A few years ago, buying a fraction of a luxury hotel or trading carbon credits instantly across borders was unthinkable. Today, thanks to RWA tokenization, such opportunities are becoming mainstream — with the potential to reshape a $16 trillion market.

The real question is: which blockchain can carry this enormous load? Increasingly, all eyes are on Solana, whose combination of speed, affordability, and ecosystem growth makes it a natural hub for tokenizing the world’s assets. Here’s why Solana could be the key to unlocking this unprecedented financial revolution. Let’s dive in!

Solana’s Role in the Growing $16 Trillion RWA Opportunity

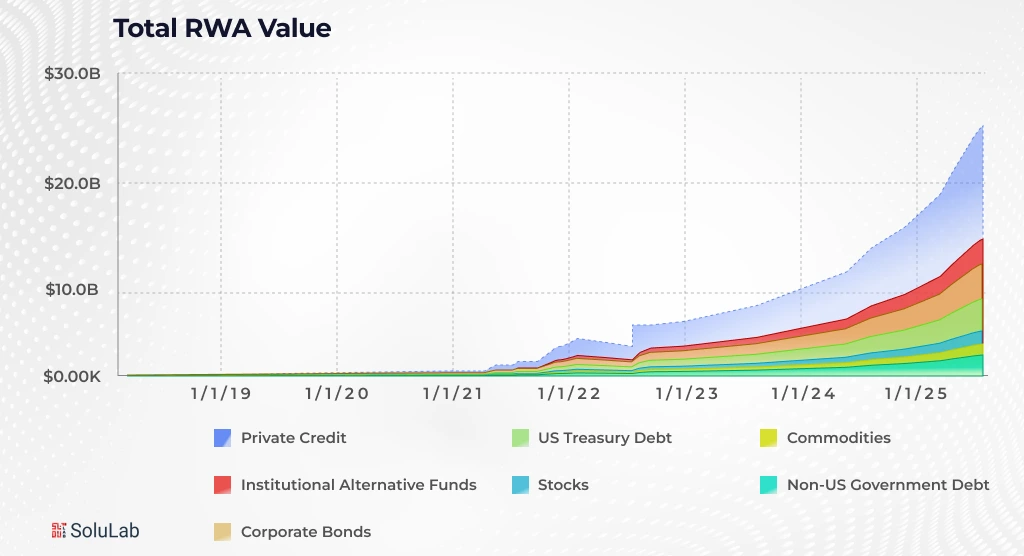

The real-world asset (RWA) tokenization market is witnessing explosive growth, expanding from $5 billion in 2022 to over $24 billion by mid-2025, a 380% surge in just three years. Leading financial analysts and institutions are bullish, like Boston Consulting Group (BCG), which projects the market could reach $16 trillion by 2030, while Standard Chartered forecasts it could climb as high as $30 trillion by 2034.

This rapid expansion is driven by the need for faster, more transparent, and secure ways to digitize real-world assets – including real estate, bonds, loans, and other high-value instruments. Businesses and institutions are increasingly looking for blockchain solutions that combine high throughput, low fees, and robust compliance, making Solana a standout choice.

Solana stands out as the top blockchain for RWA tokenization, thanks to high-speed transactions, low fees, and scalable architecture. For B2B leaders and institutional clients, adopting Solana for RWA tokenization is a strategic move to tap into a multi-trillion-dollar market while staying secure, compliant, and competitive.

Market Overview of RWA Tokenization

1. Market Size and Growth

RWA tokenization is not just hype; it’s real adoption by institutions. The market is already worth over $24 billion and is expected to grow into the trillions in the next decade.

Different forecasts show:

- $16.1 trillion by 2030 – BCG & ADDX

- $30 trillion by 2034 – Standard Chartered

- $18.9 trillion by 2033 – Ripple/BCG

- $3.5–$10 trillion by 2030 – 21.co

This growth is driven by institutions chasing yield in a high-interest market. For example, tokenized U.S. Treasuries jumped from $1.2 billion to $6.9 billion in 12 months. Among all tokenized assets, private credit dominates, making up 61% of the market as of April 2025.

2. Leading Asset Classes

Not every asset is tokenized equally. The categories with the most adoption and liquidity include:

- Tokenized Treasuries & Money Market Funds – $7.4B, up 80% YTD

- Private Credit – $14B+ in active loans, the largest non-stablecoin segment

- Real Estate – Expected $1.5 trillion by 2025, Deloitte predicts $1T in private funds by 2035

- Tokenized Equities – Fractional stock ownership now possible on Solana with projects like xStocks (55 SPL-based equities, including Apple & Tesla)

3. What Institutions Are Doing

Big players are proving this is serious business:

- BlackRock launched its BUIDL USD Institutional Digital Liquidity Fund on Solana in March 2024. The fund grew from $500M to $1.7B in 7 months and now has $3B AUM.

- Franklin Templeton’s FOBXX fund, live since 2021, added Solana in February 2025 and now manages $594M in tokenized U.S. government securities.

These are production-grade deployments, not tests. They validate Solana as a powerful blockchain for real-world asset tokenization.

Why is Solana the Ideal Platform for RWA Tokenization?

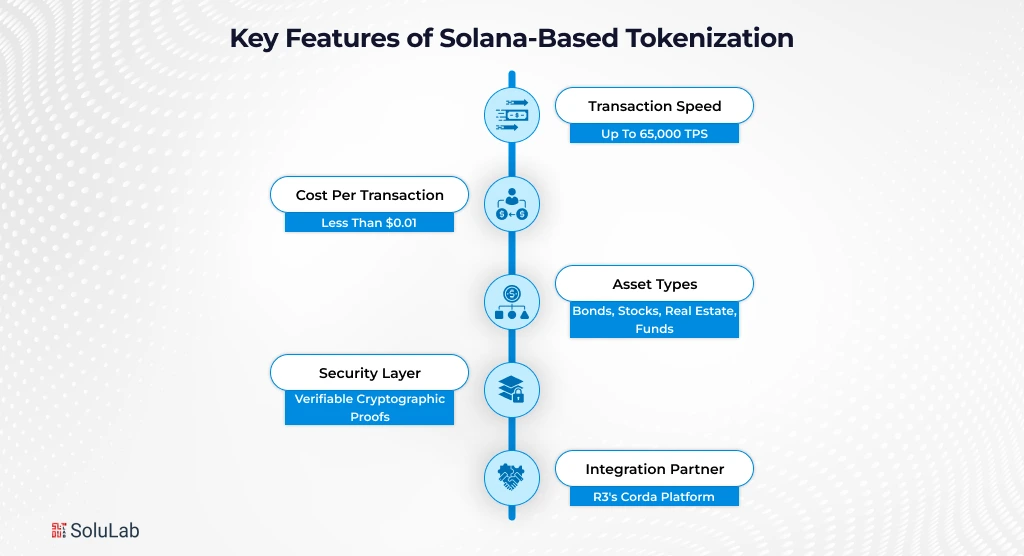

When enterprise teams consider real-world asset (RWA) tokenization, the stakes are high: speed, cost, compliance, and reliability determine whether a project scales successfully. Solana addresses all of these, making it the ideal blockchain for institutional-grade tokenization.

With 65,000+ transactions per second (TPS), sub-cent transaction fees ($0.00025), and 400ms block times, Solana enables real-time settlement for daily yield distributions, dividend payouts, and fractional ownership trades. Unlike Ethereum, Solana avoids network congestion and high gas fees, making micro-investments and fractional ownership practical for both institutional and retail participation.

Low costs also unlock liquidity. For example, a $1 million property can be divided into 10,000 tokens, each valued at $100, allowing both retail and institutional investors to participate together. This fractional ownership model drives a healthy, liquid market for tokenized assets.

The Solana ecosystem is fully integrated for enterprise RWA projects:

- Issuance: Platforms like Securitize manage $2.8B+ in tokenized assets

- Trading: Jupiter, Orca, and Phoenix provide liquidity and secondary markets

- Oracles: Pyth Network delivers ultra-fast 400ms price feeds

- Custody: Anchorage, Fireblocks, and Copper secure institutional assets

- Compliance: Fractal and Civic provide on-chain KYC/AML integration

This end-to-end integration ensures that tokenized assets can instantly serve as collateral, liquidity, or tradable instruments across platforms, providing fast, secure, and cost-efficient solutions.

For regulated enterprises, Solana offers advanced compliance capabilities:

- Token Extensions (Token-2022): Confidential transfers, transfer restrictions, and built-in compliance hooks

- Solana Permissioned Environments (SPEs): Private, regulated subnets for institutional deployments

- Native KYC Integration: Identity verification enforced on-chain without third-party tools

For B2B clients, financial institutions, and asset managers, Solana provides a scalable, compliant, and efficient infrastructure for launching and managing tokenized assets. Enterprises can confidently deploy institutional-grade RWA projects while maintaining regulatory compliance and operational efficiency.

Key Features a Solana RWA Tokenization Platform Needs

When building a Solana RWA platform, it’s not just about issuing tokens. Enterprises need a full-stack solution that is secure, scalable, and compliant. Here’s what your platform should have to succeed in the market.

What technical features should a Solana RWA platform have?

- High-speed processing – Use Solana’s 65,000+ TPS to handle large institutional trades without slowing down.

- Fractional ownership for micro-investors – Let people invest from $1–$100 in tokenized real-world assets.

- Automated smart contracts – Manage dividend payouts, interest accruals, and redemptions automatically.

How to make a Solana RWA platform compliant and secure?

- KYC and AML integration – Real-time identity checks to follow global regulations like SEC and MiCA.

- Audit trails and reporting – Automatically generate reports for compliance and transparency.

- Institutional custody support – Use multi-sig wallets and cold storage to protect high-value assets.

What makes a Solana RWA platform user-friendly?

- Wallet support – Platforms like Phantom and Backpack should natively show tokenized RWA assets.

- Fiat on/off ramps – Easy conversion between USD (or other currencies) and tokenized assets.

- Mobile-friendly interface – Essential for emerging market adoption in regions like LATAM, Africa, and Southeast Asia.

How to track and manage tokenized assets efficiently?

- Real-time dashboards – Monitor asset performance, investor demographics, and yields.

- Portfolio management tools – Let investors manage diversified RWA baskets easily.

- API integrations with finance systems – Connect to Bloomberg, SWIFT, or other traditional platforms for smooth operations.

Business Benefits of RWA Tokenization for Enterprises

Many real-world assets, like real estate, private equity, and infrastructure, are illiquid. By using RWA tokenization on Solana, these assets become tradable 24/7, allowing enterprises to:

- Recycle capital faster for new investments

- Reach global investors without intermediaries

- Reduce holding and management costs

This makes tokenization a powerful tool for businesses looking to maximize asset efficiency.

How Tokenization Reduces Operational Costs?

Manual processes in traditional finance are slow and expensive. Smart contracts on Solana can automate key operations, helping companies:

- Cut operational costs by up to 70%

- Eliminate brokers, clearinghouses, and paper-based settlements

- Streamline asset issuance, trading, and custody

This allows businesses to focus on growth rather than routine processes.

How Tokenization Creates New Revenue Streams?

Tokenizing assets opens up multiple income opportunities:

- Interest from fractional private credit loans

- Platform fees from issuance, trading, and compliance services

- Staking and collateralization: Use tokenized RWAs as decentralized finance (DeFi) collateral to earn additional yield

By diversifying revenue channels, enterprises can generate more consistent returns from their assets.

How Tokenization Improves Risk Management?

Using Solana-based RWA platforms helps enterprises manage risks better:

- Immutable ownership records reduce fraud

- Programmable compliance ensures regulatory rules are followed automatically

- Real-time monitoring allows proactive risk mitigation

These features provide businesses with secure, transparent, and reliable operations.

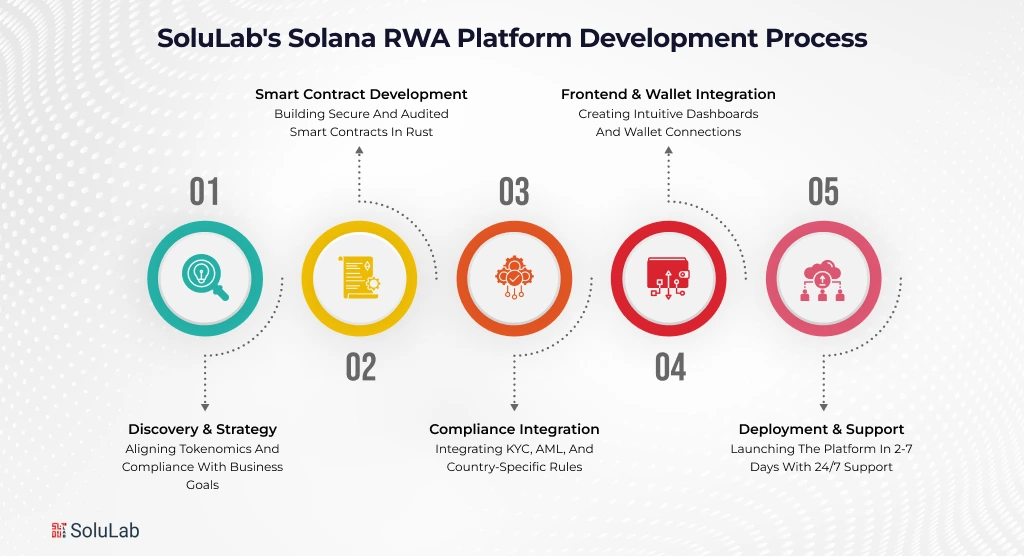

How SoluLab Builds Solana RWA Platforms?

As a top RWA tokenization company, SoluLab provides end-to-end Solana blockchain development for enterprises looking to digitize real-world assets. Our solutions make tokenizing real estate, commodities, and private credit simple, secure, and fast.

1. Discovery & Strategy – We align your tokenomics, compliance, and user experience with your business goals.

2. Smart Contract Development – Build secure contracts in Rust, fully audited for safety.

3. Compliance Integration – KYC, AML, and country-specific rules are built in for high-difficulty compliance needs.

4. Frontend & Wallet Integration – Intuitive dashboards and wallet connections for both retail and institutional investors.

5. Deployment & Support – Launch your platform in as little as 27 days, with 24/7 monitoring and maintenance.

Whether you want to tokenize real-world assets, digital securities, or private loans, SoluLab offers the asset tokenization services you need to succeed.

Conclusion

Solana’s high-speed transactions, low costs, scalability, and robust ecosystem make it the ideal blockchain for RWA tokenization. Enterprises looking to digitize and trade real-world assets can leverage Solana’s capabilities to enhance liquidity, operational efficiency, and access to capital.

By partnering with experienced developers like SoluLab, enterprises can successfully navigate the complexities of RWA tokenization and capitalize on the opportunities presented by this burgeoning market.

Contact us today to get started!

FAQs

1: Why work with an RWA tokenization development company?

A professional RWA tokenization development company like SoluLab helps enterprises design, build, and deploy secure tokenization platforms. They ensure compliance, integrate smart contracts, and provide operational support, reducing technical risks and accelerating go-to-market timelines.

2: How do I choose the right RWA tokenization company?

A trusted RWA tokenization company will provide end-to-end solutions: from smart contract development to compliance integration, custody solutions, and ongoing support. Look for companies with proven experience in Solana blockchain development and enterprise-grade security practices.

3: How fast can I launch a Solana RWA platform?

A Solana RWA platform can be launched quickly, depending on complexity. Basic tokenization setups can go live in 11 days, while full-featured platforms with KYC, custody, and trading features take 8–12 weeks.

4: Which assets are easiest to tokenize on Solana?

Tokenized Treasuries are the simplest due to regulatory clarity. Mid-difficulty assets include real estate and private credit, while high-difficulty assets include complex structured products. Tokenization allows enterprises to unlock liquidity and reach global investors efficiently.

5: How does Solana compare to Ethereum for RWA tokenization?

Solana processes 65,000+ TPS with fees under $0.01, whereas Ethereum handles ~15 TPS with fees of $10–$100+. For enterprises seeking fast, low-cost, and scalable RWA tokenization platforms, Solana provides a superior solution for tokenizing real-world assets at scale.