- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

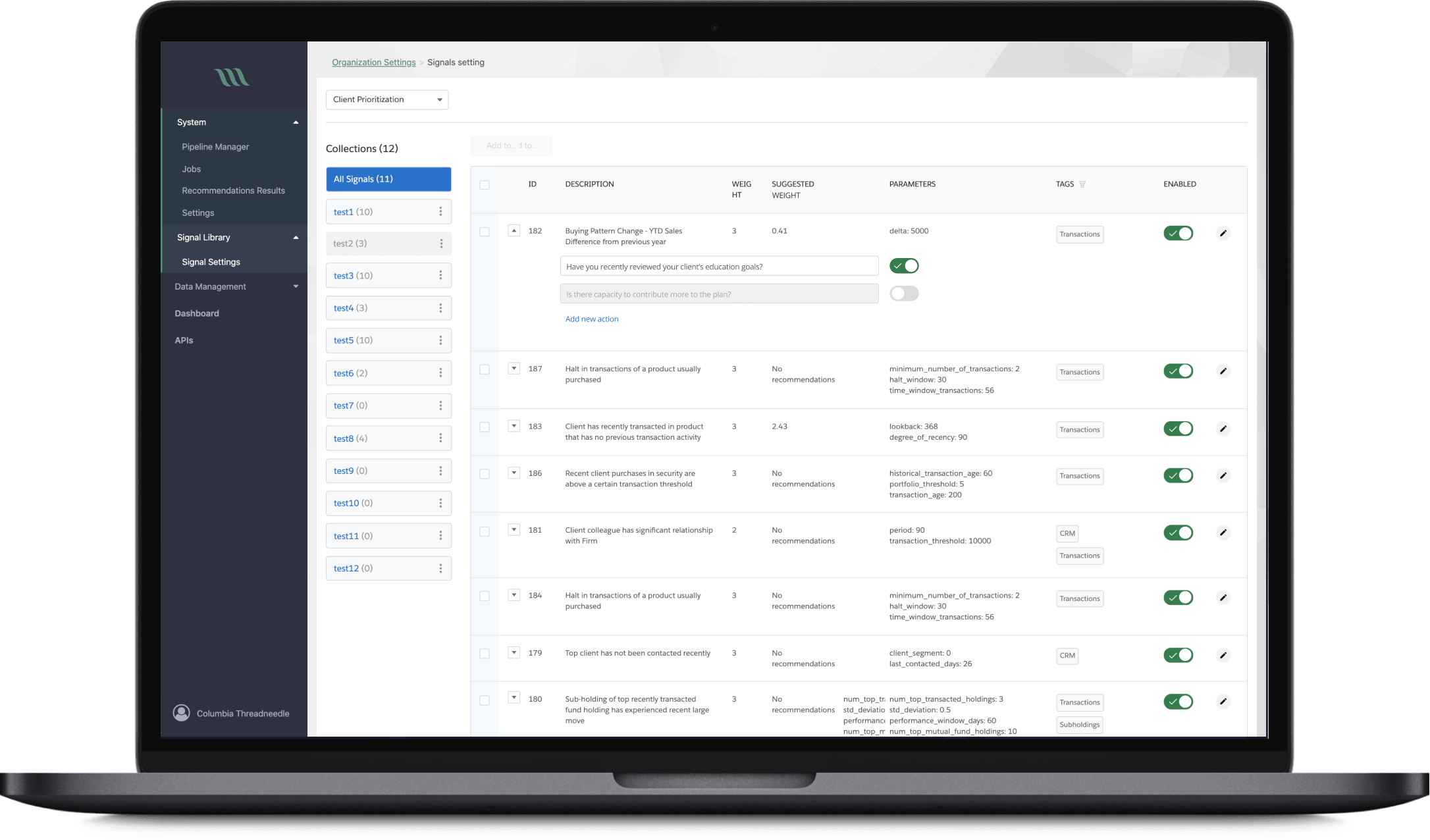

The system uses machine learning techniques to process various content feeds in real-time and boost productivity of a financial analyst or a client relationship manager in such domains as wealth management, commercial banking, fund distribution.

Tech Stack / Platforms

Features

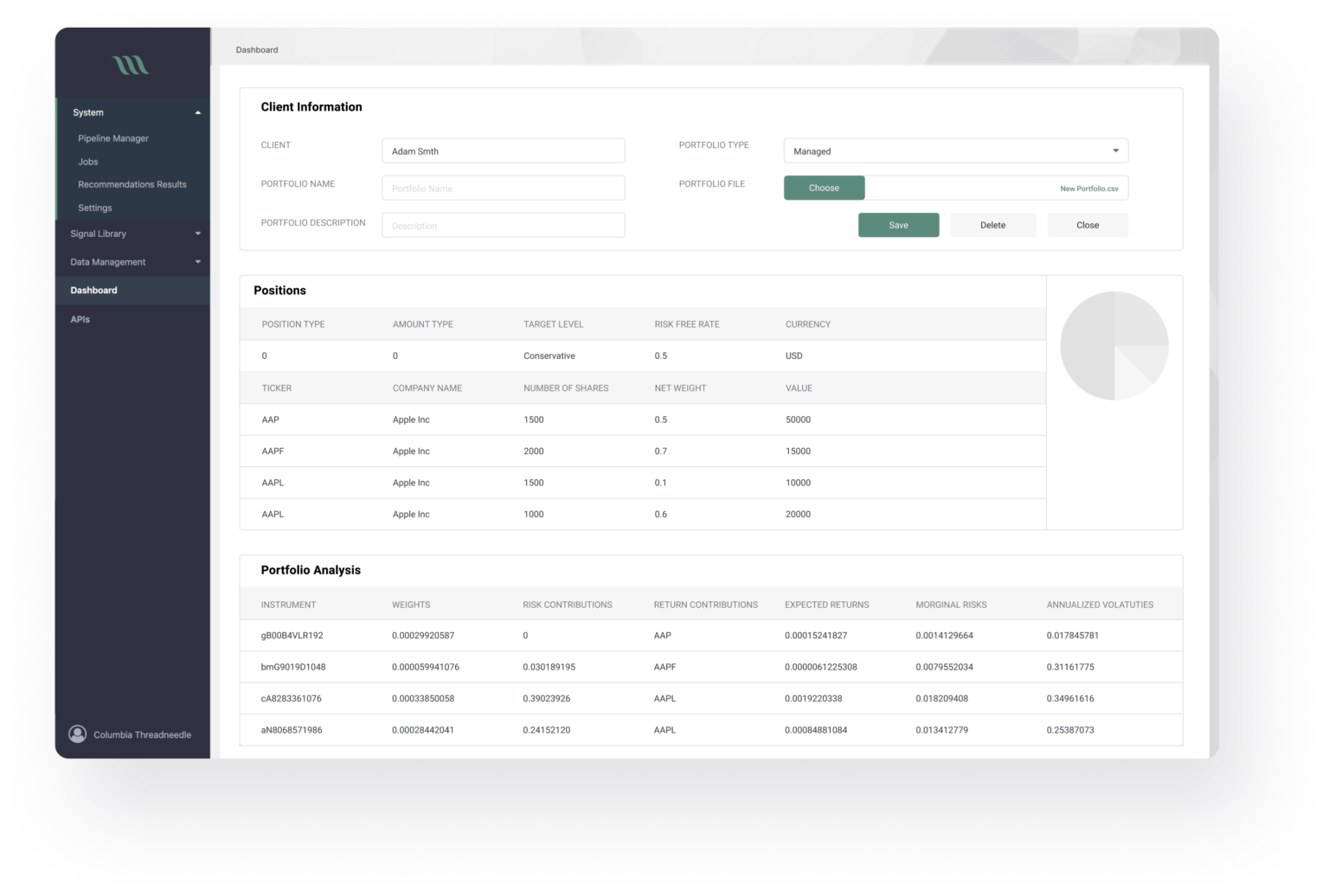

- Investment portfolio analysis and optimization

- Fund recommendation based on quantitative analysis and back testing

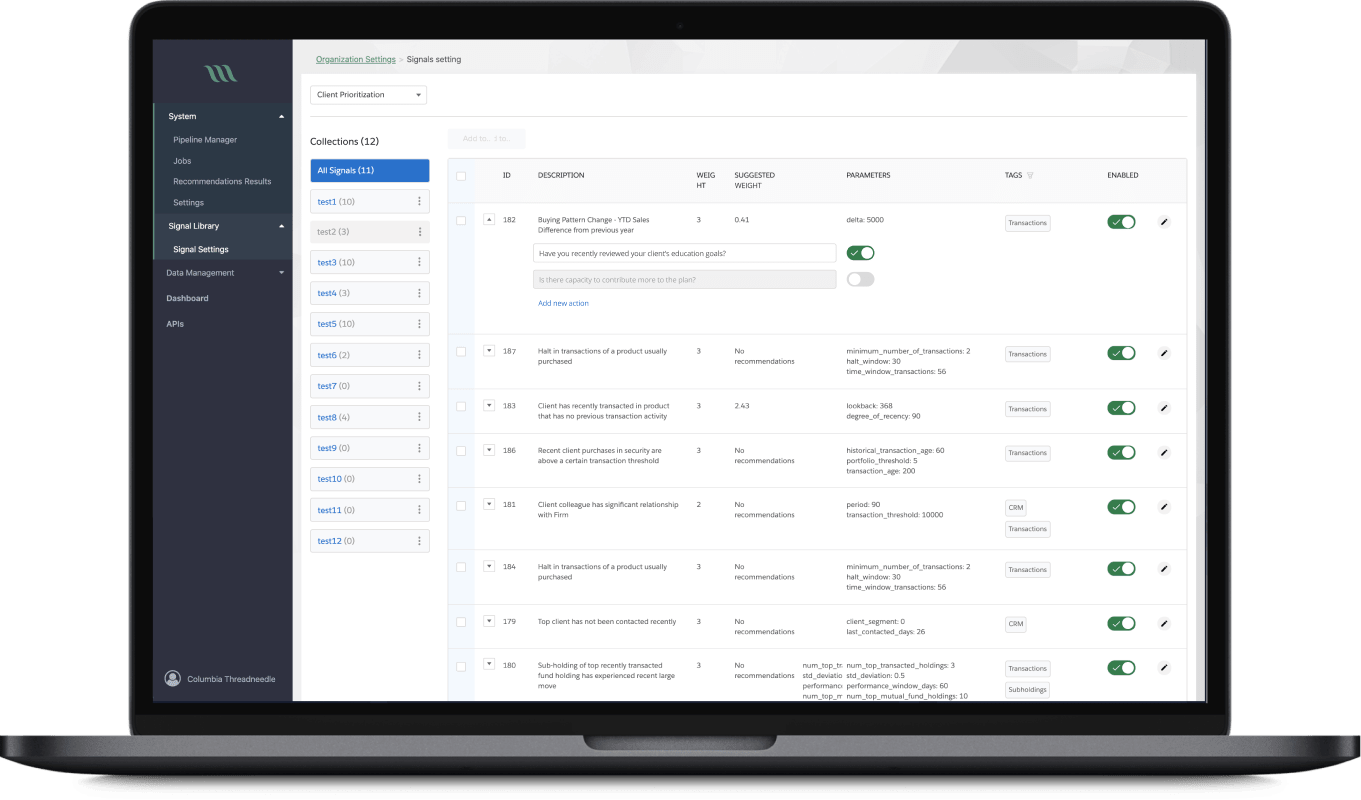

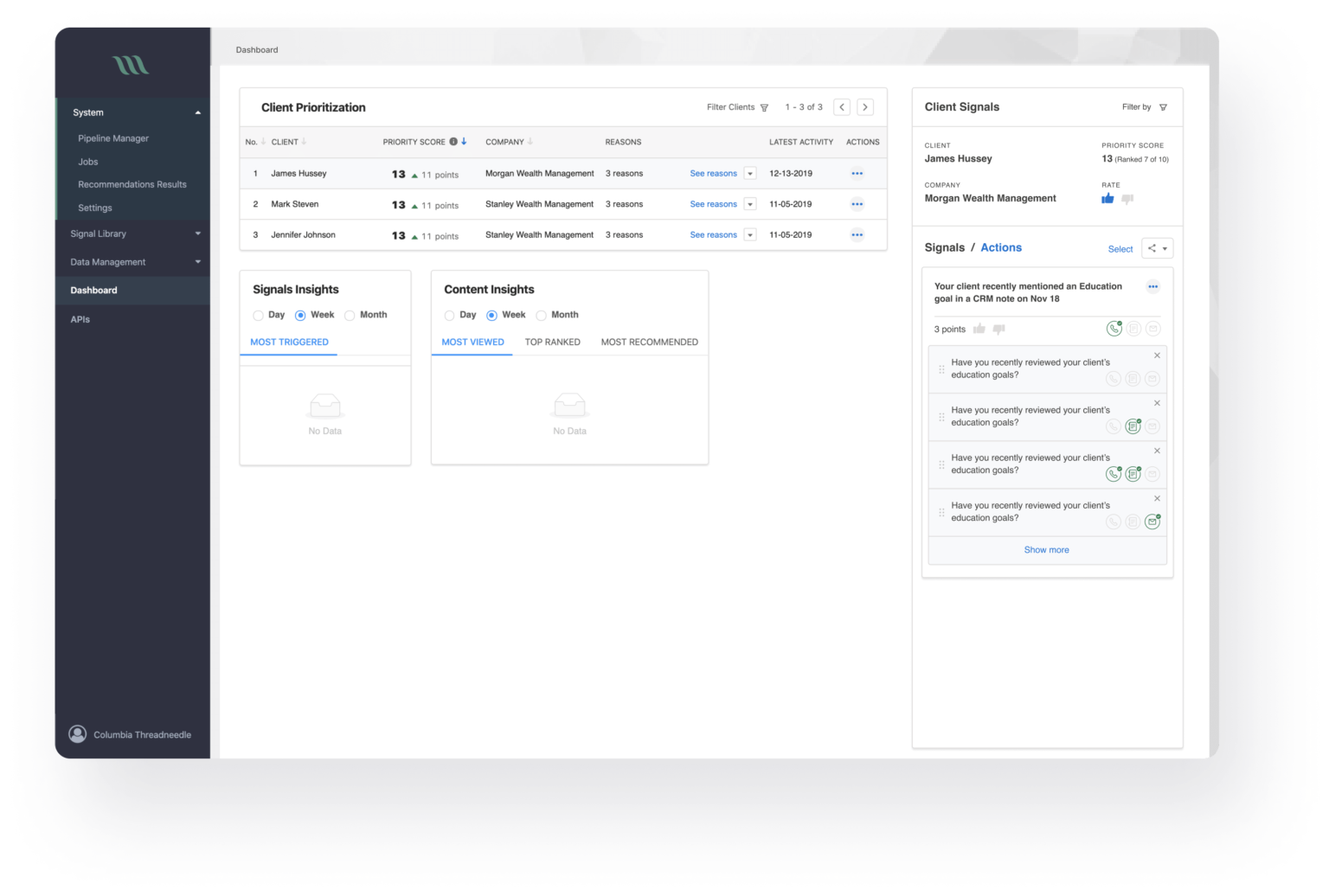

- Client prioritization – which client to call first and why basing on client’s portfolio, transactions, CRM notes and market events analysis

- Content recommendation – recommending news and research papers relevant to the client’s business and current market situation

- Chat bot natural language interface – ability to answer advanced questions about specific funds, stocks or market events

- Real-time analysis of multiple data feeds from ThomsonReuters, Morningstar and other sources.

How it Started

June 2015

The client contacted SoluLab by a reference with an idea of a Fintech product. Initially the functionality of the system was very small. It was meant to provide quantative recommendations of Liquid Alternatives (mainly Hedge Funds) to a client’s portfolio by analyzing mutual correlations, risk/return ratio etc.

Discovery Phase

July 2015

We started the project with a discovery phase during which the SoluLab team elaborated the idea into a requirements specification. Our Software Architect analyzed suggested integrations and came up with an estimate and architecture for the MVP of the system.

First Version

October 2015

The initial MVP allowed a client to upload his portfolio, show quantitative analysis of the portfolio, and get a recommendation for its optimization using pre-configured securities.

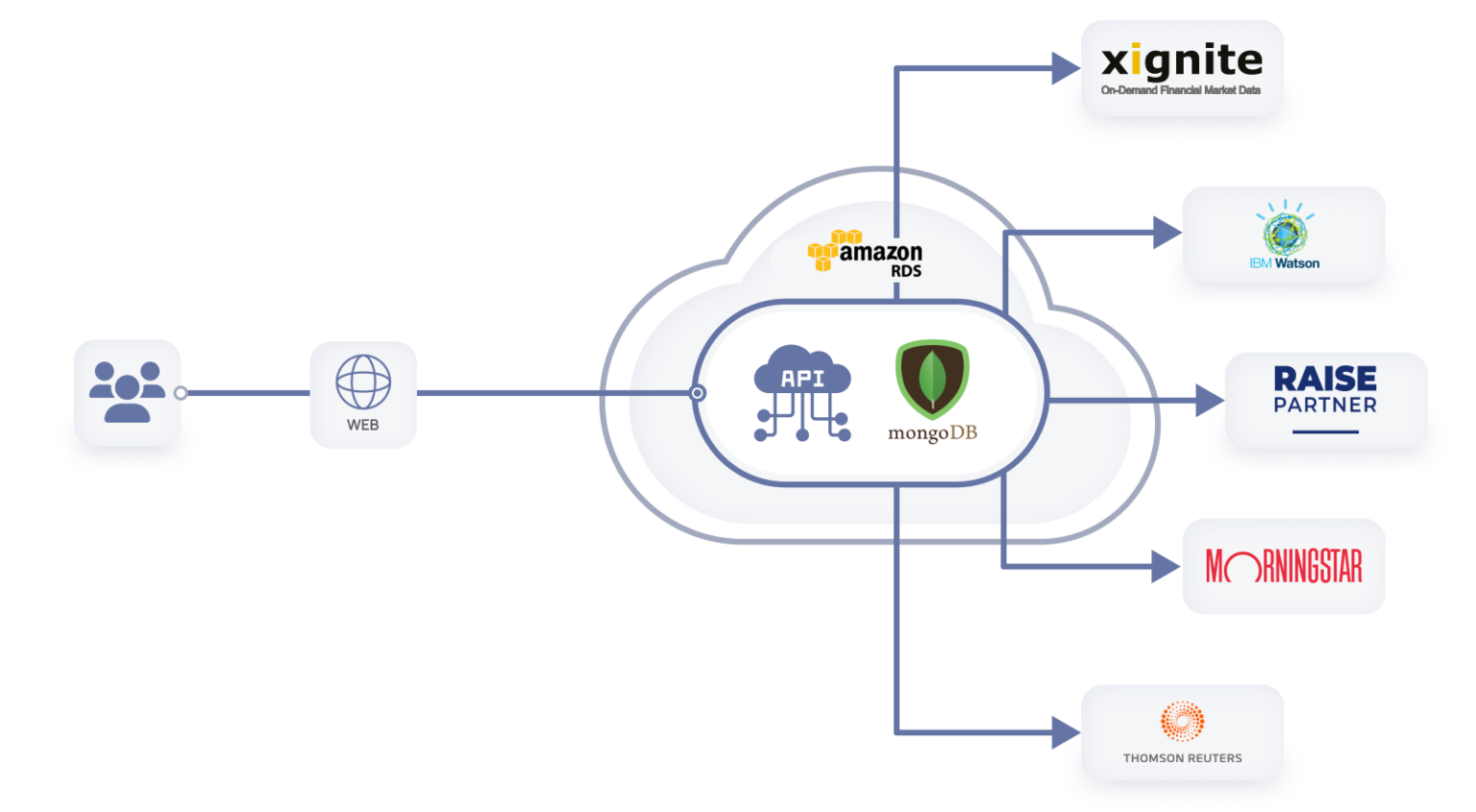

It had two integrations:

- Xignite to obtain daily price changes for a variety of securities from NYSE and NASDAQ;

- Raise Partner – quantitative analysis engine that calculated various financial metrics of the portfolio. It included Risk, Return, Sharpe Ratio, Skeweness, Max Drawdown, Diversification, Volatility etc for the whole portfolio and contributions of each instrument in the portfolio. This also allowed portfolio optimization to achieve various goals, i.e. minimize the risk/maximize the return or the Sharpe ratio.

IBM Watson

November 2015

During the implementation of the MVP the Client significantly changed the product idea. He saw a tremendous opportunity in combining quantitative analysis in Finance with Artificial Intelligence and Natural Language Processing.

We created a quick PoC that combined IBM Watson conversation services with already implemented portfolio analysis and recommendation service. It allowed the potential user to ask questions about their portfolio and market situation in natural language and receive in response a thorough personalized analysis using various data sources and quantities engine.

TechStars

January 2016

The PoC had a tremendous success. It allowed the client to enter two accelerator programs – Fintech Sandbox in New York and, later, TechStars London. The startup raised the Seed round investment from TechStars and also from Thomson Reuters at the end of the program.

The client moved from New York to London for 3 months to participate in TechStars accelerator program. During that time, SoluLab management and technical team visited the client 3 times for one week and participated in the brainstorms and product strategy. After work parties built close partner relationship between our team and the Client resulting in SoluLab becoming an investor and technological partner of the product.

Morningstar

May 2016

While the Client was taking care of the business side of the startup at TechStars, our development team has been working on expanding the conversation interface with new intents and new data providers.

We integrated various APIs from Morningstar including Morningstar data feed on funds, Morningstar reports and Morningstar API center. This resulted in an increase of the number of various questions about different funds the system could handle.

The updated functionality also supported analysis of market events and their impact on user’s portfolio. The system explained which factors (interest rates, oil prices etc.) affected the performance and volatility of the funds or a portfolio.

Thomson Reuters

June 2016

After graduating from TechStars program the Client signed an agreement with Thomson Reuters who became a strategic partner/reseller and investor. Thomson Reuters was interested in adding AI fintech services to its platform and offering these features to its clients.

This collaboration led to the integration of multiple Thomson Reuters services:

- Machine readable news

- IntelligentTagger (OpenCalais) NLP processing service

- Real time and historical stock quotes

- Stock and Fund analytics and Bear/Bull forecasting services

All this information was integrated with existing conversational interface and available via questions and answers.

Third-Party Integrations

- Xignite provides cloud-based financial market data distribution solutions for fintech companies and financial services providers. It is integrated to obtain daily price changes for a variety of securities from NYSE and NASDAQ.

- Raise Partner is a quantitative analysis engine that calculates various portfolio financial metrics and allows portfolio optimization to achieve various goals.

- IBM Watson Conversational Service enables conversational interfaces to be integrated into any application, device, or channel. It’s been integrated as a complement to the portfolio analysis and recommendation service to allow the potential user to ask questions in natural language and receive a thorough, personalized analysis based on multiple data sources and quantities engine.

- Morningstar is a financial services company that provides a range of investment research and investment management services. It’s integrated to provide real-time global data on various types of securities.

- Thomson Reuters provides expert resources, tools and technology in the areas of tax, legal and risk helping financial services companis deliver world-class services to their clients. We’ve integrated various Thomson Reuters services into the existing conversational interface and made the information provided by Thomson Reuters accessible to users through questions and answers.

Change of the Strategy

January 2016 – Summer 2017

It appeared that the Client’s vision of the AI-based system that is able to speak about any financial question and provide client’s content and personalization was too big to implement in a short time frame and for the Seed round investment budget.

The product was also too big to sell as it intended to significantly change the way financial institutions worked. Meanwhile, the Seed round money ran out. Development was essentially paused and the Client took time to rethink the strategy.

AI Content Recommendation and Client Prioritization System

August 2017

After a few month’s pause the Client came back with a new product strategy. He decided to narrow the focus and start building the big vision with small practical steps: Intelligent APIs that could supplement existing processes and systems used in the financial world rather than aiming to replace them. This also meant that each API could be sold separately.

The first version of the essentially new product contained two APIs:

- Content personalization

- Client prioritization

With the help of various machine learning algorithms, the APIs analyze all the information the financial institution has on their clients: CRM data and CRM notes, recent transactions, portfolios, market information in the news about their sector/location.

This solution could improve efficiency of Relationship Managers. The system recommends which clients should be called first, as it indicates if there may be a problem that needs to be solved or an opportunity for cross-sell/upsell. Managers could also be better prepared for the meetings by reading relevant content about this client (news, bank’s analytical material, about products, industry, trends etc.).

The content personalization API analyses the real-time data feeds and processes them with various NLP techniques. With the help of machine learning algorithms, it recommends which content is the most relevant to a given client. Thus saving the time spent on manual preparation and making the service much more personalized to the end clients.

First Real Clients

April 2018 – May 2018

Large European commercial bank and US asset management company became the first clients of the AI-powered platform. In May 2018 the client successfully closed series A investment of $5 000 000 with the strategic investor.

Present Time

Currently the project continues with addition of more and more AI and financial functionality into the product and new clients acquisition.

Technical Solution

Machine Learning

- NLTK

- TensorFlow

- Spycy

- Scikit-learn

- Neo4j

- IBM Watson

NLP

- Entity extraction

- Text classification

- Topic modelling

- Sentiment analysis

- AI search

Recommendation system

- Hybrid Collaborative filtering

- Similarity analysis

- Deep neural Networks