Cross-border payments are the bloodstream of global business, yet the pipes carrying that money still feel like they were built in another lifetime. Anyone who has watched a transfer crawl through correspondent banks, stuck in cut-off windows, drifting across time zones, or pending for no real reason knows exactly how fragile the system is. And even the smartest tokenized payment platforms collapse fast if the foundation beneath them is this outdated. Now look at the scale.

| Businesses already move over $150 trillion across borders each year, with the number climbing to $250 trillion by 2027. |

It’s insane volume, but most institutions are still running on old workflows, mismatched rules, and isolated systems. So when banks or fintechs try to build modern tokenized rails or explore Tokenization MoUs, they’re basically paving a high-speed expressway on top of cracked concrete. Without one shared playbook, things break, compliance gets messy, integrations fail, and partners don’t move in sync.

That’s why a Tokenization MoU is the backbone. It aligns everyone before the first transaction ever moves. And in the rest of this article, you’ll see exactly why it’s non-negotiable and how a Tokenization MoU works inside a tokenized payments platform, and how enterprises can build their own before going live.

What Is a Tokenization MoU?

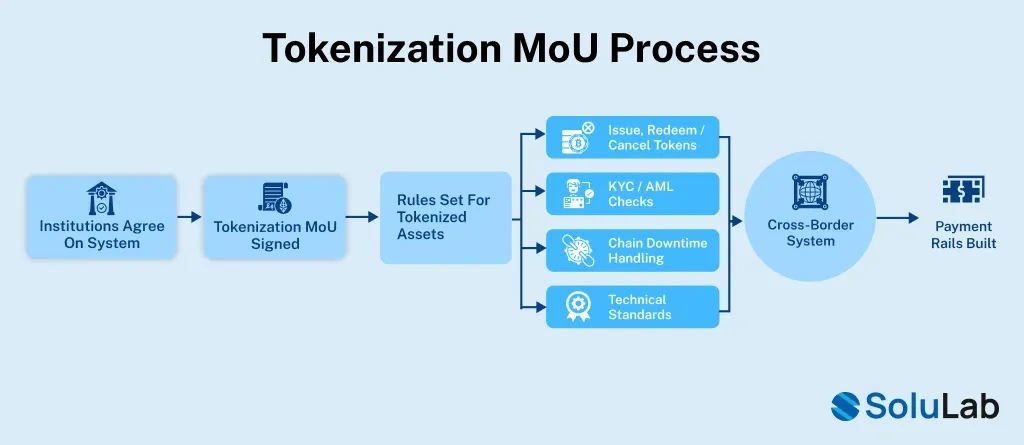

Before anyone builds a tokenized payment network, two or more institutions need to agree on how the system will actually work. That’s where a Tokenization MoU comes in.

Think of it as the playbook that banks, fintechs, and network operators sign before moving money on-chain. It sets the rules for how tokenized assets behave, whether they’re stablecoins, tokenized deposits, digital securities, or CBDCs. Without it, every player builds in their own direction, and the whole ecosystem becomes messy fast.

A good Tokenization MoU quietly solves problems before they ever appear. It answers the real questions that decide whether your cross-border system will scale or collapse:

- How do we issue, redeem, or cancel tokens across different countries

- Who handles KYC/AML checks as tokens move between networks

- What happens if one chain goes down mid-settlement

- What technical standards will everyone follow so systems actually talk to each other

Even Global institutions are already using Tokenization MoUs to build real payment rails. Not long ago, the Monetary Authority of Singapore (MAS) and Deutsche Bundesbank signed a Tokenization MoU to explore shared rules for cross-border settlement. UBS and Ant International did the same to run real-time payments with tokenized deposits.

These are serious players, and they’re telling the world something important: If you want to build modern, compliant, high-speed payment infrastructure, a Tokenization MoU is the foundation.

Why Tokenization MoUs Are Becoming Core to Modern Digital Money Systems?

The global payments world is changing fast as every bank, fintech, and enterprise now wants faster cross-border payments, real-time settlement, and smoother money movement. But the truth is, nothing works unless everyone agrees on how these new systems should talk to each other. This is where a Tokenization MoU becomes the quiet hero in the background.

Think of the digital money ecosystem as three big highways being built at the same time:

stablecoins, tokenized bank deposits, and CBDCs. Each moves value differently, follows different rules, and uses different technology. Without a shared guide, these highways would crash into each other. A Tokenization of MoU works like the traffic rulebook that keeps everything aligned.

Take stablecoins used for global commerce. They look simple on the surface, but real questions sit underneath:

- Who manages the reserve

- Who handles redemption

- How do regulators monitor activity

A well-written MoU solves this by defining roles, data rules, and risk controls, making digital payment token services safe for businesses.

The same applies to banks turning deposits into blockchain-based tokens. When UBS launched its wholesale digital currency, it needed a clear plan for liquidity, settlement timing, and compliance. Their agreement worked like a blueprint for exactly what a business-friendly banking MoU should be. And for governments exploring MoU for CBDC pilots like mBridge or Project Guardian, this framework ensures national currencies and private assets settle together without friction.

How Tokenization MoUs Solve Enterprise Pain Points in Global Payments?

When a company moves from old payment rails to tokenized settlement, everything changes. The speed is faster, the rules are stricter, and there’s zero room for confusion. That’s why more enterprises now rely on a Tokenization MoU. This simple yet powerful agreement ensures that every participant is aligned before money starts moving across borders.

1. Interoperability Becomes Non-Negotiable

Connecting banks, countries, and blockchains without a shared framework is impossible. A Tokenization MoU creates the common data formats, token standards, and messaging rules needed so a stablecoin on one chain can settle with a tokenized deposit on another. This is exactly why MAS and Deutsche Bundesbank signed their 2025 MoU tokenized cross-border payments need one playbook, not ten.

2. Compliance Breaks Without Pre-Alignment

Tokenized payments settle in seconds but Regulators don’t. Different jurisdictions have different AML, KYC, sanctions, and reporting rules. One mismatch can freeze a payment. A Tokenizating MoU clearly defines:

- Who handles each compliance step

- How to flag risky transactions instantly

- What to do if a regulator blocks a transfer

Without this, enterprises face either delays or major regulatory risk.

3. Disputes Need Governance, Not Lawyers

Tokenized systems don’t have decades of banking precedents. When things go wrong, you need rules not court cases. A Tokenization of MoU decides:

- Who reverses a failed transfer

- How to handle smart-contract bugs

- Which chain is valid during a fork

This is the difference between production-grade payments and experimental pilots.

4. Real-Time Liquidity Needs Pre-Set Rules

Tokenized settlement is 24/7, but liquidity can only move that fast if both sides agree on the rules first. A well-designed banking MoU sets:

- Liquidity commitments

- Whether settlement is atomic or batched

- How to source liquidity during shortfalls

Ant International and UBS proved that this real-time, multi-currency settlement only works because their MoU defines the liquidity model upfront.

When Should Banks and Fintechs Implement a Tokenization MoU?

Banks and fintechs should create a Tokenization MoU long before they launch any product. The biggest mistakes happen when teams go live first and then realize their system can’t talk to their partners. The right time is 3–6 months before launch, while the tech, compliance rules, and cross-chain workflows are still flexible. This early alignment helps if you’re building digital payment token services or planning cross-border payments.

During pilot programs, the MoU becomes the guidebook. It keeps every party aligned on testing, risk controls, data rules, and how tokens will move between networks. It acts as the operating manual used before you scale into real volume especially for projects like CBDCs or MoU for CBDC or when using asset tokenization services.

And when expanding into new countries, the MoU must evolve. Each region has its own regulations, settlement rules, and banking workflows. Updating your banking MoU early prevents delays, failed integrations, and compliance risks.

This is why even advanced markets (like the Singapore–Germany example) align first before building live systems. If you’re a bank, fintech, or crypto payment gateway, this timing can save millions and reduce launch risk.

What Every Tokenization MoU Must Include to Work Smoothly?

When institutions decide to work together on tokenized payments, they need a shared rulebook they can trust. That rulebook is the Tokenization MoU, which controls how every token, every message, and every settlement moves through the system. This is the foundation that connects banks, fintechs, and global partners before any real transactions go live.

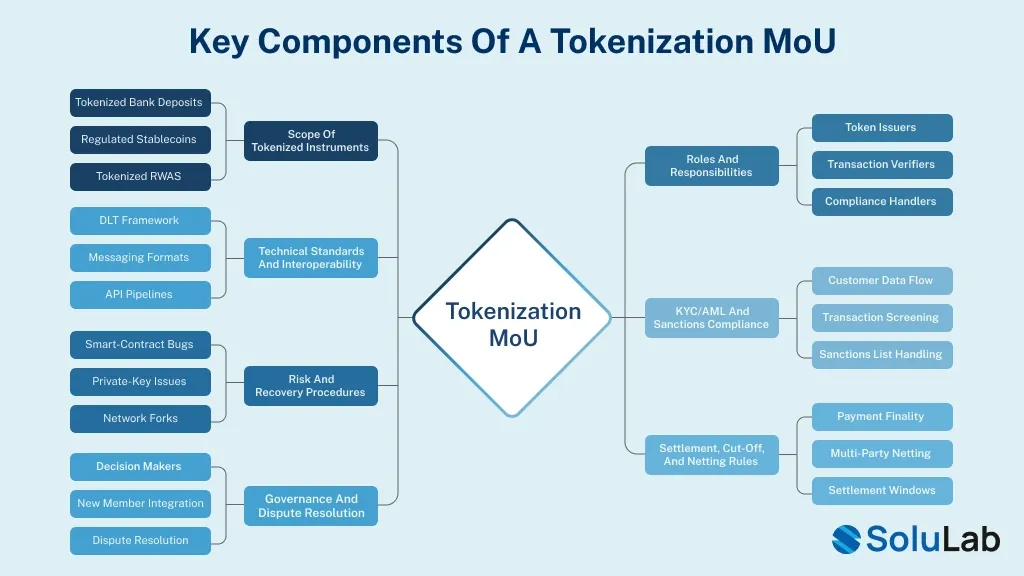

1. Scope of Tokenized Instruments

The first part of the MoU sets the boundaries. It explains exactly what types of tokenized assets the network will support whether it’s tokenized bank deposits, regulated stablecoins, tokenized RWAs, or even early experiments connected to MoU for CBDC pilots.

Every asset class comes with its own rules, and defining this scope ensures no one is confused later about what can or cannot be settled on the network.

2. Roles and Responsibilities

A tokenized ecosystem only works when every participant knows their job. This section explains who issues tokens, who verifies transactions, who handles compliance, and who takes responsibility if something fails.

This part of the MoU prevents chaos by making every duty crystal clear. For agencies providing asset tokenization services, this clarity is critical, because enterprises expect predictable workflows and fast resolutions.

3. Technical Standards and Interoperability

Since tokenized payments run on distributed systems, the MoU defines how all the technology connects. It lays out the DLT framework, the messaging formats, the API pipelines, and how different networks communicate with each other.

This is where interoperability becomes real because without shared standards, cross-chain payments fall apart. For many enterprises exploring digital payment token services or payment tokenization, this technical alignment is the difference between a working platform and an expensive experiment.

4. KYC/AML and Sanctions Compliance

Even in a tokenized world, compliance cannot be an afterthought. The MoU explains how customer data flows, how transactions are screened, and what happens when a payment hits a sanctions list. It covers data residency, privacy laws, and cross-border reporting rules. This protects every party while allowing regulated cross-border payments to move safely without losing speed.

5. Risk and Recovery Procedures

If something breaks, everyone needs to know what happens next. This section outlines how institutions respond to smart-contract bugs, private-key issues, network forks, or fraudulent transfers. It describes the investigation steps, recovery timelines, and cost-sharing rules.

This makes the system stronger and builds trust, especially for institutions considering RWA tokenization platform development services, where operational risk is a major concern.

6. Settlement, Cut-Off, and Netting Rules

Even though tokenized networks aim for 24/7 settlement, operational boundaries still exist. The MoU explains exactly when a payment is final, how multi-party netting works, and what settlement windows apply across regions.

This creates a predictable rhythm for banks and large enterprises, especially those exploring modern banking MoU structures for tokenized settlements.

7. Governance and Dispute Resolution

The final part explains how the network evolves. It defines who makes decisions, how new members join, and how disputes are resolved without slowing down the ecosystem. This governance layer becomes even more important when the MoU is embedded directly into smart contracts, a future many central banks and enterprises are openly pursuing while exploring tokenizing MoU models.

How a Tokenization MoU Works in a Cross-Border Payment Flow?

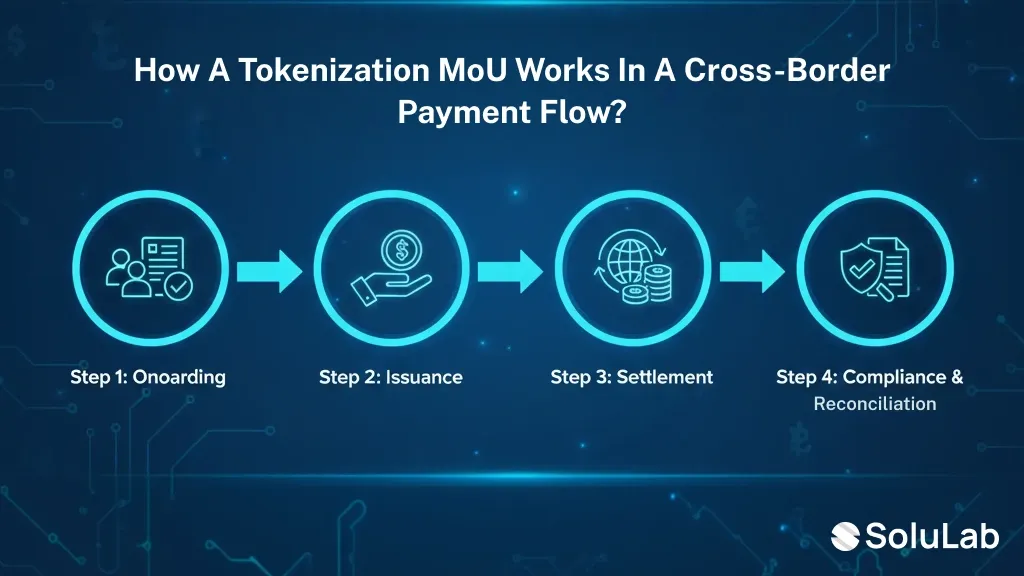

Imagine two companies, one in Singapore, one in Frankfurt, trying to move money fast. Today, this takes 2–5 days, high fees, and manual checks. But with a Tokenization MoU, the whole flow becomes instant. Here is how it’s done in 4 steps.

Step 1: Onboarding

Both companies complete KYC with their banks. Thanks to the Tokenization MoU, data sharing, API usage, and identity verification are predefined, so banks sync customer information smoothly. Each company receives a digital wallet to hold tokenized deposits, laying the foundation for all digital payment token services.

Step 2: Issuance

When Singapore Corp deposits money, its bank issues a token representing that value. Frankfurt’s bank does the same. The Tokenizating MoU ensures agreement on which blockchain to use, how tokens are minted, and how reserves are verified. This creates trust, transparency, and auditability key in RWA tokenization platform development services.

Step 3: Settlement

Singapore wants to send 1M SGD to Frankfurt in EUR instantly. Payment tokenization makes it happen: SGD tokens are debited, EUR tokens are created, FX is executed automatically, and final settlement is confirmed in seconds. No correspondent banks, waiting or friction, just seamless cross-border payments powered by the pre-agreed Tokenization MoU framework.

Step 4: Compliance & Reconciliation

Both banks receive real-time alerts for AML, sanctions, and unusual flows. If an issue arises, the banking MoU already defines reversal or investigation rules. If everything is clear, transactions auto-reconcile within minutes, ensuring secure and compliant tokenized operations.

Industry Collaborations Built on Tokenization MoUs

The world of cross-border payments is no longer theoretical. Leading institutions are already putting Tokenization MoUs into practice, showing how structured collaboration can unlock faster, frictionless settlements.

1. MAS and Deutsche Bundesbank

Singapore and Germany’s central banks signed a formal Tokenization of MoU to build seamless cross-border digital asset settlement. This agreement focuses on:

- Reducing costs and processing times through innovative settlement solutions.

- Promoting shared standards for payment tokenization, FX, and securities using tokenized assets.

- Enabling interoperability across diverse digital asset platforms.

This is live infrastructure, backed by two of the world’s most sophisticated financial regulators.

2. Project mBridge

The HKMA, People’s Bank of China, Bank of Thailand, and Central Bank of UAE ran a CBDC pilot guided by implicit MoU for CBDC frameworks:

- Ensuring each jurisdiction’s CBDC interoperates seamlessly.

- Enabling atomic foreign exchange settlement (Payment-versus-Payment).

- Preventing localized disputes from disrupting the entire network.

In just six weeks of Q3 2022, over 160 cross-border transactions worth HK$171 million were successfully settled. The pilot succeeded because the operational rules were clear, precise, and enforceable.

What Happens If You Don’t Use a Tokenization MoU?

If you just launched a payment tokenization platform internally, everything runs smoothly. You onboard a partner bank, expecting seamless cross-border payments. Six months later, a transaction fails mid-transfer. Your system marks it as settled, but their system shows it as pending. Chaos, delays, and confusion. Here’s why this happens without a Tokenization MoU:

- Due to Regulatory Fragmentation, different KYC/AML rules slow settlements and increase risk without a shared MoU for CBDC.

- Without a Tokenization MoU, networks stay siloed, and digital payment token services fail to interoperate efficiently.

- If a smart contract fails or a key is compromised, no tokenization of MoU means there’s no recovery plan, halting operations.

- Independent liquidity and FX rules make cross-border payments costly, unpredictable, and high-risk.

- Lack of structured asset tokenization services documentation exposes your enterprise to penalties where a proper Tokenization MoU aligns rules and reduces risk

In short, skipping a Tokenization MoU turns your tokenized payment network into a patchwork of risk, inefficiency, and compliance gaps.

Conclusion

Cross-border payments are changing fast. Payment tokenization, tokenized deposits, stablecoins, and CBDCs are now infrastructure, not experiments. But infrastructure without rules is chaos.

A Tokenization MoU is the blueprint that turns tokenized assets into reliable, compliant, and frictionless payment systems. MAS and Deutsche Bundesbank, Project mBridge all succeed because their Tokenization of MoU frameworks are clear, shared, and actionable.

At SoluLab, we help enterprises implement digital payment token services, built on a solid MoU for CBDC foundation. So, skip the confusion and wasted time and start with a Tokenization MoU, and you’re building systems that actually work, scale, and stay compliant. Everything else is just noise.

FAQs

Not exactly. A regular partnership agreement covers commercial terms like revenue sharing, pricing, and liability. A Tokenization MoU focuses on operational and governance rules, how tokenized assets behave across shared platforms. Many institutions use both to ensure smooth collaboration while maintaining compliance.

Yes. Even with stablecoins, cross-border payments require clarity on dispute resolution, liability, and compliance flows. A Tokenization of MoU ensures all parties understand operational rules even for informal arrangements, so transactions remain predictable and secure.

When banks implement CBDC alongside private stablecoins or tokenized deposits, the MoU for CBDC defines how these assets interact. It sets priorities for settlements, manages FX between digital assets, and coordinates regulatory oversight. This ensures a frictionless integration between public and private tokenized systems.

Technically yes, but it’s complex. Each jurisdiction has different rules and technical constraints. Most banks create a master MoU with jurisdiction-specific appendices. A good example is MAS and Deutsche Bundesbank, they signed a bilateral MoU designed to scale while maintaining compliance across borders.

Ownership usually falls on three pillars: Payments Operations, Compliance/Legal, and Technology. Strategic decisions involve Treasury or Payment Systems leadership. Central banks often coordinate policy-level guidance while implementation happens in the back office.

For a simple bank-to-bank setup, expect 5–8 months from scope to live pilot. Multi-party networks like RWA tokenization platform development services or bank-fintech collaborations can take 12+ months, depending on infrastructure, regulatory alignment, and executive buy-in. A well-structured Tokenizating MoU lays the foundation for all subsequent payment tokenization processes.

Absolutely. By clearly defining rules for operations, compliance, and interoperability, a Tokenization MoU enables frictionless cross border payments and sets the stage for scalable digital payment token services. It also supports banks and fintechs integrating crypto payment gateway development company solutions safely and efficiently.