The crypto market has been cyclical for over a decade. Prices increase, prices deflate, stories shift, and new fashions replace the ancient. Retail speculation was the dominant force in early adoption, and institutions largely remained on the margins.

But that phase is ending…

The total crypto market capitalization has passed through various trading milestones, such as the multiple trillion-dollar thresholds in the recent cycles, as per the data provided by CoinMarketCap. It is not the short-term performance but the long-term performance that is important now. The shift is apparent, as reported by the World Economic Forum and Forbes. Crypto development solutions are ceasing to be a type of speculative asset and are becoming a layer of world finance.

2026 is expected to be the year this transition becomes visible at scale.

Key Takeaways

- Crypto in 2026 is shifting from speculation to infrastructure, with enterprises driving long-term adoption across banking, payments, and asset management.

- Institutional capital now accounts for over 60% of market influence, reshaping liquidity, standards, and market behavior.

- Stablecoins and RWA tokenization are becoming core financial tools, enabling faster settlements, payroll, and cross-border trade at scale.

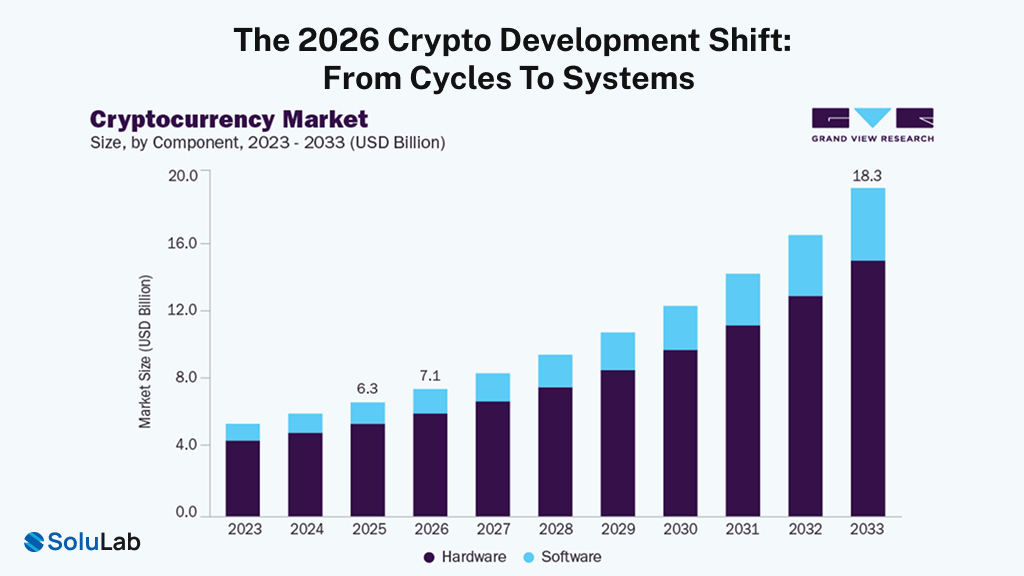

The 2026 Crypto Development Shift: From Cycles to Systems

Crypto is no longer evolving around hype cycles. It is being rebuilt as financial infrastructure.

A Look at the Historical Data

In early cycles between 2023 and 2026, crypto growth followed predictable boom and bust patterns. Bitcoin halvings, retail demand, and leverage drove prices. Infrastructure, compliance, and governance came later.

From 2021 onward, things began to change.

- Institutional custody solutions matured

- Central banks started studying digital assets seriously

- Regulators moved from uncertainty to structured frameworks

Statista data shows that institutional exposure to crypto assets has grown steadily, even during market downturns. This suggests long-term confidence rather than short-term speculation.

Why Systems Matter More Than Cycles Now?

Financial systems depend on reliability, not volatility. By 2026, crypto will be designed to meet enterprise standards.

This includes:

- Compliance-ready platforms

- Transparent asset backing

- Interoperability with traditional finance

- Scalable infrastructure for global usage

Crypto in global finance is becoming less visible to users but more critical to back-end operations.

7 Crypto Trends Driving the Global Market in 2026

These trends show how crypto is no longer operating on the fringes of finance. By 2026, it will become part of real economic systems, governed by capital discipline, regulation, and enterprise use cases.

#1. The End of the Pure “Four-Year Cycle” Thinking

For years, crypto markets were explained through simple cycles driven by Bitcoin halvings and retail speculation. That model is starting to break.

Institutional capital does not behave like retail money. Pension funds, asset managers, and corporate treasuries allocate slowly and hold for longer horizons. As this capital grows, market behavior becomes more stable. Instead of sharp boom-and-bust cycles, the crypto market is moving toward longer accumulation and consolidation phases.

This does not mean volatility disappears. It means crypto starts behaving more like an emerging asset class than a casino.

#2. Bitcoin Evolves into a Strategic Crypto Asset

Bitcoin has been starting to be regarded as a long-term strategic asset, as opposed to a short-term trade. Companies, governments, and institutions have started considering Bitcoin as one of the commodities, foreign reserves, and other assets.

This change is important as it varies the quality of demand. Strategic holders tone down the pressure of reflexive selling and bring credibility to crypto in international finance. Bitcoin has been playing a more fundamental part in the overall crypto market capitalization than a speculative one.

#3. Regulation Unlocks Institutional Participation

The year 2026 is looking like one where regulating will cease to be a menace and begin serving as an enabler.

Simpler structures in the US, Europe, and some parts of Asia are providing institutions with legal protection to deploy capital. This is particularly vital to crypto in financial services, where compliance is not an option.

Some Facts:

United States: Better classification of assets, ETF approvals and custody regulations.

European Union: MiCA framework of stablecoins and services with digital assets.

Middle East: Sandbox and pro-innovation crypto licensing.

Asia: Good quality and adherence to restricted institutional access.

Regulation gives the banks and the enterprises an understanding of how to handle the custody, the classification of the assets, and the risk management. That is what opens serious capital.

#4. Stablecoins Become Core Financial Infrastructure

Stablecoins are slowly accomplishing what not even other crypto assets have ever accomplished: application at scale in the real world.

They are already being used in payroll, treasury management, and offshore settlements. Global financial research bodies argue that hundreds of billions of transactions are done every month with stablecoins.

In 2026, AI powered crypto banking solutions will use stablecoins as a central element and a significant contributor to integrating crypto in banking systems.

#5. RWA Platform Development Moves from Pilot to Production

Tokenization of real-world assets is no longer experimental. Government bonds, commodities, funds, and real estate are actively being tokenized.

The global market for tokenized RWAs is expected to grow into the trillions over the next decade. For enterprises, RWA in crypto offers better liquidity, faster settlement, and global access.

RWA crypto investments are becoming part of mainstream portfolio construction.

#6. Compliance-First Crypto Design Becomes Standard

Those platforms that are constructed non-compliantly find it hard to survive. KYC, AML, proof-of-reserves, and auditability are now mandatory as opposed to optional.

This trend is creating a need of enterprise level platforms and white-label crypto bank development agencies that know both technology and regulation.

#7. Automation and Smart Financial Workflows Take Over

Reconciliation, settlements, and reporting are being automated by smart contracts and intelligent systems. This saves the cost of operation and human error.

Crypto is not about tokens anymore, but it is about financial workflows, which are programmable and can scale around the globe.

How to Choose the Right Crypto Model by Industry and Region?

Not every crypto model works everywhere. Industry use cases and regional regulations matter.

| Industry | Primary Focus Areas | How Crypto Is Applied | Business Value |

| Banking & Financial Services | Stablecoins, tokenized deposits, secure custody | Banks integrate stablecoins for settlement, offer digital asset custody, and explore tokenized liabilities | Faster settlements, reduced counterparty risk, new revenue streams |

| Asset Management | Tokenized funds, on-chain settlement, regulated DeFi | Funds tokenize traditional assets and use blockchain for post-trade settlement | Improved liquidity, lower operational costs, and global investor access |

| Commodities & Trade | Tokenized commodities, RWA platforms | Gold, oil, and carbon credits are tokenized and traded on-chain | Better price transparency, fractional ownership, and faster trade settlement |

| Fintech & Payments | Cross-border payments, treasury management | Crypto rails and stablecoins replace slow correspondent banking | Near-instant settlements, lower fees, 24/7 operations |

| Enterprises & Corporates | Treasury optimization, global payouts | Corporations use stablecoins for payroll and vendor payments | Capital efficiency, reduced FX friction, operational simplicity |

How Modern Crypto or RWA Platform Development Will Look in 2026?

Developing crypto and RWA infrastructure in 2026 will be less experimental and more implementation-oriented. Businesses desire compliant systems that would operate on the first day.

1. Consulting & Strategy: Determine the appropriate crypto or RWA model in accordance with business objectives, industry application, and local policies. This phase is the prevention of expensive redesigns in the future.

2. Custom Architecture Design: Platforms are customized with the help of modular, multi-chain, and hybrid blockchain structures to guarantee scalability and regulatory flexibility.

3. Compliance Integration: The KYC, AML, transaction monitoring, and reporting features are not implemented as an additional feature on a platform.

4. Platform Development: Enterprise-grade standards are used to develop platform-based smart contracts, asset tokenization logic, custody integrations, and APIs.

5. UI / UX design: Easy-to-use interfaces are created in a manner that users would be communicating with financial products rather than complicated blockchain processes.

6. Testing & Launch: The platforms become operational following security testing, regulatory testing, and performance testing.

A modern Crypto Development Company now delivers end-to-end, fintech-grade solutions rather than experimental Web3 products.

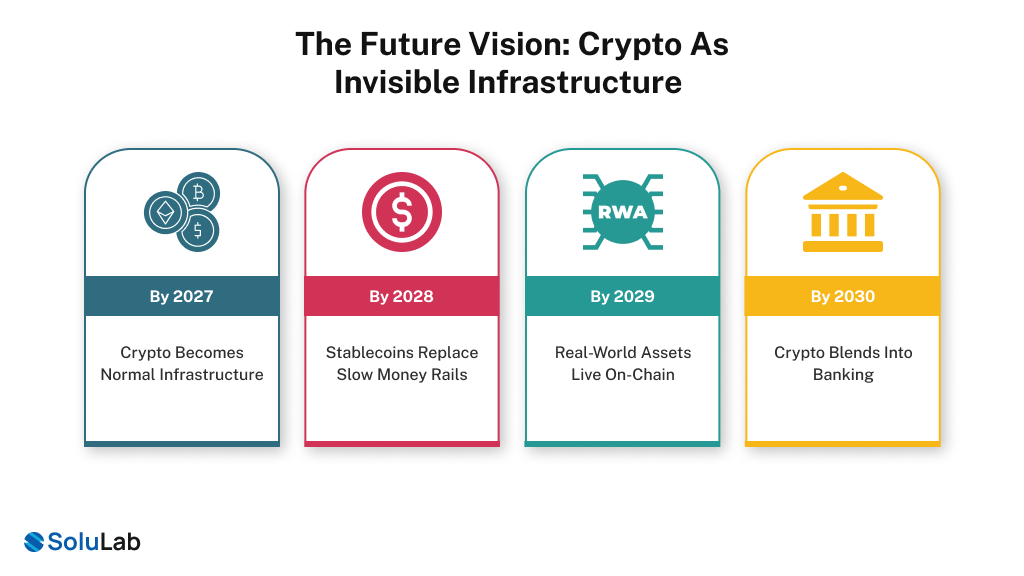

The Future Vision: Crypto as Invisible Infrastructure

The future of crypto is not about speculation or buzzwords. It is about usefulness.

By 2027, crypto becomes normal infrastructure

Crypto will stop being treated as a separate industry. In major economies like the United States and the European Union, digital assets will quietly support payments, settlements, and custody.

By 2028, stablecoins replace slow money rails

Stablecoins will be widely used for payroll, cross-border trade, and treasury operations. Businesses will move value in minutes instead of waiting days.

By 2029, real-world assets live on-chain

Government bonds, funds, and commodities will be tokenized. Tokenized securities like U.S. Treasuries will trade globally with instant settlement.

By 2030, crypto blends into banking

Banks will offer crypto-backed products without calling them “crypto.” Users will interact with familiar apps, powered by blockchain behind the scenes.

Long term, crypto becomes invisible

When crypto works best, people won’t notice it. They’ll just experience faster, cheaper, and more transparent finance.

Conclusion

Through the right crypto and RWA infrastructure, your business can take a new turn. Discuss the details in more depth with a top Tokenization Platform Development Company like SoluLab. The right partner is key to long-term success.

SoluLab offers effective solutions and services aligned with modern crypto and tokenization needs. For example:

- Regulatory Compliance & Licensing Integration

- RWA Platform & Asset Tokenization Development

- Crypto Banking & Stablecoin Infrastructure Solutions

These are just a few of the services available. With 250+ in-house expert developers, your vision can move from concept to reality within weeks.

Contact us today to start building future-ready crypto systems.

FAQs

Crypto or RWA platform development typically costs $10,000 to $200,000, depending on features, compliance needs, asset type, and region-specific regulations.

Development usually takes 3 to 6 months, including consulting, compliance integration, smart contracts, UI/UX design, testing, and launch.

Gold and silver tokenization converts physical metals into blockchain-based crypto assets, backed 1:1, enabling fractional ownership, liquidity, transparency, and global trading.

A real estate tokenization platform enables digital ownership of properties through tokens, improving liquidity, faster settlement, global access, and compliant RWA crypto investments.

You can contact SoluLab for crypto banking solutions, RWA platform development, and white-label crypto products through their website or direct consultation channels.