Ever feel lost trying to figure out which cryptocurrencies have long-term potential beyond hype?

With thousands of coins out there, most won’t survive the next regulatory wave.

Global finance is evolving, and not every crypto is built to survive in a regulated, bank-friendly future. But some are. ISO 20022, the global standard for financial messaging, is becoming the bridge between traditional banking and digital assets. And a select few cryptocurrencies are already aligned with it.

In this blog, we’ll reveal the Top 8 ISO 20022-Compliant Cryptocurrencies you should keep an eye on for 2026 — coins designed to work with the system, not against it.

What is ISO 20022?

ISO 20022 is a standard that facilitates the exchange of financial information between institutions, ensuring a more structured, efficient, and interoperable system for financial transactions. It provides a universal format for messages, including payment instructions, securities transactions, and fund transfers.

In simpler terms, ISO 20022 enables different financial systems to communicate with each other in a standardized manner, thereby improving transparency, reducing errors, and accelerating transactions.

While it’s widely used in traditional finance (banks, payment processors). Adoption of ISO 20022 Coins and Crypto is accelerating global interoperability, aligning with major cross‑border messaging systems like SWIFT and SEPA. This integration improves cross-border payments, regulatory compliance, and real-time processing.

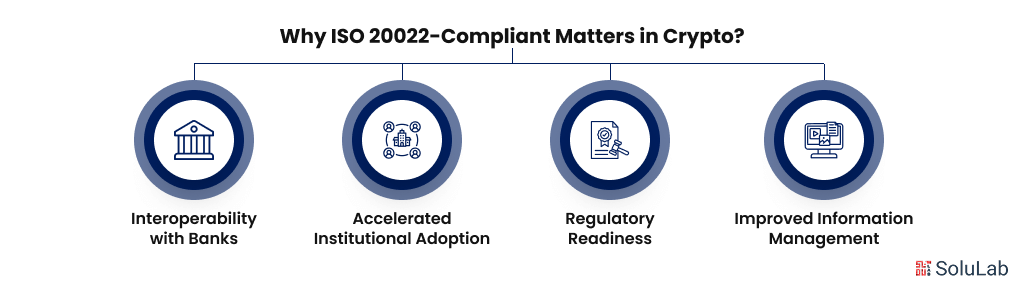

Why ISO 20022-Compliant Matters in Crypto?

ISO 20022 is a globally agreed communications standard used by banks and other financial institutions to communicate data-rich, standard, and secure data. ISO 20022-compliant cryptocurrencies will be better off as traditional finance switches to this industry standard.

This is the reason why it matters:

- Interoperability with Banks: Regulatory cryptos would be ideal for payments and institutions because they are easy to integrate with global banking systems.

- Regulatory Readiness: Coins in ISO 20022 are more likely to meet future regulations, and this appeals to governments and other major investors as well.

- Accelerated Institutional Adoption: Cryptocurrencies that comply with the ISO have a better probability of being the by financial institutions.

- Improved information management: Additional information on the transaction promotes automation, fraud detection, and compliance.

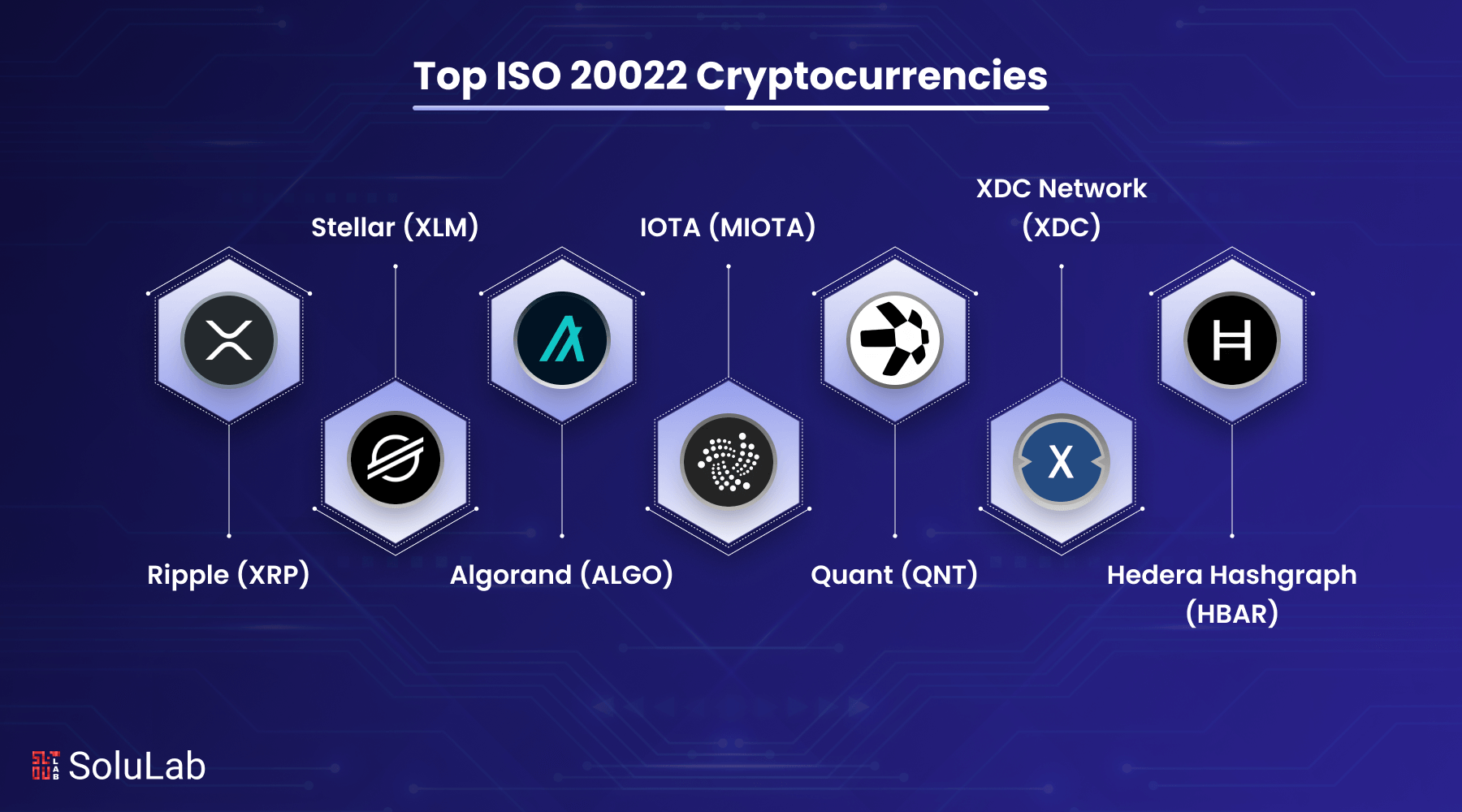

Top 8 ISO 20022-Compliant Cryptocurrencies of 2026

ISO-aligned coins may become more widely used and trusted, specifically by institutions, as more than 70 countries accept the standard. Here are the Most Popular ISO 20022 20022-compliant cryptocurrencies you should know:

-

Cardano (ADA)

Cardano (ADA) provides a secure and effective platform for developing smart contracts and dApps. It prioritizes interoperability, sustainability, and scalability while improving upon previous blockchains.

The Cardano Computation Layer (CCL), which runs smart contracts, and the Cardano Settlement Layer (CSL), which handles cryptocurrency transactions, are the two primary components of this network. Ouroboros, a Proof-of-Stake technique that enables users to receive rewards through staked ADA currency, keeps the network safe.

-

Ripple (XRP)

A cryptocurrency and digital payment system named Ripple (XRP) seeks to make international financial transactions easier. The Ripple Protocol Consensus Algorithm (RPCA), which XRP employs, enables verified nodes to process payments quickly and effectively without the need for energy-intensive mining.

By providing quick, international payments and money transfers, Ripple offers crypto-friendly banks and other financial organizations a more affordable alternative to the conventional SWIFT network. In the Ripple network, XRP serves as a bridge currency that facilitates simple value exchange between various fiat currencies through the XRP / USD pair.

-

Stellar (XLM)

Stellar (XLM), a cryptocurrency and decentralized payment network, promotes financial inclusion and low-cost cross-border transactions. This Ripple-based infrastructure connects banks, payment processors, and users globally. Stellar’s Stellar Consensus Protocol (SCP) instantly confirms transactions through a community of authorized nodes, eliminating resource-intensive mining.

Stellar employs Lumens (XLM) to bridge currencies and improve cross-border transactions. Lumens preserve the connection and prevent spam. Stellar focuses on tiny transactions and develops digital assets via its decentralized exchange. It helps uninsured persons use financial services for money transfers and tokenized assets.

-

Algorand (ALGO)

Algorand (ALGO) is a cryptocurrency platform for dApp development. Though decentralized, it’s Just Proof of Stake (PPoS) that validates transactions. Algorand’s PPoS lets users have an equal chance to produce and review newer blocks, keeping the network secure and lower resource-intensive than mining-based systems.

The ALGO network exchanges, confirms, and rewards transactions with Algorand. Algorand is appropriate for financial services, DeFi, and asset tokenization since it processes multiple transactions. The platform’s safe and efficient blockchain makes it a strong contender.

-

IOTA (MIOTA)

IOTA (MIOTA) is an IoT cryptocurrency and ledger system. The IOTA Foundation proposed “IOTA Rebased” as a major update. This upgrade converts the network from a Layer 1 IOTA blockchain to a Move-based object ledger.

The update aims to scale, decentralize, and program the network. Developers can create dApps straight on the main network. The Move programming language will be used to construct Layer 1 smart contracts in IOTA. This will simplify blockchain applications in supply chain management, asset tokenization, and digital identity.

-

Quant (QNT)

The purpose of Quant (QNT) is to enhance communication between various blockchains and conventional financial institutions. Data distributing, cross-chain operations, and the creation of decentralized applications (dApps) on several blockchains are all made possible by Overledger, the foundational platform.

By providing safe and effective communication and value exchange between blockchains, this technology improves the scalability, liquidity, and functionality of the whole sector. The native currency, QNT, is used to reward network users who contribute to network maintenance, pay transaction fees, and access Overledger services. The deflationary nature of QNT, which has a fixed supply, increases its value.

-

XDC Network (XDC)

XDC Network (XDC) is a cryptocurrency network for supply chain management, trade financing, and safe and effective cross-border transactions. The XinFin Composite Blockchain, upon which XDC is based, combines elements of publicly and privately managed blockchains to produce an adaptable and interconnected system.

XDC Network maintains the network’s security and decentralization by utilizing XinFin Delegated Proof of Stake, or XDPoS, to guarantee speedy transaction confirmations. Payment for transactions, platform service access, and network decision-making are all accomplished with the XDC token. Practical applications are the main focus of XDC, particularly in logistics and trade finance.

-

Hedera Hashgraph (HBAR)

The Hashgraph consensus technique is used by Hedera Hashgraph (HBAR) to offer great speed, security, and equity. It supports the development and operation of decentralized applications (dApps) in social networking, gaming, supply chain management, and banking.

Hedera uses a directed acyclic graph (DAG) in place of a conventional blockchain to reach consensus, enabling faster transactions with minimal power consumption. The system’s token, HBAR, is used to stake to protect the network, pay transaction fees, and take action in decision-making. Its deflationary method and fixed supply contribute to its value preservation.

Benefits of ISO 20022 Compliance For Crypto

The ISO 20022 is changing traditional finance communications with crypto. Its implementation introduces order, transparency, and universal harmony, and makes digital assets effective, compliant, and reliable in the financial environment.

1. Increased Cross-Border Payment Efficiency: The ISO 20022 simplifies message structures by cutting friction in cross-border payments. Payments with cryptocurrencies are faster, more precise, and cheaper, allowing smooth interoperability between blockchain networks and the rest of the financial institutions across the globe.

2. Regulatory and Institutional Alignment: There is standardization of the messaging, which facilitates the achievement of global compliance standards by crypto platforms. This will open up the space to institutional players who will operate with more confidence, knowing that their operations are within the regulator’s expectations.

3. Trust and Fairness: Transactions can be easily traced and audited when the data is structured and standardized. This brings transparency, minimizes the chances of fraud, and increases the level of trust among the users, regulators, and other financial partners dealing with crypto assets.

4. Improved Compatibility with the Legacy Finance (TradFi): ISO 20022 fulfills the blockchain-to-legacy system communication gap. Through it, crypto users can more easily integrate into bank and financial systems, speeding mainstream adoption and usage of digital currencies.

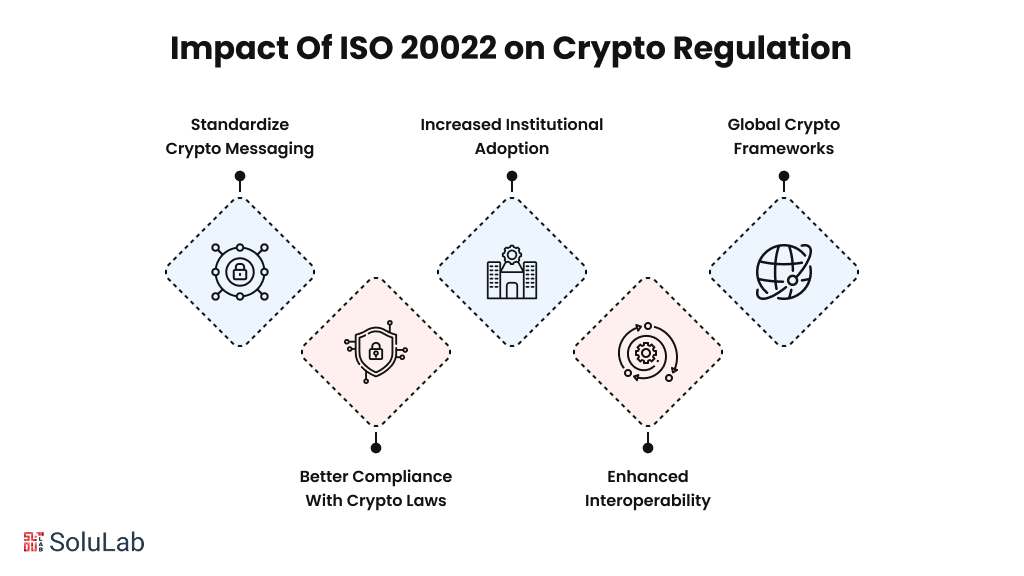

How will ISO 20022 Impact Crypto Regulation in 2026?

ISO 20022 might become a game-changer for how cryptocurrencies are regulated and integrated in 2026. Here’s what you need to know:

- ISO 20022 will standardize crypto messaging: ISO 20022 introduces a universal messaging format for financial institutions. Once applied to cryptocurrency transactions, it can simplify communication, reduce errors, and boost transparency—making it easier for crypto regulations to take shape across global markets.

- Better compliance with cryptocurrency laws and regulations: With clear transaction metadata and structured information, regulators can track suspicious activities. This helps cryptocurrency development companies stay compliant with cryptocurrency laws and regulations, while building trust.

- Increased institutional adoption of cryptocurrency: Standardization through ISO 20022 aligns crypto with traditional finance protocols. As a result, banks and large financial institutions may feel more secure entering the cryptocurrency market—helping crypto go mainstream.

- Enhanced interoperability across platforms: ISO 20022 supports richer data formats, enabling communication between crypto exchanges, banks, and payment providers. This can lead to a more integrated financial system where digital assets move.

- Encouragement for more global crypto frameworks: As countries adopt ISO 20022, it will push for crypto regulations and help establish a global framework, easing cross-border compliance and launching crypto services globally.

Conclusion

As the global financial system moves toward ISO 20022 adoption, cryptocurrencies aligned with this standard are gaining serious attention. From improved interoperability to faster cross-border transactions, these ISO-compliant cryptocurrencies could show how value moves globally.

For investors, developers, and institutions alike, keeping an eye on this evolving list of ISO 20022-compliant cryptocurrencies in 2026 isn’t just smart, it’s strategic. As innovation accelerates, these coins may become key players in bridging crypto with mainstream financial systems.

NovaPay Nexus partnered with SoluLab to integrate multi-crypto support, enhance security, and build a user-friendly interface. The result? A decentralized, fee-free payment solution empowering businesses with full control and privacy. NovaPay Nexus now drives wider adoption of ISO-compliant cryptocurrencies across industries, redefining how secure digital payments are made.

SoluLab, a top cryptocurrency development company, can help you bring your blockchain vision to life. Have an idea in mind, let’s connect!

FAQ

1. Is ISO 20022 mandatory for cryptocurrency adoption?

Adoption, however, improves compatibility with conventional finance. Cryptocurrencies that are ISO-compliant are better positioned to comply with international cryptocurrency laws and regulations, as well as future ones.

2. How do I buy ISO 20022 coins?

Major exchanges offer ISO 20022 Coins and Crypto for purchase. Before purchasing compliant coins, do extensive research using reputable bitcoin coin market platforms.

3. What is the Future of ISO 20022 and Cryptocurrency Integration?

With ISO 20022 Coins and Crypto enabling safe, standardized messaging and opening up possibilities for greater integration into banking and regulated finance systems, the future is bright.

4. Will other cryptocurrencies adopt ISO 20022?

To stay competitive and follow changing bitcoin rules and regulations globally, many projects may adopt ISO standards as regulatory pressure increases.

5. How does ISO 20022 affect cross-border transactions?

It improves international payments’ efficiency, speed, and transparency. While keeping to international crypto rules and financial messaging standards, ISO-compliant cryptocurrencies can expedite cross-border transactions.