Ever tried investing in real estate or fine art and felt overwhelmed by the paperwork, middlemen, and high entry barriers? That’s the problem with traditional asset ownership: it’s slow, costly, and exclusive. Owning a fraction of a luxury property or a rare painting, all through a few taps on your phone.

That’s where AI agents in asset tokenization come in. They simplify the complex process of turning physical assets into digital tokens using blockchain technology, while automating tasks like verification, compliance, and trading.

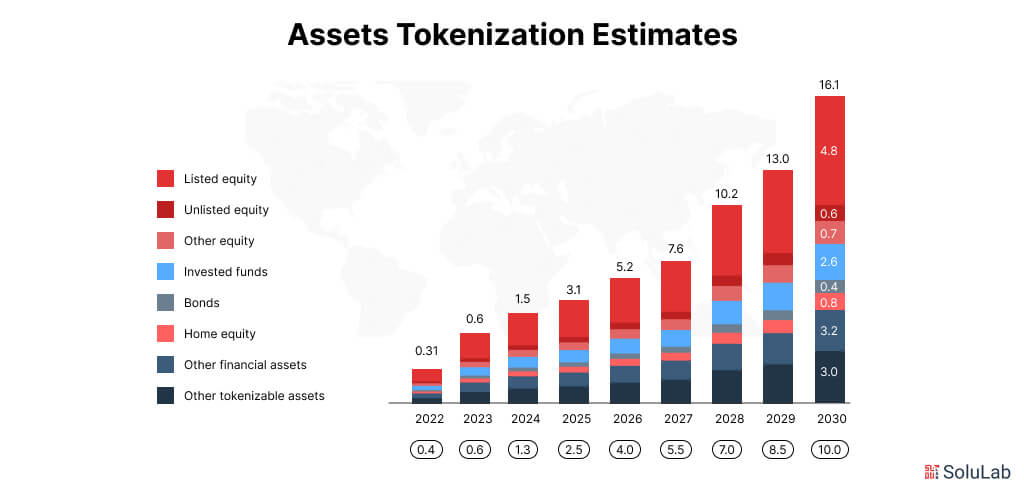

| Asset Tokenization Market: Valued at $5.6 billion in 2024, it’s projected to grow to $30.21 billion by 2034, reflecting an 18.4% CAGR. |

In this blog, we’ll break down how AI agents are redefining digital ownership, making asset tokenization smarter, faster, and far more scalable than ever before. Let’s dive into the future of investing, powered by AI and blockchain!

What are AI Agents?

AI agents are intelligent software programs designed to autonomously perceive their environment, make decisions, and take actions to achieve specific goals. AI agents use cases autonomously to determine the optimal course of action to take for completing the goals that humans specify. These agents can range from simple bots that automate tasks to complex systems capable of handling multi-step reasoning, like planning a trip, writing code, or managing a conversation.

They’re often powered by machine learning and large language models (LLMs), allowing them to adapt and improve over time. Popular examples include customer support chatbots, virtual assistants, and autonomous AI research agents like AutoGPT and AgentGPT.

Understanding Asset Tokenization

Asset tokenization is the process of converting real-world assets, like real estate, artwork, or stocks, into digital tokens on a blockchain. These tokens represent ownership or shares of the physical asset and can be traded, sold, or transferred with ease. Due to blockchain technology, this process is not only transparent but also secure and highly efficient.

It reduces the need for middlemen, lowers transaction costs, and allows for fractional ownership, meaning you don’t need to buy an entire asset to invest in it. As blockchain evolves, asset tokenization is becoming a game-changer in how we handle and invest in traditional assets.

What is the Need for AI Agents in Asset Tokenization?

Tokenization uses smart contracts and blocks to create crypto assets from real assets. As asset tokenization scales with blockchain technology, the need for intelligent automation grows. This is where AI agents step in to improve, secure, and optimize complex processes.

Transforming Asset Valuation

- Automated valuation models (AVMs): AI is an important instrument for precise valuation due to its capacity to process enormous information, such as asset records, market movements, and economic indicators. AI guarantees, fairness and transparency in tokenized transactions by automating the value of assets, including real estate.

- Predictive Analysis: AI predicts future market movements rather than merely responding to the data. AI focuses on price patterns by evaluating both historical and current data, giving investors the knowledge they need to make better decisions in a market that is changing quickly.

Automated Contracts

- Smart Contracts Creation: Asset tokenization using AI makes smart contract development quicker, more effective, and less prone to errors possible by humans. Automatic generation of predefined phrases speeds up the process of tokenization and lessons, and administrative workloads.

- Self-Executed Contracts: These agents are capable of independently monitoring and carrying out smart contracts, guaranteeing smooth, timely fulfillment. AI makes sure everything runs well, whether it’s handling transaction fees or automating the payments of rent in real estate tokenization.

- Risk Assessment: By examining variables like geopolitical development and market, volatility, AI proactively, detects and evaluates hazards. AI assists investors in managing uncertainty and safeguarding their investments by offering risk insights.

Improving Security

AI-based asset management tokenization is a watchful guard that is always looking for all transaction patterns that can point to fraud. This is known as anomaly detection. AI preserves trust within tokenized assets and helps avoid expensive breaches by identifying questionable activity early.

- Real-Time Monitoring: AI keeps an eye out for security risks on Blockchain networks, guaranteeing a prompt reaction to any possible weaknesses. Token assets are safe and dependable because of this increased attention to detail.

- Biometric Authentication: AI-powered asset tokenization biometric technologies, such as fingerprint, scanning, and facial recognition, improve security in the field of asset tokenization by guaranteeing that only authorized users may access private information or assets.

Simplifying Compliance and Regulations

- Automated Compliance Checks: AI makes sure that companies remain compliant when tokenization requirements change. AI assesses businesses in staying ahead of the law and avoiding expensive fines by automatically verifying regulatory compliance.

- Timely Reporting: Compliance is a continuous process rather than a one-time event. AI can produce real-time reports, which lose the possibility of oversight by ensuring the organization state is current with requirements like AML/ KYC and tax standards.

- AI Chatbots: AI-powered chatbots provide 24 seven customer service, responding to inquiries on tokenized assets and helping investors as needed. This improves the client experience and increases consumer satisfaction.

- Individualized Suggestions: AI customized investment suggestions by examining investor preferences and historical performance, assisting people in making more knowledgeable and self-assured decisions regarding tokenized assets.

The role of AI in asset tokenization is very important and not merely a trend. The asset tokenization process is being changed by these intelligent solutions, which are also improving security, guarantee, compliance, streaming procedures, and offering individualized investor support.

Read Also: AI Tokenization For Asset Ownership

Real-World Use Cases of Asset Tokenization

Here we present actual instances of tokenized assets below:

-

Diamond Standard Tokenized Fund

To operate in the United States, Oasis Pro tokenized the Diamond Standard Fund (“Fund”) and floated it on the Oasis Pro Market, which is registered with the SEC’s ATS. Later, it broadened the Fund to the Asia market through the platform of InvestaX.

What’s the Fund About

The intangible Diamond Standard Commodities are what the Fund owns and stores physically, its real assets. The Fund allows experienced investors to invest in the first diamond commodity licensed by a regulator in the world with diamond as an asset class.

Type of fund: Alternative fund

Sponsors: Horizon Diamond Advisers, LLC and DSAM Advisors, LLC

Diamond commodities are a portfolio asset.

Bloomberg’s DIAMINDX is the benchmark index.

-

Mikro Kapital ALTERNATIVE eNoteTM Tokenized Bond

Mikro Kapital is the issuer that operates as a microfinancing company with targets aiding small and medium enterprises in the developing world. ALTERNATIVE, the digital security, and Corporate eNote provider fractionalizes business loans with Mikro Kapital issuing an ALTERNATIVE eNote™ Tokenized Offer to be listed on the regulated platforms of Obligate and InvestaX.

About the Tokenized eNoteTM

Fixed coupon, fixed maturity debt instruments linked to microfinance risks can be bought by professional investors and institutions from ALTERNATIVE – a securitization fund from Mikro Kapital. Thus, to ensure that micro-, small— and medium-sized businesses and entrepreneurs have access to financing services, the issuer takes on credit risks associated with the debt and equity of Microfinance firms, small financial institutions, leasing companies, banks, or credit cooperatives.

Mikro Kapital eNoteTM- ALTERNATIVE Bond tokenizations

The issuer Mikro Kapital is a microfinance-integrated company engaging in providing small-sized credits to independent businesses in developing countries. ALTERNATIVE eNote™ is an exclusive product of Mikro Kapital, which tokenizes its tokens and publicly offers them on regulated platforms of Obligate and InvestaX.

-

Methodic CoinDesk ETH

The Object of the methodic coindesk ETitle/ETH staking Fund is to deliver the entire return on Ethereum and ETH staking rewards. The issuer has also applied tokenization to enable the Fund to access a wider market of investors. Rewards that are received in Ether and are cashed in for currency or in-kind are given back by the Fund. The main token sale of InvestaX is held via the regulated platform.

-

Metavisio Corporate Bond

Metavisio SA which is an issuer of computer equipment that belongs to the entry category is a Euronext list company with a focus on the growth regions like India. The company has a brand name that has existed for 130 years and has support from established players in the market such as Microsoft, Google, NVIDIA, and others.

The Metavisio Corporate Bond was launched in March 2024. Through the funding, the company aims to expand its production facilities in India which will enable it to grow the company’s overseas business effectively. The Metavisio Corporate Bond is provided through the Singapore-regulated marketplace InvestaX.

Future of AI Agents in Tokenization of Assets

The role artificial intelligence plays occupies a prominent position in the tokenization of assets, and this role only grows as it evolves. Here are some changes you’ll see in upcoming years in tokenization:

1. Smarter Automation: AI agents will handle everything—from verifying asset ownership to executing smart contracts, making tokenization faster and less error-prone.

2. Fraud Detection in Real-Time: With machine learning, AI agents can quickly detect unusual patterns or suspicious activities, keeping transactions secure.

3. Personalized Investment Opportunities: AI will analyze your risk appetite and suggest tokenized assets tailored to your goals, like your own digital investment advisor.

4. Regulatory Compliance: AI agents can keep up with changing legal frameworks, ensuring every transaction stays compliant without manual checks.

5. Faster Settlement Times: AI can drastically reduce the time it takes to settle asset trades, from days to minutes.

6. Scalable Ecosystems: As more assets get tokenized, AI agents will help scale operations without increasing human workload.

Conclusion

AI agents are changing asset tokenization into a smarter, faster, and more secure process. By combining automation with the transparency of blockchain technology, they’re making digital ownership more accessible and efficient than ever.

From improving asset verification to managing compliance and reducing fraud, AI agents are paving the way for a future where traditional asset management feels outdated.

As tokenized markets continue to grow, these intelligent systems will play an essential role in scaling operations without increasing complexity. In short, AI agents aren’t just a tech trend—they’re the backbone of the next phase in digital asset ownership and innovation.

Digital Quest, by SoluLab, an AI Agent development company, changed its user experience and customer interaction strategy by collaborating with us, showing the potential of artificial intelligence technology. In addition to offering precise, customized travel advice, the chatbot created a smooth feedback loop for ongoing development.

Get in touch with SoluLab today and start your process of transformation!

FAQs

1. What is tokenization in AI?

In the field of AI, tokenization is the act of breaking up input text into smaller tokens like words or subwords which can be done by an asset tokenization development company. This lays the groundwork for tasks involving natural language processing (NLP), which allows AI to comprehend human language.

2. Is Alexa an AI Agent?

Amazon has big hopes for Alexa’s growth. Alexa will be able to carry out duties on her own if it is developed as an AI agent. That was clarified by CEO Andy Jassy on a call regarding financial performance.

3. What is Asset Tokenization?

The process of using blockchain technology to transform the value of an intangible or tangible item into a digital token is known as asset tokenization. Fractional ownership, enhanced liquidity, and transparent traceability are all made possible by this change.

4. What is an example of tokenization?

Tokenization is the process of substituting a non-sensitive token for a sensitive data piece, like a bank account number. The token is considered to be a randomly generated data string with no inherent value or significance that can be exploited.

5. Can Solulab assist with tokenization services?

Yes, Solulab uses AI and Blockchain to streamline asset tokenization. We offer entire tokenization solutions using our experience. We seamlessly integrate modern technologies from the tokenization framework conception for secure blockchain.