Traditional payment systems are getting outdated. High transaction fees, delayed settlements, and limited flexibility often frustrate both businesses and customers. In fact, sticking only to cash or card puts your business at a disadvantage.

As digital currencies become more mainstream globally, customers expect secure and fast payment options. Businesses that fail to adapt risk falling behind competitors who offer crypto checkout experiences. That’s where POS crypto wallet integration comes in.

Whether you’re a retailer or service provider, accepting crypto via POS boosts convenience, expands your customer base, and future-proofs your business. Let’s explore why now is the time to act.

What Is POS Crypto Wallet Integration?

POS Crypto Wallet Integration refers to connecting a Point of Sale (POS) system with a cryptocurrency wallet so that businesses can accept crypto payments directly at checkout, both online and offline.

The global crypto wallet market is projected to grow from $14.39 billion in 2024 to $19.03 billion in 2025, marking a 32.2% CAGR.

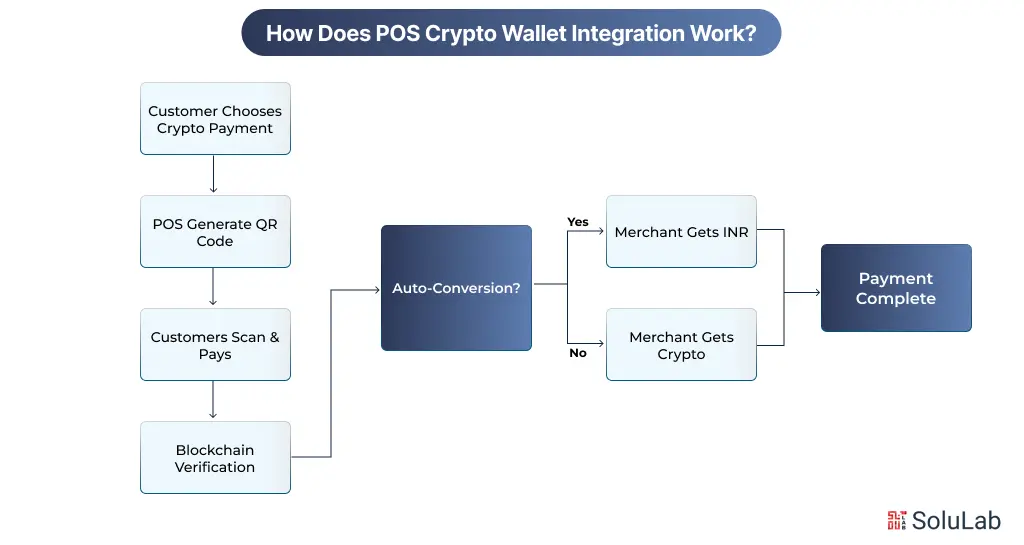

Here’s how it works

- A customer wants to pay with crypto like Bitcoin, Ethereum, or USDT

- The POS system (used at retail stores, cafes, or online shops) is integrated with a crypto wallet or gateway.

- The system generates a QR code or wallet address

- The customer scans it and pays from their crypto wallet

- The payment is verified and confirmed on the blockchain

- The merchant receives the crypto or an auto-converted INR value via the provider (if supported)

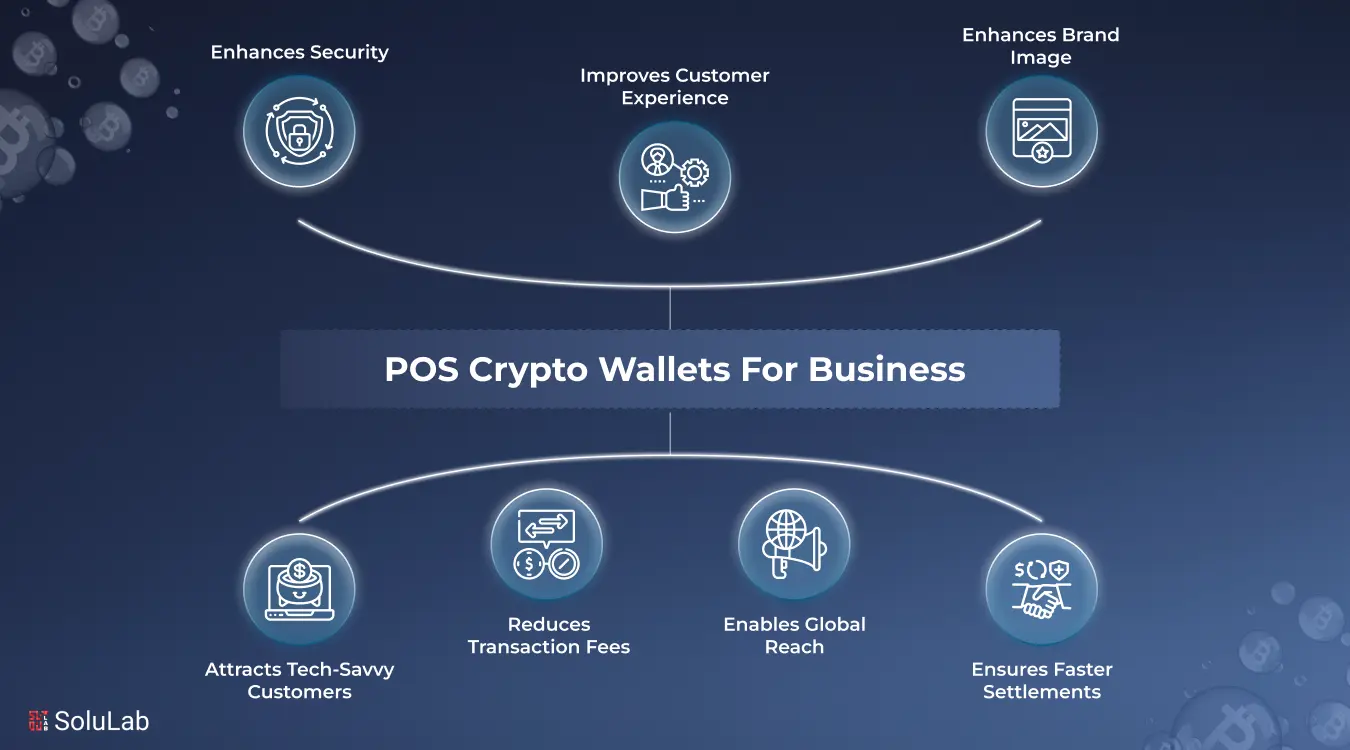

Why POS Crypto Wallet Integration Matters for Modern Businesses?

Integrating crypto wallet functionality into Point of Sale (POS) systems represents a strategic move that can transform how businesses operate and serve their customers.

1. Attracts Tech-Savvy Customers

Integrating crypto payments showcases your business as innovative and forward-thinking, appealing to a growing demographic of tech-savvy consumers who prefer digital currencies.

2. Reduces Transaction Fees

Cryptocurrency transactions often incur lower fees compared to traditional payment methods, helping businesses save on processing costs.

3. Enables Global Reach

Accepting cryptocurrencies allows businesses to tap into international markets without the complexities of currency conversions or cross-border fees.

4. Ensures Faster Settlements

Crypto transactions are processed quickly, often within minutes, improving cash flow and reducing waiting times associated with traditional banking systems.

5. Enhances Security

Blockchain technology provides a secure and transparent transaction method, reducing the risks of fraud and chargebacks.

6. Improves Customer Experience

Providing multiple payment options, including cryptocurrencies, caters to customer preferences and enhances the overall shopping experience

7. Enhances Brand Image

Embracing innovative payment methods like crypto can elevate your brand’s image, portraying it as modern and customer-centric.

Key Features of a POS System

Here’s a quick rundown of the key features of a POS (Point of Sale) system that help modern businesses run smoothly and deliver a better customer experience, whether it’s a retail store, café, or service-based setup.

-

Payment Processing

Handles all types of payments, cash, card, UPI, wallets, and even crypto in some setups. It ensures fast and secure transactions, making the checkout experience seamless for both customers and staff.

-

Inventory Management

Tracks product stock levels in real-time. It notifies you when items are low, helps prevent overstocking, and ensures popular products are always available, saving time and avoiding manual errors.

-

Customer Relationship Management (CRM) Integration

Stores customer data like past purchases, birthdays, or preferences. This helps businesses offer personalized deals, send loyalty rewards, and improve retention with targeted marketing.

-

Resource Planning

Allows business owners to manage staff schedules, track hours worked, and allocate resources efficiently, useful in restaurants or multi-branch retail outlets.

-

Reporting and Analytics

Generates sales reports, customer insights, and performance dashboards. These analytics help business owners make smart, data-driven decisions quickly, from best-selling products to peak shopping times.

-

Invoicing

Automatically generates professional invoices for every transaction. Some systems also support GST-compliant billing and digital receipts via email or WhatsApp — which is especially handy in the Indian context.

-

Simple UX/UI for Staff and Customers

A good POS system offers a clean, intuitive interface. This ensures your team can learn it quickly and customers don’t face delays at checkout — no tech stress, just smooth selling.

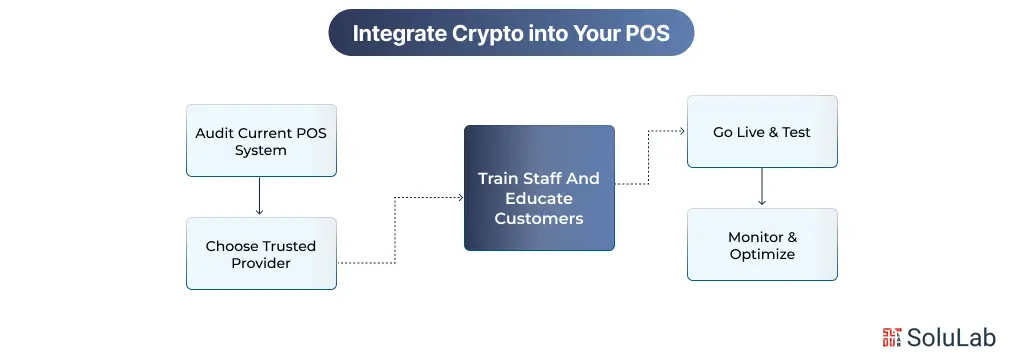

How to Integrate Crypto into Your POS?

Integrating crypto into your POS system isn’t as complicated as it looks. Here’s a simple step-by-step guide to help you make the switch with confidence:

1. Audit Your Current System

Start by evaluating your existing POS setup. Check if it supports third-party integrations or crypto plugins. Knowing your system’s limitations and strengths will help you choose the right solution without disrupting daily operations.

2. Choose a Trusted Provider

Partner with a reliable crypto POS provider that supports popular cryptocurrencies, offers security, and complies with local regulations. Look for options that integrate well with your current system.

3. Educate Staff and Customers

Train your staff on how to accept crypto payments and handle any issues. Use simple signage or FAQs to educate customers, making them feel comfortable and secure while paying with digital currencies.

4. Optimize and Evolve

Monitor how crypto payments perform. Gather feedback, track transactions, and stay updated with new features or compliance needs. Keep improving the experience so it stays smooth and future-proof.

Future of POS Crypto Wallets

Blockchain, AI, and user preferences will result in rapid change in POS crypto wallets in 2025. As cryptocurrencies gain popularity, POS systems are adjusting to offer secure, efficient crypto payment alternatives.

- Personalized financial insights: Predictive analytics and automated portfolio management are changing crypto wallets with AI. Smart wallets monitor user activity and market trends to make personalized recommendations, improving financial decision-making.

- Real-Time Crypto-to-Fiat Conversion: Modern POS systems can instantly convert cryptocurrencies into local fiat currencies. This functionality stabilizes merchants’ revenue streams by reducing digital asset volatility.

- Integration with Web3 and Metaverse: Crypto wallets are adapting to dApps and virtual worlds. Businesses can capitalize on burgeoning digital economies by letting customers manage NFTs, virtual properties, and in-game assets directly through their wallets.

Crypto wallets now use fingerprint scans and facial recognition for security. These characteristics and behavioral biometrics protect digital assets from illegal access.

Conclusion

Integrating POS crypto wallets is no longer a futuristic option—it’s a smart business move for 2025. With benefits like faster transactions, lower fees, global reach, and enhanced security, crypto-ready POS systems help businesses stay competitive and customer-focused.

They also open doors to a younger, tech-savvy audience that prefers decentralized payment methods. Whether you run a café or an e-commerce store, adopting crypto can future-proof your operations. Update your systems, and position your brand at the forefront of the next financial revolution.

SoluLab, a crypto wallet development company can help you set up POS crypto wallet plus, give you expert guidance. Contact us today to discuss further.

FAQs

1. What is a POS crypto wallet?

A POS crypto wallet is a digital payment solution that allows businesses to accept cryptocurrencies like Bitcoin or Ethereum through their Point-of-Sale system.

2. Which cryptocurrencies can be accepted via POS?

Most crypto POS providers support major coins like Bitcoin (BTC), Ethereum (ETH), USDT, and sometimes local tokens, depending on the provider.

3. What is the cost of integrating a crypto POS?

Basic crypto POS integration can be cost-effective, with some providers charging flat fees or taking a small percentage per transaction.

4. Can I offer refunds on crypto transactions?

Yes, but it must be done manually. You’ll need to confirm wallet addresses and transaction IDs, as crypto is irreversible once sent.

5. Do customers want to pay with crypto?

The demand is growing, especially among Gen Z and global tourists. Accepting crypto can be a great differentiator and brand builder.