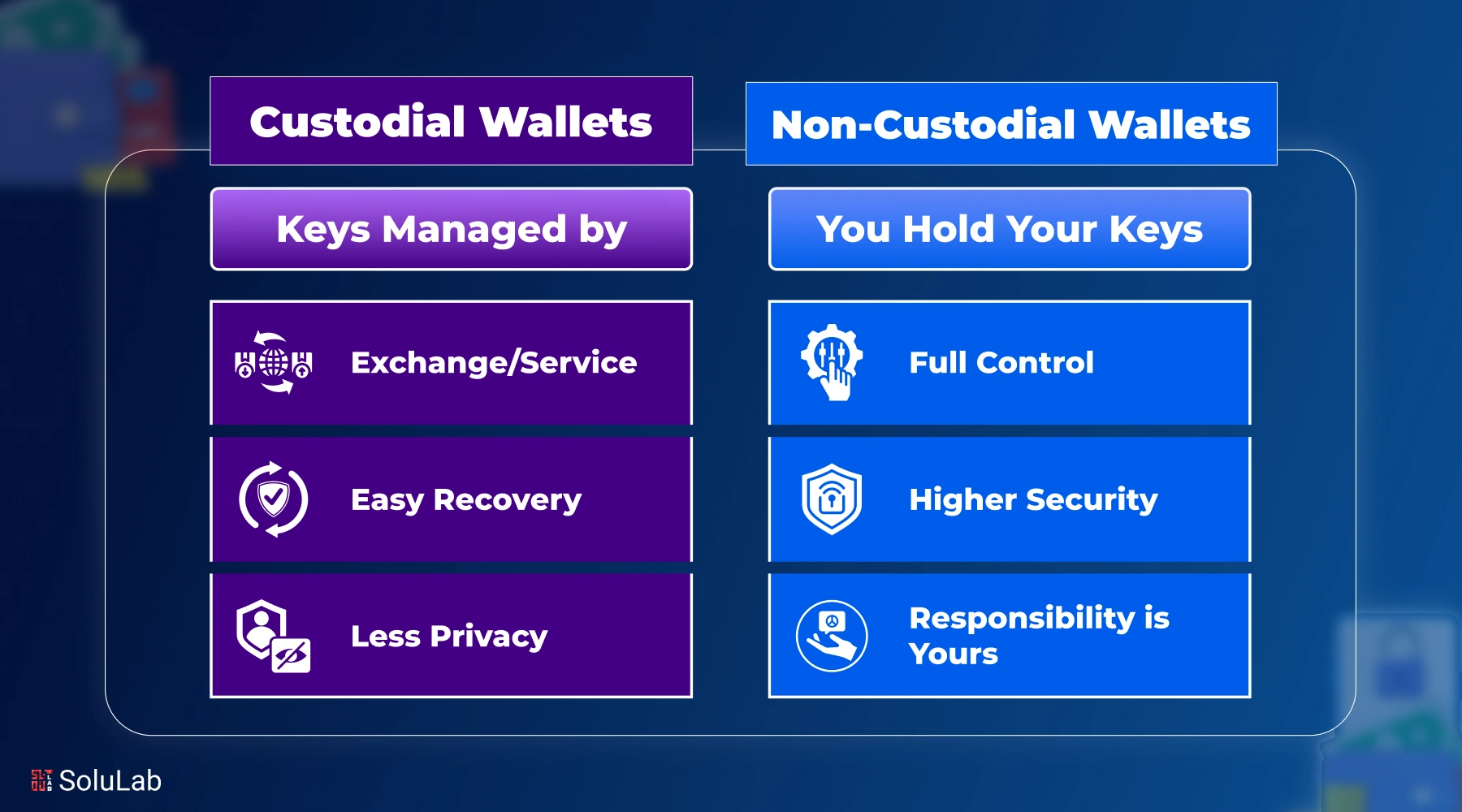

Choosing between custodial wallets and non-custodial wallets really comes down to your goals. A custodial wallet is simple to use, great for beginners, and perfect for everyday trading. A self-custody wallet or non-custodial wallet gives you full control of your crypto, but you also take full responsibility for security.

The 2025 numbers say a lot. Crypto exchanges faced $2.37 billion in stolen funds in just the first half of the year, a 66% rise from H1 2024. Meanwhile, cold self-custody wallets with proper security show under 5% incident rates, while online software crypto wallets cross 15% breach rates.

This is why the debate around custodial vs non-custodial wallets is more important than ever. And if you’re exploring your own product, our agency builds secure, scalable solutions through expert crypto wallet development services, helping you choose the right model while keeping it cost-efficient.

Key Takeaways

Custodial wallets offer convenience and recovery support, making them ideal for beginners, exchanges, and enterprises that prioritize ease of use.

Non-custodial wallets provide full control and private-key ownership, suited for experienced users, DeFi investors, and those who value maximum security.

The right choice depends on your risk tolerance, technical comfort, and asset management goals, especially as regulations and Web3 apps evolve in 2026.

Why Choosing the Right Wallet Is Critical for Crypto Security?

Choosing the right crypto wallet matters because it controls how your private keys are stored, who can access your funds, and what happens if something fails. In crypto, your wallet is the main security layer; there is no reset button or customer support that can recover lost keys.

- A custodial wallet stores your keys on a company’s servers.

- A non-custodial wallet stores your keys on your own device.

The difference between custodial and non-custodial wallets impacts:

- control over private keys

- risk of hacks or server breaches

- recovery options

- compliance and regulation

- how fast funds can be moved

- responsibility during a failure

From a business point of view, especially for founders and teams handling project funds, the wallet type you choose affects security, operations, and trust. If your wallet setup is wrong, your entire system becomes vulnerable.

For companies building products, partnering with one of the best crypto wallet development companies ensures you choose a structure that is safe, scalable, and compliant.

What Are Custodial and Non-Custodial Wallets?

When people talk about crypto wallets, they usually mean two types: custodial and non-custodial. The easiest way to understand them is by thinking of renting a house vs. owning a house.

1. Custodial Wallets

A custodial wallet is like renting. A company stores and manages your private keys for you. You get access to your assets, but the company holds the real control. This type is popular among beginners and teams who want simple access, low responsibility, and someone else handling the technical part.

Key points businesses care about:

- Easy onboarding

- Faster recovery if someone loses access

- Customer support from the provider

- Good for exchanges, apps, and new traders

This is where the benefits of custodial wallets matter because users want a safe and simple tool instead of managing keys on their own.

2. Non-Custodial Wallets

A non-custodial wallet is like owning your house. You hold the private keys yourself. You have full control of your assets, and no one can freeze or limit your funds. This is preferred by people who want independence and by advanced users who work with DeFi, NFTs, staking, or multi-chain apps.

Key points for businesses and pro users:

- You fully own and control your crypto

- No third-party risks

- Works best for decentralized apps

- Great for teams that want full transparency and security

This is where the benefits of non-custodial wallets come in: more freedom, more privacy, and more trustless control.

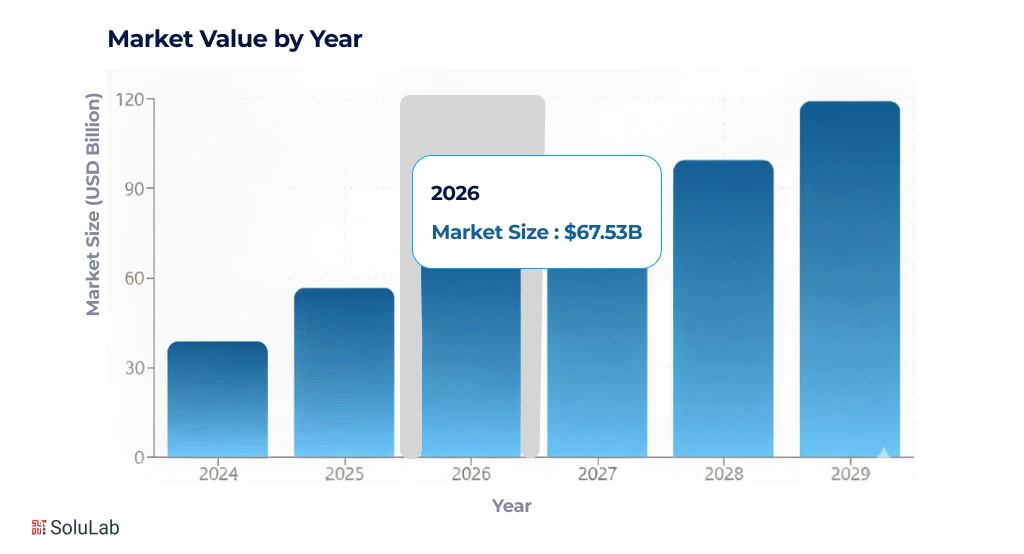

Crypto Wallet Market Trends & Consumer Preferences in 2026

Crypto adoption in 2026 is rising faster than ever. The market is growing, and the way people store their assets is changing too.

Here are the key trends:

- 960M – 1.2B global crypto users by 2026.

- 59% users prefer self-custody; 41% prefer custodial.

- 300% increase in hardware wallet sales after FTX.

- DeFi activity is pushing non-custodial wallet adoption further.

- Enterprises are now building their own wallets using custom development for better control and security.

- 24 countries updated wallet compliance rules in 2025, making secure design more important than ever.

These trends show one thing clearly: Users and businesses want safer, smarter, and more reliable wallet solutions.

So, if you’re a founder building the next big thing in Web3, now is the right time to invest in your own wallet system. With user adoption rising and compliance getting stricter, you need a setup that’s secure, scalable, and built for real-world use.

Compliance & Regulation Changes Every Founder Should Know

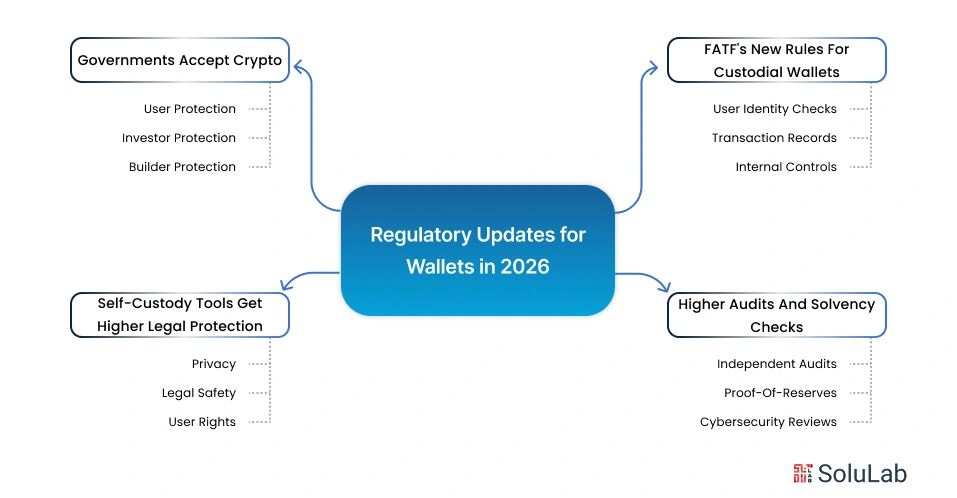

Crypto rules became much stricter in 2026, and these changes directly affect how users choose between custodial and non-custodial wallets. For businesses building wallet products, these updates matter even more. Here are the key points:

1. FATF’s New Rules for Custodial Wallets

Global regulators now require stronger KYC and monitoring for custodial wallets, especially for platforms offering the best custodial wallets. This means companies must show:

- Clear user identity checks

- Transparent transaction records

- Strong internal controls

If you’re running or building a custodial wallet, this is no longer optional.

2. Self-Custody Tools Get Higher Legal Protection

Many countries now treat self-custody wallet systems as private digital vaults. This gives non-custodial wallets:

- More privacy

- More legal safety

- More user rights

Basically, governments now respect non-custodial ownership as a valid form of digital property.

3. Higher Audits and Solvency Checks for Custodial Platforms

Any crypto exchange platform offering the Best custodial wallets must now pass:

- Independent audits

- Proof-of-reserves checks

- Stronger cybersecurity reviews

This was pushed after past failures in the industry.

4. Governments Accept That Crypto Is Permanent

By 2026, regulators finally understood the simple truth is Crypto is staying. So they are building clearer rules to protect users, investors, and builders. For founders and teams building crypto products, this is the best time to focus on secure solutions.

Advantages and Disadvantages of Custodial & Non-Custodial Wallets

| Wallet Type | Pros | Cons |

| Custodial Wallets |

Very easy to use No private key or seed phrase to manage 24/7 customer support on many platforms Password or email-based account recovery Good for beginners, businesses, and teams that need shared access |

You depend on the company holding your funds Risk of exchange hacks or company failure Possible withdrawal limits or delays Must follow KYC and regulations Not ideal for long-term storage |

| Non-Custodial Wallets |

You fully own your crypto and private keys No third-party control over your assets Works smoothly with DeFi, NFTs, and Web3 apps Better privacy and independence |

If you lose your seed phrase, funds are lost forever Slightly more technical to set up No customer support for recovery Responsibility for security is 100% on you |

What FTX Taught Us About Crypto Wallet Security?

The FTX collapse delivered one of the most powerful lessons to the crypto world: if you don’t hold your private keys, you don’t control your crypto.

At its peak in 2021, FTX was valued at 32 billion USD and had over 1 million active users worldwide. Regarded as one of the safest and most reputable exchanges, it managed billions in daily trading volume. Yet, in November 2022, everything unraveled. Users discovered that customer funds, estimated at around 8 to 10 billion USD, had been misappropriated and used by FTX and its sister company, Alameda Research.

When the exchange collapsed, millions of users were locked out of their accounts, unable to withdraw their own assets. The reason was simple: FTX had full custody of customer funds. This is the clearest example of the risk inherent in custodial vs. non‑custodial wallet systems.

FTX didn’t fail because of blockchain technology or crypto protocols. It failed because users trusted a centralized entity with their private keys. In contrast, self‑custody wallets, whether hardware or software‑based, allow users to directly control their crypto through private keys stored only by them.

If those same users had stored their funds in non‑custodial wallets, the collapse of FTX would not have locked up their assets. Their crypto would have remained safely in their own wallets, untouched by the exchange’s failure.

Best Security Practices for Every Wallet Type

No matter which wallet you use custodial or non-custodial, security is the first thing you should care about. These simple steps help reduce risk and protect your user funds, project treasury, or personal assets.

1. Enable 2FA (Two-Factor Authentication)

Always turn on 2FA for every custodial wallet or exchange account. It adds an extra layer of protection on top of your password.

2. Use Hardware Wallets for Long-Term Storage

For anyone holding large amounts of crypto, a hardware wallet is still one of the safest options. It keeps your private keys offline and away from common online attacks. This applies to users of both non-custodial wallets and hybrid setups.

3. Keep Seed Phrases Offline

Your seed phrase should never be stored in screenshots, notes apps, or cloud backups. Write it down, keep it offline, and store it in a secure place. If someone gets the seed phrase of your self-custody wallet, they get full control forever.

4. Avoid Unknown Browser Extensions

Extensions can secretly read your clipboard, access tabs, or inject scripts. Only install tools from trusted sources, especially when using online crypto wallets or any Web3 dApp.

5. Use Multi-Sig for Business Accounts

If you are a founder or managing project funds, set up a multi-sig wallet. This prevents a single team member from moving funds alone. It’s one of the most important steps for DAO treasuries, Web3 startups, and anyone building with crypto wallet development services.

6. Always Verify Links

Phishing attacks are still the number one reason for wallet hacks. Always double-check URLs, especially when logging into a custodial wallet or signing transactions in a non-custodial wallet.

7. Keep Backup Devices Safe

If you use backup hardware wallets or seed phrase copies, store them in separate safe places. Losing backups can lock you out. A stolen backup can drain your wallet.

How to Pick the Best Wallet for Your Crypto Strategy?

Choosing the right wallet matters because it directly affects how safe your crypto is. Most users fall into two groups: people who want convenience and people who want full control. Here’s a simple and clear way to decide.

| Wallet Type | Best For | Why Choose It? | Key Needs |

| Custodial Wallet | New crypto users, traders, and businesses that need easy access | A third party manages your keys. This makes it simple to use and easier to recover if you lose access. | Simple UI, customer support, recovery options, centralized control |

| Non-Custodial Wallet | Users who want full ownership and high security | You control your private keys. No one can freeze your funds or access your assets. | Managing private keys, DeFi, NFTs, staking, and high privacy |

| Hybrid Setup (Most Recommended) | Smart investors, founders, and teams handling project funds | Use custodial wallets for daily trading and fast access, use non-custodial wallets for long-term storage and higher security. | Balanced safety, flexibility, and risk management |

Conclusion

Choosing the right wallet is not a small step. It decides how safe your crypto really is. This is not only a tech choice, but it is also a long-term financial security decision. If you prefer an easy setup and support, a custodial wallet may work better, and if you want full control and hold your own keys, a self-custody or non-custodial wallet is the right fit.

The goal is simple – pick the wallet that matches how you manage risk, how you store assets, and how your business operates.

And if you are building a wallet or a Web3 product, our team can help. SoluLab, as a crypto wallet development company, designs and builds wallets that are secure, compliant, scalable, and ready for real-world users.

Whether you need a custodial, non-custodial, multi-chain, or enterprise-grade solution, we offer full-stack crypto wallet development services to match your product goals.

If you want expert help, better security, and faster development, contact our experts. We’re here to build it with you!

FAQs

1. Can a business use both custodial and non-custodial wallets?

Yes, many businesses use both. This gives them more control and flexibility. A custodial wallet helps with quick payments and easy team access, while a non-custodial wallet protects long-term holdings and treasury funds. This balance reduces risk and keeps operations smooth.

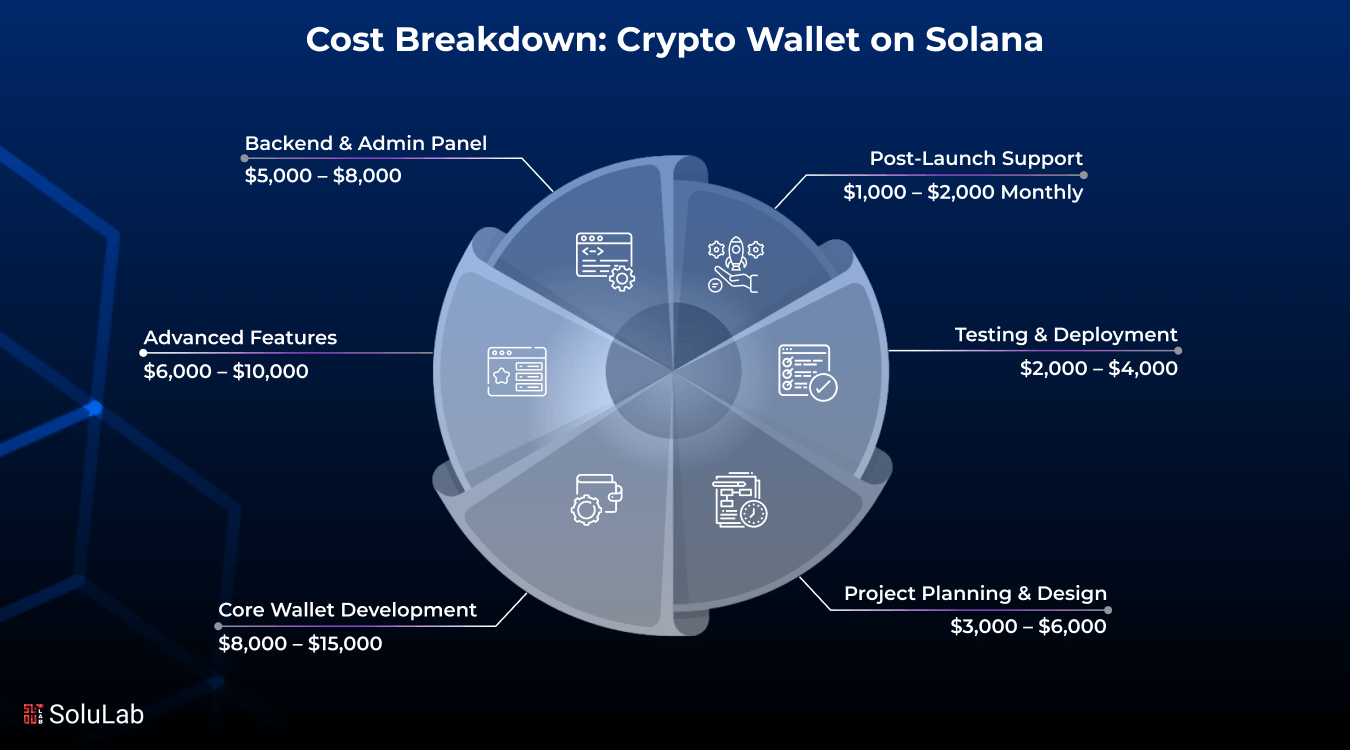

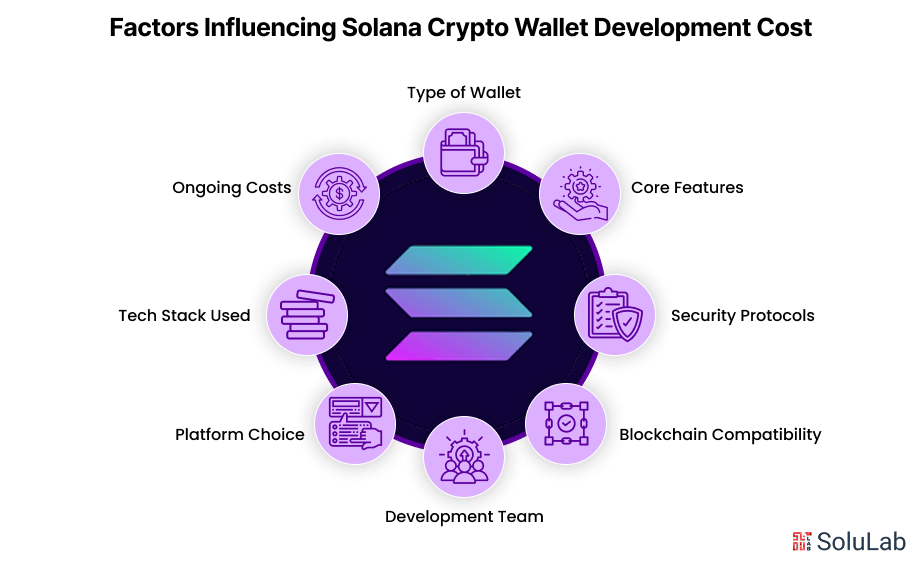

2. How much does crypto wallet development cost?

The cost depends on the features and level of security needed. Adding support for multiple chains, KYC, staking, or DeFi will increase the price. Enterprise wallets with compliance layers, monitoring tools, and advanced security naturally cost more than simple personal wallets. The budget changes based on complexity and integrations.

3. Can I integrate both wallet types inside a single Web3 product?

Yes, this is common and useful. Many apps offer a simple custodial option when users sign up, and a non-custodial option for advanced users who want more control. This hybrid setup improves user experience, increases conversions, and gives businesses more flexibility.

4. How long does it take to build a crypto wallet from scratch?

A full wallet build usually takes between 4 to 12 weeks, depending on design, features, security needs, and chain integrations. Enterprise wallets may take longer due to compliance checks, deeper testing, and additional security layers. A proper development cycle includes planning, UI, blockchain integration, audits, and a stable launch.

5. Do custodial wallets charge more fees than non-custodial wallets?

Often yes, because custodial wallets may include trading fees, withdrawal charges, and platform service costs. Non-custodial wallets usually only charge blockchain network fees, making them more cost-efficient for long-term holding.