Gold has always been a trusted store of value, but it has not been easy to trade or move around. Traditional gold investments are often illiquid, expensive to transfer, and wrapped in paperwork. From legal hurdles to blockchain choices, it’s a complex process that can overwhelm even experienced founders. With the right strategy, you can build a secure, compliant, and user-friendly gold tokenization platform.

| According to Coingecko, tokenized gold’s market value reached $2 billion, indicating an increase in investor interest and uptake. |

You can turn physical gold into secure, traceable digital tokens. In this blog, we’ll break down the process into simple, actionable steps on creating a gold tokenization platform, covering everything from compliance and custody to blockchain tech and liquidity.

How Does Gold Tokenization Work?

Whether you’re a crypto enthusiast or a startup founder, you can easily build your gold tokenization platform the smart way. Here’s how gold tokenization works:

1. Gold Acquisition: First, physical gold is purchased from trusted sources. This gold is then securely stored in certified vaults, ensuring every token is backed by real, tangible gold.

2. Issuing Tokens: Once the gold is secured, digital tokens are created on a blockchain. Each token represents a specific amount of gold, say, 1 token equals 1 gram.

3. Ownership Verification: Blockchain technology ensures every token transaction is recorded and verifiable. This creates a transparent, tamper-proof record of who owns what, making ownership super easy to track.

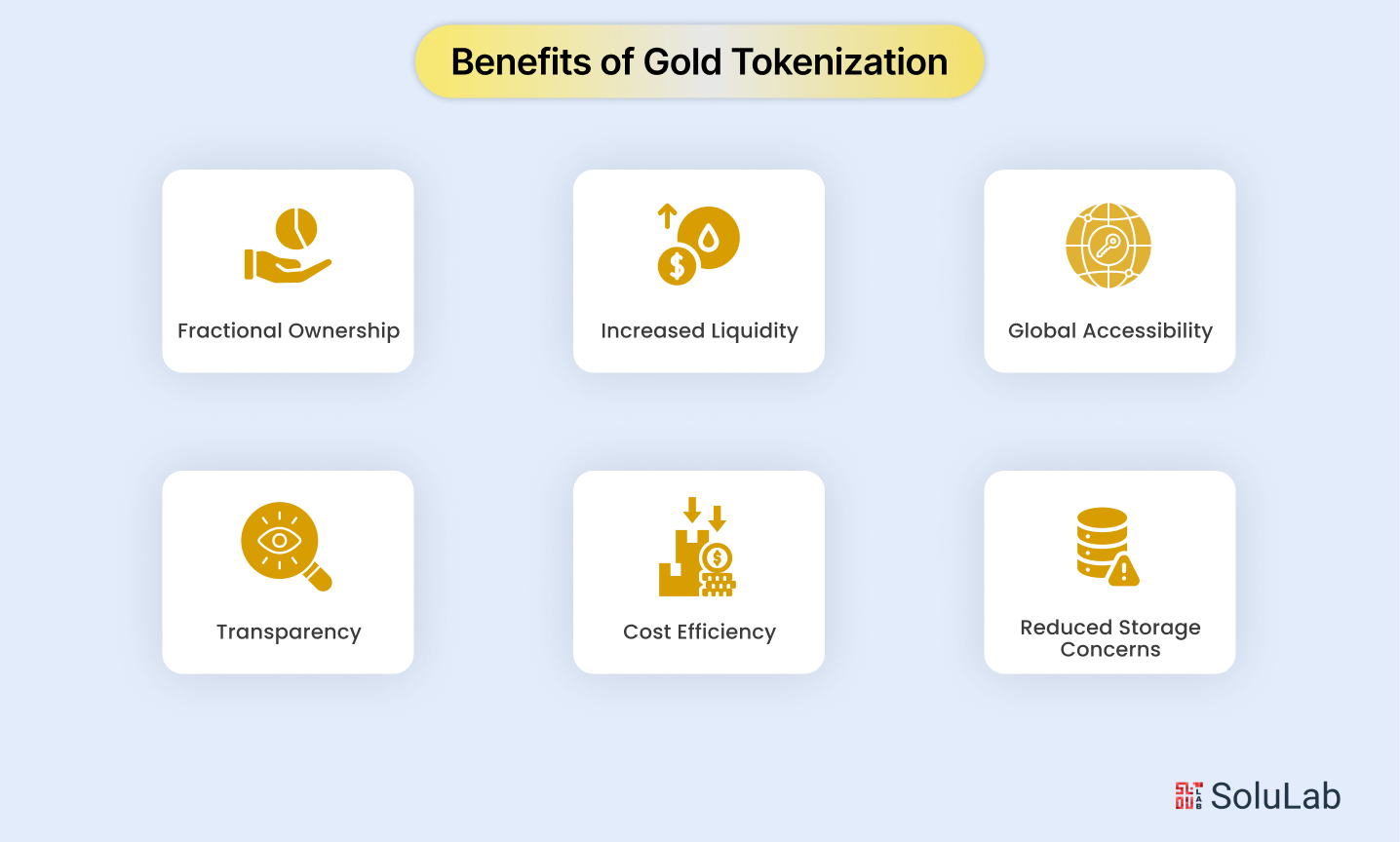

Benefits of Gold Tokenization

Gold tokenization is changing the way people invest in gold by combining the stability of a traditional asset with the speed and convenience of blockchain technology. Here’s how it benefits investors like you and why gold tokenization is popular:

1. Small Ownership: With gold tokenization, you don’t need to buy a whole gold bar. You can own a fraction of it, like just 0.1 gram. This makes gold investment way more accessible, especially for retail investors who want to start small without compromising on value.

2. Increased Liquidity: Selling physical gold can be time-consuming and sometimes tricky. But tokenized gold can be traded instantly on digital platforms. It’s as easy as buying or selling any cryptocurrency, making it super liquid and investor-friendly.

3. Global Reach: Tokenized gold isn’t bound by borders. Anyone from anywhere can invest or trade it 24/7 using just an internet connection. This opens up new markets and makes gold accessible to a truly global audience.

4. Transparency: Blockchain keeps everything transparent. Each transaction and gold reserve audit is recorded and traceable. This builds trust because investors can verify that the token they hold is backed by real gold.

5. Cost Efficiency and Reduced Storage Concerns: Forget paying for vaults or worrying about theft. When you invest in tokenized gold, a trusted custodian stores the physical gold while you hold the digital equivalent, cutting costs and stress at the same time.

Check Out Our Blog: Top Gold Tokenization Development Companies

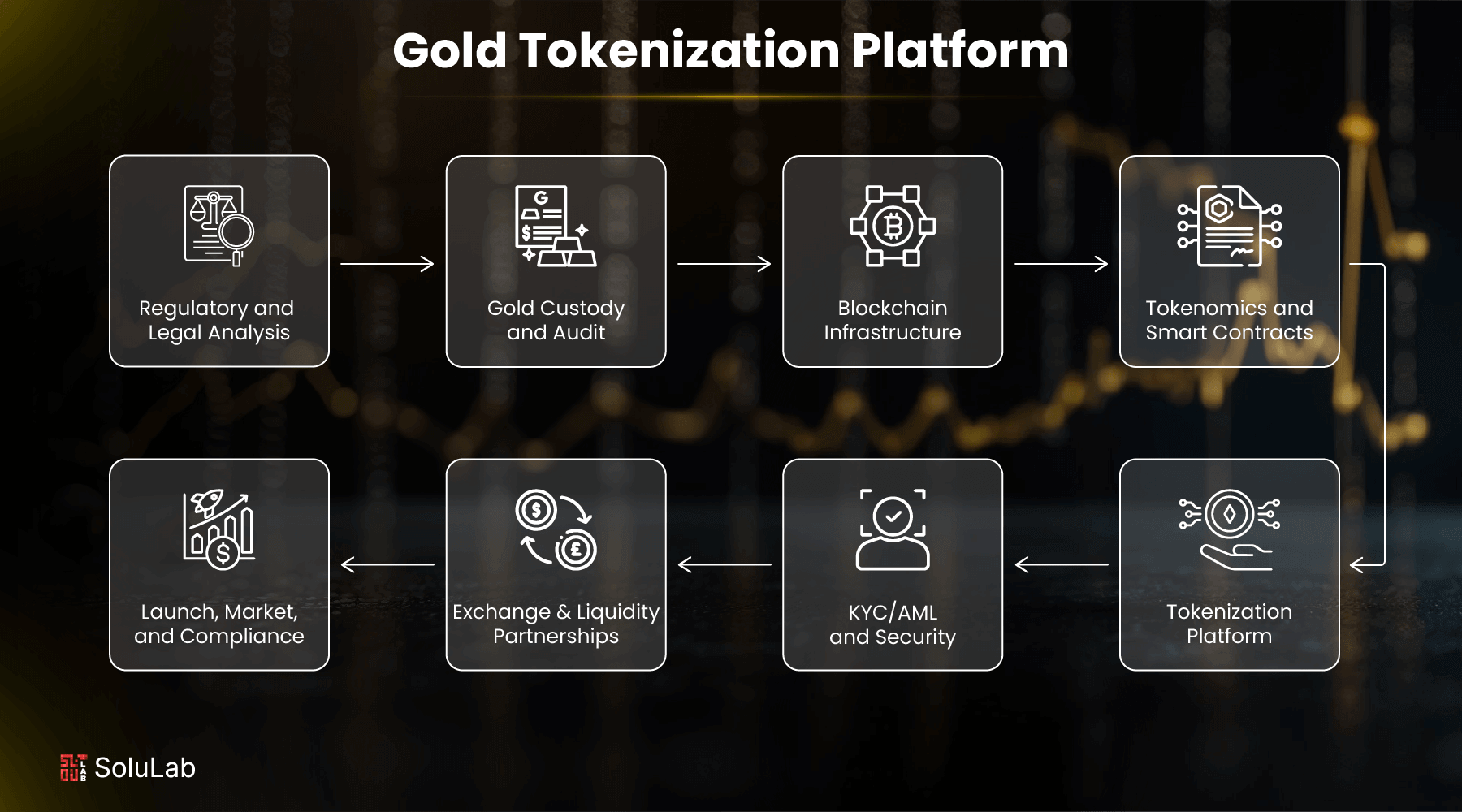

How To Build a Gold Tokenization Platform on Blockchain?

Here’s a simple 8-step roadmap to help you understand the gold tokenization platform development process:

1. Conduct Regulatory and Legal Analysis

Before you start, understand that gold is a regulated asset, and so is crypto. Talk to legal experts to ensure your platform follows local laws around KYC, AML, and securities. Skipping this step could get you into serious trouble later.

2. Establish Gold Custody and Audit Mechanisms

Your digital gold needs a real-world backup. Partner with a trusted vault or custodian who’ll store the actual gold. Make sure there’s an audit trail—regular inspections by third-party firms will help build user trust and keep everything transparent.

3. Choose Blockchain Infrastructure

Pick a blockchain that suits your needs. Ethereum is popular, but platforms like Polygon or Avalanche can be faster and cheaper. Your choice should support smart contracts and tokens like ERC-20 or ERC-1400 for flexibility and scalability.

4. Design Tokenomics and Smart Contracts

Define how your token works. Will 1 token equal 1 gram of gold? What about transaction fees? Use smart contracts to automate minting, burning, and transfers. Make sure they’re secure and tested—this is where your system’s integrity lives.

5. Develop the Tokenization Platform

Now build your platform—think user-friendly dashboards, gold/token balance views, wallet integration, and real-time pricing. A clean interface and smooth UX will make your platform easier to adopt, even for users new to crypto.

6. Implement KYC/AML and Security Measures

Don’t skip security. You’ll need to verify user identities with KYC tools and follow AML protocols. On top of that, add two-factor authentication and encryption to protect user data and transactions from hackers.

7. Partner with Liquidity Providers and Exchanges

Your token needs to be tradable. Collaborate with crypto exchanges to list your gold-backed token. Partnering with market makers also helps ensure there’s enough liquidity for smooth trading, which boosts credibility.

8. Launch, Market, and Maintain Compliance

Time to go live! But before launching, test it with real users. Promote your platform with a strong marketing push and keep engaging your community. Also, stay on top of regulations—it’s a moving target, and compliance never ends.

Future of Gold Tokenization

With gold tokenization, you don’t need to invest in large quantities. You can own tiny fractions of real, asset-backed gold stored in secure vaults. It’s a game-changer, especially for small investors who want exposure to gold without the hassle of physical storage.

Transactions become lightning-fast, fully transparent, and available 24/7. No more relying on traditional market hours or middlemen. With an RWA tokenization platform, everything is recorded on the blockchain, so there’s zero guesswork about ownership or reserves—it’s all out in the open.

What’s more exciting? These gold tokens could soon be part of the DeFi world. Think loans, staking, or trading—all backed by digital gold.

In short, gold tokenization is making one of the oldest forms of wealth fit perfectly into the future of finance. And if you’re into investing or tech, this is a space worth watching.

Conclusion

Building a gold tokenization platform is not easy, but with the right strategy, it’s entirely doable. From regulations and securing real-world gold to leveraging blockchain and ensuring user trust, each step plays a crucial role in creating a transparent, secure, and scalable platform.

As digital assets gain momentum, tokenized gold offers a unique bridge between traditional wealth and modern technology. Whether you’re a fintech startup or a gold investor eyeing innovation, this is your chance to be part of the future of finance.

SoluLab, a leading gold tokenization development company,can help you build tokenization platforms and solve all your queries. Get in touch with our team to discuss further.

FAQs

1. What is gold tokenization?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain. Each token represents a specific amount of gold and can be traded or stored digitally.

2. How much does it cost to build a gold tokenization platform?

Development costs vary widely, from ₹20 lakhs to ₹1 crore+, depending on features, blockchain used, legal fees, and third-party integrations like KYC tools.

3. What is the role of smart contracts?

Smart contracts automate functions like token issuance, transfer, redemption, and compliance checks, making your platform efficient, secure, and transparent.

4. Who are my potential users?

Retail investors, high-net-worth individuals, institutions, and crypto traders—all looking for a stable, gold-backed asset with digital convenience.

5. How long does it take to launch a platform?

It typically takes 4–8 months to go from planning to launch, depending on your team, complexity, and regulatory hurdles.