What if you could be able to send money across borders in seconds, with almost no fees, and without worrying about exchange rate fluctuations? For millions of people worldwide, remittances are more than just transactions—they are a lifeline for families, education, and small businesses. Yet, traditional remittance systems remain slow, costly, and inaccessible for many, especially in emerging markets.

Stablecoins solve the issue by combining the speed of blockchain with the stability of fiat currencies, eventually transforming global money transfers. For startups, this shift isn’t just about financial innovation; it’s a golden opportunity to disrupt the outdated remittance market, deliver better value to users, and build scalable business models in the fast-evolving fintech space. Let’s delve deeper into the concept to know more about it!

What is the Stablecoin Remittance?

Stablecoin remittance refers to the process of sending money across borders using stablecoins. This doesn’t involve traditional banking rails like SWIFT or money transfer operators. In this model, funds are converted into a stablecoin (like USDT, USDC, or a regulated fiat-backed token), transferred instantly over a blockchain. Then redeemed as local currency by the receiver.

Think of it as a digital bridge:

- The sender uses fiat money, which is converted into a stablecoin.

- The stablecoin moves across the blockchain (fast, transparent, low-cost).

- The receiver cashes out into their local currency or keeps the stablecoin for savings or digital payments.

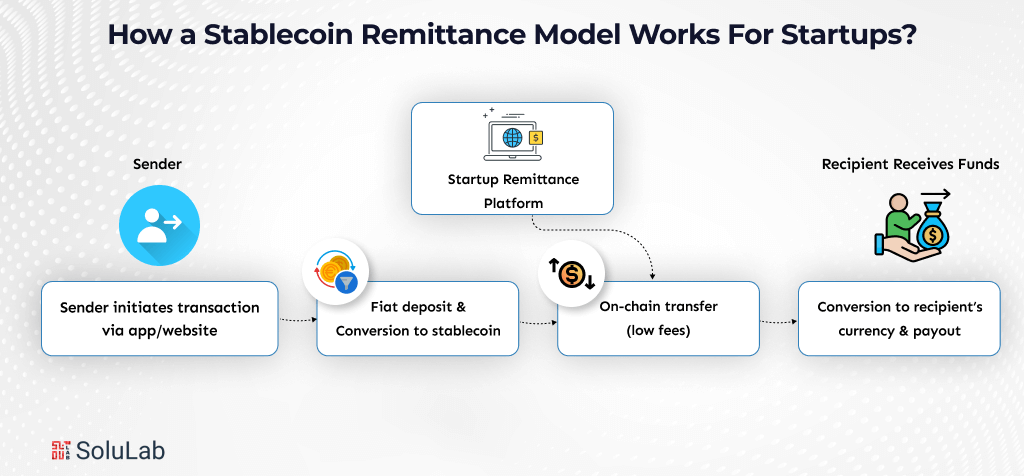

How a Stablecoin Remittance Model Works For Startups?

As the global payment transactions are increasing in multiples, from big businesses to enterprises, they are racing to find faster, cheaper, and secure solutions. Let’s take a look at the detailed process of how Stabelcoin works for remittance for startups.

-

Onboarding & Funding

The first step in the stablecoin remittance model is integrated KYC/KYB flows. This also includes IDV providers, risk scoring, sanction screening, and payment collection (bank transfer, card, ACH, local PSPs).

The main reason for this is that fast, compliant onboarding reduces friction and regulatory risk. You can go fully in-house KYC with third-party vendors.

-

Tokenization / Stablecoin Funding

If you are just getting started, you can either partner with a custodial issuer to mint fiat-backed stablecoins. Or you can even use existing market options like USDC, USDT, or EURI.

Implementation requires mint/burn APIs, reserve attestations, custody setup with hot and cold wallets, and clear treasury rules. This step is crucial because it preserves transparency and issuer trust. This determines regulator and partner acceptance.

-

On-Chain Transfer & Routing

As a start-up up you need to have a transaction engine that can submit transfers to the chosen blockchain. This is also for supporting smart contract workflows, and includes routing logic for the cheapest and fastest path. You can either run their own nodes and infrastructure or rely on RPC providers.

A key choice here is between permissioned chains for stronger control. Or public chains for liquidity and interoperability, with bridges or atomic swaps if multi-chain support is needed. This step matters because it delivers the T+0 promise, real-time finality, low latency, and fewer intermediaries.

-

Liquidity & FX Corridor Management

Startups need to set up pre-funded corridor pools with both stablecoins and local fiat. An automated quoting engine, smart spreads, and hedging logic support them. Market-maker integrations can further enhance liquidity.

This design enables the popular “stablecoin sandwich” model (fiat A → stablecoin → fiat B). This controls FX slippage, ensures instant payouts, and preserves healthy margins. With well-structured liquidity management, startups can scale confidently across multiple remittance corridors.

-

Off-Ramp / Redemption & Payout

A good partner can help you in developing off-ramp adapters to regulated exchanges. Also, payout APIs for banks and agents, and integrations with local rails such as UPI, ACH, SEPA, or MPESA.

Strong off-ramp design ensures that funds move seamlessly from stablecoins to local currencies. Hence, delivering the speed and reliability customers expect.

-

Compliance, Governance & Monitoring

The last and important step is monitoring and updating the system as the compliance and government regulations. Embed compliance directly into transaction flows with inline AML/KYC checks, Travel Rule handling, sanctions screening, and real-time monitoring.

Build regulator-ready audit exports and include incident or circuit-breaker controls for added resilience. To gain user trust, reduce overhead, and operate under regulations, you need to include compliance as part of the architecture from the beginning.

Read Also: UAE’s Dirham-Backed Stablecoin

What Is the Cost of Developing a Stablecoin Remittance Platform?

When you think about the cost of building a stablecoin remittance platform, it’s less about a fixed price tag. This is more about what you’re actually building.

- The budget depends on the choices you make- whether you’re integrating ready-made APIs or creating custom modules for wallets, liquidity pools, or compliance.

- The minimum budget starts from $15,000, perfect if you’re aiming for a basic MVP.

- At this stage, you’ll get essential token features, simple stabilization, and a minimal user interface to test your idea quickly.

- The higher end can go up to $100,000+. This is where you get the advanced features and maintenance.

- A pre-built white label platform with token infrastructure, stablecoin wallets, backend systems, smart contracts, security audits, and more for your business needs.

- For any startup, expenses vary based on its goal and what it wants to control. Using third-party providers for KYC, custody, or FX makes it quick and affordable, too.

Not just investment, you need compliance layers to build a Stablecoin remittance platform. The integration with local payment rails and ongoing audits gives you a headache. So, a good option is to partner with a professional development company and gain the quick market launch effects.

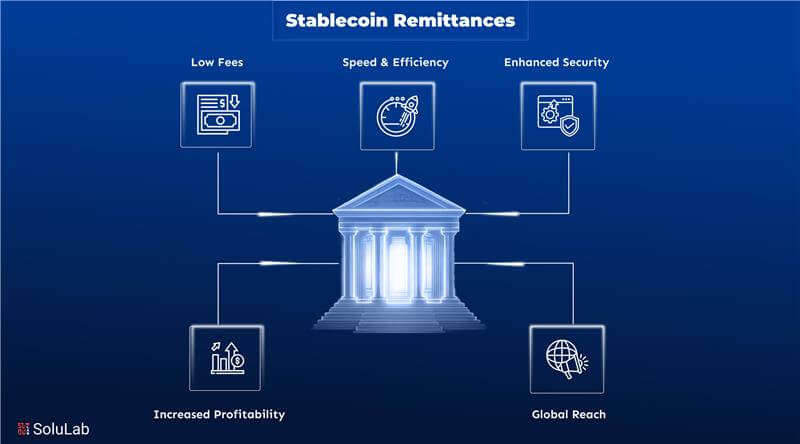

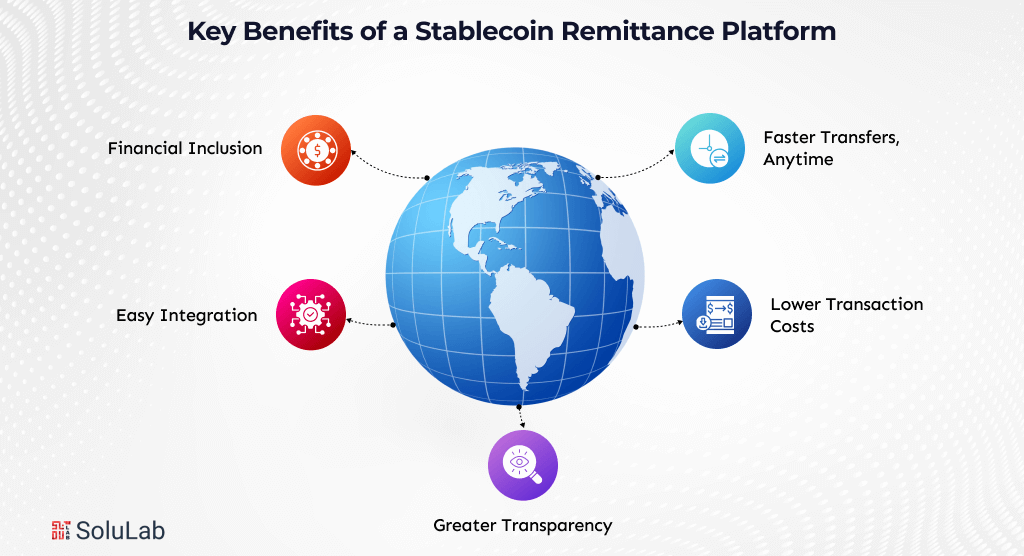

Key Benefits of a Stablecoin Remittance Platform

Stablecoin remittance isn’t just about using crypto. It’s about solving real-time Cross-Border stablecoin settlements that businesses and customers face. Here are the biggest benefits you can count on:

-

Faster Transfers, Anytime

With stablecoins, money moves in minutes instead of days. No waiting for banking hours or clearing cycles. For your business, this means faster settlements and happier customers who don’t feel the frustration of delays.

-

Lower Transaction Costs

Traditional rails involve multiple intermediaries, each taking a cut. Stablecoins cut out most of that. The result? More value reaches the recipient, and your business saves on operational fees.

-

Greater Transparency

Every transaction is recorded on-chain, giving you and your customers a clear, traceable history. This not only builds trust but also makes audits and reporting much simpler.

-

Financial Inclusion

Stablecoins open the door to people in markets with weak banking infrastructure. Whether it’s freelancers, gig workers, or families, you can reach new customers who traditional systems have underserved.

-

Easy Integration

Modern stablecoin platforms are API-driven, so you can integrate them into your existing apps or banking systems without major rework. This keeps deployment smooth and scalable.

Emerging Market Opportunities for Startups

Stablecoin remittance is no longer just an idea; it’s already being adopted across fast-growing corridors. For startups, this presents significant opportunities to step in where traditional systems are too slow or too costly.

- Latin America: Platforms like Bitso and Conduit are already using stablecoins to give people instant access to money, even outside bank hours. Customers also use it to protect themselves from local inflation.

- Africa: Mobile money systems, such as M-PESA, are integrating with stablecoin rails, making cross-border payments quicker and more affordable.

- Asia: Countries like the Philippines and India are strong remittance markets. Here, stablecoins reduce costs for workers sending money home.

- Global corporates: Big names are moving too. PayPal uses its PYUSD stablecoin for Xoom transfers, escaping banking-hour limitations. Consulting firms like EY note that corporates are exploring stablecoins for payroll and treasury efficiency.

- Market size: Cross-border payments hit $179 trillion last year, showing the scale of demand for faster, cheaper solutions.

For startups, these regions and sectors are proof that stablecoin remittance is a real, growing market, one where you can make a strong impact.

The Future of Stablecoin Remittances in Global Finance

Stablecoin remittances are shaping up to be a cornerstone of modern global finance, not just a niche trend.

Mainstream Adoption scenarios predict that stablecoin remittance volumes could hit $135 to 180 billion by 2030, capturing 15 to 20% of global remittance flows. This is mainly due to the growing U.S. GENIUS Act and the EU’s MiCA framework.

Also, stablecoin payment transactions are expected to surpass $187 billion globally by 2028. making remittances a significant growth driver. These numbers are proof that the future is going to be more stable for transactions through these stablecoins for remittance payments.

Conclusion

As per the above details, you might have already understood how stablecoins for remittance are a game-changer in global finance. This idea is a smarter, faster, and more cost-effective way to transfer the assets. That also brings more users to your business if the platform is more effective and enhanced according to your customers.

If you are looking to launch a stablecoin remittance platform, SoluLab is here to aid you in the process. We, at SoluLab, a top stablecoin development company, design tailored ecosystems to drive your business growth. We build remittance platforms, DeFi solutions, and payment gateways. Our expert team ensures security, growth, and user adoption from day one.

Contact us today for more details!

FAQs

1. Why are stablecoins better for remittance than traditional banking?

Yes, because they cut out middlemen, reduce fees, and deliver money in minutes, not days. It’s faster, cheaper, and your users get more value instantly.

2. Do stablecoin remittance platforms work in all countries?

Not everywhere yet, but adoption is growing fast in Asia, Africa, and Latin America. You’ll see expanding corridors as regulations get clearer and demand rises.

3. Can my startup launch such a platform without a huge investment?

Yes, you can. By using APIs, third-party providers, and smart partnerships, startups avoid massive costs and still build scalable, compliant remittance platforms quickly.

4. What makes SoluLab different as a stablecoin development company?

SoluLab builds custom stablecoins and platforms that are secure, scalable, and regulation-ready. The team focuses on faster launches, long-term growth, and smooth adoption for businesses worldwide.

5. Can stablecoins be used for employee salaries, too?

Yes, absolutely. Many global businesses are exploring stablecoin payrolls because they’re quick, borderless, and protect against local currency fluctuations. It’s becoming a smart, future-ready option.