Artificial Intelligence is transforming every field and financial modeling is no exception. It has changed the traditional ways financial professionals analyze data and improved decision-making. Traditionally, financial modeling had been an intensive process with labor and required high manual input and analysis. However, introducing AI in technologies streamlines the processes to enhance efficiency and accuracy. AI for financial modeling excels in understanding huge piles of data from recent trends to historical data to identify patterns that humans may overlook.

Moreover, AI financial modeling can forecast market movements and risk assessment with greater precision by leveraging machine language leading to more informed investment strategies. As AI continues to develop, its impact on financial modeling will keep on growing which makes it essential for navigating the complexities of dynamics. Projections estimate that the banking industry could increase by $340 billion as a result of Generative AI.

What is AI Financial Modeling?

The creation and optimization of financial models with the use of artificial intelligence and machine learning techniques is known as AI financial modeling. AI financial modeling utilizes advanced algorithms and data-processing spot patterns, makes predictions, and produces insights from financial data, as compared to traditional financial modeling techniques that mostly rely on human input and ad hoc spreadsheets.

AI financial modeling combines the capabilities of machine learning, deep learning, and natural language processing with the financial modeling concepts of corporate finance and accounting. The development of more flexible and financial models is made possible by these AI technologies, which can:

- Process and examine vast amounts of data to find complex patterns and links that human analysts would not notice right away.

- Adjust in real time in response to fresh data inputs or shifting market conditions.

- Reduce human error and save time for deeper research by automating repetitive operations and computations.

How Does AI Work for Financial Modeling?

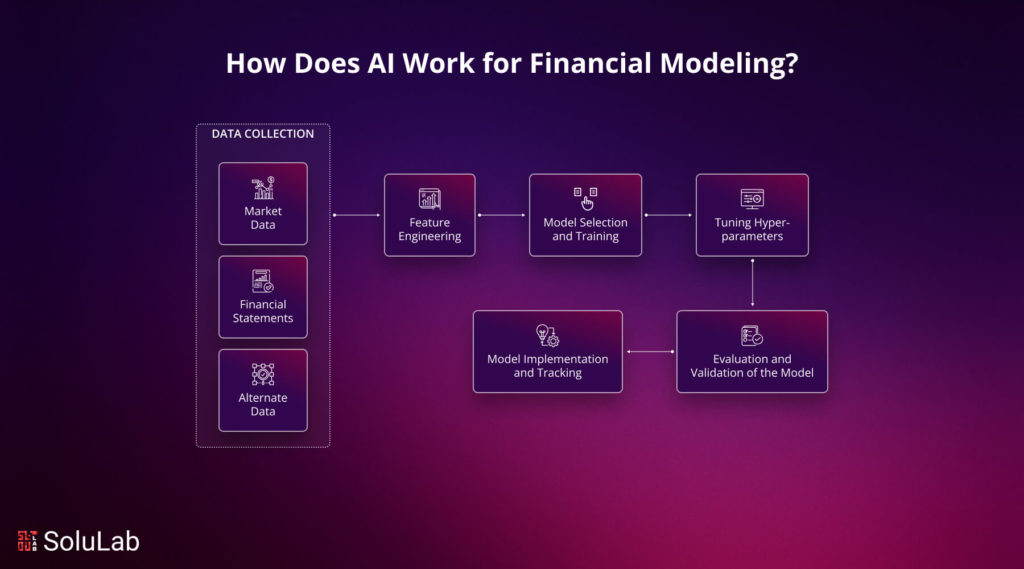

Automation is a key benefit of AI in financial modeling. AI is being widely used in algorithmic trading, where financial institutions employ algorithms to analyze market data and make trades at a higher pace. By leveraging AI tools for financial modeling, businesses can indulge in new possibilities easily for growth and success. The future of finance is intertwined with the developments of AI. Here are the key points on how financial modeling AI works for financial modeling:

1. Data Collection

AI starts with gathering all the data from available sources. 9 out of 10 organizations support AI for a competitive advantage. These sources include:

- Market Data: Real-time data can easily be gathered from stock exchanges and financial news enhancing the accuracy of the model in assessing risk and forecasting.

- Financial Statements: Income statements, balance sheets, and cash flow statements are the data used to provide a comprehensive view of a company’s financial health.

- Alternate Data: Some other sources like social media sentiment and web scraping offer insights into market trends and consumer behavior, this can be ignored easily.

2. Feature Engineering

The selection and transformation of relevant variables from raw data to generate the most informative features for machine learning models is called feature engineering. The AI financial model generator system can analyze data to find the drivers of financial outcomes and optimize the process. This step improves the models’ precision and reduces data complexity.

3. Model Selection and Training

The financial model AI can select the best machine learning models for financial modeling purposes, based on their properties given data, and particular goals of investigation. For instance, if the aim is to predict the future values of the stock, then it will choose a time series forecasting model, like ARIMA or LSTM. After this step, the selected models are trained.

4. Tuning Hyper-parameters

Free AI for financial modeling uses Hyperparameter tuning refers to the process of adjusting the parameters involved in the machine learning models for better performance. Through the use of grid search or random search, the artificial intelligence system can automate this procedure by trying different combinations of hyperparameters and then scoring them on how well their performance is on the validation set. It’s thus quite easier to ensure that these models are tailored to the specific problem. 63% of organizations intend to adopt AI globally within the next three years

5. Evaluation and Validation of the Model

AI systems can, on their own, assess the performance of the models they have been trained for on various metrics such as F1-score, accuracy, precision, and recall. Another financial modeling AI tool they can utilize is cross-validation so that the models can generalize on fresh, untested data. This will make it possible to deploy only top-performance models and also detect any overfitting or underfitting problems.

6. Model Implementation and Tracking

AI financial model algorithms can be constructed to deploy trained and tested models right into production— Web Apps or APIs. Moreover, they can track their performance in real-time and trigger notifications upon discovery of anomalies or mistakes. This way, it makes sure that the models keep working effectively and enables one to spot possible problems or alterations in the underlying data.

In general, artificial intelligence modeling is useful in the Customer service automation and optimization of several financial modeling processes, right from data gathering to model deployment and monitoring. Financial analysts can improve accuracy, and time, and make better decisions driven by data insights by leveraging AI.

Here are the top 10 financial modeling AI tools:

- Datarails

- Planful Predict

- Stampli Inc.

- Trillion Inc.

- Booke AI

- Cube

- Domo

- Nanonets

- Gradient AI

- Sage Intacct

How is AI Financial Modeling Different From Traditional Financial Modeling?

On many grounds, AI modeling financial modeling ensures much more efficiency, accuracy, and adaptability compared to traditional financial modeling. Recent banking trends reveal that the operating profits of the U.S. banking sector could grow by $340 billion with the use of generative AI.

| Aspect | Traditional Financial Modeling | AI-Powered Financial Modeling |

| Automated Operations | Primarily tied to time-consuming human data collecting and entry which is prone to errors. | Reduces human mistakes and facilitates real-time data incorporation by automating data entry and collecting. |

| Ability to Predict | Less responsive to shifts in the market because of a reliance on data from the past and predetermined assumptions. | Makes use of machine learning techniques to identify patterns and generate more precise predictions. |

| Personalization | Provides broad estimates based on several predictions. | Evaluate each investor’s profile to provide recommendations specific to their objectives. |

| Analysis of Scenarios | Static solutions often face problems with “what-if” situations. | Fast stimulation of multiple scenarios at once for financial soundness evaluation. |

| Reporting and Graphics | Leads to a lot of complicated and large spreadsheets. | Produces accessible reports and graphics for improved stakeholders. |

In a nutshell, AI financial modeling outperforms all the traditional techniques through the use of process automation, prediction accuracy, personalized insights, and dynamic scenario analysis, all leading to superior financial decisions in the end.

Applications of AI in Financial Modeling

Here are some AI use cases in financial modeling that will help you better understand AI in financial modeling:

-

Algorithm Trading

AI financial modeling algorithms are used to analyze market trends with real-time data, this helps execute trades at a much higher speed and also helps in capitalizing opportunities. For example: A hedge fund will use machine learning to predict short-term prices in stock movement which would be based on order book data to profit even from small price differences.

-

Automated Data Processing

Data processing can be automated when dealing with AI for financial modeling that can be collected, cleaned, and integrated automatically from all sources, including news articles, market data streams, and accounting systems. This, in turn, reduces the time used in data preparation and gives the analyst more time to focus on more complex analysis and modeling.

-

Improving Analytics

AI tools for financial modeling algorithms or machine learning models can thus be used to scan historical data for patterns and trends that could aid in improving the accuracy levels of projections for financial performance, market conditions, and economic indicators. Investment decisions and financial estimates can therefore be seen to be more professional.

-

Recognizing Fraud

Artificial Intelligence models, through the constant analysis of market activity and financial transactions, can help in tracking suspicious trends and abnormalities that might indicate fraud or any form of financial crime. This also enables any financial organization to upkeep asset protection and regulatory compliance.

-

Optimizing Investment Strategy

AI modeling can be used at a fast pace to evaluate massive amounts of data, from financial statements to market news and sentiment on social media, for finding under-valued assets, possible avenues of investments, and risk factors. Such information would then be used to help investment managers optimize their portfolios and make better selections.

-

Simplifying Reporting and Compliance

It ensures accuracy and timeliness in regulatory filings and the generation of financial reports. Furthermore, financial modeling examples also assist firms in keeping up with the continuously changing requirements by scanning any changes that will be made to the models.

Read Blog: Top 10 AI Development Companies in Finance

Implementing AI in Financial Modeling

Most of the implementation of AI agent use cases into financial modeling will be based on a systematic approach according to which new technologies will be combined with well-known and relevant financial practices. Here is a step-by-step guide on how artificial intelligence can be combined with financial modeling:

-

Goal Setting

Setting clear goals is thus the first step toward the integration of AI in financial modeling. Second, define your goals for using AI agents. To create more accurate forecasts, strengthen control over risks, or perfect the methods of investing. Setting clear objectives will help measure progress and keep the implementation process on track.

-

Assemble a Multidisciplinary Team

Put together a team consisting of domain experts, IT experts, data scientists, and financial analysts. This kind of collaboration across domains is necessary to understand the financial background and the technical requirements for introducing agent artificial intelligence. Each of the participants brings very unique perspectives that can improve overall performance.

-

Audit Data

The quality and sources of the existing data must be audited. Test the availability, relevance, and reliability of the data in question—of interest to Finance AI agent models. After this is provided, the information gaps that would arise with the integration of external databases or gathering more data can be identified. This would ensure that the base for AI modeling is sound and complete.

-

Choose the Right Technology Stack

Choose the right technologies and tools for implementing AI agent use cases. This may involve selecting machine learning frameworks like TensorFlow or PyTorch, data processing tools such as Apache Spark, and programming languages like Python or R. The technological stack shall align with the specializations in your team and the goals regarding your financial modeling.

-

Create Prototypes

Test the feasibility of AI models in the real world by developing prototypes. To test the principles underlying more complex algorithms, develop simple basic models. Prototyping will allow experimentation and assist in early detection of problems.

-

Apply Agile Methodologies

Follow agile development and implementation processes for artificial intelligence models. This approach will enable iterative development that sustains small adjustments based on testing and feedback. Regular sprints and reviews will help keep the project aligned with the goals of the corporation and the needs of users.

-

Governance Structure Implementation

Second, establish a governance framework that shall govern the application of financial model AI, emphasizing compliance with laws, data protection, and ethical issues. In this line, the framework should set policies for data usage, model transparency, and accountability to hold users responsible and ethical in the usage of AI applications.

-

Assess Performance Measures

Set up some KPIs that can help in measuring the performance of AI models for financial modeling. The metrics can be return on investment, user happiness, analysis speed, and accuracy of forecasting. Look at these indicators regularly to find out where the integration of AI is working well and where it needs to be improved.

Benefits of AI for Financial Modeling

The incorporation of AI into financial modeling with the help of an AI agent development company brings along several advantages that help improve the efficacy and efficiency of financial analysis. Some of the key benefits include:

- Higher Accuracy: AI systems are less prone to human error when working through big data sets with high accuracy. Therefore, financial assessments and forecasts can be deemed more reliable for decision-making.

- More Speed: AI tools for financial modeling can automate time-consuming operations that not only include data entry and processing for analysis but also help prepare financial models and reports much faster compared to conventional methods. The financial analyst is now much better placed to respond to market and customer demands almost instantly.

- Better Ability to Make Decisions: Advanced predictive analytics from financial modeling examples is more granular in understanding probable future events. It allows financial professionals to make better decisions based on data-driven insight. They are capable of processing and analyzing complex datasets very accurately, reducing the possibility of human error.

- Scalability: AI financial model systems easily scale to meet the requirements of complicated modeling requirements with growing data sets. In that respect, due to its ability to adapt, financial modeling can continue to function without the need for a substantial increase in resources as organizations grow and data quantities rise.

- Mitigation of Risk: The analysis of real-time data identifies the possible dangers and improves risk management. By identifying these outliers and trends, Artificial Intelligence enables problem-solving at the firms before their situation worsens, in the end safeguarding the financial assets.

- Economy of Cost: The financial modeling AI tool, has the capacity of a lever of enhancement in financial analysis, reduces the time and resources required by automating repetitive operations, and improves the accuracy of financial models. This reduces operational expenses and frees financial teams to focus on important projects, not putting them into mundane tasks.

How SoluLab Transformed Banking and Finance with Gen AI?

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

The Final Word

AI is changing customer service by making interactions faster, smarter, and more efficient. From chatbots handling to predictive analytics improving personalization, AI helps businesses deliver seamless support at scale. It reduces response time, operates 24/7, and learns from past interactions to get better over time.

While human agents remain essential for complex issues, AI allows them to focus on higher-value tasks by handling repetitive ones. As technology continues to grow, the blend of human empathy and AI efficiency will define the future of customer experience—faster, happier customers, and smarter support systems across industries. The banking industry struggles with rising customer expectations, outdated manual processes, and growing cybersecurity threats.

SoluLab stepped in as a leading AI development company to automate operations and boost personalization. This reduced workload and enhanced digital experiences for customers. Banks also strengthened data security with advanced AI-driven safeguards. The result? 3x higher customer satisfaction, 70% faster processes, and 98% fewer cyber threats.

FAQs

1. What does AI mean for financial modeling?

The inclusion of Artificial Intelligence technologies—such as Machine Learning and Natural Language Processing—into financial modeling increases the accuracy and efficiency of financial models. It eases data processing, offers better predictive analytics, and gives more insight to help one make a decision.

2. How does AI improve the accuracy of financial model predictions?

Artificial intelligence helps in increasing forecasting accuracy by raking through huge information to find out patterns and trends, which human analysts would simply disregard. Over time, machine learning algorithms can adapt to new data, refining forecasts and allowing for more accurate projections in finance.

3. Is AI useful for risk management in financial modeling?

Indeed, AI is a must in risk management since it works relentlessly and points out threats instantaneously in financial data. With the power to score almost all varieties of risk indicators, such as credit risk and market volatility, AI eases the way for businesses to reduce the likelihood of losses efficiently.

4. What type of financial models would most benefit from the integration of AI?

Artificial intelligence can enhance financial models on credit scoring, stock price prediction, portfolio optimization—fraud detection systems, and many other areas. Only naturally, all of these models will benefit from the increased accuracy and productivity that AI can provide.

5. How can SoluLab help with AI in financial modeling?

SoluLab deals in custom AI-driven financial modeling solutions tailored to the enterprise segment. With a focus on automated investing platforms, risk management tools, and predictive analytics, SoluLab can help businesses leverage AI in fine-tuning and modernizing their financial strategy and decision-making processes. To find out more about how we can help with your financial modeling projects, get in touch with us.