- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

The crypto exchange industry is expanding at record speed as global adoption rises. Bybit’s latest milestone shows why regulated platforms are shaping the next phase of digital finance.

On October 9, 2025, Bybit became the first exchange to secure the UAE’s Virtual Asset Platform Operator License from the Securities and Commodities Authority (SCA).

This approval highlights the UAE’s adoption of global digital assets. It also validates the importance of a compliance-first model for any business planning to start a Bybit-like crypto exchange platform. With demand increasing, enterprises now have a strong opportunity to develop a crypto exchange platform in the UAE.

Key Takeaways

- In this guide, you’ll read about:Dubai’s clear regulations and 1,000+ active firms give businesses a strong base to develop exchanges.

- Bybit’s 2025 SCA approval shows how compliance unlocks regulated crypto exchange, custody, and rapid market trust.

- Building a Bybit-like exchange requires structured planning, strong security, deep liquidity, and regulatory-aligned deployment.

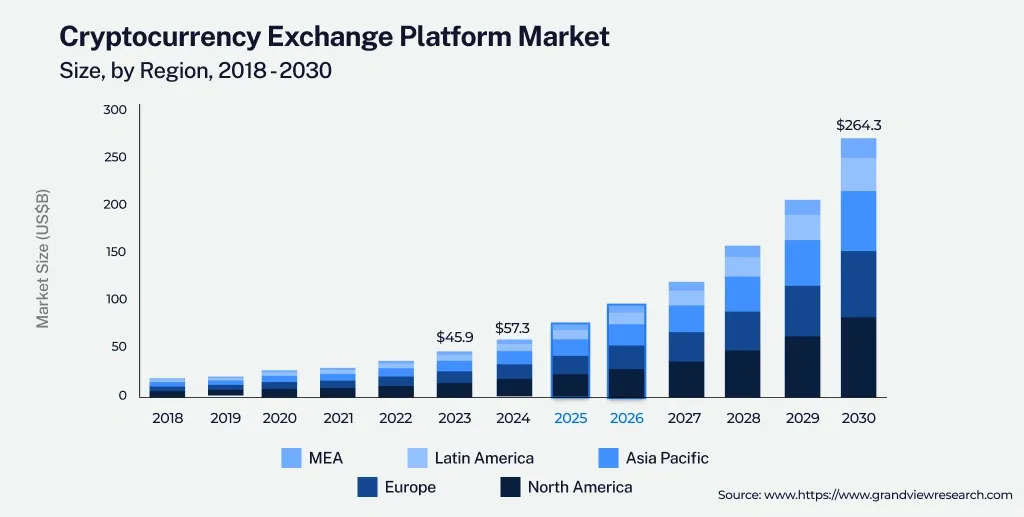

Global Crypto Exchange Market Growth Overview

The market for digital asset trading platforms continues to scale. Businesses planning to start a crypto exchange platform benefit from clear demand patterns backed by strong data.

Key market insights:

- The global cryptocurrency exchange platform market was valued at USD 45.89 billion in 2023. It is expected to reach USD 264.31 billion by 2030, supported by a 28.4% CAGR.

- North America generated over 29% of global revenue, proving the maturity of institutional trading.

- Asia Pacific is projected to record the fastest CAGR, driven by increased retail participation and emerging regulations.

- Bitcoin accounted for 45% of trading activity, confirming the sustained demand for high-liquidity assets.

- Commercial users represented over 68% of platform usage, demonstrating the shift toward enterprise-grade exchanges.

These insights show why businesses worldwide are launching white label crypto exchange platforms to capture rising trading volumes.

How Bybit Became a Dominant Trading Platform?

Bybit’s rise reflects strong execution, regulatory alignment, and a clear product vision. Founded in 2018, it quickly became the world’s second-largest exchange by trading volume. Its success rests on speed, security, and a user-centric model.

A major milestone came on October 9, 2025, when Bybit received the UAE’s first Virtual Asset Platform Operator License.

This followed its In-Principle Approval (IPA) in February 2025. With this license, Bybit can now offer regulated trading, brokerage, custody, and fiat conversion services in the UAE.

The approval also adds to its compliance roadmap, which includes:

- MiCAR authorisation in Europe (May 2025)

- Resumption of full operations in India (September 2025)

This shows how a compliance-first model can help new businesses launch a Bybit-like platform that earns regulatory trust and investor confidence.

Ben Zhou, Co-founder and CEO of Bybit, said, “ Receiving the full Virtual Asset Platform Operator License from the SCA is a testament to Bybit’s unwavering commitment to building trust through compliance and transparency. The UAE has emerged as a global leader in digital asset regulation, and this recognition underscores the strength of our security and governance standards.

At Bybit, we see regulation as the foundation for sustainable growth. This milestone marks another step forward in our global regulatory roadmap… from MiCAR in Europe to India and now the UAE… as we continue to set new benchmarks for a secure and responsible digital asset ecosystem.”

Key Features That Make Bybit Stand Out

Here are the key features that crypto exchange platforms take from Bybit.

1. High-Performance Trading Engine

Bybit processes up to 100,000 transactions per second, enabling seamless trading even under high volatility. The low-latency engine supports market, limit, and stop-loss orders with accuracy. This performance standard is essential for anyone planning to build the best crypto exchange platform.

2. Advanced Derivatives Trading Suite

Bybit dominates perpetual contracts and futures markets. These asset classes generate higher revenue for exchanges. A Bybit-like crypto exchange platform must support leveraged products with strong risk controls.

3. Strong Security and Governance

Bybit uses cold storage, multi-layer security, strict auditing, and insurance reserves. Its compliance-first roadmap sets expectations for startups building a crypto exchange platform development roadmap in the UAE.

Read Out Blog: Launch Your Cryptocurrency Exchange Software in the UK

4. Multi-Asset and Multi-Market Support

It supports major cryptocurrencies, altcoins, stablecoins, and institutional trading tools. This breadth helps attract diverse traders and meets business demand for liquidity depth.

5. Superior User Experience Across Devices

Bybit offers a clean interface on the web, iOS, and Android. Cross-device parity helps users trade at any time. Startups investing in a white label crypto exchange platform must prioritize unified UX.

6. Global Compliance and Local Market Alignment

Bybit’s regulatory approvals across Europe, India, and now the UAE show how compliance accelerates global adoption. Businesses that follow similar frameworks gain faster market trust.

Dubai’s Regulatory Support For Crypto Exchanges

Dubai offers one of the world’s most structured frameworks for digital assets. Its regulations help businesses create fully compliant trading platforms. The UAE handled over USD 25 billion in crypto transactions in 2022, showing the strength of its regulated environment.

1. AML and KYC Enforcement

The UAE enforces strict Anti-Money Laundering and Know-Your-Customer rules. Exchanges must verify user identity and financial standing. This helps prevent misuse of decentralized assets.

2. VASP Licensing Rules

Under Cabinet Resolution No. 111 of 2022, Virtual Asset Service Providers must obtain formal licenses. The rules cover exchange operations, custody, transfers, and brokerage services.

3. VARA Compliance and Risk Management Rulebook

Exchanges must follow the VARA AML/CFT rulebook. Every exchange needs a qualified MLRO, transaction monitoring tools, and Travel Rule compliance for transfers above AED 3,500.

4. Supportive Free Zones

ADGM, DMCC, and RAK Digital Assets Oasis offer specialized crypto frameworks. These zones support innovation with business grants, banking access, and clear licensing.

Read Also: Why White-Label Crypto Exchange Development Makes Sense for UAE Banks?

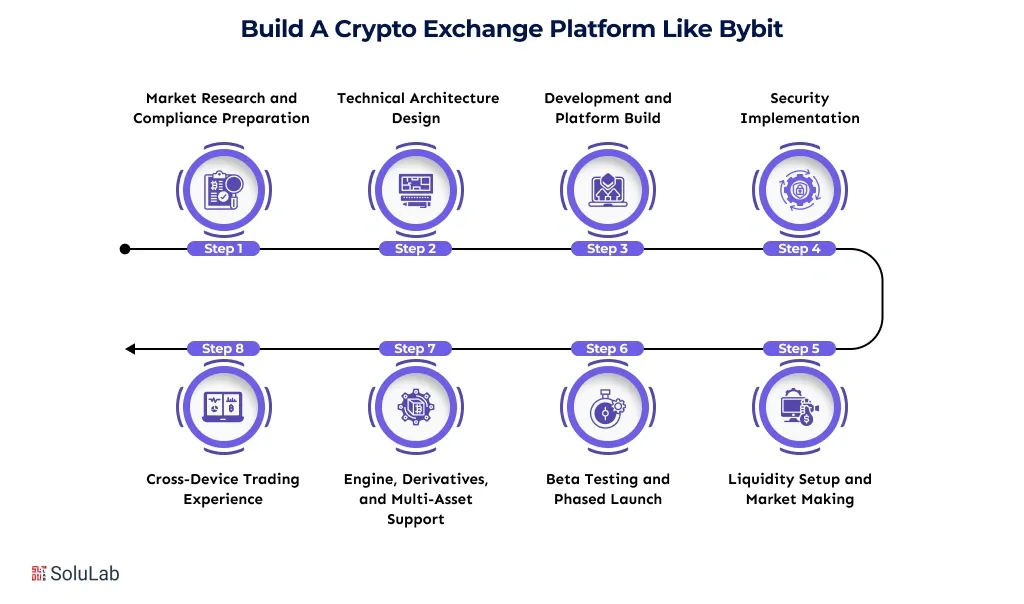

How To Build A Crypto Exchange Platform Like Bybit?

Building a Bybit-like crypto exchange platform requires structured planning, technical depth, and compliance alignment.

Step 1. Market Research and Compliance Preparation

Businesses should identify target users, trading needs, and competitive gaps. Compliance review is essential. Exchanges must prepare documents for UAE regulators and understand licensing paths.

Step 2. Technical Architecture Design

A scalable system is key. Plan a microservices architecture that handles more users as your platform grows. Define APIs, database logic, and third-party integrations for payments and liquidity.

Step 3. Development and Platform Build

Create modules for trading, user onboarding, asset management, and admin controls. Test the platform under load. Ensure accurate order matching and transparent trade history.

Step 4. Security Implementation

Security must stay at the core. Implement encryption, DDoS protection, multi-factor login, cold storage, and smart fraud detection.

Step 5. Liquidity Setup and Market Making

Partner with global liquidity providers. Offer deep order books from day one. Strong liquidity increases trading volume and user trust.

Step 6. Beta Testing and Phased Launch

Invite selected traders for closed beta testing. Fix usability issues, validate system load, and refine key features. Launch in phases to avoid operational strain.

Step 7. Engine, Derivatives, and Multi-Asset Support

A fast matching engine is essential. Add derivatives later to increase revenue. Support Bitcoin, Ethereum, altcoins, and stablecoins to attract diverse users.

Step 8. Cross-Device Trading Experience

Develop responsive web apps and native mobile apps. Ensure fast login, clean interfaces, and uniform functionality.

Cost and Time to Build a Bybit-Like Platform

The minimum cost to build a crypto exchange platform starts at around USD 20k, and takes 3 to 4 weeks.

The cost and duration increase as the integrations, advanced features, and enterprise-grade requirements increase. This is why choosing the best crypto exchange development company becomes essential.

Competitive Advantages Of Operating a Crypto Exchange Platform In the Dubai Market

Dubai offers strong strategic advantages for enterprises planning to launch a Bybit-like crypto exchange platform.

Key competitive benefits:

- Government-backed regulation creates trust: Businesses gain credibility due to the UAE’s structured compliance ecosystem. This helps attract institutional users.

- Access to crypto-friendly free zones: ADGM, DMCC, and RAK DAO offer clear digital asset laws, fast licensing, and strong investor networks.

- Low-tax environment improves 20-30% profitability: Companies keep more revenue since the UAE offers tax-efficient structures for digital asset businesses.

- Availability of skilled tech and compliance talent: Dubai attracts global professionals, helping teams scale faster without operational risk.

- Growing demand from both retail and institutions: The UAE has one of the fastest-growing digital asset user bases in the region. This supports long-term platform growth.

- Strategic geographic position supports global expansion: Businesses can serve Asia, Europe, and Africa from a single regulated hub.

Conclusion

As you see from the above discussion, the global digital assets exchange system grows at record speed. And businesses are running to keep up with the market and user requirements. If you are also looking for a high-performance, regulation-ready crypto exchange platform development, then SoluLab is at your service.

To make a platform like Bybit, all you need is an expert partner. Solulab completed

150+ successful exchange projects. Our recent DLCC, a next-gen DeFi platform, shows the impact of strong execution. By modernizing automated trading and liquidity functions, DLCC achieved 85% stronger transaction security and improved system reliability.

If you’re planning to build, upgrade, or scale your crypto exchange platform, our team can help you confidently. Schedule a free call to discuss your crypto exchange vision!

FAQs

Yes, Dubai is one of the best locations to launch a crypto exchange due to its clear regulatory framework under VARA, strong banking infrastructure, and a rapidly growing digital asset ecosystem. These factors make it easier for new exchange operators to launch, scale, and build trust with global users.

Yes, Bybit’s UAE licensing significantly improved market confidence by demonstrating that crypto exchanges can operate legally and transparently in Dubai. This approval has encouraged investors, banks, and users to trust regulated crypto exchange platforms entering the UAE market.

Building crypto exchange typically takes 2 to 4 months and starts with a mid-range budget, depending on features such as spot or derivatives trading, compliance, liquidity integration, and security architecture. However, AI powered crypto exchange platforms may require additional time and investment.

Businesses choose SoluLab for crypto exchange development in USA because of its proven experience in building secure, scalable, and regulation-ready trading platforms. SoluLab handles everything from architecture and compliance integration to liquidity, security audits, and post-launch support.

Crypto exchange platforms are widely used by fintech companies, proprietary trading firms, Web3 startups, gaming and NFT ecosystems, asset management firms, and cross-border payment providers that require fast, secure digital asset trading infrastructure.