The global financial system is at a turning point. Every day, trillions of dollars move through banks and payment networks that were built decades ago. These systems are slow, costly, and complex. At the same time, the stablecoins vs traditional finance conversation has moved beyond hype. It’s no longer just a crypto talking point, but a real business discussion. Banks, fintech companies, and even regulators are now looking closely at where stablecoins actually fit as money systems evolve.

The numbers tell their own story. The stablecoin market is around $280 billion today, but it’s expected to cross $3.8 trillion by 2030. That kind of growth isn’t driven by hype, but by real use cases, businesses wanting faster settlements, lower costs, and a simpler way to move money across borders. As a result, stablecoins vs traditional banking is no longer theoretical. enterprises and financial institutions now see stablecoins as real infrastructure for payments, treasury, and cross-border transfers.

But this raises a bigger question: are stablecoins building a parallel financial system, or quietly becoming the rails that banks and payment networks will run on next that distinction matters, and it’s exactly what we’ll break down next.

Key Takeaways

- Stablecoins are shaking up how money moves because stuff that used to take days now happens in minutes.

- The idea that stablecoins could replace banks is not just talk anymore, as CBDCs and enterprise-grade stablecoins are making it real.

- Major financial services companies are exploring stablecoins to improve financial planning services and cross-border settlements.

- By 2026, stablecoins might handle $10–15 trillion a year, covering 10–15% of cross-border payments like trade finance, remittances, and businesses.

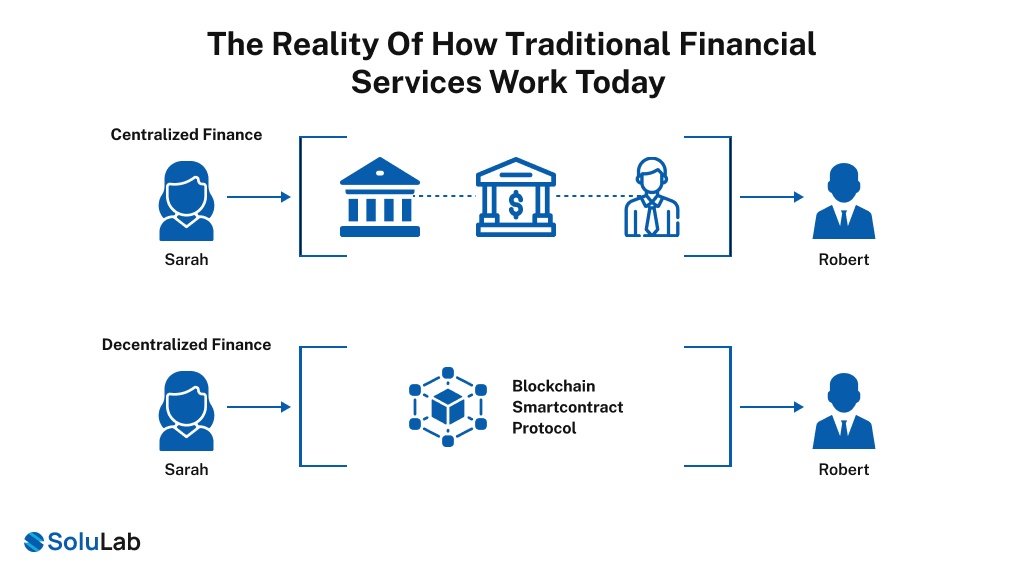

The Reality of How Traditional Financial Services Work Today

Here’s the thing you already know that banks weren’t made for moving money fast across the world, because sending money abroad might look instant, but it actually passes through several banks and clearing systems, slowing everything down, adding additional fees, and triggering more checks.

Most transfers take a few days and cost a noticeable chunk, plus hidden currency fees. If your business moves money often, it gets annoying fast. We all know that SWIFT has been around forever, and while it’s secure, it’s still stuck in old-school batch processing. For example, if you send money late on Friday, the chances are it won’t show up until Tuesday. That messes with cash flow and makes managing global teams or marketplaces more complicated than it should be.

That’s why stablecoins and blockchain payments are starting to make sense. Banks are built to manage trust and risk, not to move money fast. That worked decades ago, but now it just slows things down. They’re not failing, as they’re just not made for today’s fast, digital businesses. Stablecoins let you send money instantly, cut costs, and keep cash flowing no matter where your business operates.

Why Are Businesses Choosing Stablecoins Over Traditional Finance?

At a business level, stablecoins vs traditional finance is a systems comparison. The question is, which financial rails move money faster, cheaper, and with more control for modern businesses operating globally. Let’s find out.

| Factor | Stablecoins | Traditional Finance (Banks & Payment Systems) |

| Settlement Speed | Transactions settle in seconds to minutes on blockchains like Ethereum or Polygon | Domestic transfers take 24–48 hours, and cross-border through SWIFT can take 2–5 days |

| Transaction Cost | $5–$20 per transfer, depending on network congestion | $30–$75 per wire plus 1–2% FX spreads |

| Cross-Border Payments | Borderless by default; same process for local and global transfers | Multiple intermediaries, currency conversions, and delays |

| Access | Anyone with internet and a wallet can participate | Requires bank accounts, approvals, and minimum balances |

| Transparency | Transactions and reserves are publicly verifiable on-chain | Operations are opaque; users rely on trust and statements |

| Programmability | Payments can be automated using smart contracts | Limited automation; relies on manual or batch processes |

For companies and individuals moving capital globally, these differences aren’t theoretical. They turn into real savings as settlement times drop from days to minutes, while fees that once ran into the millions each year can be reduced significantly by using stablecoins for payments.

This is why fintechs, payment providers, and even banks are now building on stablecoin infrastructure instead of ignoring it. Stablecoins aren’t replacing banks overnight, but they are changing how money moves. As for startups and platforms, the real opportunity is in blending stablecoins with existing systems, which unlocks faster payments, lower costs, and true global scale.

Can Stablecoins Replace Banks for B2B Payments

Stablecoins won’t kill banks, but they are already doing some banking jobs better. The real question now isn’t stablecoins vs banks, it’s which parts of finance stablecoins clearly win at. And in 2026, that difference matters a lot more than it did a few years ago.

Where stablecoins really shine is moving money, making payments, settlements, and cross-border transfers easier. For B2B stablecoin payments, companies now move money in minutes, which wasn’t possible with traditional banking. Compare that to bank wires that take days, stop on weekends, and charge $20–$50 per transfer. For companies paying global vendors or moving funds between countries, the gap is obvious.

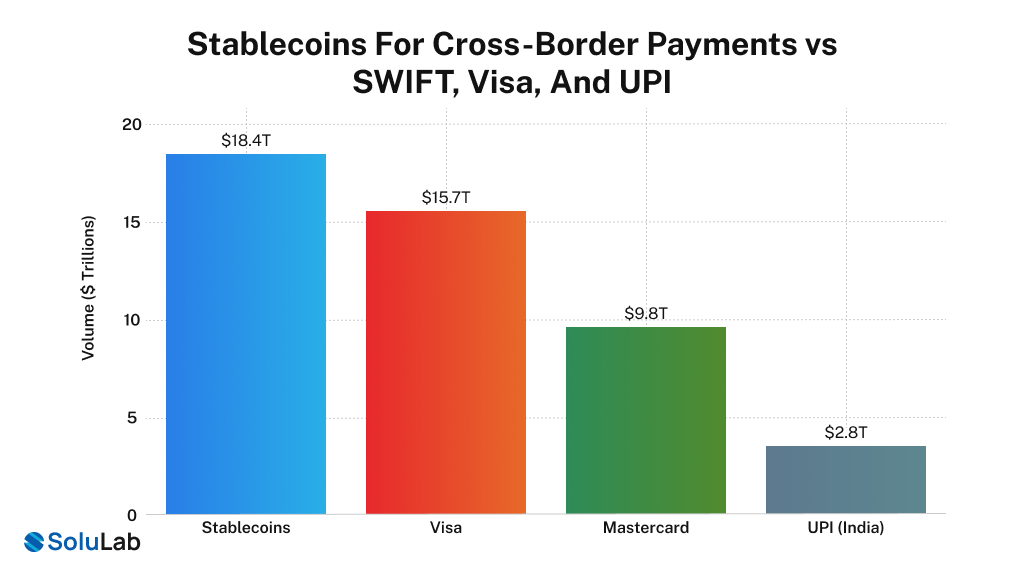

This isn’t theory anymore as Stablecoins already handle more than $8 trillion in on-chain transactions every year, which puts them in the same league as major card networks. For you, this also means cleaner books like real-time tracking, transparent records, and even programmable payments. These are things old banking systems were never built to handle.

But banks still matter to most of us, especially when it comes to trust and protection. As lending, Business loans, mortgages, and credit lines exist because banks assess risk and operate under regulation, but Stablecoins don’t offer this at scale yet. We know that DeFi lending exists, but it’s volatile and still too risky for most serious businesses.

There’s also a major safety concern. As Banks offer deposit insurance, chargebacks, and dispute resolution, but with stablecoins, if an issuer collapses or funds go to the wrong address, recovery is unlikely impossible. That’s a risk most companies usually can’t ignore.

So according to SoluLab, the future is coexistence. The real opportunity is building systems that connect stablecoins and traditional banks in a smart way. That’s where businesses win, and strong fintech and infrastructure teams can create real value.

Stablecoins for Cross-Border Payments vs SWIFT, Visa, and UPI

Payments didn’t suddenly stop working, but you can feel the strain. As stablecoins started getting real usage, the old systems began to show where they slow things down, especially when money has to move across borders. When you look closely, it’s less about who’s better and more about how differently these systems were built.

1. Stablecoins vs SWIFT

SWIFT is everywhere in global finance, but it’s often misunderstood. It doesn’t actually move money, rather it sends messages, and then banks take over, passing things through correspondent banks, clearing systems, and internal processes, which is why things stretch out over days.

With stablecoins, that extra layering just isn’t there. When a transaction happens, the value moves at the same time, on-chain, without waiting for confirmations from multiple systems that were never designed to talk to each other in real time.

That’s why stablecoins vs SWIFT stopped being just talk. Around 2024 and 2025, banks started testing blockchain settlement because the cost and delays were getting harder to justify. SWIFT still matters, but it’s slowly adapting as faster settlement becomes part of normal operations.

2. Stablecoins vs Visa

Visa is trusted for a reason, and it works incredibly well at scale, but it’s still a network that sits on top of banks. The swipe looks instant, but the real settlement happens later, during banking hours, and finality isn’t always immediate.

Stablecoins skip most of that. They don’t wait for banks to reconcile, they don’t pause on weekends, and they move value directly from one side to the other. Once it’s sent, it’s done.

Visa sees where this is going, which is why it’s not fighting it. Instead, it’s supporting stablecoin payments, building easier on-ramps, and working with blockchain infrastructure. What’s coming isn’t a replacement, but a mix of old reliability and new settlement speed.

3. Stablecoins vs UPI

UPI already proves that fast and cheap payments are possible. Inside India, it’s smooth, almost instant, and works at massive volume without much friction, which is why people trust it daily.

The problem shows up the moment payments leave the country. Then banks, FX layers, and traditional settlement systems step in, and everything slows down and gets more expensive.

Stablecoins don’t change their behavior across borders. They move globally the same way they move locally, without extra steps. That’s why governments are now looking at stablecoins alongside CBDCs, including early ideas around a digital rupee. The aim is to make cross-border payments feel as easy as local ones.

How Governments Shape Stablecoins in Banking, Cross-Border Payments, and Financial Services?

When stablecoins first showed up, there were almost no rules, which is why a lot of people thought they would replace government money. That phase didn’t last very long. As stablecoins started handling real volume, governments stepped in, not to kill them, but to shape how they should work. This shift matters because banks and institutions only move once the rules are clear enough to trust.

Today, stablecoins aren’t trying to sit outside the system. They’re being pulled into it, and that’s where real adoption is coming from.

The Regulatory Landscape

From around 2023, regulation stopped being vague and started becoming practical. Most of the countries moved from warnings to actual frameworks, which gave stablecoin issuers something solid to build on.

In Europe, MiCA laid out clear expectations around reserves and transparency. In the US, laws are still being debated, but the direction is clear enough for serious players. At the same time, places like Singapore, Hong Kong, and the UAE moved faster because they see stablecoins as financial infrastructure, not just crypto products.

What’s important is that regulation didn’t slow the space down rather it cleaned it up. Big issuers like USDC and Tether adjusted and stayed, but projects that ignored compliance slowly dropped off, which made the market more stable overall.

The Rise of CBDCs

In many countries, this has led to licensed stablecoin models, where issuers need full reserves, audits, and strict AML/KYC checks. While private companies were building stablecoins, governments started doing something similar with CBDCs. China rolled out the digital yuan, Europe worked on the digital euro, and the US began serious talks around a digital dollar.

Even though CBDCs and stablecoins come from different issuers, they run on similar digital setups, which means the settlement logic is largely the same. Because of that, they’re more likely to exist together rather than compete head-on. That setup builds trust and pulls stablecoins closer to traditional finance instead of pushing them away.

The Shift from Opposition to Integration

Between 2018 and 2020, banks mostly saw stablecoins as a threat. That view changed once regulation became clearer and volumes grew.

JPMorgan launched JPM Coin and now processes over a billion dollars daily, Goldman Sachs invested heavily in digital asset infrastructure, and BNY Mellon, the largest custody bank globally, now offers crypto and stablecoin custody.

These aren’t experiments. As banks usually don’t move this way unless they see long-term value, where stablecoins solve problems banks already had but couldn’t fix with legacy systems.

Why Banks Are Adopting Stablecoins?

Banks are adopting stablecoins for practical reasons. They speed up settlement, reduce friction, and make cross-border payments easier. At the same time, they open up new revenue from custody, issuance, and compliance services.

There’s also a control angle. If banks don’t integrate stablecoins, fintechs, and crypto-native players will keep building parallel systems, which banks don’t want happening outside their reach.

By 2026, most large banks will either issue their own stablecoins or connect to existing ones. These will run on blockchain rails, settle instantly, but still stay centrally managed. Customer accounts won’t change, but money will move faster behind the scenes. That’s the real shift as crypto isn’t replacing banks, and they are using blockchain to upgrade how money actually moves.

How Banks and Institutions Are Using Stablecoins in Payments and Cross-Border Transfers?

Stablecoins already live inside big banks and payment networks, not as demos, but as working systems. They’re being used where things were slow, expensive, or messy before, especially around settlement and liquidity. What’s interesting is that none of this replaces banks or card networks, and it just sits underneath and fixes the boring but painful parts.

1. JPMorgan – JPM Coin for Wholesale Payments & Treasury

JPMorgan built JPM Coin on its Onyx blockchain so large companies can move tokenized USD and EUR between their own accounts and subsidiaries. It sounds simple, but for treasury teams, this changes how money actually moves during the day, not just at cut-off times.

The problem they solved using JPM Coin

Earlier, most internal and cross-border movements depended on SWIFT, which meant delays, time-zone issues, and money parked in multiple places just in case. Cash would sit idle, not because it was needed, but because transfers were slow and predictable only once a day.

Business impact it has

- Payments between internal accounts now move almost instantly, even outside banking hours

- Companies don’t need to keep extra buffers everywhere, which frees up working capital

- Treasury teams get better visibility and control during the day, not after it ends

- Over time, this lowers financing costs and day-to-day operational friction

2. Visa – Stablecoin Settlement Using USDC

Visa didn’t change how cards work for users, but it did change how settlement happens behind the scenes. By enabling USDC-based settlement for some partners, Visa kept its network and compliance layers, but swapped out the slow part that happens after transactions.

The problem they solved using USDC-based settlement layer

Traditional settlement runs in batches, with fixed schedules, which means waiting days, pre-funding accounts, and carrying FX risk while everything clears. It works, but it’s heavy and expensive, especially at scale.

Business impact it has

- Settlement moves from multi-day cycles to near real-time

- Less pre-funding is needed, which improves cash flow for partners

- FX and operational costs drop because money moves faster

- Merchants and users see no difference, which is exactly the point

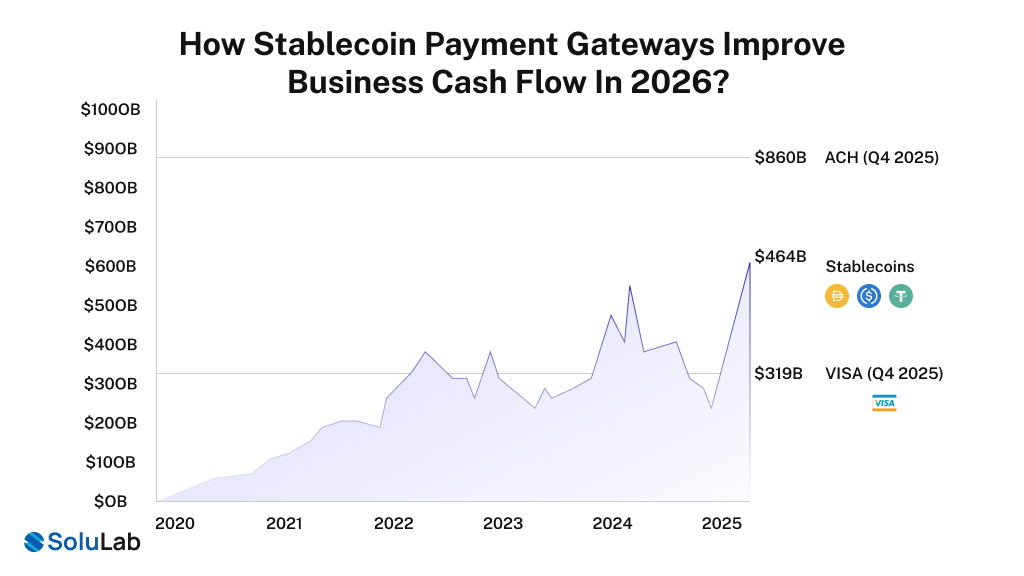

How Stablecoin Payment Gateways Improve Business Cash Flow in 2026?

Finance isn’t about crypto taking over banks. It’s really about stablecoins and traditional finance working together, which ends up creating a sort of hybrid system. By 2026, we’ll see the adoption of CBDCs, bank-issued stablecoins, and private stablecoins running on shared blockchain rails, while banks keep handling credit, deposits, compliance, and managing customer relationships.

For most people, it won’t feel like much has changed. However, for businesses and treasury teams, it will completely change the way money moves. The old back-and-forth debate between stablecoins and banks will start to fade, as both systems mix together, making cash moves faster, simpler, and more flexible.

Research even shows that tokenized money could cover 15–25% of global cross-border payments by the end of the decade, which really shows how big this shift could be for companies. This matters because these systems move value faster, cheaper, and with fewer intermediaries.

Instead of waiting days for settlement, businesses can move funds in seconds. This is why banks and fintechs are investing in blockchain-based payment infrastructure rather than fighting stablecoins. What the economics already show is that

- Cross-border fees drop from 5–7% to under 1%

- Settlement time falls from days to under a minute

- Payment friction reduces by up to 90% at scale

With global smartphone adoption heading toward 80%+, billions of users can access digital dollars and euros via stablecoin wallets even without a bank account. Banks that adapt by issuing tokens and offering programmable money services will grow faster, while others risk falling behind.

So stablecoins won’t replace banks, but they will replace slow financial infrastructure, and the businesses building on this stack early will lead the next phase of finance.

Conclusion

People often think stablecoins are trying to fight banks, but that’s not really it. The change is more about real business needs like faster payments, lower costs, and smoother workflows. Banks and stablecoins are actually starting to work together, which means what was once just a test is quickly becoming normal.

By 2026, most systems will blend stablecoins with traditional banking in some way. Businesses that start implementing or integrating stablecoins now will enjoy faster, more efficient, and scalable payments. At SoluLab, as a stablecoin development company, we work with businesses to build secure, fully compliant solutions from scratch. This shift is already happening, and the ones who adapt early are the ones who will rise ahead of the trends.

FAQs

So, it really depends on what you’re comparing it with. Stablecoins like USDC are backed with real dollars, and you can check the treasury anytime, which is great because you always know what’s there. We all know that Banks are safer for smaller deposits with FDIC insurance, but if you’re moving millions of dollars, stablecoins might be a faster and secure way to send and receive money

Not really, and actually, governments are looking at CBDCs, which are kind of similar. Mostly, regulators care about licenses, audits, and making sure reserves are there, so only the coins that aren’t properly backed get in trouble. Well-audited coins like USDC work really well without any issues.

Yes, but currently it’s not common yet. Sending coins to someone else works instantly, which is great, but most stores aren’t ready for it. In a couple of years, it’ll probably feel as normal as using cards, UPI, or any other usual payment method.

Most stablecoins have real dollars or assets behind them, which keeps them steady. Some use algorithms, which, honestly, can be a bit risky. Usually, for businesses, it’s safer to use coins that actually show proof of reserves, so you’re not left confused.

Yeah, usually you do. Pretty much any move, like getting paid, swapping for cash, or paying bills, counts. Even if the coin doesn’t change in value, it’s safer to report it, and honestly, just chatting with a tax person makes life easier.