The world of finance is evolving fast. In 2026, businesses and startups are looking for hybrid wallets that combine fiat and crypto in a single, seamless app. For investors and product teams, having a smart wallet solution is a way to stay competitive. The numbers speak for themselves.

| The market for hybrid wallet solutions is expected to reach $17.60 billion by 2033, growing over 10% annually. Even small MVPs start at $25K–$60K, while full enterprise-grade wallets can cost $600K or more. |

Understanding the real cost and features before you invest is critical. So, in this guide, you’ll discover what makes a strong wallet, how hybrid wallet development costs are structured, and the key steps to build a secure, scalable solution that meets both business and user needs.

Why Hybrid Wallets Are Becoming the New Standard in Web3 Payments?

A hybrid wallet is a modern digital wallet that allows users to store, send, and manage both fiat money (like USD, EUR) and crypto assets (like Bitcoin, Ethereum, or stablecoins) all in one platform. Unlike traditional wallets that only handle one type of currency, hybrid wallet crypto solutions bridge the gap between traditional finance and blockchain technology, giving businesses and users a single, seamless place to manage all their money.

Here’s why it is important for businesses today:

- Companies can track both on-chain (crypto) and off-chain (fiat) balances in a single platform, saving time and reducing errors.

- Users get a smooth experience, handling crypto payments, stablecoins, and regular fiat money without switching apps.

- Hybrid wallet crypto solutions make transactions faster and simpler, especially for cross-border payments.

So, for any business planning to scale in 2026, having a hybrid wallet is a strategic tool that drives efficiency, trust, and growth.

What Are You Building When You Start Hybrid Wallet Development?

Before discussing cost, understand what makes a hybrid wallet different. A traditional crypto wallet holds one thing: crypto. A hybrid wallet holds two worlds simultaneously and makes it look like one.

The user experience feels simple.

- Open the app.

- See your balance.

- Tap a button to buy crypto with fiat.

- Tap another to convert back.

But that simplicity masks orchestration across completely different financial systems. Behind the scenes, your backend is:

- Syncing with traditional banking APIs (payment processors, banks)

- Syncing with blockchain networks (Ethereum, Solana, Polygon)

- Managing regulatory compliance across jurisdictions

- Reconciling transactions in real-time

- Maintaining security standards that institutional investors expect

- This coordination is what makes hybrid wallets valuable. It’s also what makes them expensive.

How Much Does Hybrid Wallet Development Cost for a Production Launch?

Understanding the hybrid wallet development cost is critical before starting your project. The Cost of Hybrid Wallets depends on complexity, features, compliance requirements, security, and integrations. Let’s break it down clearly so you know what to expect:

| Complexity | Estimated Cost (USD) | Main Drivers & Business Perspective |

| Simple MVP | $5,000 – $40,000 | Core functionality with single payment rail. – Store, send, receive fiat and crypto. Basic KYC/AML and regulatory checks. Ideal for startups testing ideas quickly. Collect early insights to improve features. Budget-friendly, focused on speed and essential functionality. Enterprise-grade security and multi-chain support not included. |

| Medium/Advanced | $40,000 – $100,000 | Multi-chain support for multiple blockchains. Smooth integration for fiat-to-crypto and vice versa. Optimized mobile and web apps with moderate security. KYC, AML checks, and basic audit logs included. Suitable for growing businesses targeting more users. Multi-layered protection for user funds and data. Basic loyalty, transaction history, and reporting tools. |

| Enterprise Grade | $100,000 – $250,000 | Supports high-volume and cross-border transactions. Advanced KYC/AML, sanction screening, and audit-ready reporting. Virtual/physical card and POS integration. – Multi-party computation, HSMs, and fraud monitoring. Modular architecture ready for regional expansion. Multi-chain, stablecoin support, treasury management, and reporting dashboards. Continuous operation with monitoring and support for long-term reliability. |

Key points to consider:

1. Integrations drive cost: Every bank, card network, stablecoin, or blockchain you connect adds to the Hybrid Wallet Development effort.

2. Compliance is critical: Adding KYC/AML checks, sanctions screening, and audit-ready logs increases the hybrid wallet crypto cost but keeps your business safe.

3. Security matters: Using proper custody models, multi-party computation, and secure APIs ensures your best hybrid wallet is reliable for users.

4. Ongoing maintenance: Even after launch, you’ll need monitoring, updates, and compliance checks; these are part of the Hybrid Wallet cost you must budget.

By understanding these costs upfront, your business can plan the right hybrid wallet app development cost, avoid surprises, and choose the best crypto wallet development partner to deliver a safe, scalable, and revenue-ready wallet.

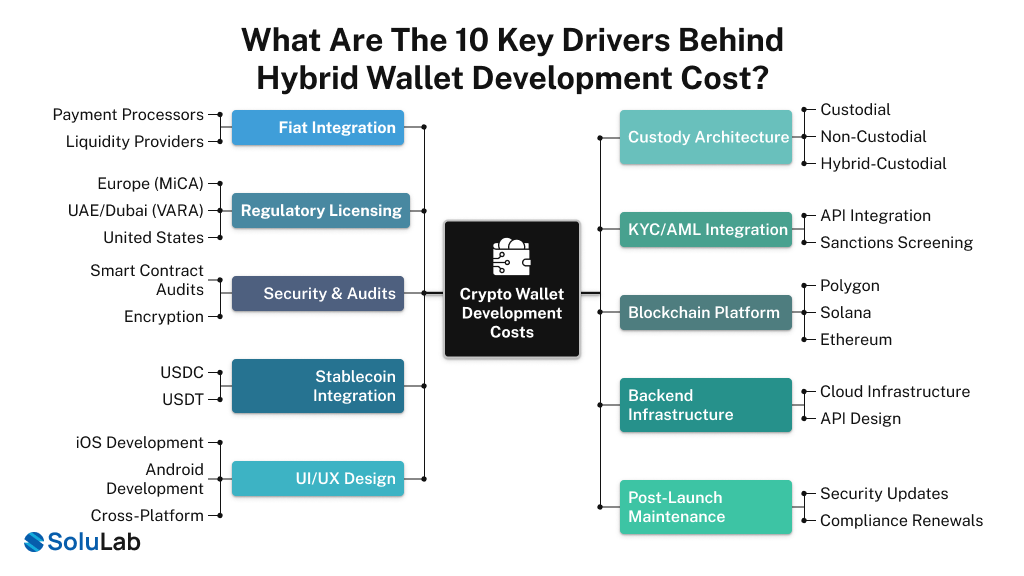

What Are The 10 Key Factors That Influence Hybrid Wallet Development Cost?

1. Fiat Integration:

Connecting to traditional banking isn’t like integrating a simple API. Payment processors (Stripe, MoonPay, Ramp), banks, compliance vendors, and liquidity providers each have approval processes, fraud controls, and integration timelines.

Off-ramps are even trickier. You’re now responsible for liquidating crypto at fair rates, managing chargebacks, and coordinating payout execution with banking partners.

- Real cost: $30,000 – $80,000, depending on how many payment methods you support.

- Add another $5,000–$15,000 per fiat currency (EUR, GBP, INR).

Teams consistently underestimate this because they focus on the API integration, not the business operations behind it.

2. Custody Architecture

Who holds the keys? This choice reshapes everything.

1. Custodial (you hold keys): Simpler UX, heavier compliance. Budget $60K–$100K for MVP, plus $20K–$50K annually for licensing, audits, and insurance.

2. Non-custodial (user holds keys): Complex UX, lighter compliance. Budget $80K–$150K for MVP, but no licensing overhead.

3. Hybrid-custodial (the middle path): Users delegate key management optionally but retain control. Most sophisticated technically. Budget $120K–$200K for MVP.

Which one: Custodial or Non-custodial wallet? Custodial is faster to market if you have compliance expertise, Non-custodial scales with fewer regulatory headaches, and Hybrid maximizes user choice but demands elite engineering.

3. Regulatory Licensing by Geography

Your target market determines compliance costs more than anything.

1. Europe (MiCA): Over 65% of EU crypto startups applied for licenses by mid-2025.

- Capital requirement: €50,000 – €150,000

- Annual compliance cost: €500,000+ for medium-sized providers

- Legal & licensing: €100,000 – €250,000 upfront

- Fine for non-compliance: €1.2 million average (some exceeded €5 million)

2. UAE/Dubai (VARA): Crypto-friendly but structured.

- Application fee: AED 40,000 – AED 100,000 ($10,900–$27,250)

- Annual supervision: AED 80,000 – AED 200,000 ($21,800–$54,500)

- Timeline: 4–8 months

- Processing is slower but clearer than Europe

3. United States: Fragmented across FinCEN, SEC, and state regulators.

- MSB registration: $25,000–$100,000 per state

- Legal navigation: $150,000–$300,000+

- Annual monitoring: $50,000–$100,000

- Budget 15–20% of development cost for compliance.

For a $250K project, that’s $37,500–$50,000 in direct costs, plus $100,000–$200,000 upfront if targeting Europe or Dubai.

4. KYC/AML Integration

Every jurisdiction requires Know Your Customer (KYC) and Anti-Money Laundering (AML) verification. This is baked into your onboarding, not bolted on afterward.

- Real work: API integration with KYC providers ($5K–$10K), sanctions screening setup ($3K–$8K), transaction monitoring ($5K–$12K), regular audits (ongoing).

- Cost: $20,000 – $45,000 initial setup, $10,000–$20,000 annually for monitoring and updates.

5. Security & Smart Contract Audits

You’re handling user funds. Security isn’t optional.

- Basic smart contract audit: $5,000–$15,000

- Standard DeFi/wallet audit: $50,000–$100,000

- Advanced audit with formal verification: $150,000–$300,000+

- Continuous monitoring: $2,000–$10,000/month

Plus foundational infrastructure:

- Encryption & key management: $15,000–$30,000

- Hardware security modules: $10,000–$25,000

- Penetration testing: $8,000–$20,000

- Security certifications (SOC 2, ISO 27001): $5,000–$15,000

Budget 15–20% of the total project cost for security. In a $250K project, that’s $37,500–$50,000 minimum.

6. Blockchain Platform & Multi-Chain Support

Single blockchain means simpler architecture and lower cost. Multi-blockchain means your users access more liquidity but you manage more complexity.

Cost comparison:

- Polygon: $0.01–$0.10 per transaction (most cost-efficient for users)

- Solana: $0.00064 per transaction (fastest, cheapest)

- Ethereum mainnet: $0.50–$5+ per transaction (most congestion)

- Base, Arbitrum, Optimism: $0.05–$0.20 per transaction (balanced)

Adding support for each additional chain costs 20–30% more engineering. For multi-chain wallets: add $50,000–$100,000 and 2–3 months to timeline.

7. Stablecoin Integration

Most hybrid wallets need 2–3 stablecoins (USDC, USDT). More stablecoins mean more integration work.

- Single stablecoin: $5,000–$10,000 (included in base)

- 3–5 stablecoins across chains: $15,000–$30,000

- Proprietary or institutional stablecoins: $30,000–$60,000+

8. Backend Infrastructure & APIs

The backend orchestrates everything. Coordinating fiat and crypto, reconciling ledgers, ensuring real-time sync.

- Cloud infrastructure: $5,000–$15,000/year

- API design & integrations: $20,000–$50,000

- Database & ledger management: $10,000–$25,000

- Real-time transaction processing: $15,000–$40,000

- Monitoring & analytics: $8,000–$20,000/year

- Backend typically costs 20–25% of total development.

9. UI/UX Design & Mobile Development

A wallet succeeds or fails based on whether users actually use it without calling support three times.

- UI/UX design: $10,000–$35,000 (depending on complexity)

- iOS development: $40,000–$60,000

- Android development: $35,000–$55,000

- Cross-platform (React Native, Flutter): $30,000–$50,000 (saves 20–30%)

Mobile typically costs more than backend. Most teams use cross-platform frameworks to reduce cost without sacrificing quality.

10. Post-Launch Maintenance (The Hidden Cost)

This is where executives get surprised. Development cost is upfront. Operating cost is forever. Annual maintenance runs 15–20% of the initial development cost:

- $250K project: $37,500–$50,000/year

- $150K project: $22,500–$30,000/year

This covers security updates ($10K–$20K/year), compliance renewals ($8K–$15K/year), feature enhancements ($15K–$25K/year), support staff ($10K–$20K/year), infrastructure ($5K–$15K/year).

Many teams underestimate this, leading to technical debt and security vulnerabilities within 18 months.

What Are The Top Cost-Saving Strategies For Hybrid Wallet Projects?

If you’re planning to build a hybrid wallet, keeping development and operating costs under control is one of the smartest moves you can make. Here are practical ways enterprises and startups can reduce the hybrid wallet development cost and still ship a strong product.

1. Work with trusted white-label providers

Partnering with established tech providers like SoluLab helps you cut the hybrid wallet development cost while speeding up delivery. You get a ready foundation, fewer engineering hours, and faster go-to-market, all without sacrificing quality.

2. Standardize your stablecoin & fiat flows

By keeping conversions simple and consistent, teams reduce reconciliation work and avoid expensive manual processes. This directly lowers the total Cost of Hybrid Wallets over time.

3. Use a modular, future-ready architecture

A modular setup lets you upgrade compliance, custody, KYC tools, and integrations without rebuilding the entire system. This is one of the biggest levers in keeping your long-term Hybrid Wallet cost predictable.

4. Add smart routing for cross-border payments

Intelligent routing helps you cut international transfer fees, reduce gas usage, and optimize liquidity paths. This keeps the overall Cost of Hybrid Wallets significantly lower.

Why do enterprises trust SoluLab for hybrid wallet development that cuts costs?

SoluLab makes it easy for companies to create a crypto wallet that works smoothly for users and scales for business needs, and is cost-effective for builders. Our team has deep experience in hybrid wallet development.

- Compliance systems that work in parts for MiCA, VARA, and US rules, so no need to start over for each market.

- Ready-to-use cash options with Stripe, MoonPay, Ramp, which are quicker approvals and less expense.

- Design that grows to add blockchains and features without big rewrites.

- Safety from the start with built-in checks and rule-following logs from day one.

- Smart spending with quicker first versions and careful planning to avoid going over budget.

Our goal is to help you get to market quicker without wasting time or money on unnecessary development. If you want a wallet that’s secure, flexible, and ready to grow with your business, we’re here to help.

Conclusion

Hybrid wallets cost $150K–$300K because they’re complex. They touch banking, blockchain, compliance, and security, all running simultaneously. That complexity is also their value.In the end, the real difference comes from choosing the right development partner. That’s where SoluLab, top crypto wallet development company, makes an impact. Anyone can build a wallet that works. If you’re ready to build a hybrid wallet that scales, attracts institutional users, and stands up to regulatory scrutiny, the investment is worth it. Just go in with open eyes about where your money goes!

FAQs

The cost mostly depends on how complex your idea is. If your wallet needs many features, multiple blockchain connections, or advanced security, the price goes up. Another factor is the experience of the team building it. A strong team charges more but usually delivers a safer, faster, and more stable product.

The easiest way is to start with a modular approach. You don’t need every feature on day one. Build the core first and add extras only when you need them. Using trusted stablecoins and ready-made components also saves time. And choosing a team that already has experience in hybrid wallets reduces mistakes that usually increase cost.

Most hybrid wallets take about six to twelve weeks. Simple wallets get done faster. Wallets that include on-ramps, swaps, or multi-chain support take longer. The timeline is mostly based on how many moving parts your product has.

In many cases, yes. A hybrid wallet gives you the safety of custodial storage with the freedom of non-custodial control. This balance protects beginners from mistakes while still giving advanced users full control when they want it.

It depends on the regions you want to serve. Some countries need you to meet strict compliance rules. Others only need basic verification and reporting. A good development partner can help you understand what applies to your case before you start building.

A basic MVP usually starts around fifteen to thirty thousand dollars. This covers core features like login, wallet creation, basic swaps, and simple compliance. As you add features like staking or multi-chain support, the budget increases.