As we are moving towards 2026, cryptocurrency exchanges have become critical infrastructure for the digital assets ecosystem. These platforms enable users to buy, sell, trade, or swap digital currencies, including Bitcoin, Ethereum, and various altcoins. With the rising adoption of exchanges by retail investors and institutions, demand for well-built, secure, and compliant platforms is surging.

| As of 2025, there are 248+ listed spot crypto exchanges, though only around 200–220 appear consistently active in terms of volume and listings. |

If you’re looking to build one, choosing the right crypto exchange development company USA is a pivotal decision. You’ll want to understand what kinds of exchanges exist, what features matter most, and what to look for in your development partner.

Understanding Crypto Exchange Development

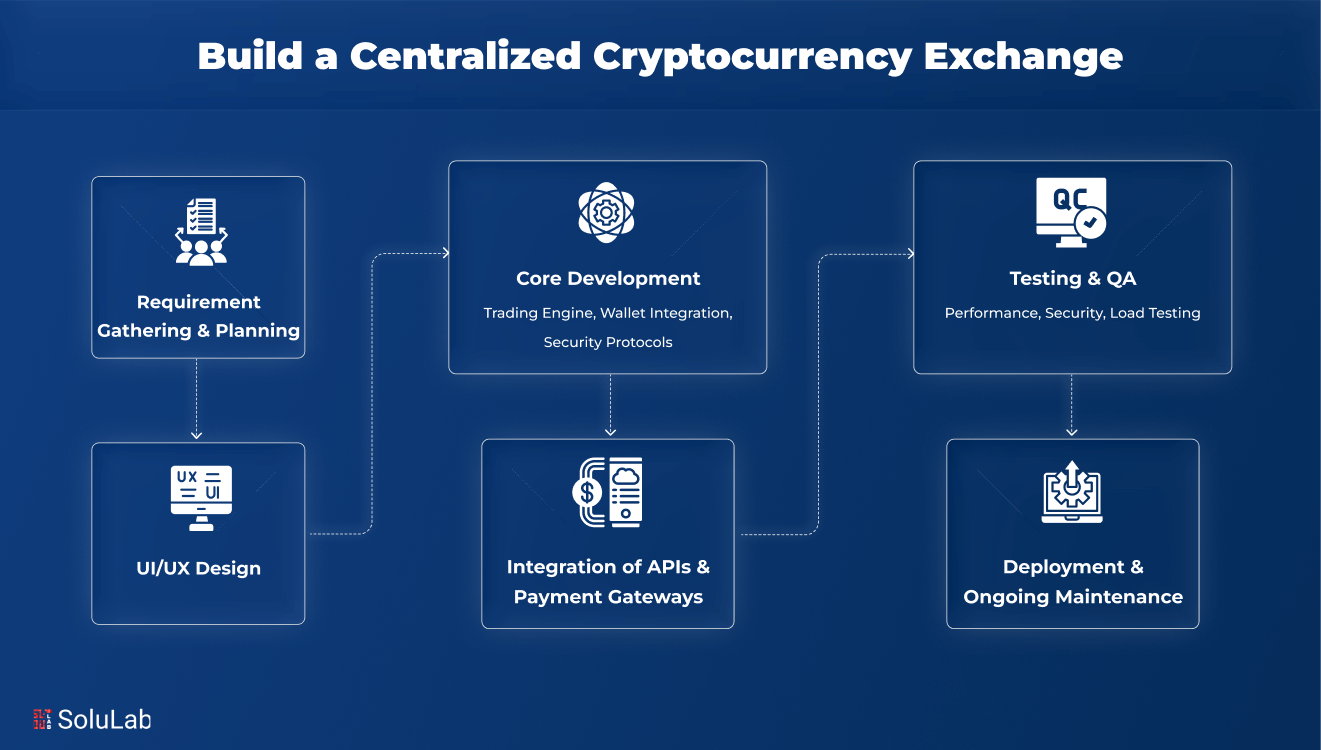

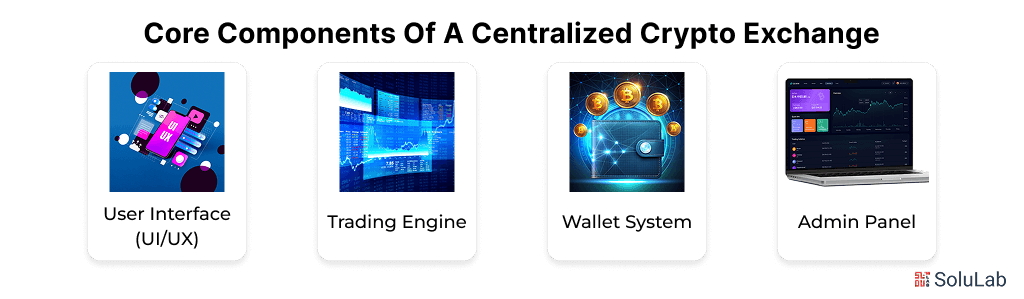

Leading centralized crypto exchange development goes far beyond coding. It requires secure trading engines that process orders quickly, wallets with hot and cold storage, and smart contracts for decentralized operations.

Security layers, such as encryption, DDoS protection, and two-factor authentication, safeguard transactions. Modern exchanges also integrate compliance modules such as KYC and AML to meet global standards.

- According to CoinLaw, global crypto exchange volumes touched $9.7 trillion in August 2025, reflecting rapid adoption worldwide.

- This surge highlights why businesses seek the best crypto exchange development company in the USA for secure and scalable platforms.

Firms specializing in crypto exchange software development USA combine blockchain expertise with strong UI/UX and regulatory compliance, ensuring a reliable launch.

Key Factors to Consider Before Choosing a Crypto Exchange Development Company

If you aim to hire the best crypto exchange development company USA (or anywhere), these are the serious criteria:

1. Experience and Portfolio

Companies that have built multiple exchanges, centralized, decentralized, hybrid, or white-label, bring more tried-and-tested know-how.

Ask for case studies and what blockchain protocols they use- Ethereum, Solana, BNB Chain, others? Did they build trading engines, or just integrate white-label solutions?

2. Technical Expertise & Custom Solutions

A top centralized crypto exchange development services providers should offer custom architectures. They should handle smart contracts, cross-chain interoperability, staking, and DeFi integrations, according to your vision. Off-the-shelf or cookie-cutter solutions may save cost, but often limit future growth.

3. Regulatory Compliance & Security

Must know KYC/AML laws, securities regulation, data privacy laws (GDPR if serving EU users), etc. Security is non-negotiable, including regular security audits, encryption, standards compliance, etc.

4. Scalability & Performance

Your platform must scale: both in users and in trading volume. Architecture (microservices, modular, cloud, or hybrid infra) should allow adding new features (NFTs, derivatives, multichain) without major rewrites.

5. Support & Maintenance

After launch, many issues will arise: security patches, platform upgrades, scaling, and possibly integration of new tokens or blockchains. A reliable white label crypto exchange development company offers ongoing support, not just a one-time build.

6. Transparent Costs & Delivery Timelines

Hidden costs, vague deadlines, or shifting requirements can derail projects. Good companies propose clear milestones, estimates, trade-offs, and the pricing model (fixed, hourly, milestone-based). Make sure there’s clarity upfront.

7. Reputation, Reviews, and References

Talk to prior clients. Check independent reviews. How did they handle deadlines, scope changes, and post-launch issues? A strong developer partnership often depends more on communication and adaptability than just technical skill alone.

Top 10 Crypto Exchange Development Companies in USA [2026 Edition]

Multiple companies offer crypto exchange development services; however, the following 10 stand out with their expertise, services, and cost. Let’s check each of them in detail.

1. SoluLab

SoluLab is often seen as one of the best crypto exchange development companies in the USA. Its high-performance crypto exchange platforms, centralized, decentralized, or hybrid, are designed to handle high volumes, ensure airtight security, and meet global regulations. The company is also recognized among the top 10 crypto token development companies, offering end-to-end token creation, smart contract integration, and decentralized ecosystem development.

$25 – $49/ hr

200 – 249

2014

2. Bitdeal

Bitdeal specializes in centralized crypto exchange development and decentralized crypto exchange development with white-label and custom models. Their offerings include liquidity management, P2P exchanges, ICO platforms, and token development. They are known for quick deployment timelines with robust security integrations.

$30-$70/ hr

200-250

2015

3. Beleaf Technologies

Beleaf Technologies delivers crypto exchange platform development services covering centralized, decentralized, and hybrid exchanges. Their team also provides staking platforms, NFT integration, and blockchain wallets tailored to specific business needs. The company emphasizes performance and scalability, making it a strong option for startups.

$2500 onwards

50 – 200

2016

4. WeAlwin Technologies

WeAlwin Technologies provides end-to-end crypto exchange platform development services, from custom UI/UX to high-speed trading engines. They specialize in both centralized and decentralized exchanges, along with token development and blockchain consulting for enterprises. Their white-label solutions help businesses launch quickly.

$2500 onwards

100-200

2013

5. Hivelance

Hivelance focuses on building secure, scalable, and customizable exchanges with services in centralized crypto exchange development and decentralized crypto exchange development. They are known for cross-platform support, smart contract auditing, and liquidity API integration. Their platforms cater to enterprises aiming for global reach.

$30-$60/ hr

100+

2012

6. PixelPlex

PixelPlex offers tailor-made crypto exchange software development services in the USA, including high-frequency trading engines, AI-driven fraud detection, and multi-chain wallet support. Their team also builds cross-border payment systems and enterprise-grade blockchain solutions beyond exchanges.

$75~

100-250

2007

7. Fire Bee Techno Services

Fire Bee Techno Services develops custom exchange platforms with built-in features for high liquidity, multi-layer security, and fiat integration. They deliver crypto exchange platform development services with staking, DeFi modules, and P2P trading options, making them attractive for emerging businesses.

$20-$40/ hr

50-100

2016

8. Coinsclone

Coinsclone is a leading cryptocurrency exchange development company known for its ready-to-deploy white-label and custom crypto exchange solutions. With a focus on scalability, security, and innovation, Coinsclone delivers feature-rich decentralized and centralized trading platforms tailored to each client’s business goals.

$20-$50/ hr

50-200

2014

9. Openxcell

Openxcell is a leading crypto exchange development company USA, recognized for building reliable, secure, and compliant exchange platforms. Their team provides custom trading engines, wallet integration, payment gateway solutions, and AML/KYC modules. They also focus on scalability for enterprise adoption.

$2500+

500-1000

2009

10. Technoloader

Technoloader is a top cryptocurrency exchange development company specializing in creating secure, scalable, and high-performance crypto trading platforms. They offer both white-label and custom-built solutions tailored to diverse business requirements. Their exchanges are built with KYC/AML compliance, liquidity management and advanced trading engines.

$25-60/ hr

100-250

2016

Conclusion

As highlighted in the blog, cryptocurrency exchanges are now the backbone of the digital economy. From advanced trading engines to AI-powered fraud detection, the industry is rapidly evolving to deliver safer, faster, and more reliable trading experiences. If you are also planning to launch your own platform, then SoluLab is here to guide you.

We, at SoluLab, the top crypto exchange development company in the USA, build regulation-ready, scalable exchanges. Our solutions enable seamless onboarding, institutional-grade safety, and future-ready innovation. Stay ahead of the curve with a trusted crypto exchange development partner.

Contact us today and begin your journey toward building a powerful, compliant exchange platform.

FAQs

1. How long does it usually take to develop a crypto exchange platform?

Development timelines vary depending on features and complexity, but most full-scale exchanges take between 4 to 12+ weeks, including design, coding, integrations, security testing, and regulatory compliance preparations.

2. What factors should businesses consider before choosing a crypto exchange development company?

Businesses should prioritize security, regulatory expertise, scalability, and post-launch support. Evaluating technical expertise, transparent costs, and the ability to deliver tailored solutions is crucial for ensuring long-term success in competitive markets.

3. How much does it cost to develop a cryptocurrency exchange in the USA?

The cost typically ranges from $10k, depending on features, technology stack, and compliance requirements. White-label options are cheaper, while custom platforms with advanced integrations cost significantly more.

4. Why is SoluLab considered a top crypto exchange development company in the USA?

SoluLab is known for delivering secure, regulation-ready exchanges with advanced trading engines, scalability, and compliance features, ensuring businesses launch platforms that are both future-ready and trusted in the evolving crypto ecosystem.

5. Why is regulatory compliance so important in crypto exchange development?

Regulatory compliance builds user trust, ensures legal operation, and protects against financial penalties. With global scrutiny rising, integrating KYC, AML, and securities law compliance is essential for platform credibility and sustainability.