Crypto is becoming a key part of business growth in 2025 as companies of all sizes want to offer crypto services like wallets, payments, or tokens, but building them from scratch takes too much time and money. That’s why smart companies now choose Crypto-as-a-Service (CaaS), a faster, safer, and cost-effective way to launch crypto features.

As the global crypto market will cross $3.5 trillion by 2025, CaaS solutions help businesses join this boom quickly.

With ready APIs, wallet systems, and compliance tools, you can launch crypto features in weeks, not months, while cutting setup costs by up to 70%. If you want to stay ahead, a custom CaaS solution is your fastest path.

This blog walks you through:

- What is Crypto-as-a-Service?

- Types of CaaS

- How CaaS works?

- Its benefits and use cases

If you are planning to launch your own crypto products, then this article is for you!

What Is Crypto-as-a-Service (CaaS)?

Crypto-as-a-Service (CaaS) is a ready-made crypto infrastructure that enables any business to easily add features such as wallets, trading, custody, and compliance to their app or website without building a blockchain from scratch.

Think of it like Stripe or Plaid, but for crypto. Instead of spending months or even years developing, testing, and securing your own system, you can use CaaS APIs or SDKs to plug crypto tools directly into your product. This means you can launch new crypto features in days or weeks, not months.

A strong crypto-as-a-service (CaaS) model allows your team to:

- Integrate crypto wallets, payments, or exchanges in just a few weeks.

- Focus on your user experience (UI/UX) while experts handle the backend.

- Access enterprise-grade security, real-time blockchain data, and regulatory tools through a single dashboard.

A good crypto-as-a-service (CaaS) model handles everything behind the scenes, like the tech, security, and regulations, while your team focuses on design, user experience, and growth. It’s the fastest way for any business to enter the crypto space with confidence.

Core Components of a Crypto-as-a-Service (CaaS) Platform

A strong Crypto-as-a-Service platform is built on several key parts that make it secure, scalable, and easy to use. These parts work together to help your business launch crypto services fast while staying safe and compliant. Here’s what every CaaS solution must include:

1. Trading Engine

This is the core of every CaaS platform. It manages buy and sell orders and makes sure trades happen quickly and fairly.

- Matches orders in real time (under 100 ms).

- Handles market, limit, and stop orders.

- Keeps prices fair using a central order book system.

- Scales easily when trading volume grows.

A powerful trading engine means your users get fast, transparent crypto trades, which is a key trust factor in today’s market.

2. Multi-Currency Wallet System

The wallet system is where users store and move their crypto safely. A good CaaS platform must support many blockchains like Bitcoin, Ethereum, Polygon, and Solana.

- Uses both hot wallets (for fast transfers) and cold storage (offline safety).

- Adds multi-signature security so no one can move funds alone.

- Keeps keys protected with HSM or MPC encryption.

- Works for both custodial and non-custodial wallets.

This helps businesses offer secure, user-friendly crypto services with full transparency.

3. Custody & Compliance

If your project deals with large funds, safe custody and regulatory compliance are must-haves.

- Keeps client assets fully separated from company funds.

- Meets rules like KYC, AML, and MiCA.

- Stores most assets in cold wallets and insures them.

With proper crypto custody and compliance, your platform becomes trustworthy for investors and institutions.

4. Liquidity & Market Access

A good CaaS solution connects to big exchanges like Binance or Coinbase to offer deep liquidity and the best prices.

- Aggregates liquidity from multiple exchanges.

- Let’s users swap crypto pairs instantly (e.g., ETH ↔ USDC).

- Supports fiat on/off ramps through trusted payment partners.

This ensures smooth, stable, and profitable trading for your users.

5. Admin Dashboard

The admin panel gives your team full control and visibility.

- Shows live data on users, trades, and system performance.

- Let’s admins approve or reject transactions safely.

- Tracks compliance and generates reports easily.

A strong back office keeps your crypto platform running smoothly and helps prevent risks.

6. API & SDK Integration

Your developers can connect any product to the CaaS system using simple APIs.

- REST and WebSocket APIs for live updates.

- SDKs in popular languages like Node.js, Python, and Java.

- Sandbox testing before launch.

This helps you add crypto features quickly to your app or website without heavy backend work.

7. Security Layer

Security is the most important part of any crypto-as-a-service platform.

- Uses AES-256 encryption and TLS 1.3 for all data.

- Includes 2FA and biometric login options.

- Regular third-party security audits and DDoS protection.

Strong security builds user trust and keeps your business safe.

8. Tokenization & Staking Modules

Modern CaaS platforms also let businesses create and manage their own crypto tokens.

- Launch custom ERC-20 tokens or NFTs.

- Add staking and reward programs.

- Run token sales or launchpads with built-in compliance.

This helps businesses build extra revenue channels inside their ecosystem.

9. Global Infrastructure

Enterprise clients often need multi-region servers and 24/7 support.

- Runs on a global cloud network for low latency.

- Offers multi-language UI for worldwide users.

- Provides round-the-clock support with fast response.

This makes your CaaS platform scalable and future-ready for global growth.

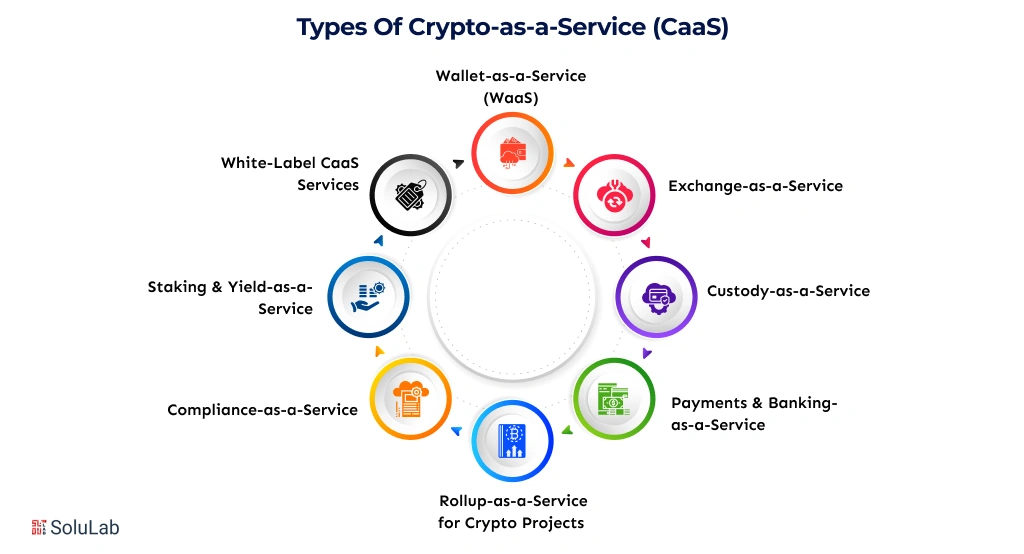

Types of Crypto-as-a-Service (CaaS) Solutions

When a business wants to enter the crypto space, it doesn’t need to build everything from zero. That’s where Crypto-as-a-Service (CaaS) helps. It gives you ready-to-use crypto services through APIs and white-label tools that can be added to your product fast. Below are the main types of CaaS solutions every business should know about before getting started:

1. Wallet-as-a-Service (WaaS)

A wallet-as-a-service lets your users send, receive, and store crypto safely inside your own app. It supports multi-currency wallets, private key management, and multi-sig security. Businesses use this type of CaaS solution when they want to give users a secure and branded crypto wallet without managing blockchain code.

2. Exchange-as-a-Service

This model allows your platform to run a crypto exchange or a trading engine under your own brand. You can offer spot, futures, or token swaps with full control over your fees and user flow. It’s perfect for fintechs, startups, or banks wanting to add crypto trading features fast.

3. Custody-as-a-Service

This type of Crypto-as-a-Service solution focuses on security and compliance. It helps store large volumes of crypto for your users or clients while staying KYC/AML compliant. You get cold storage, multi-sig wallets, and insurance-backed protection, which are essential for regulated businesses and institutions.

4. Payments & Banking-as-a-Service

If your business deals with digital payments or global transfers, you can use crypto banking-as-a-service to make faster, cheaper cross-border payments. It helps businesses accept and settle payments in crypto or stablecoins while connecting easily with traditional finance systems.

5. Rollup-as-a-Service for Crypto Projects

For Web3 builders, rollup-as-a-service for crypto projects is becoming very popular. It allows developers to launch their own blockchain rollups (like Optimistic or ZK rollups) without building complex infrastructure. This gives projects better scalability, low gas fees, and high speed, making it a top choice for DeFi, NFT, and gaming apps.

6. Compliance-as-a-Service

Every serious crypto business must follow rules. Compliance-as-a-Service adds KYC (Know Your Customer), AML (Anti-Money Laundering), and transaction monitoring features to your platform. It ensures your crypto services stay safe and legal in every region you operate.

7. Staking & Yield-as-a-Service

This CaaS model helps businesses offer staking, yield farming, or passive income features directly in their app. It attracts and retains users by giving them ways to earn rewards on their crypto holdings, all managed safely on the backend by your tech partner.

8. White-Label CaaS Services

A white-label CaaS service lets your company own the brand while the technology runs in the background. You get full control of your logo, colors, and user experience, but the infrastructure, security, and updates are handled by experts. Also, you don’t need to build trading systems or liquidity engines; it handles everything from order matching to compliance.

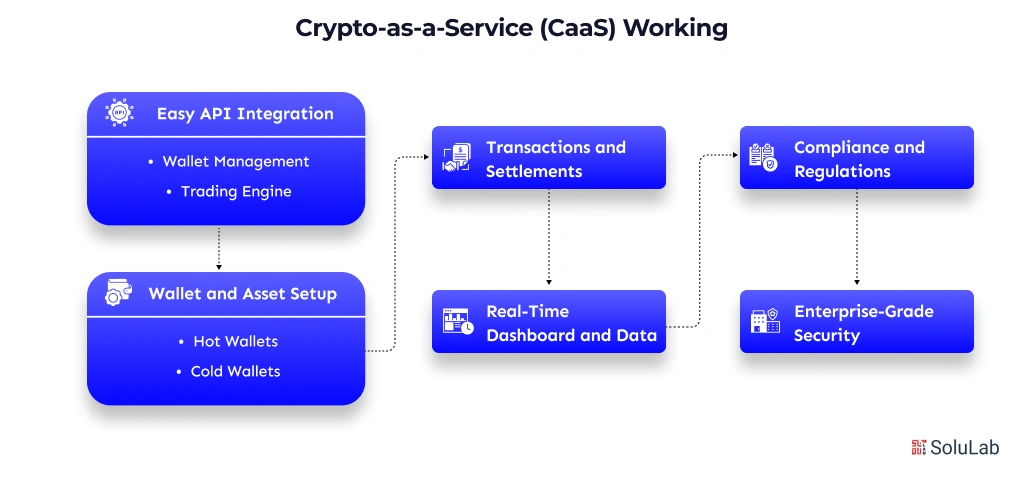

How Crypto-as-a-Service (CaaS) Works?

If you’re a business that wants to add crypto features like wallets, trading, or payments, then Crypto-as-a-Service (CaaS) is the smartest and safest way to do it in 2025.

Instead of spending months building your own system, a CaaS provider gives you everything ready, like APIs, wallets, security, and compliance tools, so you can launch crypto services in just a few weeks. Let’s break down how the CaaS model really works.

1. Easy API Integration

Every Crypto-as-a-Service solution starts with simple API connections. Your developers link your app or website to the CaaS platform using standard REST or WebSocket APIs. Once connected, your app can instantly talk to the CaaS backend, which manages all the hard parts like wallets, trading, settlements, and KYC/AML compliance.

You don’t need deep blockchain skills; it works just like connecting any other payment or banking API. Common CaaS API services include:

- Wallet Management: create and manage wallets for Bitcoin, Ethereum, or Polygon.

- Trading Engine: handle real-time prices, buy/sell orders, and trades.

- Compliance Tools: add KYC/AML checks so every user is verified safely.

- Liquidity Access: connect to top exchanges like Binance, Coinbase, or Kraken for deep liquidity.

This setup usually takes only a few days, far faster than building a custom blockchain system.

2. Wallet and Asset Setup

After integration, your CaaS provider automatically creates secure wallets for your users. These wallets use private keys stored in safe custody, often with hardware security modules (HSMs) or cold storage that keeps them away from hackers.

Types of wallets:

- Hot Wallets: online wallets used for instant transactions.

- Cold Wallets: offline wallets used for extra protection.

Top names like Fireblocks, Vaultody, and Binance CaaS use multi-signature security, meaning no single person can move funds alone. This setup keeps user assets safe as an essential feature in an industry that faced over $2.2 billion in yearly breaches.

3. Transactions and Settlements

Here’s what happens when your user makes a crypto trade or payment:

- The user places an order on your app.

- The CaaS system checks for matches within your platform.

- If no match is found, it connects to global exchanges for liquidity.

- Once the trade is matched, funds move instantly, and wallets update.

- Every transaction is recorded on the blockchain, which is permanent and transparent.

This entire process happens in seconds, not days, making crypto banking as a service a strong choice for fintech and payment startups.

4. Real-Time Dashboard and Data

A complete CaaS solution includes a dashboard where you can:

- Track trading volume, deposits, and withdrawals.

- Monitor new users and KYC verification.

- Set your own fees and export financial reports.

- Review audit logs for security and compliance.

You can even connect this dashboard to your CRM or analytics tools through webhooks to see data in real time that helps your team make smarter business decisions.

5. Compliance and Regulations

One of the biggest advantages of using Crypto-as-a-Service is automatic compliance. CaaS platforms help you follow global crypto laws without hiring big legal teams.

They handle:

- KYC (Know Your Customer): verify user identity with tools like Onfido or Jumio.

- AML (Anti-Money Laundering): monitor and block suspicious transactions.

- Regulatory Reports: auto-generate reports for MiCA (EU), FinCEN (US), and FATF.

This automation cuts compliance costs by up to 70%, while keeping your business safe and trusted globally.

6. Enterprise-Grade Security

Security is at the core of every good Crypto-as-a-Service platform. A quality provider protects both your users and your infrastructure with:

- Encrypted APIs and DDoS protection.

- Two-factor authentication for users and admins.

- Multi-signature wallets and time-locked transactions for safe transfers.

- 24/7 monitoring by expert Security Operations (SOC) teams.

This kind of protection builds long-term trust, which is something every business needs in crypto.

By using Crypto-as-a-Service, your business can launch crypto products quickly, cut development costs, and stay fully compliant. Whether you want to build a crypto banking app, a trading platform, or a white-label CaaS service, the right development team can make it happen quickly and safely.

Why Businesses Are Moving from Custom Builds to CaaS?

A few years ago, building a crypto exchange or wallet platform meant starting everything from zero. But in 2025, that’s no longer the smart move. Today, banks, fintech startups, and crypto projects are switching to Crypto-as-a-Service (CaaS) because it saves time, reduces cost, and adds strong security from day one.

When you build a crypto product yourself, the cost goes far beyond coding. A basic platform can cost $130,000 – $300,000, while larger systems can cross $1 million. And that’s just the start, you still need to pay for:

- Hosting & Infrastructure: $5,000 – $50,000 every month, depending on traffic.

- Security Tools: Firewalls, audits, and insurance can add 30 – 50 % more to your tech bills.

Compliance Costs: In 2025, over 30 new crypto laws were introduced in the U.S. alone, forcing companies to hire lawyers and engineers just to stay compliant.

Even after spending all that, launching late can hurt your product. A full custom build takes 9–12 months, while a CaaS solution can go live in 2–4 weeks, cutting your time-to-market by over 60 %. Security is another big reason businesses now prefer Crypto-as-a-Service. In 2025, hackers stole more than $3.1 billion from crypto platforms because of poor setups and weak wallet systems.

A trusted CaaS provider gives you:

- Bank-grade security with multi-signature wallets and live monitoring

- Regular audits and insurance to prevent major losses

- Automatic compliance updates across the U.S., EU, India, and Asia-Pacific

With this, you can focus on your users while your crypto-as-a-service partner manages the complex tech, security, and rules for you.

If you’re a fintech, bank, startup, or gaming project, using CaaS development services helps you:

- Save up to 70 % on total development cost

- Launch crypto features 3 times faster

- Get enterprise-grade security and compliance from day one

- Use ready APIs for wallets, trading, and payments

- Scale globally with less risk

Key Benefits of Crypto-as-a-Service (CaaS)

Crypto-as-a-Service (CaaS) helps businesses launch crypto products faster and cheaper. Instead of building from zero, you use ready-made tools, APIs, and security systems designed by experts.

- Faster Launch: Go live in weeks using pre-built APIs, no need to build your own crypto system.

- Lower Cost: Save up to 70% on development time and setup compared to custom crypto builds.

- Secure by Design: Get multi-signature wallets, cold storage, and regular security audits handled for you.

- Compliant Everywhere: Built-in KYC/AML tools keep your platform legally safe in all regions.

- Scalable & Flexible: Add new features anytime, like rollup as a service for crypto projects or other crypto services as your business grows.

Businesses choose the crypto-as-a-service (CaaS) model because it lets them focus on growth while experts handle the tech, security, and compliance.

Top Use Cases for CaaS Solutions

CaaS solutions work for many industries from startups to large enterprises. Here’s how different sectors use them:

- Banks & Fintechs: Launch crypto banking as a service to let users buy, trade, and store crypto safely.

- eCommerce Stores: Accept crypto payments globally with low fees and faster transactions.

- Gaming Projects: Add NFTs, tokens, and in-game wallets using white-label CaaS services.

- Remittance Apps: Enable users to send stablecoins worldwide in minutes instead of days.

- Enterprises: Run crypto payrolls and vendor payments securely and transparently.

With the right crypto development company, your business can use the CaaS solution to launch faster, stay compliant, and scale easily.

Real Life Examples: How CaaS Is Used Right Now

1. Stripe – Stablecoin Payments for 500K+ Businesses

Stripe made headlines by launching stablecoin-powered payments using CaaS infrastructure on Base and Polygon networks. This move helped 500,000+ businesses accept USDC payments globally.

Results:

- Payments settle in seconds (not days)

- No crypto volatility, as Stripe auto-converts USDC to USD

- Fully KYC-compliant

- Launched in under 4 weeks

2. Binance CaaS – Banks & Fintechs Go Crypto

In 2025, Binance launched CaaS for licensed institutions like banks, brokers, and fintechs to launch their own crypto platforms in just 2–4 weeks. Earlier, building an exchange took 9–12 months and $150K–$250K.

With Binance CaaS:

- Setup time drops by 70%

- Compliance and liquidity come pre-built

- Full white-label branding and control

Conclusion

The rise of Crypto-as-a-Service (CaaS) is transforming how banks, fintechs, and enterprises enter the digital asset market. Giants like DBS Bank, Stripe, and Binance have already proven its potential in their operations. With a concept like CaaS, businesses no longer need to build everything from scratch. With the right partner, you can launch secure, compliant, and revenue-ready crypto services in weeks, not months.

SoluLab, a leading crypto development company, bridges this gap by offering custom-built, regulation-ready, enterprise-grade CaaS platforms that help your business grow faster while staying safe and compliant. We build secure, scalable, and compliant crypto-as-a-service models that help you enter the market faster and grow.

Want to launch your own crypto product under your brand name? Contact us for market-ready solutions now!

FAQs

1. How does SoluLab connect CaaS with my company’s existing systems like ERP, CRM, or payment gateways?

Our team makes sure your new CaaS solution fits perfectly with your current setup. We plan every integration carefully and use custom connectors like REST, WebSocket, or GraphQL APIs to link your Crypto-as-a-Service platform with your databases and apps.

2. Can we customize the blockchain or crypto assets used in our CaaS platform?

Yes, absolutely. We design custom CaaS platforms where you choose the blockchain networks you want like Ethereum, Polygon, Solana, or Hyperledger and the assets you support like crypto, stablecoins, NFTs, or tokenized real-world assets.

3. Can my CaaS platform scale as my users and transactions grow?

Yes. Our Crypto-as-a-Service platforms are built for easy scaling. They support auto-scaling APIs, load balancing, and real-time monitoring so your system stays fast even during traffic spikes or token airdrops. You get smooth performance when demand is high and optimized costs when it’s low.

4. How are CaaS platforms tested and audited before launch?

Every project goes through a full testing and audit phase. We check everything like functionality, security, integrations, and compliance. This includes API testing, smart-contract audits, and dry runs for reports and payments. You’ll receive detailed audit logs and validation reports before your platform goes live.

5. How does SoluLab handle new laws or compliance changes after launch?

We track all crypto regulations and keep your platform updated. When laws change in the US, EU (MiCA), or APAC regions, we update your compliance modules and screen flows. You’ll also get quarterly audits, quick patches, and advisory calls so your business always stays compliant.