For businesses in commodities, supply chain, logistics, and investment sectors, tokenized copper offers a better way to track ownership, simplify trading, and cut costs.

According to PwC, tokenized assets could grow into a $16 trillion market by 2030, and industrial metals like copper are expected to be a major part of that growth. As the demand for copper rises, especially in electric vehicles, green energy, and electronics, tokenization makes it easier for companies to access and manage copper in real time

What is Copper Tokenization and Why It Matters?

Copper tokenization means turning real copper into digital tokens using blockchain. Each token represents a real piece of physical copper held in a secure storage facility, like a vault or warehouse. These tokens can be bought, sold, or transferred easily online, just like digital assets.

Every copper token is fully backed by actual copper. This allows companies to trade copper digitally without needing to move the physical metal. It saves time, reduces cost, and makes transactions faster and more secure.

For businesses, this opens up major advantages. By using the tokenization of physical assets like copper, companies get:

- Faster settlements

- Lower transaction costs

- Improved transparency and traceability

- Access to global markets

When you work with a trusted token development company USA, your platform is built with top-level security, regulatory compliance, and flexible blockchain integration, essential for scaling in today’s digital economy.

Copper tokenization isn’t just about technology; it’s a smarter, more efficient way to manage and trade real-world assets. Whether you’re in commodities trading, manufacturing, or asset management, using advanced Cloud Management Software gives you a competitive edge in a global digital market.

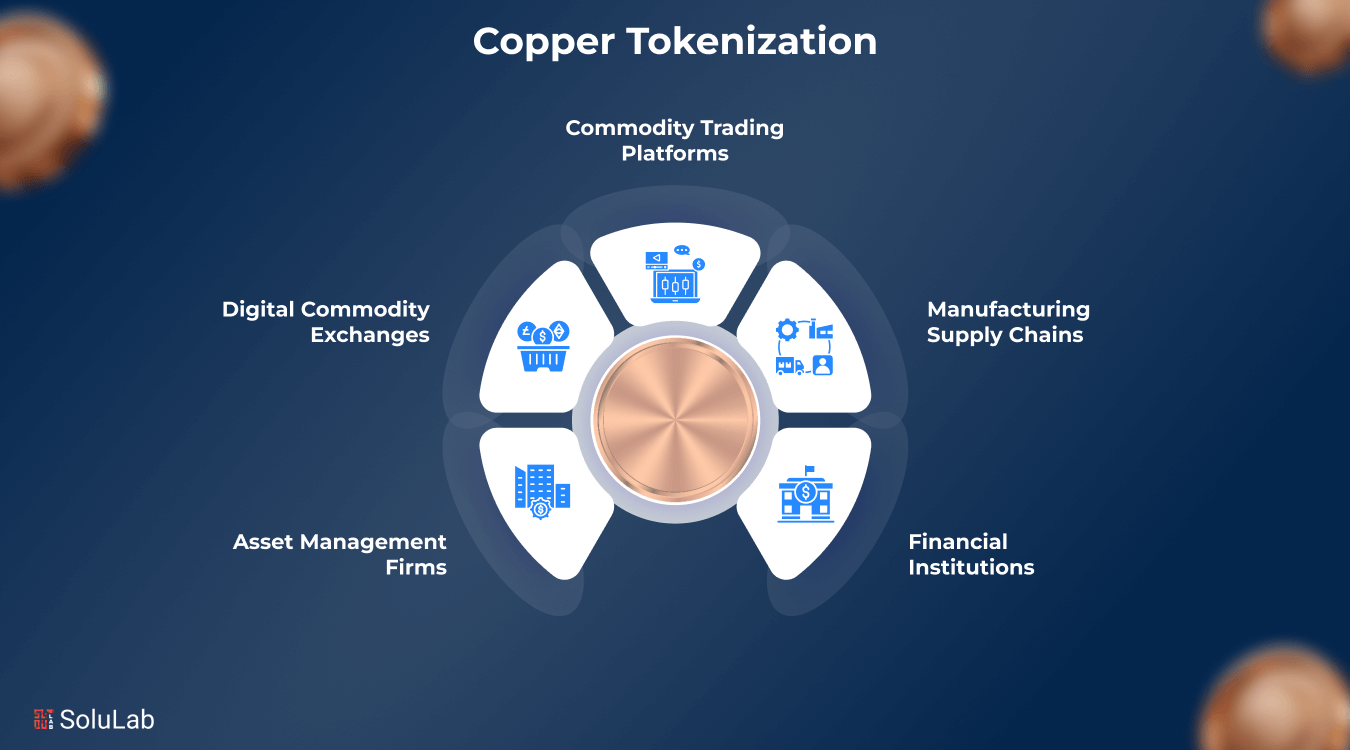

Top Business Use Cases for Copper Tokenization

Many industries today are looking for smarter, faster, and more secure ways to work with physical commodities like copper. Copper tokenization helps solve these challenges by turning real copper into digital tokens that are easy to trade, track, and manage. Here are the most important ways businesses are using tokenized copper today:

1. Commodity Trading Platforms

Companies that trade raw materials can use copper tokens to get real-time access to global copper markets. Instead of waiting days or weeks for paperwork to settle trades, digital copper tokens can be bought, sold, or transferred instantly.

This speeds up transactions and reduces risk, especially when built on a secure copper tokenization platform powered by a trusted token development company USA.

2. Manufacturing Supply Chains

Manufacturers that rely on copper for production can use copper tokenization platforms to track where their copper is coming from, where it’s going, and how much they have at any time.

This gives businesses better control over their inventory, sourcing, and delivery timelines, improving efficiency and reducing losses. With support from a blockchain development company, the entire copper supply chain becomes visible and auditable on the blockchain.

3. Financial Institutions

Banks and finance companies are using the tokenization of physical assets to turn copper into financial products. Instead of holding tons of physical copper, they can offer fractional ownership in copper-backed tokens.

This lets investors buy small shares of real copper through regulated platforms built by a smart contract development company. It opens new investment options without the need for storage or transport.

4. Asset Management Firms

Firms that manage investments are using tokenized copper to build new types of portfolios.

By working with RWA tokenization companies and a reliable asset tokenization company in the USA, they can launch products that combine copper with other tokenized real-world assets like gold or real estate.

These products appeal to both traditional and digital investors, offering more choice, better liquidity, and faster settlement.

5. Digital Commodity Exchanges

New-age digital exchanges are using copper tokenization to list copper as a blockchain-based asset, just like cryptocurrencies. This allows 24/7 trading, automated compliance, and global access to copper investment.

Exchanges that partner with a tokenization platform development company can easily onboard more commodities, making them future-ready.

Read Also: Silver Tokenization Platform Development

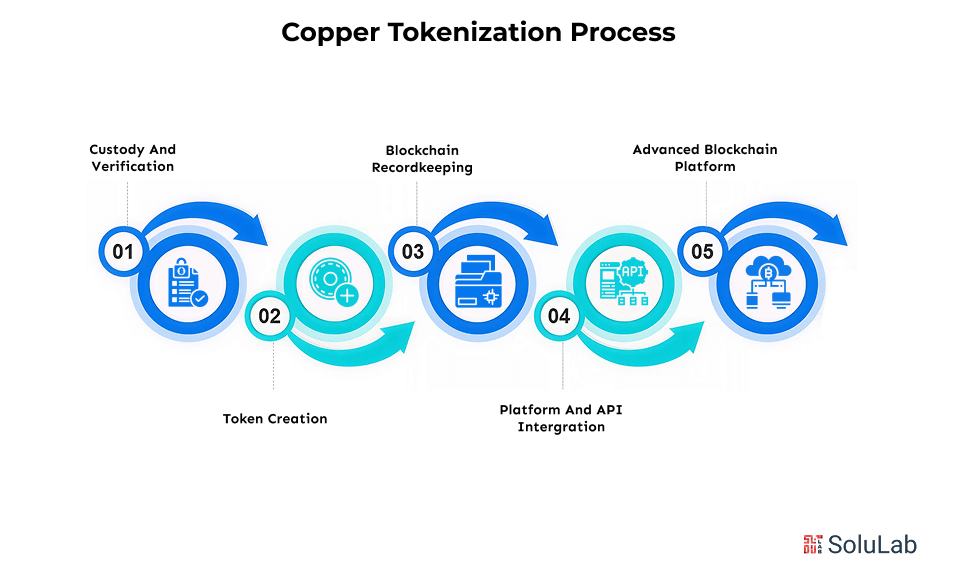

How Copper Tokenization Works?

Copper tokenization is the process of turning real, physical copper into digital tokens on a blockchain. These tokens are secure, traceable, and easy to manage, ideal for businesses dealing with copper at scale.

Here’s how the process works step-by-step:

1. Custody and Verification

The copper is stored safely in a secure, certified location, often by a third-party custodian. This ensures the metal backing of your copper tokens is real and verified.

2. Token Creation with Smart Contracts

A reliable token development company USA builds smart contracts to create copper tokens. These tokens are directly linked to the physical copper, making ownership easy to transfer digitally.

3. Blockchain Recordkeeping

Every transaction is stored on the blockchain. That means businesses get a transparent, tamper-proof log of who owns what, which is key for audits and regulatory compliance.

4. Platform and API Integration

A professional tokenization platform development company helps you set up dashboards and APIs to manage your tokens, users, and business workflows. This makes it easy for your internal teams or partners to interact with your tokenized assets.

5. Advanced Blockchain Integration

To build a complete enterprise solution, your platform can be connected with tools from a smart contract development company or a blockchain consulting company. This lets you add features like automated compliance, payments, or trading.

This setup allows B2B companies like manufacturers, commodity traders, or financial institutions to digitize copper ownership, reduce manual processes, and expand their global reach through secure blockchain systems.

It’s a smart way to modernize how copper is tracked, traded, and invested in. So if you are looking to build a Copper Tokenization Platform.

Read Also: Green Energy Tokenization

How to Build a Copper Tokenization Platform?

Creating a strong copper tokenization platform involves a few clear steps. Here’s a simple guide for businesses looking to digitize their copper assets and enter the world of tokenized commodities.

1. Secure Physical Copper and Custodian

First, make sure you have a reliable supply of physical copper. Store it with a trusted custodian or storage facility that can verify and audit your inventory. This is key to ensuring every token is backed by real-world copper.

2. Pick the Right Blockchain

Choose a blockchain that is secure, scalable, and commonly used in the industry. Most RWA tokenization companies prefer blockchains like Ethereum, Polygon, or Avalanche because they are well-tested and support smart contracts.

3. Develop Smart Contracts

Hire a professional smart contract development company to create smart contracts. These control how your copper tokens are minted, transferred, or destroyed. The contracts also include rules for compliance, ownership, and transaction tracking.

4. Build a User-Friendly Platform

Your clients will interact with your platform regularly, so design a dashboard that is easy to use. A reliable tokenization platform development company can help create a smooth, functional interface that includes dashboards, analytics, and role-based access for users.

5. Add Legal and Compliance Features

For global business, compliance is non-negotiable. Add KYC (Know Your Customer), AML (Anti-Money Laundering), and other legal checks. If you’re in the U.S., it’s important to partner with an asset tokenization company in USA that understands SEC regulations.

6. Ensure Real Asset Backing

Every tokenized copper token should represent a real, physical asset. Use blockchain or IoT systems to provide proof of ownership and verify that the copper is stored securely.

7. Integrate With Broader Financial Systems

To increase functionality, your platform should connect with systems like blockchain in trade finance. This allows businesses to use tokenized copper for lending, staking, or as collateral for loans.

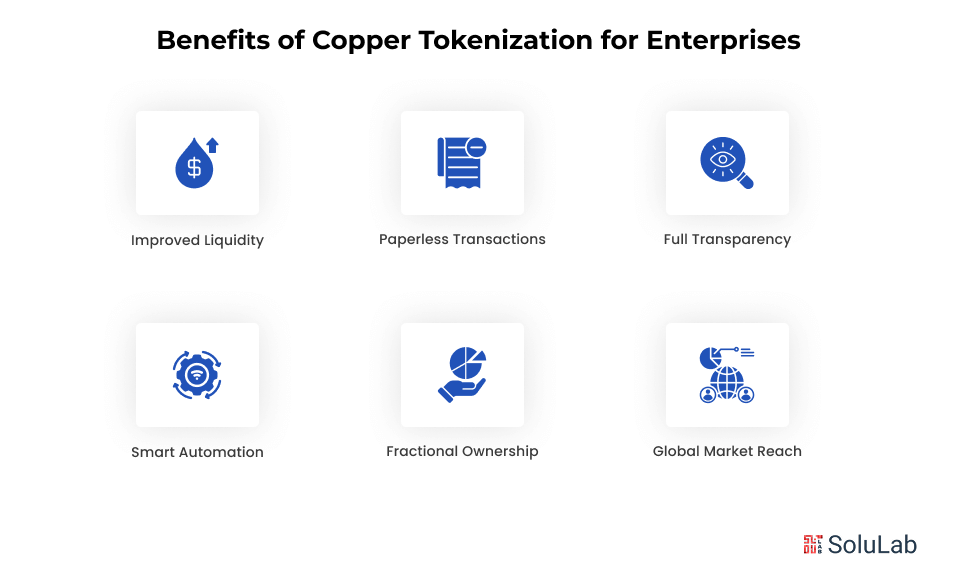

Benefits of Copper Tokenization for Enterprises

Copper tokenization offers major advantages for businesses looking to modernize how they manage, trade, and invest in physical copper. Here are the key benefits for modern companies:

1. Improved Liquidity

By turning physical copper into tokens, companies can trade copper instantly and globally, without the need for delays or intermediaries. This makes it easier to access funds and improve cash flow.

2. Faster and Paperless Transactions

Using a secure copper tokenization platform, businesses can skip the paperwork. All ownership transfers and transactions happen digitally and in real time.

3. Full Transparency

All transactions are recorded on the blockchain, so businesses get clear, tamper-proof audit trails. This builds trust and makes regulatory reporting easier.

4. Smart Automation

With help from a smart contract development company, businesses can automate compliance and transaction rules. This reduces manual work and errors.

5. Fractional Ownership

Tokenized copper can be split into smaller units. This allows investors or trading firms to buy and sell just a portion of a copper asset, opening new investment models.

6. Global Market Reach

Working with a reliable copper tokenization company or asset tokenization company in the USA gives you access to global digital commodity markets without the limits of traditional systems.

These benefits make copper tokenization a smart choice for any enterprise looking to digitize their commodity operations. If you are already exploring gold tokenization development or considering entering other commodity markets, copper is a great place to start.

Conclusion

Copper tokenization is more than just a new trend; it’s a smart way for businesses to modernize how they trade and manage copper. By turning physical copper into digital tokens, companies can make trading faster, safer, and easier to scale.

If you’re a business dealing with commodities, working with SoluLab, a trusted asset tokenization company in the USA, can help you build a complete copper tokenization system that fits today’s compliance rules and improves liquidity. As global markets shift to digital, businesses that start using copper tokenization platforms early will have a big advantage.

Have a unique business idea? Let’s connect!

FAQs

1. What is copper tokenization?

It’s the process of turning real copper into digital tokens on a blockchain. These tokens represent ownership of the physical copper.

2. Are copper tokens secure?

Yes. When created by a trusted token development company USA using smart contracts and safe storage, copper tokens are highly secure.

3. How can I start a copper tokenization business?

Team up with an experienced copper tokenization company or a professional blockchain development company that can build your platform, smart contracts, and compliance tools.

4. Can I tokenize other physical assets like gold or oil?

Yes. Many providers also offer gold tokenization development and similar services for other commodities.

5. What are the benefits of copper tokenization for enterprises?

It brings better liquidity, faster transactions, and easier compliance, all through a secure, blockchain-based system.

6. Do I need to be in the USA to build a copper tokenization platform?

No. But if you want to operate in the U.S., working with a certified asset tokenization company in USA ensures your platform follows local laws and regulations.