As cryptocurrency aficionados get more familiar with DApps, the number of DApps increases constantly. Decentralized applications are programs that operate on a blockchain or a peer-to-peer network. These platforms are not managed by a central authority, but rather by a broad network of users, who control them themselves. DApps are not only simpler to build, but they also appeal to users who are worried about privacy in the future.

Smart contracts represent the fundamental logic of a decentralized application. Smart contracts work as blockchain building blocks that receive information from externally available sensors/events. Moreover, they assist the blockchain in managing the status of every participant.

Decentralized apps do not have to run on top of a blockchain network. Tor, Popcorn Time, BitTorrent, and BitMessage are examples of decentralized apps that operate on a P2P network but not on a blockchain — which is a kind of P2P network in and of itself. In this blog, we will look into the top blockchain dApps in 2025.

What are Blockchain dApps?

Blockchain dApps are decentralized applications that utilize blockchain technology as their underlying infrastructure. These applications operate on a distributed network of computers (nodes) that maintain a shared, tamper-resistant ledger of transactions or data.

Blockchain dApps typically have the following characteristics:

1. Decentralization: They run on a network of nodes rather than a centralized server, meaning no single entity has control over the entire network.

2. Transparency: Transactions and data on the blockchain are transparent and publicly accessible, providing users with visibility into the history of the application.

3. Immutability: Once recorded on the blockchain, data cannot be easily altered or deleted, ensuring the integrity and security of the application.

4. Smart Contracts: Many blockchain dApps utilize smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automatically execute when predefined conditions are met, enabling trustless and automated transactions.

5. Tokenization: Some blockchain dApps involve the use of tokens, which represent digital assets or utility within the application. These tokens can be used for various purposes, such as payments, voting, governance, or accessing specific features.

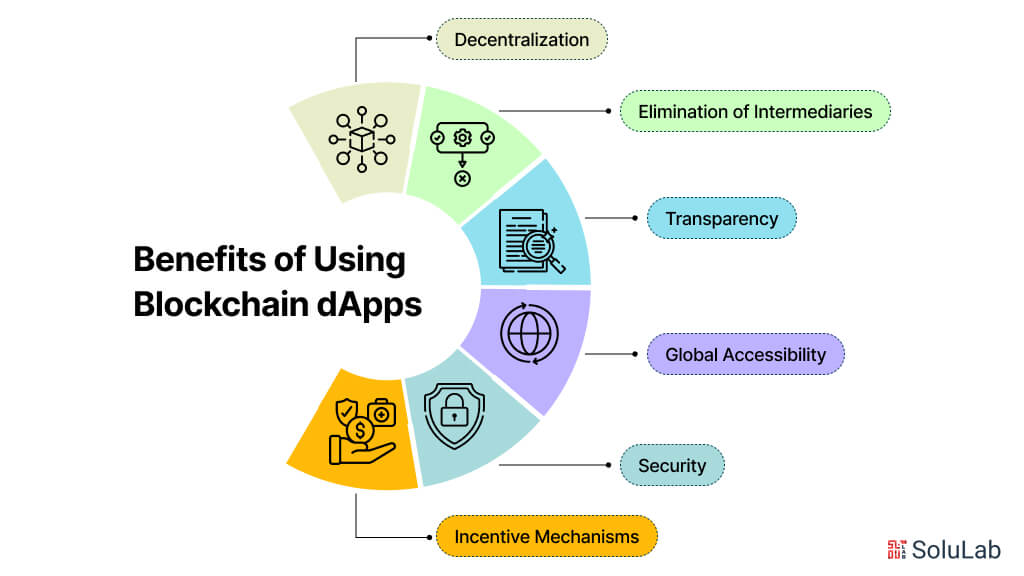

Benefits of Using Blockchain dApps

There are several benefits of using blockchain dApps. Some of them include:

- Decentralization: Blockchain dApps operate on decentralized networks, ensuring that no single entity has control over the entire system. This decentralization fosters trust among users by reducing the risk of censorship, manipulation, or single points of failure.

- Transparency: Transactions and data recorded on the blockchain are transparent and immutable, meaning they can be verified by anyone at any time. This transparency enhances trust and accountability within the ecosystem, as users can independently verify the integrity of the data.

- Security: The cryptographic principles underlying blockchain technology provide robust security features. Data stored on the blockchain is cryptographically hashed and distributed across multiple nodes, making it highly resistant to tampering, fraud, and cyberattacks.

- Elimination of Intermediaries: By leveraging smart contracts and decentralized networks, blockchain dApps eliminate the need for intermediaries, such as banks or clearinghouses, in various transactions. This not only reduces costs but also accelerates transaction processing and enhances efficiency.

- Global Accessibility: Blockchain dApps are accessible to anyone with an internet connection, regardless of geographic location or socio-economic status. This global accessibility democratizes access to financial services, digital assets, and decentralized applications, fostering financial inclusion and economic empowerment.

- Incentive Mechanisms: Many blockchain platforms incorporate incentive mechanisms, such as token rewards or staking, to incentivize network participants to contribute resources and maintain the integrity of the network. These mechanisms align the interests of participants and help ensure the sustainability and security of the ecosystem.

The Current State of Blockchain dApps

Due to the increasing desire for decentralized solutions and the rapid expansion and variety of technology, the current state of blockchain dApps is remarkable. Among the top blockchain platforms to build dApps, Ethereum stands out for its robust smart contract functionality and extensive developer community. However, issues with scalability and expensive transaction fees have prompted the rise of substitute platforms that provide quicker and more affordable dApp development alternatives, such as Binance Smart Chain, Polygon, Cardano, and Solana.

With its decentralized options for lending, borrowing, and trading, decentralized finance, or DeFi, has become a major factor in the transformation of traditional financial services. Comparably, the emergence of non-fungible tokens (NFTs) has drawn a lot of interest. Platforms built on the Ethereum platform, such as OpenSea and Rarible, have developed into hubs for the exchange of digital collectibles and artwork. Even while scalability problems still exist, approaches like layer 2 scaling and interoperability protocols are opening the door for a more connected and scalable blockchain dApp environment that will likely see more innovation and use in the years to come.

How Do Blockchain dApps Work?

Decentralized applications (dApps) operate on a decentralized network infrastructure, which distinguishes them from traditional centralized applications. Instead of relying on a central server, dApps utilize a network of computers, or nodes, distributed across the globe. These nodes work collaboratively to validate and record transactions on a blockchain, a distributed ledger that serves as the backbone of the dApp ecosystem. By decentralizing control and data storage, top decentralized apps or dApps eliminate single points of failure and reduce the risk of censorship or manipulation.

Smart contracts play a crucial role in the functionality of dApps. These self-executing contracts are written in code and deployed on the blockchain. They automatically execute predefined actions when specific conditions are met, without the need for intermediaries or third-party oversight. Smart contracts enable trustless interactions between users, facilitating secure and transparent transactions within the dApp ecosystem. Users interact with dApps through user-friendly interfaces, such as web or mobile applications, which connect to the underlying blockchain network. Through these interfaces, users can access the functionalities offered by the dApp, interact with smart contracts, and submit transactions. Overall, the most popular dApps use decentralization, smart contracts, blockchain technology, and user interfaces to provide transparent, secure, and trustless applications across various domains, empowering users with greater control over their data and assets.

How Did We Compile the List of Top Blockchain dApps in 2025?

As we explore the domain of blockchain technology in 2025, the importance of decentralized applications (dApps) remains paramount. These digital advancements are transforming various sectors by providing unmatched transparency, security, and effectiveness. To identify the best blockchain dApps, several critical factors are at play. From user engagement and security protocols to innovation and adherence to regulations, let’s examine the essential criteria for recognizing the most promising dApps in the upcoming year.

- User Adoption and Activity: Look for top decentralized apps with a high number of active users and consistent usage over time. User adoption is a strong indicator of the dApp’s popularity and relevance in the market.

- Transaction Volume and Scalability: Evaluate the dApp’s transaction volume and its ability to handle scalability. A top dApp should have a robust infrastructure capable of processing a high volume of transactions efficiently.

- Security and Transparency: Prioritize dApps that prioritize security measures and offer transparent operations. Blockchain’s inherent security features should be effectively implemented to protect user data and assets.

- Innovative Features and Functionality: Choose dApps that offer innovative features and functionalities, setting them apart from competitors. Look for unique selling points that enhance user experience and provide added value.

- Community Engagement and Support: Assess the level of community engagement and support surrounding the dApp. Active communities can contribute to the development, promotion, and improvement of the dApp, ensuring its long-term success.

- Partnerships and Collaborations: Consider dApps that have formed strategic partnerships and collaborations with reputable organizations. Partnerships can enhance credibility, provide access to resources, and open up new opportunities for growth.

- Regulatory Compliance: Ensure that the dApp complies with relevant regulations and legal requirements. Regulatory compliance is crucial for maintaining trust among users and avoiding potential legal issues in the future.

- Track Record and Reputation: Research the dApp’s track record and reputation in the blockchain community. Choose dApps with a proven history of reliability, transparency, and ethical conduct.

- Tokenomics and Economic Model: Analyze the tokenomics and economic model of the dApp, including token distribution, utility, and governance mechanisms. A well-designed economic model can incentivize user participation and contribute to the dApp’s sustainability.

- Market Trends and Adoption: Stay informed about market trends and the adoption of blockchain technology. Monitor the most popular dApps and emerging trends to identify opportunities and make informed decisions.

Interested? Here are the most popular dApps to check out in 2025!

-

Uniswap

Uniswap’s impact on decentralized finance (DeFi) goes beyond its user-friendly interface. It is known as one of the top crypto dApps known for automated liquidity protocol, based on constant product market-making, which ensures that trading pairs always have sufficient liquidity, even for lesser-known tokens. Uniswap’s decentralized nature also means that anyone can contribute liquidity to the platform and earn fees, fostering a community-driven ecosystem. Additionally, Uniswap’s V3 introduced concentrated liquidity, allowing liquidity providers to concentrate their funds within a price range, further optimizing capital efficiency.

-

Compound

Compound’s protocol dynamically adjusts interest rates based on supply and demand, ensuring efficient allocation of assets across borrowing and lending markets. Its transparent governance process enables token holders to propose and vote on changes to the protocol, ensuring its adaptability and resilience. Moreover, the Compound’s interest-earning tokens (cTokens) represent users’ share of the underlying pool and accrue interest in real time, providing a seamless and passive income stream for participants.

Read Also: Build a dApps on Solana

-

Chainlink

Chainlink’s decentralized oracle network utilizes a robust security model, including multiple independent node operators, to provide tamper-proof data feeds to smart contracts. Its modular architecture allows developers to customize Oracle solutions to their specific use cases, ensuring flexibility and scalability. Furthermore, Chainlink is known as the best blockchain for dApps due to the extensive network of data providers and aggregators that ensures high-quality and reliable data across various industries, including finance, insurance, gaming, and supply chain management.

-

MakerDAO

MakerDAO’s stablecoin Dai maintains its peg to the US dollar through a system of over-collateralization and automated liquidation mechanisms, ensuring its stability even in volatile market conditions. The decentralized governance process, facilitated by MKR token holders, enables continuous improvements to the protocol and ensures its security and integrity. Additionally, MakerDAO’s integration with other DeFi protocols and platforms expands Dai’s utility and adoption within the broader ecosystem.

-

CryptoKitties

CryptoKitties introduced the concept of non-fungible tokens (NFTs) to a mainstream audience, sparking a craze for digital collectibles and paving the way for the NFT market’s explosive growth. Each CryptoKitty is unique and owned by the user as an ERC-721 token on the Ethereum blockchain, providing immutable ownership and provenance. The breeding mechanism, based on genetic algorithms, allows users to create new and rare CryptoKitties, driving engagement and value within the platform.

-

Aave

Aave’s flash loan feature enables users to borrow assets without collateral as long as the borrowed amount is repaid within the same transaction, opening up new possibilities for arbitrage, collateral swaps, and protocol interactions. Its transparent and user-centric approach to governance ensures community participation and consensus in protocol upgrades and parameter adjustments. Furthermore, Aave’s integration with other DeFi platforms through its open-source codebase enhances interoperability and liquidity within the ecosystem.

-

Synthetix

Synthetix’s synthetic asset issuance protocol allows users to mint and trade synthetic assets, known as Synths, that track the value of real-world assets, including fiat currencies, commodities, and cryptocurrencies. Its unique staking mechanism, based on SNX tokens, collateralizes Synths and incentivizes network participants to maintain the protocol’s stability and security. Moreover, Synthetix’s decentralized exchange (Synthetix.Exchange) facilitates seamless and permissionless trading of Synths, enabling users to access a diverse range of assets without liquidity constraints.

-

Balancer

Balancer’s customizable liquidity pools and automated portfolio management strategies provide users with flexibility and control over their assets. Its smart order routing mechanism ensures optimal prices and slippage for traders across various liquidity pools, enhancing liquidity and efficiency in decentralized exchanges. Additionally, Balancer’s integration with other DeFi protocols and platforms through its open-source codebase enables composability and interoperability within the broader DeFi ecosystem.

-

Yearn.finance

Yearn.finance’s yield aggregation strategies automate the process of optimizing yield farming opportunities across various DeFi protocols, maximizing returns for users’ crypto assets. Its suite of products, including Vaults and Earn, offers different risk-reward profiles and strategies to cater to diverse investor preferences. Furthermore, Yearn.finance’s community-driven governance model empowers token holders to propose and vote on changes to the protocol, ensuring its responsiveness to market dynamics and user needs.

-

Decentraland

Decentraland’s virtual reality platform enables users to own, develop, and monetize virtual real estate, known as LAND, within a decentralized metaverse. Its scripting language, based on HTML, CSS, and JavaScript, allows developers to create interactive and immersive experiences, ranging from virtual art galleries to multiplayer games. Moreover, Decentraland’s DAO governance model enables community members to propose and vote on decisions regarding the platform’s development and evolution, fostering a vibrant and collaborative ecosystem.

Conclusion

In 2025, the world of blockchain dApps is buzzing with excitement as these decentralized applications redefine how we interact with digital assets and virtual spaces. From swapping tokens on Uniswap to immersing ourselves in virtual realms like Decentraland, these dApps aren’t just about finance—they’re about unlocking new possibilities and experiences in our digital lives. As we look ahead, the growth of these dApps will depend on factors like how user-friendly they are and how regulations shape their development. But one thing’s for sure: blockchain dApps are here to stay, offering us a glimpse into a future where decentralization and community-driven innovation reign supreme.

FAQs

1. What are blockchain dApps?

Blockchain dApps, short for decentralized applications, are software applications built on blockchain technology. They operate on a decentralized network of computers, offering various functionalities without relying on a central authority.

2. How do blockchain dApps differ from traditional apps?

Unlike traditional apps, blockchain dApps don’t rely on a centralized server. Instead, they leverage blockchain technology for decentralized consensus and data storage, providing greater security, transparency, and censorship resistance.

3. What are some popular use cases for blockchain dApps?

Popular use cases for blockchain dApps include decentralized finance (DeFi), digital collectibles (NFTs), decentralized exchanges (DEXs), gaming, supply chain management, identity verification, and decentralized social networks.

4. Are blockchain dApps safe to use?

While blockchain dApps offer enhanced security through decentralization and cryptographic principles, users should exercise caution and conduct due diligence before interacting with any dApp. It’s essential to verify the smart contract code, review community feedback, and use reputable platforms.

5. How can I get started with blockchain dApps?

To get started with blockchain dApps, you’ll need a compatible cryptocurrency wallet and access to a blockchain network such as Ethereum. From there, you can explore popular dApps through platforms like DappRadar or directly access them through their respective websites or interfaces. Remember to start with small transactions and familiarize yourself with the dApp’s features and functionality.