- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

Asset tokenization is moving fast from experimentation to real enterprise adoption. Financial institutions, real estate firms, commodity businesses, and Web3-native companies are now actively exploring enterprise-grade tokenization platforms. The main reason behind this is to digitize ownership, improve liquidity, and streamline asset management.

The World Economic Forum on Jan 13, 2026, published the view of Larry Fink and Rob Goldstein of BlackRock that “tokenization can greatly expand the world of investable assets beyond the listed stocks and bonds that dominate markets today.”

However, asset tokenization platform development is not just about deploying smart contracts. It involves business clarity, system design, compliance strategy, security, and long-term scalability.

Key Takeaways

- An enterprise-grade tokenization platform must be designed as long-term financial infrastructure.

- Early decisions around architecture, data flow, and blockchain selection directly impact scalability, security, and regulatory alignment.

- A structured checklist helps enterprises reduce 40% risk, control costs, and accelerate the adoption of asset tokenization platforms.

This blog presents a structured checklist to help enterprises understand how to build a tokenized asset platform, what to validate before development, and what it realistically takes in terms of cost, time, and execution.

Getting Started: Defining the Asset and Business Foundation

Before writing a single line of code, enterprises must align on fundamentals. This step decides whether the platform will scale or stall.

Key Questions To Answer Early

- What type of asset is being tokenized (real estate, debt, equity, carbon credits, commodities, IP)?

- Is the asset physical, financial, or digital-native?

- Who owns the asset today and how will ownership change after tokenization?

- Is fractional ownership required?

- Who are the end users (institutions, retail investors, internal enterprise users)?

Business Clarity Checklist

- Revenue model (issuance fees, transaction fees, platform subscription)

- Target geography and jurisdictions

- Primary use case (capital raising, liquidity, internal asset tracking)

- Long-term vision (private issuance vs secondary trading readiness)

Without this clarity, even the best enterprise tokenization platform for digital assets will struggle to deliver ROI.

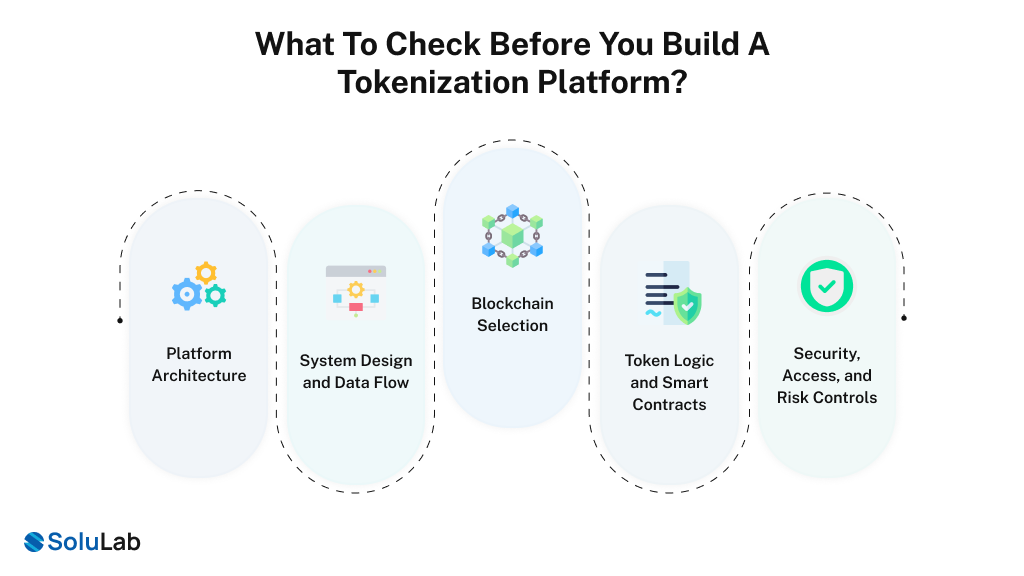

What to Check Before You Build a Tokenization Platform?

This section works as a pre-development readiness gate. The goal is not to design the platform yet, but to confirm whether the organization, asset, and regulatory thinking are mature enough to support tokenization at scale.

1. Organizational Readiness

Before development starts, internal alignment is critical.

Key checks include:

- Alignment between legal, compliance, technology, and operations teams

- Clear ownership of decision-making and approvals

- Budget allocation not just for build, but for audits, maintenance, and upgrades

- Long-term commitment to operate the platform post-launch

Tokenization platforms are not one-time projects. They are an ongoing financial infrastructure.

2. Legal and Compliance Baseline

Compliance should shape architecture decisions from day one.

Key readiness points:

- Clear understanding of how the asset is classified

- Awareness of regulatory exposure across operating regions

- Early definition of compliance responsibilities (issuer, platform, third parties)

- High-level compliance strategy aligned with business goals

A strong compliance strategy for tokenized asset platforms starts before development, not after launch.

Read More: How to Ensure VARA Compliance in Your Blockchain Solution?

Core Checklist 1: Platform Architecture

This layer defines how the platform is structured technically and operationally. Enterprises must take a special tokenization platform development consultancy before jumping into ideas.

Architecture Decisions to Validate

- On-chain vs off-chain data responsibilities

- Smart contract layer vs backend service logic

- Modular architecture for flexibility and upgrades

- Ability to support multiple asset types on the same platform

Early architectural choices determine how easily the platform can evolve.

Enterprise Considerations

- Upgradeability without impacting issued assets

- Role-based access for issuers, admins, and investors

- High availability, performance, and fault tolerance

An enterprise-grade tokenization platform must behave like financial infrastructure, not a prototype.

Core Checklist 2: System Design and Data Flow

System design determines reliability, transparency, and auditability. So, make sure you definitely check them.

Data Flow Planning

- Asset onboarding and verification workflow

- Token issuance and lifecycle tracking

- Ownership transfer and history recording

- Event logging for audits and reporting

Backend System Components

- Asset registry and metadata storage

- User and identity management

- Transaction indexing and monitoring

- Reporting and analytics engine

Well-designed data flow reduces compliance risk and operational friction over time.

Core Checklist 3: Blockchain Selection

Blockchain choice impacts cost, scalability, and user experience, as shown below:

Evaluation Criteria

- Transaction cost stability and predictability

- Network reliability and ecosystem maturity

- Security track record

- Enterprise tooling and integration support

Common Enterprise Approaches

- Public blockchains for transparency and liquidity

- Private or permissioned chains for internal control

- Hybrid models for regulated or restricted assets

Blockchain selection should align with long-term platform goals, not short-term trends.

Core Checklist 4: Token Logic and Smart Contracts

Smart contracts define how tokenized assets behave. Let’s see the details below.

Core Token Logic Requirements

- Minting and burning controls

- Supply limits and issuance rules

- Transfer restrictions and permissions

- Ownership and governance rights

Enterprise-Grade Contract Features

- Role-based permissions

- Pause and emergency controls

- Upgrade mechanisms

- Support for corporate actions such as dividends or splits

Smart contracts must be designed for change, audits, and longevity.

Core Checklist 5: Security, Access, and Risk Controls

Security is foundational, not optional. No matter how big your company is, customer trust depends on transparency and privacy.

Security Checklist

- Independent smart contract audits

- Secure key and wallet management

- Multi-signature admin controls

- Infrastructure hardening

Risk Management Considerations

- Clear separation of admin privileges

- Incident response planning

- Data privacy and encryption

- Regulatory audit readiness

Security failures directly impact enterprise trust and brand value.

Execution Readiness: UX, Integrations, and Go-Live Planning

A technically sound platform still fails if execution is weak. So, first, you must ensure you have all the tokenization platform checklist ready. Once your tokenization platform development company starts building, you can understand the flow and can ask for any customizations.

| User Experience (UI, UX) | Integrations | Go-Live Planning |

| Simple investor onboarding | KYC and AML providers | MVP vs full-scale launch |

| Transparent asset dashboards | Payment gateways | Pilot asset issuance |

| Clear transaction history | Custodians and wallets | Monitoring and feedback loops |

| Intuitive admin interfaces | Enterprise systems (ERP, CRM) | Post-launch support model |

Development cost range

- Basic tokenization platform development: $10,000-$25,000

- MVP tokenization platform: $30,000–$70,000

- Enterprise-grade tokenization platform: $120,000 – $250,000+

- Ongoing maintenance and audits: 15–25% annually

Typical timelines

- Discovery and architecture: 3–4 weeks

- MVP development: 8–12 weeks

- Enterprise platform build: 4–6 months

- Audits and compliance alignment: parallel or post-build

Costs vary based on asset complexity, compliance scope, and integrations.

How SoluLab Helps You Apply This Tokenization Development Checklist?

SoluLab works with enterprises and startups to turn tokenization concepts into production-ready platforms. Our approach focuses on applying this checklist in real-world conditions.

How we support enterprises?

- Asset and platform feasibility assessment

- Architecture and blockchain selection guidance

- Secure smart contract and platform development

- Compliance-aware system design

- Long-term support and scaling strategy

Rather than offering generic tokenization platform development services, SoluLab helps businesses build platforms that are usable, compliant, and scalable.

If you are planning an enterprise tokenization platform for digital assets, starting with a structured checklist is the safest path forward!

FAQs

Finance, real estate, private equity, commodities, carbon credits, and supply chain industries use tokenization to improve liquidity, transparency, and asset management at enterprise scale.

Yes. Banks, regulators, and enterprises worldwide are piloting and deploying tokenized assets, especially for real-world assets, private markets, and cross-border settlement use cases.

You can reach SoluLab through their website contact form or directly book a consultation to discuss your tokenization platform requirements and business goals.

Common integrations include KYC and AML providers, payment gateways, custodians, wallets, ERP systems, CRM tools, and compliance monitoring platforms.

Current trends include real-world asset tokenization, institutional-grade platforms, hybrid blockchains, automated compliance, and integration of tokenization with traditional financial systems.