- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

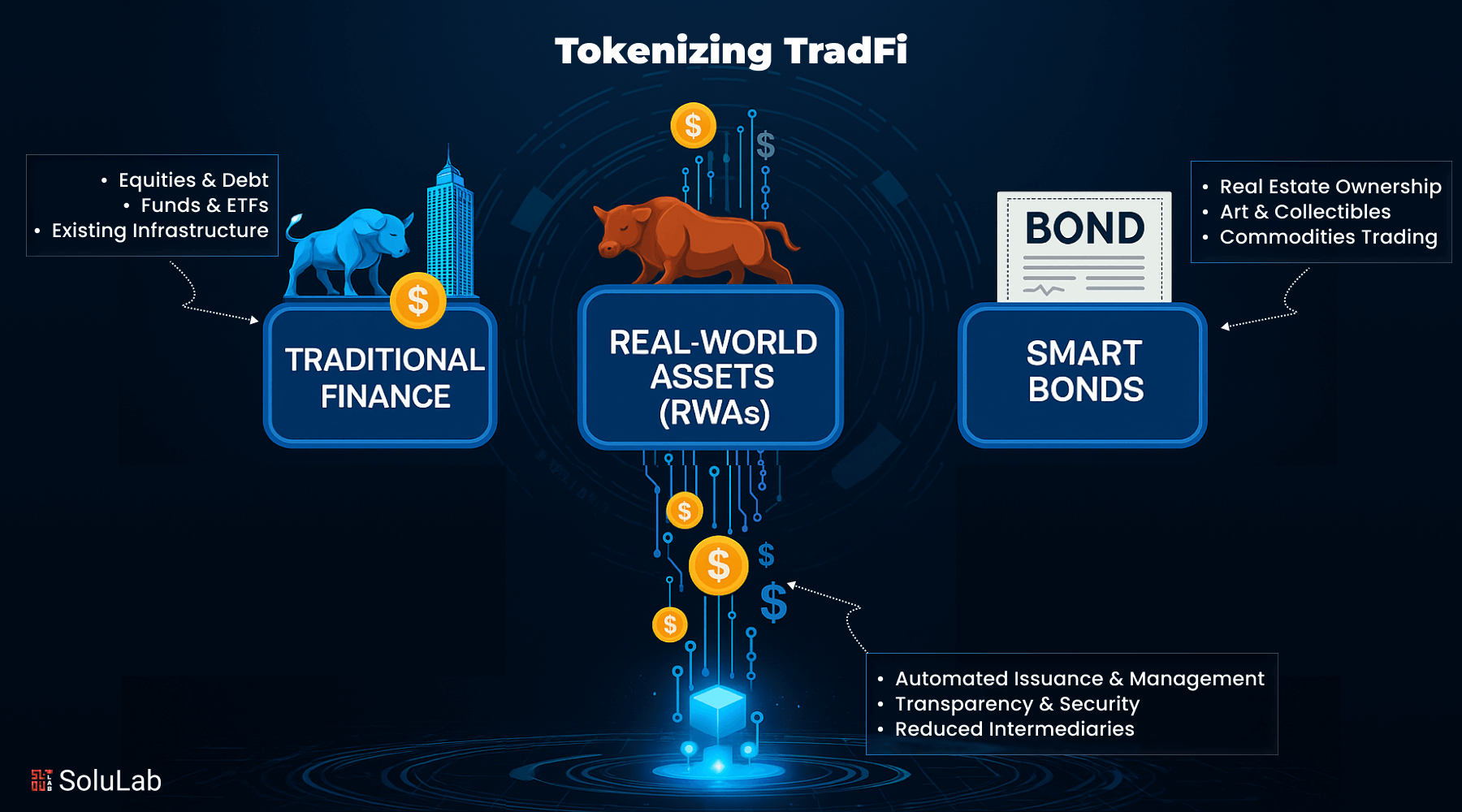

Have you ever thought that buying a piece of real estate or a government bond is as easy as a digital token? Maybe you should experience it now. The development of tokenized real-world assets and smart bonds is transforming the global financial system. Tokenization aims to bridge traditional finance (TradFi) and decentralized finance (DeFi).

Real estate, bonds, and private equity are now getting digitized into tokens. Isn’t it amusing and simple? This move’s main focus is quick transactions, transparency, and broader access. This blog provides information on the tokenization process and its impact on the real world.

How DeFi and TradFi Support Each Other?

DeFi and TradFi bring unique strengths to the financial world. When combined, they create a powerful system that is faster, safer, and more open. DeFi uses smart contracts and blockchain to cut out middlemen, while TradFi offers regulation, investor trust, and global financial backing.

-

DeFi Strengths: Trustless, Transparent, 24/7

DeFi runs on blockchain protocols. It works without banks or brokers, offering global access around the clock. Users can track transactions in real-time, making the system fully transparent and auditable. Anyone with an internet connection can join.

-

TradFi Strengths: Regulation, Capital, Reach

Traditional finance brings regulation, stability, and deep capital pools. It protects users through laws, KYC checks, and trusted financial systems. Over 75% of people worldwide already rely on banks, giving TradFi unmatched reach and credibility.

-

Convergence Over Conflict: The Combinational Future

The future is not about DeFi replacing TradFi. It’s about working together. Hybrid models will power secure, fast, and accessible financial systems for everyone, combining DeFi innovation with TradFi reliability.

The Rise of Hybrid Finance and Tokenized RWAs

Hybrid finance uses blockchain to upgrade how financial institutions work. Tokenized real-world assets (RWAs) are leading this change, making assets more accessible and programmable.

1. How Tokenized Assets Bridge DeFi and TradFi?

Tokenized RWAs bring the speed of DeFi and the safety of TradFi into one system. They automate KYC, allow fractional ownership, and use smart contracts for real-time transactions.

2. Key Examples: Bonds, PE, Real Estate, Stablecoins

Let’s check out how tokenized RWAs are enhancing bonds, private equity, real estate, and stablecoins.

- Banks tokenize bonds for faster settlement and programmable interest payments.

- Private equity firms automate cap tables and dividend flows using smart contracts.

- Real estate developers sell property shares globally through fractional tokens.

- Stablecoins help settle transactions instantly across borders.

3. Regulatory Catalysts Like MiCA Driving Change

The European MiCA regulation sets clear rules for digital assets. It boosts trust in tokenization. More countries are now creating similar legal frameworks to support this shift.

Core Use Cases of Real-World Asset Tokenization

Tokenizing real-world assets helps many sectors. It improves access, efficiency, and transparency across various investment classes.

-

Real Estate and Private Equity

Property and fund shares can now be divided into tokens. This opens access for small investors and increases market liquidity.

-

Fixed-Income Instruments and Alternative Assets

Banks issue tokenized bonds that settle instantly. Even rare assets like art, wine, and music rights are entering the token market.

-

Stablecoins Powering Cross-Border Settlement

Stablecoins are known for being simple and quick global payment assets. These help in trade settlements across borders with their well-built-in compliance.

Read Also: RWA-backed Stablecoins

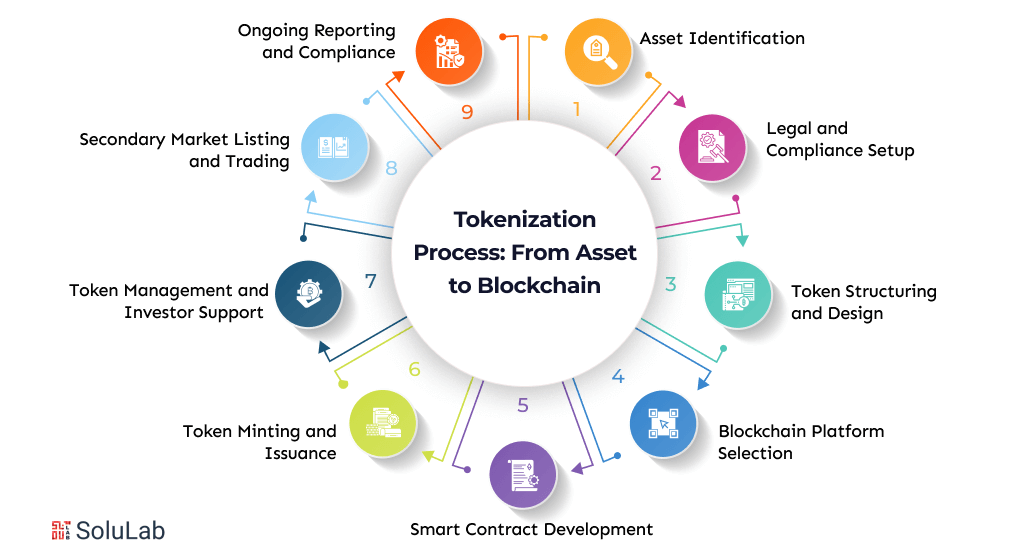

The Tokenization Process: From Asset to Blockchain

Tokenizing a real-world asset is not a one-step task. It requires a secure, structured approach that balances blockchain benefits with real-world rules. Each stage ensures the asset is legally sound, technically secure, and ready for digital trading.

Here’s a simple breakdown of the full process:

1. Asset Identification

The process begins by identifying the asset. It could be real estate, artwork, a bond, or intellectual property. Owners must confirm legal title, clear any disputes, and validate the asset’s value through expert appraisal. Without proper identification, tokenization can’t move forward.

2. Legal and Compliance Setup

Once the asset is verified, legal compliance comes next. This step ensures the tokenization process follows local laws, including KYC (Know Your Customer), AML (Anti-Money Laundering), and securities regulations. Legal experts help structure the token according to investor rights and jurisdiction-specific rules.

3. Token Structuring and Design

In this stage, developers decide how the token will function. They define the type, whether equity, debt, or utility, and set the total supply. Each token may represent a fraction of ownership or a debt claim. The team also defines rules for transfers, dividends, or voting rights.

4. Blockchain Platform Selection

Not every blockchain fits every asset. The team chooses a platform like Ethereum, Polygon, or a private chain. The selection depends on asset size, transaction needs, security requirements, and gas fees. The right platform ensures scalability and smooth token operations.

5. Smart Contract Development

Smart contracts automate the asset’s behavior. They enforce ownership, track transfers, distribute payouts, and execute rules without human intervention. Developers write and test these contracts carefully to match legal terms and prevent bugs or breaches.

6. Token Minting and Issuance

After development, the digital tokens are created or minted, on the selected blockchain. Tokens are distributed to investors or asset owners, either through a public offering or private placement. This step marks the official entry of the asset into the digital space.

Read Also: RWA Tokenization In Traditional Banking

7. Token Management and Investor Support

Token ownership needs ongoing oversight. Platforms or service providers help manage token records, update investors, and offer dashboards for tracking value or receiving returns. They also support audits and ensure reporting stays transparent.

8. Secondary Market Listing and Trading

Once the token is live, it can be listed on approved exchanges or digital marketplaces. This enables buyers and sellers to trade freely, bringing much-needed liquidity to assets that were once hard to move. Compliance controls remain in place during trading.

9. Ongoing Reporting and Compliance

Even after launch, reporting continues. Asset issuers must provide regular updates, track performance, and maintain full legal compliance. All activities, payouts, transfers, and audits are logged on-chain, offering unmatched transparency to both investors and regulators.

Positive Impact of Asset Tokenization

Tokenized assets bring powerful benefits to investors, asset owners, and markets. This technology is changing how financial systems work.

- Retail investors could gain access to VIP markets without large capital funding or middleman involvement.

- Fractional ownership over the assets boosts liquidity. This allows easy buying and selling of assets.

- Also each an every transaction is noted on-chain and maintains the database. This gives regulators and auditors complete authority.

- Smart contracts cut costs by automating compliance, reporting, and dividend payouts.

- New industries like energy, IP, and carbon credits use tokenization to streamline funding and ownership.

Read More: Asset Tokenization Regulations for Australia

The Future of Tokenized Real World Assets

Tokenized real-world assets are moving beyond pilot tests. This trend is building a new financial foundation across the globe. Central banks are testing CBDCs to improve settlements. Artificial Intelligence is now used for risk scoring and asset pricing. RWA ETFs and index tokens are making diversified portfolios more accessible to all. Governments and banks are joining the tokenization movement. They are creating legal standards and scaling platforms to manage large assets efficiently.

Conclusion

Tokenization is changing how the world sees and trades real assets. It unlocks access, boosts liquidity, and brings trust through blockchain. At SoluLab, a top asset tokenization development company, we help businesses turn real estate, gold, and company shares into digital tokens. Our team studies your goals and builds the right token structure and technology to match.

Whether it’s improving transparency or reaching global investors, we ensure your assets are future-ready. With our end-to-end asset tokenization services, you gain more control, more value, and more opportunity.

Contact SoluLab today to explore how digital tokens can reshape your financial future.

FAQs

1. What are tokenized real-world assets (RWAs)?

Tokenized RWAs are digital versions of physical assets like real estate or bonds. These tokens represent ownership and can be traded easily on blockchain platforms.

2. How do DeFi and TradFi work together in asset tokenization?

DeFi brings speed and automation, while TradFi adds trust and regulation. Together, they create a balanced system that is secure, efficient, and accessible for all kinds of investors.

3. What types of assets can be tokenized today?

Real estate, private equity, bonds, art, and even music rights can be tokenized. Anything valuable in the real world can become a digital asset with blockchain technology.

4. Why is tokenization considered a game-changer for retail investors?

Tokenization lowers entry barriers. Small investors can now buy fractional shares in premium assets that were once accessible only to high-net-worth individuals or institutions.

5. Can tokenized assets be insured or used for loans like traditional ones?

Yes, tokenized assets are gaining recognition. Many platforms now support insurance and collateralization, allowing these tokens to function similarly to traditional assets in lending and risk management.