Stablecoins like USDT, USDC, BUSD, TUSD, and FDUSD are improving the crypto space in 2026, offering stability in this volatile market. But storing them securely is not easy. With countless wallets available, choosing the right wallet matters, whether you’re a trader, DeFi enthusiast, or beginner. The wrong wallet could mean slow transactions, high fees, or even security risks.

Want to know the top stablecoins which has security, easy access on mobile or desktop, and support for DeFi activities? That’s exactly what the best wallets in 2026 should do. In this guide, we’ll explore the top 5 crypto stablecoin wallets that make storing and transacting USDT, USDC, BUSD, TUSD, and FDUSD safe, simple, and efficient. Let’s get started!

The Current State Of Stablecoin Crypto Wallet Development

| By the middle of 2025, the total market cap for stablecoins had grown by a lot from the previous year, reaching about $252 billion or perhaps $277 billion. |

Stablecoin cryptocurrency wallets are in a significant phase of development due to the surge of popularity, progressive regulation, and rapid technical improvement.

1. Current State

Stablecoin wallets are now safer, more flexible, and easier to use. Multi-asset support, cross-chain compatibility, and high-level security are now prioritized, with transactions being supported on USDT, USDC, BUSD, TUSD, and FDUSD.

2. Adoption Acceleration

Stablecoins are on the increase across the world as people and organisations acknowledge that they are more stable than volatile cryptocurrencies. The expanding demand is met by wallets, which have been designed with features such as easy onboarding, mobile accessibility, and transfer simplification to enable mainstream adoption.

3. Regulatory Momentum

Governments and financial regulators are offering more transparent principles for using stablecoins and wallet functions. This regulatory transparency builds trust, institutional engagement, and wallet adherence to KYC and AML standards and helps protect the funds of its users.

4. Increasing Market and Tech Integration

Stablecoin wallets are becoming a more integrated part of decentralized finance (DeFi), exchanges, and payment systems, allowing a wider range of applications. Improved APIs, cross-chain, and blockchain interoperability allow users to handle multiple assets effectively via one and the same interface.

5. Enterprise-Grade Growth

Companies are starting to accept payments, payroll, and treasury operations using stablecoin wallets more often. Enterprise-level solutions have high security, scale, and compliance capabilities, and can handle high volumes of transactions, but will integrate with corporate financial infrastructure.

How To Choose The Best Wallet For Stablecoin?

By 2026, it won’t be only a question of convenience when selecting the right stablecoin wallet, but a question of security, flexibility, and ease of transaction. The following are the most important factors to consider for any investor.

- Security & Private Key Control: The security of your wallet determines the level of security of your money. Use wallets with encryption, two-factor authorization, and complete control of their own keys to secure USDT, USDC, BUSD, TUSD, and FDUSD.

- Multi-Stablecoin Support: Not every wallet supports all of the stablecoins. Make sure that your decision can store and process various coins such as USDT, USDC, BUSD, TUSD, and FDUSD easily, and save time and multiple wallets.

- User Experience & Accessibility: Find wallets that have an easy-to-use design, support more than one language, and provide accessibility that helps both beginners and advanced investors with storing and transferring stablecoins easily.

- Fees and Network speed: These are the direct effects of networks on the experience with crypto. Select wallets that can maintain a low cost, but at the same time provide quick transfers, when you send or often exchange stablecoins between platforms frequently.

- Cross-Platform Availability (Web, Mobile, Hardware): Flexibility is the key. The most optimal wallets operate on web, mobile, and hardware platforms, and you can access your stablecoins anytime. This keeps you in touch and in control of all the devices safely.

Top 5 Crypto Stablecoin Wallets to Watch Out for in 2026

Choosing the right wallet ensures security, convenience, and transactions for all crypto users. Here’s a list of 5 crypto wallets for stablecoins:

1. MetaMask – Best for Web3 & DeFi Users

MetaMask is ideal for DeFi enthusiasts, supporting multiple stablecoins and Web3 apps. It’s browser extension and mobile app allow easy access to decentralized exchanges while keeping private keys secure.

2. Trust Wallet – Best Mobile-Friendly Wallet

Trust Wallet offers a simple, intuitive interface for mobile users. It supports all major stablecoins, multiple blockchains, and dApps, which makes it perfect for users who want to manage crypto anytime, anywhere.

3. Binance Wallet – Best for Traders

Integrated with the Binance exchange, this wallet is perfect for traders. It allows instant stablecoin transactions, low fees, and easy conversion between cryptocurrencies, with strong security features for active users.

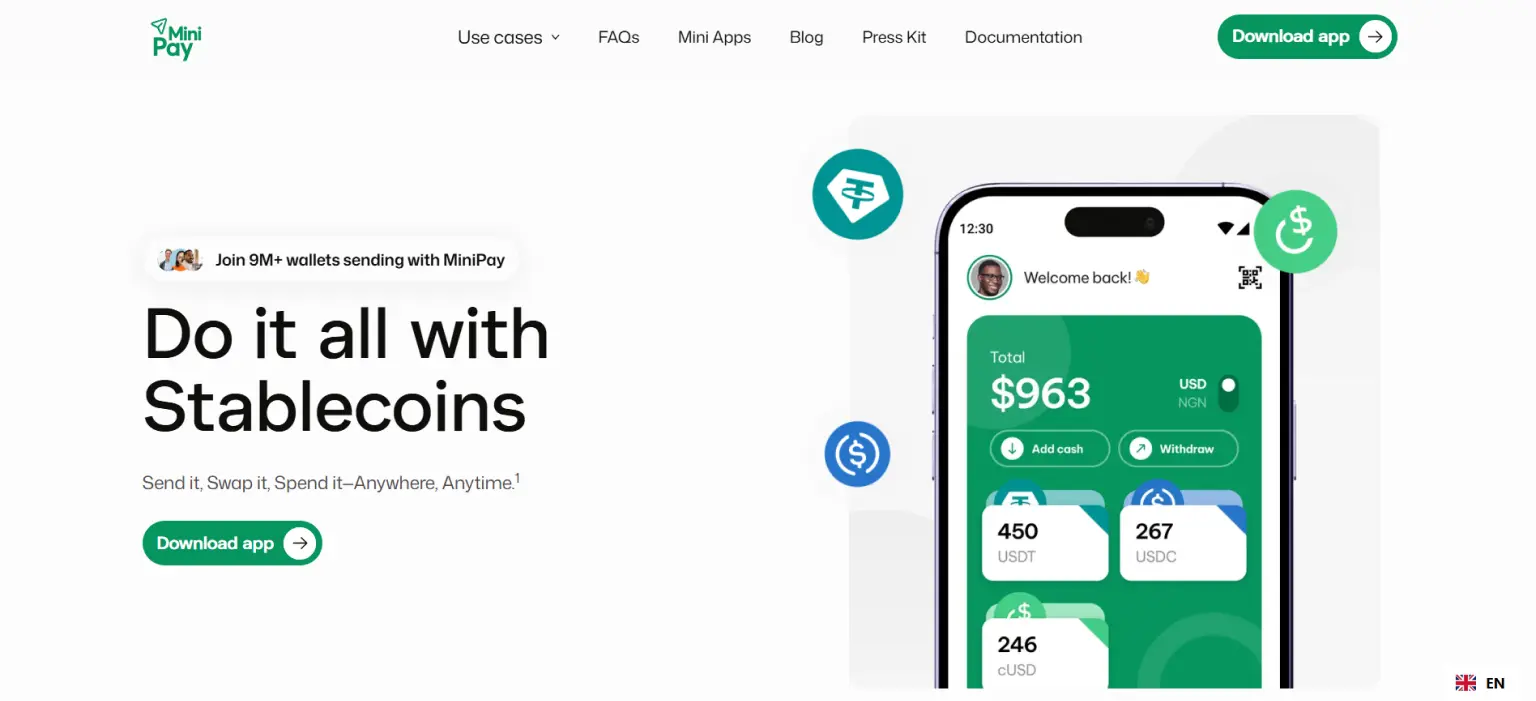

4. Mini Pay – Best Wallet for Instant Stablecoin Payments

MiniPay is a user-friendly, non-custodial stablecoin wallet built on the Celo blockchain, enabling seamless global payments in USDT, USDC, and cUSD. It offers instant, low-cost transfers and easy cash-in/cash-out options across 53+ countries.

5. Coinbase Wallet – Best for Beginners

Coinbase Wallet is beginner-friendly. It offers easy onboarding and strong support for USDT, USDC, and other stablecoins. It combines simple mobile management with secure private key storage for safe crypto use.

Benefits of Using a Dedicated Stablecoin Wallet

Using a dedicated stablecoin wallet offers several advantages over relying solely on exchange wallets. Here’s why it’s becoming the go-to choice for crypto investors:

1. Safer Than Exchange Wallets

Dedicated wallets give you full control over your private keys, reducing the risk of hacks or exchange failures. Unlike exchange wallets, where your funds are stored in a custodial environment, a personal wallet ensures that you, and only you, have access to your assets.

2. Faster Transfers and Transactions

With a dedicated wallet, transactions are often faster and more reliable, as you don’t depend on the exchange’s processing times or network congestion. Whether you’re sending USDT, USDC, BUSD, TUSD, or FDUSD, transfers are smoother and nearly instantaneous, especially when paired with blockchains optimized for speed.

3. Better Tracking of Assets

A dedicated wallet provides clear visibility and organization of all your stablecoin holdings. You can monitor balances, transaction history, and performance across multiple stablecoins in one place, making portfolio management far easier than juggling multiple exchange accounts.

4. Access to Staking, Lending, and DeFi Features

Many dedicated wallets offer integrations with DeFi platforms, allowing you to stake stablecoins, earn interest through lending protocols, or participate in liquidity pools. This unlocks additional earning potential for your assets, turning your wallet into more than just a storage solution—it becomes a tool for growth.

Conclusion

Whether you prioritize security, mobile convenience, or trading efficiency, there’s a wallet tailored to your needs. MetaMask excels for Web3 and DeFi users, and Trust Wallet is perfect for mobile management. Assess your priorities: security, usability, or accessibility, before deciding.

Token World, a premier crypto launchpad, partnered with SoluLab to enhance smart contract security, scalability, and compliance. Through GenAI solutions, interoperable token launches, and resilient tokenomics strategies, we delivered blockchain-powered solutions that streamlined fundraising, strengthened investor trust, and fostered thriving communities while mitigating volatility and regulatory challenges.

SoluLab, a leading crypto wallet development company, can help you build a secure, scalable, and user-friendly wallet. Contact us today!

FAQs

1. Which wallet is best for holding USDT securely?

Among the best cryptocurrency stablecoin wallets for safely holding USDT are Ledger Nano X and MetaMask, which provide strong security, offline storage, and smooth interaction with reliable platforms.

2. Can I store multiple stablecoins in one wallet?

Holding USDT, USDC, BUSD, TUSD, and FDUSD together is supported by multi-chain stablecoin wallets like Trust Wallet and MetaMask, which makes managing a portfolio across many blockchains easier.

3. Are hardware wallets safer for stablecoins?

Because hardware wallets like Ledger Nano X store private keys offline and guard against online threats, they are the safest option for holding various stablecoin types.

4. Do stablecoin wallets charge extra fees?

No, most wallets don’t charge more, but when you move money, there are network fees. Depending on Stablecoin use cases, such as trading or payments, costs differ by blockchain.

5. What’s the safest way to transfer stablecoins in 2026?

When learning how to utilize stablecoin for payments across platforms and apps, make sure to double-check wallet addresses, use reliable exchanges, and activate two-factor authentication to maintain security.

6. Can I use MetaMask for storing stablecoins?

Yes, MetaMask supports multiple stablecoins like USDT and USDC. It is widely used in decentralized finance (DeFi) applications, offering secure access to dApps and Web3 platforms.