Tokenization on Solana has quietly moved from a developer experiment to a serious business strategy. Today, companies are not just launching meme coins or NFTs. They are creating platform tokens, loyalty assets, in-app currencies, governance tokens, and digital financial products that need speed, low costs, and reliability.

Solana offers that foundation.

With fast transaction finality, near-zero fees, and a growing ecosystem of wallets, exchanges, and developer tools, Solana blockchain development has become a practical choice for businesses, without the friction seen on older networks.

This blog breaks down:

- Why enterprises choose Solana for tokenization

- How the tokenization process actually works

- What it costs to create a Solana token

- Who is already using tokenization on Solana today

Let’s get in to see how tokenization on Solana is shaping 2026.

Why Are Enterprises Choosing Solana for Asset Tokenization?

When businesses evaluate blockchain platforms, the question is rarely “Which chain is popular?” It is usually, “Which chain works at scale without burning budget?”

That is where Solana stands out!

1. High speed without trade-offs

Solana processes thousands of transactions per second with near-instant confirmation. For businesses running user-facing apps, marketplaces, or financial platforms, speed directly impacts user trust and retention.

2. Predictable and low transaction costs

On Solana, transaction fees are typically fractions of a cent. This matters when you:

- Launch a token on Solana for millions of users

- Run frequent transfers or micro-transactions

- Build reward or loyalty systems

Cost predictability is a major reason enterprises prefer Solana over congested networks.

3. Mature token infrastructure

Solana’s SPL Tokens are well-supported across wallets, exchanges, and developer tools. This reduces friction when:

- Creating tokens

- Integrating wallets

- Listing on exchanges

- Connecting with DeFi protocols

To design a well-versed token infrastructure, you need an experienced tokenization development company that can offer multiple services- this we will discuss in further sections.

4. Clear separation from RWA complexity

While Real World Assets on Solana use advanced compliance tooling, standard Solana tokenization remains flexible and fast. Businesses can build crypto-native assets without regulatory overhead unless their model requires it.

For most platforms, this balance is exactly what they need.

5. Tokenization Regulations

Australia’s Treasury and ASIC released updated token mapping guidelines in 2024, clarifying:

- When tokens qualify as financial products

- Licensing requirements for exchanges and issuers

Solana tokenization for Australian users must align with these classifications.

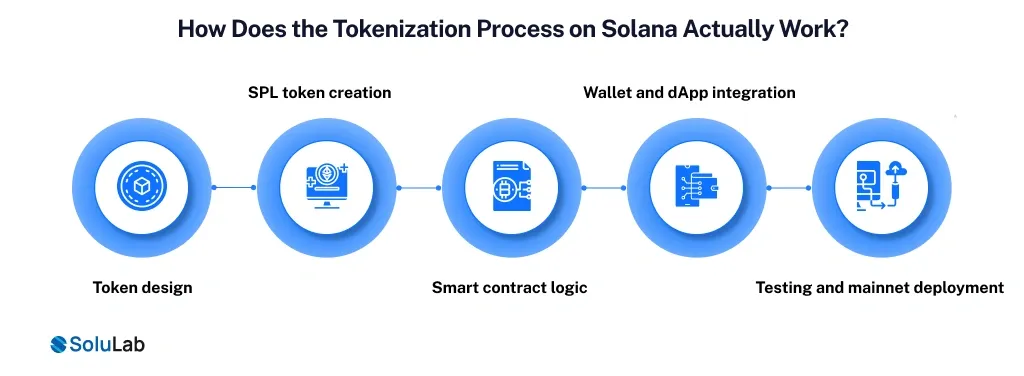

How Does the Tokenization Process on Solana Actually Work?

Building tokens on Solana follows a structured lifecycle. Below is how enterprises typically move from idea to launch.

1. Token design

Everything starts with clarity.

Before you create a Solana token, you define:

- Token purpose (utility, governance, rewards, access)

- Total supply and distribution model

- Minting and burning rules

- Transfer permissions

Strong token design avoids future rework and builds long-term value.

2. SPL token creation

Most tokens on Solana are created using SPL Tokens, the native token standard.

At this stage, you’ll need Solana developers to:

- Create the token mint

- Define decimals and supply

- Set the mint authority and freeze the authority

- Register metadata

This step officially brings your token into existence on the Solana blockchain.

3. Smart contract logic

For simple tokens, SPL standards are enough. As of advanced use cases, custom smart contract logic is added to:

- Control token transfers

- Enable staking or rewards

- Automate treasury rules

- Manage governance actions

This is where Solana token development services add real value by translating business logic into secure on-chain programs.

4. Wallet and dApp integration

Once the token exists, it must be usable. This phase includes:

- Integrating wallets like Phantom or Solflare

- Displaying balances in apps

- Enabling transfers, swaps, or staking

- Connecting tokens to dApps or dashboards

A good crypto token development solution ensures smooth user onboarding.

5. Testing and mainnet deployment

Before launch, everything is tested on Solana’s testnet:

- Token transfers

- Contract logic

- Wallet compatibility

- Edge cases

After validation, the token is deployed to the mainnet and becomes fully live. This is the moment you officially

What Does It Cost to Build and Launch Tokens on Solana?

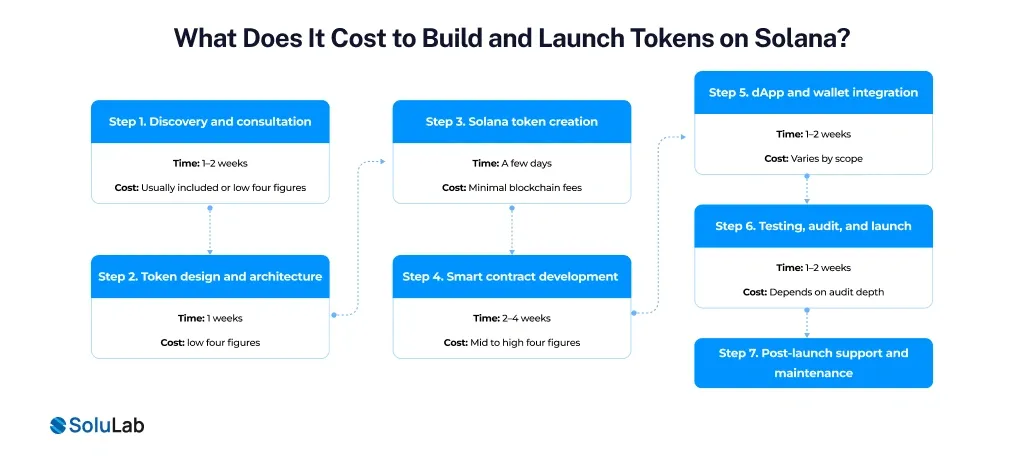

When businesses ask how much does it cost to create a Solana token, the real answer depends on how structured and scalable the project needs to be. Below is how most Solana token development services move from idea to launch, along with realistic cost and time expectations.

Step 1. Discovery and consultation

This phase defines the token’s purpose, supply, use cases, and technical scope. It helps avoid costly redesigns later.

Time: 1–2 weeks

Cost: Usually included or low four figures

Step 2. Token design and architecture

Here, teams finalize tokenomics, permissions, and whether standard SPL Tokens are enough or custom logic is needed.

Time: 1 week

Cost: Low four figures

Step 3. Solana token creation

Developers create the Solana (SOL) token, configure minting rules, and deploy it on the testnet.

Time: A few days

Cost: Minimal blockchain fees

Step 4. Smart contract development

Custom logic is added for transfers, rewards, or governance if required.

Time: 2–4 weeks

Cost: Mid to high four figures

Step 5. dApp and wallet integration

This step enables users to interact with the token inside apps and wallets.

Time: 1–2 weeks

Cost: Varies by scope

Step 6. Testing, audit, and launch

Before you launch a token on Solana, everything is tested and secured.

Time: 1–2 weeks

Cost: Depends on audit depth

Step 7. Post-launch support and maintenance

Ongoing updates, monitoring, and 24/7 support keep the token stable and scalable.

Overall, the Solana Token Creation Cost remains highly competitive, making it an efficient choice for businesses looking to build tokens on Solana without long-term cost pressure.

Which Companies and Use Cases Are Already Using Tokenization on Solana?

Tokenization on Solana is not theoretical. It is already live across multiple industries.

1. Platform and utility tokens

Startups and SaaS platforms use Solana tokens for:

- In-app payments

- Rewards and loyalty

- Governance voting

- Access control

These tokens power real user activity at scale.

2. Gaming and digital economies

Game studios build in-game currencies and assets on Solana because of:

- Fast settlement

- Low fees for micro-transactions

- Seamless wallet integration

3. Tokenized equities and financial products

A notable example is xStocks.

xStocks offers tokenized equities, crypto tokens that mirror real stocks or ETFs. Each token acts like a “claim ticket” that tracks the price of a real share, similar to how a gift card balance represents money in a bank account.

- xStocks launched support on Solana in 2024

- Expanded to Ethereum for cross-chain reach

- Recently tapped into TON and Telegram’s massive user base in 2025

This shows how Solana fits into serious financial infrastructure without sacrificing speed or usability.

4. Light RWA experimentation

While Solana real-world assets use specialized compliance tooling, some businesses explore hybrid models, starting with standard tokenization before evolving into regulated structures.

Conclusion

From the above information, you can see how tokenization on Solana is no longer just for crypto-native teams. It has become a practical option for businesses that want to:

- Launch tokens quickly

- Keep costs predictable

- Scale to real users

- Avoid unnecessary complexity

Whether you plan to build tokens on Solana for utility, governance, or digital economies, we at SoluLab, an asset tokenization development company, offer clear consultation, integrations, and solutions.

With our 250+ experts’ support, you can even have the latest features: AI-enabled tokenization, compliance-friendly tokenization, and automated KYC/AML.

For more details, contact us today and build the future with present tokenization solutions.

FAQs

The total Solana token creation cost usually ranges from $10,000 for basic SPL tokens to higher budgets for advanced. Especially for smart contracts, integrations, audits, and long-term Solana token development support.

Most businesses can build and launch a token on Solana in 4 to 8 weeks. This depends on token complexity, smart contract logic, wallet integration, testing, and compliance or security review requirements.

You can contact SoluLab directly through their website to discuss Solana token development solutions. Including consultation, cost estimates, timelines, and end-to-end support for launching tokens on Solana at enterprise scale.

SPL Tokens are used for crypto-native assets like utility tokens and rewards, while real-world assets on Solana require advanced compliance tools, permissioned transfers, and specialized infrastructure for regulated asset tokenization.

Yes. With low fees, high speed, and growing adoption for tokenization use cases like payments, gaming, and tokenized equities. Solana is increasingly chosen by enterprises building scalable blockchain products.