The new definition of longevity is no longer just about the biotech theme. It is now a long-standing economic force in this century. With AI and blockchain technology, the healthcare industry is transforming data handling and research.

The recent reports say that 60-plus citizens are spending nearly $15 trillion annually on lifespan solutions. This demand is now discussed among central banks, insurance companies, asset managers, and policymakers. This is where industries’ long-term vision is shaped, and the real world gets impacted. To know more about Lovey investing, dwell on the following discussion.

Key Takeaways

- Enterprises can reduce R&D timelines by up to 40% and improve capital efficiency by adopting AI-driven longevity platforms supported by blockchain governance.

- AI and blockchain together form the core infrastructure of the longevity economy, enabling trusted data sharing, faster discovery, and scalable investment models.

Why Longevity Investing Is Shifting Toward AI and Blockchain?

As the traditional healthcare models are adopting technology, this is simplifying data management and reducing operational costs. Additionally, AI development solutions enable quick discovery, predictions, and customization. With blockchain in the picture, the healthcare industry is maintaining a sustainable financial model. Let’s see how longevity investing with AI and Blockchain is remodelling healthcare.

- Longevity-focused AI systems can analyze millions of biological data points to identify aging pathways, treatment responses, and preventive interventions at unprecedented speed and scale.

- Blockchain technology enables secure, decentralized health data networks that preserve privacy while allowing collaboration across hospitals, research labs, insurers, and governments.

- Investors increasingly favor platform technologies that reduce research timelines by 30–50% and lower operational risk across the longevity value chain.

This shift reflects a broader understanding that longevity is not only a medical challenge, but also a financial and systemic one.

1. Why Traditional Longevity Models Are No Longer Enough

Traditional models of longevity and healthcare were made to treat short-term illnesses, not to improve long-term health. These models depend a lot on data that is kept in separate places, slow clinical processes, and care pathways that react to events.

- It can take legacy systems 10 to 15 years to get a single therapy to market, which is a big risk for investors and makes it hard for them to grow.

- Centralized data ownership makes it harder for people to work together and makes it harder to train AI models that work well with different groups of people.

- Insurance and pension frameworks presume deteriorating health with advancing age, rendering them structurally incompatible with the extension of healthspan.

Without AI-driven intelligence and blockchain-based coordination, new ideas for living longer are still slow, costly, and not well-connected.

2. Market Insights

Longevity has become a common topic in analytical reports from major financial institutions, suggesting that it is a structural change rather than a short-term trend.

- Several big banks, including CitiBank, UBS Group, Julius Baer, and Barclays, have published research that shows longevity is a long-term macroeconomic driver that is changing capital markets.

- In 2023, more than 300 companies and 250 investors were actively working at the intersection of blockchain and longevity. This shows that more organizations are getting involved.

- People are starting to want to invest in long life in countries with strong fintech, digital health, and geroscience ecosystems.

- For instance, Switzerland is home to almost 10% of all European FinTech companies.

These insights confirm that investing for the long term is going from risky exploration to smart allocation.

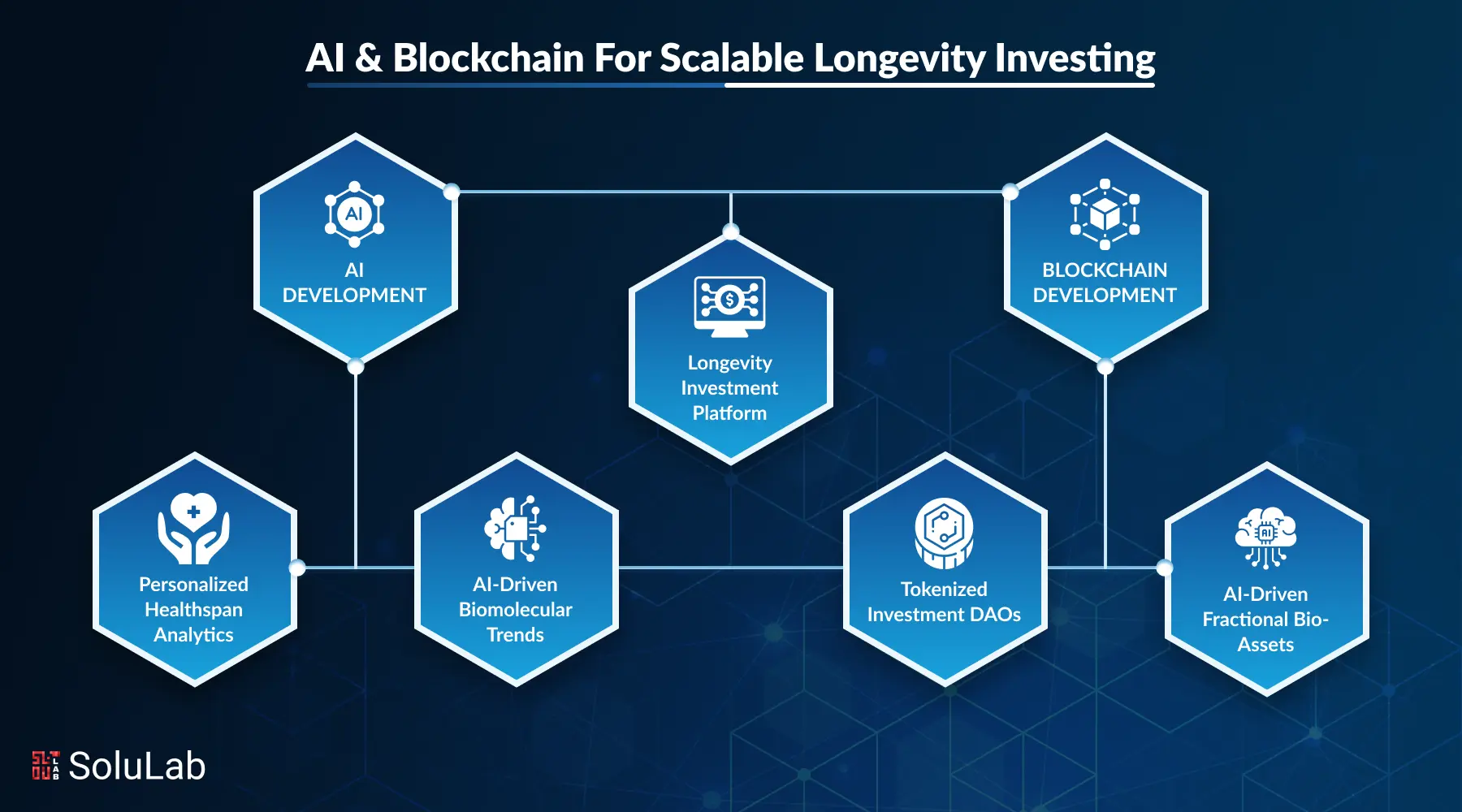

How AI and Blockchain Work Together in Longevity Investing?

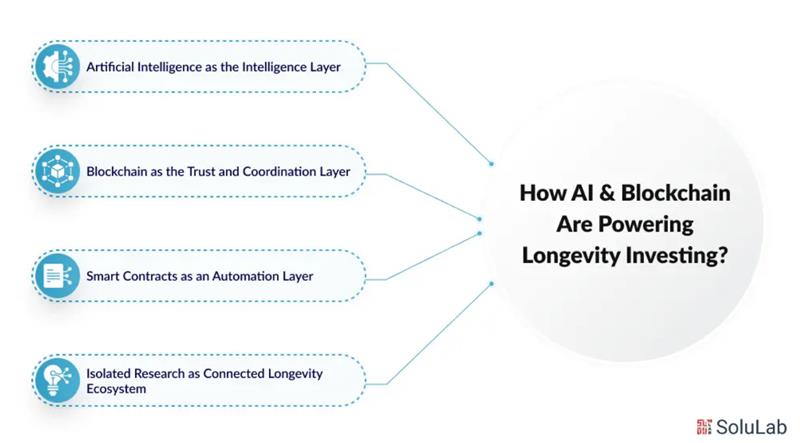

AI and blockchain are not competing technologies in longevity investing. They solve different parts of the same structural problem. AI extracts intelligence from biological and health data, while blockchain ensures that this data can be trusted, governed, and exchanged at scale.

1. AI in Longevity Investing as the Intelligence Layer for Longevity

Artificial intelligence is a key part of turning complicated biological signals into useful information. There isn’t just one thing that makes you age. It includes genetics, metabolism, the environment, behavior, and biological changes that happen over time, which traditional analytics can’t handle well.

- AI systems look at multi-omic datasets, long-term health records, and clinical trial results to find ways that people of all ages and populations can slow down the aging process and improve their health.

- Predictive AI models help find people who are at risk of getting worse as they get older, before the actual age. This makes it possible to use preventive healthcare instead of reactive healthcare.

- Generative AI speeds up drug discovery by simulating how molecules interact and suggesting new compounds. This cuts the time it takes to find new drugs by several years.

This intelligence layer makes capital more efficient in longevity investing by lowering uncertainty and making it easier to predict outcomes.

2. Blockchain as the Trust and Coordination Layer

Trust is one of the biggest problems in longevity research and investment, and blockchain solves that problem. Health and biological data are very sensitive, broken up, and controlled. AI models can’t grow responsibly without good governance.

- People can control how their health data is accessed, shared, and sold across research networks with blockchain-based consent frameworks.

- Immutable ledgers make it possible to check records of data use, clinical trial results, and research contributions. This makes it easier to reproduce results and boosts trust in regulations.

Decentralized infrastructure lessens the need for one institution. This leads people from different countries to work together without any central authority.

3. The Role of Smart Contracts and Tokenized Incentives

Smart contract development brings in automation and alignment to ecosystems that last a long time. They get rid of the need for manual coordination by using programmable logic that is linked to results.

- When certain milestones are reached, research funding can be automatically released. This cuts down on administrative problems and the wrong use of funds.

- Verified health outcomes, not fixed age-based assumptions, can start insurance payouts and financial products linked to longevity.

- Tokenized incentive systems fairly reward data contributors, researchers, and platform participants, which encourages people to stay involved in the ecosystem for a long time.

Crypto and blockchain-based financial rails make it possible for people all over the world to invest in longevity while still following the rules and being able to trace their investments.

4. From Isolated Research to Connected Longevity Ecosystems

When AI and blockchain are integrated, longevity research shifts from isolated projects into coordinated, data-driven ecosystems.

- AI models continuously improve as more verified data flows through blockchain-secured pipelines

- Researchers, healthcare providers, insurers, and investors operate on shared infrastructure rather than fragmented systems.

- Decision-making becomes faster, more transparent, and better aligned with long-term health outcomes.

This systemic shift is essential for longevity investing to scale beyond niche innovation.

Key Benefits for Investors, Researchers, and Healthcare Systems

With AI and blockchain integration, the benefits are increased in the longevity economy. Here are some benefits that you can go through:

1. Benefits for Longevity Investors

Investing for the long term takes time, but it also takes efficiency and the ability to handle risk. Both AI and blockchain make things better.

- Investors get to know about platform-based longevity technologies that work with drugs, diagnostics, insurance, and financial products.

- AI-driven insights lower the risk of R&D, which speeds up the time it takes to get value and helps make better decisions about how to build a portfolio.

- Transparency based on blockchain makes due diligence better by giving researchers, testers, and marketers access to data that can be checked.

These things make long-term investment opportunities fit with the needs of institutional capital.

2. Benefits for Researchers and Innovators

For scientific progress in longevity to happen, scientists need to work together, have access to data, and get funding regularly.

- AI speeds up the process of coming up with hypotheses, designing experiments, and interpreting results, which lets researchers concentrate on work that has a big impact.

- Decentralized funding models that use blockchain technology make it less necessary to rely on traditional grants and single funding bodies.

- Shared data infrastructure makes it easier for institutions and countries to reproduce and cross-validate their work.

This environment makes it easier to turn research into real-world use.

3. Benefits for Healthcare Systems

Healthcare systems are having a hard time because of rising costs and an aging population. AI and blockchain solutions that focus on longevity deal with both.

- Top AI development companies can help businesses create personalized care plans that improve healthspan instead of just treating problems as they come up.

- Blockchain cuts down on administrative costs by getting rid of duplicate data entry, manual reconciliation, and broken record systems.

- Sharing data safely helps providers keep providing care without breaking patient privacy.

These efficiencies lead to better results at a lower cost to the system.

4. Additional System-Level Benefits

The longevity ecosystem benefits structurally, not just for individual stakeholders.

- AI-driven longevity platforms have shown the 40% cost reduction in finding new drugs.

- Insurance claims, clinical trials, and drug supply chains have all experienced a reduction in fraud. Financial products that are linked to long life create new kinds of assets that are based on health outcomes that can be measured instead of short-term treatment cycles.

These benefits work together to make investing for the long term stronger, clearer, and more focused on getting results.

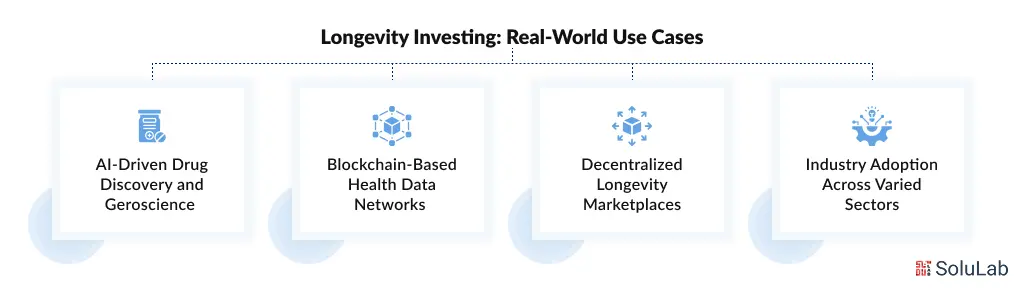

Real-World Use Cases Emerging Today

As the longevity innovation has already taken root, now it’s time to check where it has actually been deployed. Let’s go through the real-world use cases.

1. AI-Driven Drug Discovery and Geroscience

AI-powered platforms are speeding up the search for geroprotective compounds and biomarkers of aging.

- Machine learning models look at how biological aging happens to find places where interventions can be made in a number of disease categories.

- AI is used by pharmaceutical and biotech companies to rank drug candidates based on how likely they are to succeed.

- These platforms speed up the process of finding new drugs and lower the chances of failure in the later stages.

This makes drug development that focuses on longevity more cost-effective right away.

2. Blockchain-Based Health Data Networks

Health data networks that are safe are becoming basic infrastructure.

- Blockchain for healthcare lets hospitals, research institutions, and insurers work together without putting sensitive data in one place.

- Patients stay in charge while giving anonymized data to big research projects on longevity.

- Sharing data across borders helps researchers around the world study how people age and what can be done to help them.

These networks are very important for training AI models on a large scale.

3. Decentralized Longevity Marketplaces

Blockchain is making it possible for new markets to buy and sell goods and services that help people live longer.

- Customers can get verified supplements, diagnostics, wearables, and health services that are made just for them when supply chains are clear.

- It keeps track of where the product came from, how good it is, and whether or not it is real. This lowers the risk of counterfeiting.

- Smart contracts make it easy to do business and check for compliance.

These marketplaces make things easier and more reliable for both buyers and sellers.

4. Industry Adoption Across Sectors

Many industries are starting to use AI and blockchain solutions that focus on longevity.

- Insurance and pension companies are looking into products that take into account a person’s healthspan instead of their chronological age.

- Pharmaceutical and biotech companies use AI and blockchain together to make discovery, trials, and regulatory reporting better.

- FinTech and WealthTech platforms see longevity as a dividend that affects how portfolios are built over the long term.

Countries like Switzerland, Japan, the United States, the United Kingdom, and Israel are testing out financial and healthcare systems that focus on longevity.

The Future of Longevity Investing: A Long-Term Relationship, Not a Short Bet

Long-term investment is not a short-term opportunity that comes from hype cycles. It is a long-term structural change that is changing economies, financial systems, and what people expect from society.

- National longevity strategies will bring together geroscience, digital health, and fintech into a single economic system.

- Financial systems that use blockchain will see longevity as an asset that can be measured, not as a risk that can be calculated.

- AI-driven personalization will change healthcare from reactive treatment to ongoing health optimization.

Over time, the longevity industry is expected to grow bigger than most other industries in terms of market size and capitalization. Investors who get in on this change early and back scalable AI and blockchain solutions will be in a good position to lead the next phase of global economic growth.

Conclusion

As discussed, longevity transformation works best when advanced technology strengthens data trust, regulatory alignment, and long-term value creation. AI and blockchain together enable enterprises to build scalable longevity infrastructure without disrupting existing healthcare, financial, or research systems.

This is where an experienced blockchain development company makes the difference. At SoluLab, we focus on enterprise-grade AI and blockchain solutions tailored for longevity investing, healthcare innovation, and data-driven life sciences.

- 40% faster research validation through AI insights built on blockchain-verified health datasets

- 35% reduction in data fraud risk using immutable audit trails and consent-driven data access

- 25% improvement in cross-organization collaboration across healthcare, biotech, and insurers

If you are ready to integrate AI solutions for longevity investing, healthcare systems, or biotech platforms, connect with SoluLab today!

FAQs

Integration timelines typically range from 2 to 8 weeks, depending on system complexity, data readiness, and compliance needs. Modular AI and blockchain solutions enable phased deployment without disrupting existing healthcare or longevity investing workflows.

Development costs usually start from $15,000, based on use cases, data volume, AI models, and blockchain architecture. Scalable solutions help enterprises optimize costs while unlocking long-term longevity investment opportunities.

Enterprises can connect with SoluLab through the official website to discuss AI and blockchain integration for healthcare and longevity investing. The team offers consultation, architecture planning, and end-to-end development support.

Yes. AI enables personalized, preventive care while blockchain ensures secure data sharing and transparency. Together, they reduce errors, improve continuity of care, and lower operational costs, delivering measurable improvements across healthcare systems.

AI is accelerating biotechnology by improving drug discovery, biomarker identification, and clinical trial efficiency. In longevity investing, AI-driven biotech platforms reduce R&D timelines, increase success rates, and attract stronger institutional interest.