According to CoinGecko, there were 36 notable crypto airdrops throughout 2024, adding $20B to the market. A scale that has inevitably drawn global regulatory scrutiny and investor attention. Token issuers face the dual challenge of maintaining compliance while ensuring fair distribution and user privacy.

Startups and enterprises can no longer afford random, unverified campaigns. They must prove who their recipients are, without compromising decentralization or trust. This is where KYC-First + ZK Airdrops redefine the model. By merging Know Your Customer (KYC) verification with Zero-Knowledge (ZK) cryptography, projects can confirm user eligibility, prevent fraud, and satisfy compliance audits.

This blog provides you:

- The architecture and business advantages of KYC-First Airdrops.

- Key cost drivers, integration complexity, and a practical roadmap for startups and enterprises adopting zkKYC frameworks.

What Are KYC-First + ZK-Based Airdrops?

KYC-First + ZK Airdrops require verified participants before token claims. Identity checks occur off-chain, and a cryptographic proof reaches the chain. Hence, privacy and auditability coexist. This model prevents bot farming and reduces regulatory risk.

KYC-First Airdrops use third-party verification to approve participants while Zero-Knowledge Proofs confirm eligibility without revealing PII [Personally Identifiable Information]. Projects receive proof, not raw documents.

Key Components of the Model

- An identity issuer that verifies and issues credentials.

- Wallets that store verifiable credentials.

- On-chain verifier contract validating ZK proofs.

- Revocation registry to invalidate compromised credentials.

Startups gain cleaner metrics and higher LTV [Lifetime Value] users. Enterprises can access regulated markets and banking rails. Both reduce exposure to fraud and large fines.

How KYC-First + ZK Airdrops Work and Help Your Business?

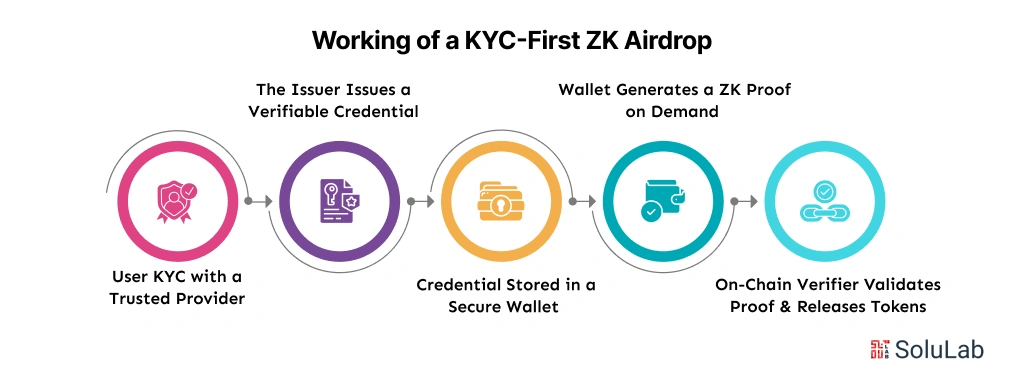

The flow begins with user verification by an approved issuer. Users receive a digital credential, and wallets generate a ZK proof on demand. Smart contracts check proofs before token distribution and crypto airdrops. This preserves privacy and enforces one-identity-one-wallet.

1. Working of a KYC-First zk Airdrop

Combining KYC verification with ZK proofs creates a secure, privacy-preserving, and efficient airdrop process:

Step 1. User KYC with a Trusted Provider

The process begins when a user completes identity verification through a trusted KYC provider. This step occurs off-chain, supported by AI systems for KYC that handle document analysis and facial recognition. The AI layer ensures accuracy and reduces manual intervention, minimizing delays and human error in verification.

Step 2. The Issuer Issues a Verifiable Credential

Once the user passes verification, the KYC provider issues a digital credential that confirms eligibility for participation. This credential includes key claims such as age, residency, and sanction status. It functions as a cryptographic proof of compliance rather than raw personal data shared with the project.

Step 3. Credential Stored in a Secure Wallet

The issued credential is then securely stored inside a credential wallet or identity vault under the user’s full control. These wallets ensure that the verified identity remains portable and reusable across future services, cutting friction during onboarding and preventing repetitive KYC submissions.

Step 4. Wallet Generates a Zero-Knowledge Proof on Demand

When the user wants to participate in an airdrop, the wallet creates a Zero-Knowledge proof that validates eligibility without exposing personal data. This proof uses Boolean claims such as confirming the user’s age or residency, providing privacy while maintaining compliance with AML and KYC standards.

Step 5. On-Chain Verifier Validates Proof and Releases Tokens

The Zero-Knowledge proof is sent to an on-chain verifier contract, which checks its validity before releasing tokens to the participant. If a credential becomes outdated or compromised, the revocation registry automatically blocks its use, ensuring the system remains secure and transparent.

2. Tools and Infrastructure Needed

There are some essential requirements to begin with the process, those are:

-

KYC Provider with ZK Support

Businesses need a KYC provider capable of issuing Zero-Knowledge credentials while ensuring compliance. Providers such as Polygon ID and Privado ID combine AI-based verification with cryptographic issuance, enabling projects to meet regulatory standards without storing sensitive data.

-

Credential Wallet or Identity Vault

A credential wallet acts as a secure digital vault where verified credentials are stored. It must support selective disclosure, on-demand proof generation, and user consent controls. An intuitive user interface encourages higher verification completion rates and smoother participation in token distributions.

-

On-Chain Verifier Contract

The verifier contract sits at the heart of the airdrop architecture. It validates submitted ZK proofs, ensures participants meet eligibility criteria, and automatically executes token transfers. Efficient gas management and rigorous audits of these contracts are critical to maintain cost efficiency and system integrity.

-

Revocation and Audit Mechanisms

A revocation registry allows invalid or expired credentials to be deactivated immediately, maintaining trust across all transactions. Audit mechanisms record every verification event on an immutable ledger, giving regulators and partners tamper-proof evidence of compliant token distribution without breaching privacy.

-

AI and Automation Layer

AI enhances every stage of the workflow by accelerating document verification, detecting fraud attempts, and flagging high-risk profiles in real time. Combined with ZK cryptography, AI technology helps identify suspicious activities without ever exposing personal identity data to third parties.

-

Legal and Compliance Tooling

Before integration, businesses must conduct jurisdictional scoping to meet international standards such as FATF, MiCA, and the Travel Rule. Automated compliance tools assist in generating audit trails and regulatory reports, reducing manual oversight while maintaining adherence to global AML and KYC requirements.

Cost factors and integration complexity for Web3 projects

The cost of implementing Web3 solutions like KYC-first and Zero-Knowledge (ZK) identity systems varies depending on project scale, provider choice, and level of customization. Understanding the key drivers helps businesses plan budgets realistically and optimize ROI.

Key Cost Drivers

- KYC Provider Fees: Most providers charge per verification, which can scale quickly with user volume.

- ZK Development & Audit: Building or customizing zero-knowledge proofs involves smart contract audits, development, and testing, which is critical for security.

- Smart Contract Deployment & Gas Costs: Deploying contracts on-chain requires gas fees, which fluctuate by network usage and complexity.

- Identity Wallet UX & Support: User-friendly interfaces, cross-platform compatibility, and support infrastructure impact design and development costs.

- Ongoing Compliance & Revocation Tools: Maintaining up-to-date KYC/AML compliance and revocation processes adds operational cost, though it reduces fraud-related losses over time.

Integration Complexity

Integration complexity depends heavily on your technology stack:

- Using off-the-shelf ZK identity frameworks can reduce development time, testing needs, and initial costs.

- Custom-built ZK circuits offer flexibility and tailored security but increase development effort, audit cycles, and upfront costs.

While custom solutions have a higher initial investment, they often deliver lower ongoing costs by reducing fraud, improving compliance, and minimizing user verification errors.

Cost Range Guidance

- Startups & Small Projects: $10K – $50K depending on user volume, framework choice, and integration depth.

- Enterprise-Grade Deployments: $70K – $500K+ for full-scale, multi-jurisdictional solutions with custom ZK circuits, compliance tooling, and dedicated support.

Planning Tip:

- Enterprises should include legal scoping, cross-border compliance, and audit cycles in their budget.

- Startups should prioritize modular, interoperable stacks to scale efficiently while controlling costs.

By factoring both integration complexity and ongoing operational efficiencies, businesses can strategically plan Web3 identity projects that are secure, compliant, and cost-effective.

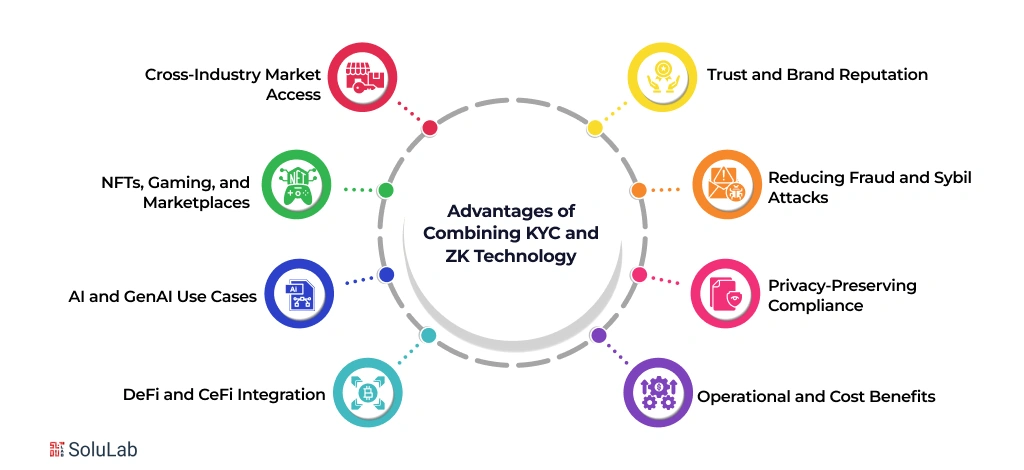

The Advantages of Combining KYC and ZK Technology

Combining KYC with Zero-Knowledge balances regulatory needs and privacy. Projects gain audit trails without storing PII. User trust increases when data exposure drops. Token distributions become fairer and more targetable.

-

Strengthening Trust and Brand Reputation

KYC-First Airdrops show institutional-grade controls that attract exchanges and custodians. Moreover, audited cryptographic proofs reassure investors during due diligence and listing reviews.

-

Reducing Fraud and Sybil Attacks

Verified credentials remove incentives for multi-wallet farming and automated bot attacks. As a result, marketing spend targets real users and tokenomics retains intended value.

-

Privacy-Preserving Compliance

Zero-Knowledge Proofs enable sanctions and residency checks without exposing PII. Hence, regulators receive evidence while user privacy remains protected by design.

-

Operational and Cost Benefits

AI solutions automate document verification, reducing manual reviews and headcount needs. Additionally, reusable credentials lower per-user KYC costs and speed onboarding across services.

-

DeFi and CeFi Integration

DeFi protocols can gate high-value actions using ZK proofs without storing user data. At the same time, CeFi partners accept proofs for faster fiat ramps and compliant custody partnerships.

-

AI and GenAI Use Cases

GenAI models can train on anonymized verification signals instead of raw PII, protecting privacy while improving fraud detection. Further, AI-driven risk scoring flags anomalies without exposing identities.

-

NFTs, Gaming, and Marketplaces

NFT drops and in-game rewards benefit from verified scarcity when KYC prevents duplicate claims. Consequently, creators monetize more effectively, and NFT marketplaces avoid wash trading.

-

Cross-Industry Partnerships and Market Access

Enterprises gain partner confidence through auditable, privacy-first proofs that meet AML expectations. As a result, access to banking rails and regulated markets becomes more feasible.

How KYC-First + ZK Airdrops Redefine Compliance in Web3?

KYC-First + ZK Airdrops create evidence of compliance while minimizing data risks. Regulators get cryptographic assurance. Users keep control of personal data. This alignment makes market access simpler.

-

Aligning with FATF and Global AML Standards

Proofs can demonstrate sanctions and KYC checks. The evidence is auditable. This reduces regulatory exposure for token issuers.

-

Meeting MiCA and EU Disclosure Expectations

Selective disclosure supports MiCA’s transparency demands. Projects can document participant eligibility without central data retention.

-

Travel Rule and On-Demand Disclosure

Proofs enable a data-on-request model for Travel Rule compliance. Only when required does extra evidence leave user control. This minimizes privacy leakage.

-

Auditability Without Doxxing Users

Auditors can verify that checks occurred. Cryptographic proofs act as tamper-evident records. No sensitive files need to change hands.

The Future of Token Distribution with KYC-First + ZK Airdrops

KYC-First + ZK Airdrops will shape the next phase of token launches. Adoption will increase as regulators and users demand both trust and privacy.

- Adoption by regulated crypto exchanges will accelerate market access. Projects with zk identity frameworks will win listings.

- Reusable credentials will cut onboarding friction and lower acquisition costs. User retention will rise as verification becomes single-time.

- Cross-platform identity standards will simplify partnerships. Interoperable zk identity frameworks will enable credential portability.

- Tokenomics will improve as legitimate users receive meaningful allocations. Investor confidence will strengthen as dilution declines.

- Data breach risk will decline, lowering insurance and compliance costs. Enterprises will prefer architectures that minimize PII storage.

- New revenue models will emerge from premium access tied to verified status. Enterprises will design gated services for verified communities.

Conclusion

Now you know how KYC merged with Zero-Knowledge technology, securing the user data and ensuring compliance. As the market expands, security becomes a major concern to be ahead of market requirements; early adoption of KYC+ZK gives you a plus point.

SoluLab, a leading blockchain development company in USA, is all set to render modern solutions for modern problems. If you are ready with your goal, we are here to help you with KYC-first airdrop development services. Our expert-driven approach ensures seamless execution for your ultimate business success.

For more information, contact us today and discuss your requirements.

FAQs

1. Why should airdrops move beyond traditional verification methods?

Traditional methods expose personal data and invite bots. KYC-First + ZK airdrops protect privacy, ensure regulatory alignment, and deliver high-quality user participation that drives measurable, long-term business value.

2. What business challenges do KYC-First + ZK Airdrops actually solve?

They address fraud, data security, and compliance costs. Businesses gain verifiable user trust, improved token economics, and cross-border regulatory readiness without compromising user experience or decentralization.

3. How can SoluLab help in building KYC-First Airdrops?

SoluLab provides end-to-end blockchain consulting services, integrating ZK frameworks, KYC integration solutions, compliance automation, and smart contract audits for startups and enterprises targeting secure, compliant token launches.

4. How much does integrating zkKYC-based systems typically cost?

Costs vary by project scale, verification provider, and smart contract complexity. Startups using ready zk identity frameworks spend less, while enterprises often invest in custom, multi-jurisdictional integrations.

5. How will privacy-preserving airdrops shape future business ecosystems?

Future airdrops will evolve into verified digital membership systems, enabling gated access, premium loyalty programs, and AI-driven identity layers that link compliant communities across multiple Web3 platforms.