With a substantial increase in recent times, the cryptocurrency market has reached a valuation of trillions of dollars. A significant portion of this success can be attributed to the potential applications of the underlying blockchain technology. Given that blockchain emerged alongside digital currencies, it comes as no surprise that its applications in the financial sector hold great promise.

In essence, blockchain in financial services can be understood as a decentralized ledger that records transactions. For financial service providers, this technology has the potential to facilitate faster and more cost-effective transactions, automate contracts, and enhance security. While blockchain technology has yet to achieve widespread adoption, several financial institutions are already leveraging its capabilities.

What are the Benefits of Blockchain in Finance?

The Ethereum blockchain transforms business networks, shared operating models, and processes in banking and finance, resulting in increased openness, inclusivity, security, efficiency, reduced costs, and novel products and services. It facilitates the issuance of digital securities within shorter timeframes and at lower unit costs, enabling greater customization. This customization aligns digital financial instruments with investor demands, expanding the investor market, minimizing costs for issuers, and mitigating counterparty risk. Over the past five years, the technology’s maturation for enterprise-grade applications has showcased these advantages:

- Security: Ethereum’s distributed, consensus-based architecture eliminates single points of failure and minimizes the need for intermediaries, resulting in a tamper-proof and hack-resistant platform. It enables the creation of secure applications that are immune to fraud and malicious third-party interference.

- Transparency: Ethereum operates on shared standards, protocols, and processes, acting as a single, centralized source of truth for all network participants, promoting transparency and trust.

- Trust: The transparent and immutable ledger facilitates collaboration, data management, and agreement reaching among various parties in a business network, enhancing trust and fostering efficient operations.

- Programmability: Ethereum supports the development and execution of smart contracts, which are tamper-proof and deterministic software that automates business logic, leading to increased trust and efficiency.

- Privacy: Ethereum offers market-leading tools for granular data privacy across all software stack layers, enabling selective data sharing in business networks. This approach significantly improves transparency, trust, and efficiency while preserving privacy and confidentiality.

- High Performance: Ethereum’s private and hybrid networks are designed to handle hundreds of transactions per second and periodic network activity surges, ensuring consistent performance.

- Scalability: Ethereum facilitates interoperability between private and public chains, providing each enterprise solution with the global reach, resilience, and integrity of the main net.

A new report from Jupiter Research predicts that blockchain in finance deployments will allow banks to achieve significant cost savings in cross-border settlement transactions. The report suggests that banks could save up to $27 billion by 2030, representing a reduction in costs of over 11%. Ethereum, in particular, has already proven its potential to disrupt the industry, delivering cost advantages of over 10 times compared to traditional technologies. Financial institutions recognize that distributed ledger technology has the potential to save billions of dollars for banks and major financial institutions over the next decade.

How Does The Digitization of Financial Instruments Impact Finance?

The digitization of financial instruments, including digital assets, smart contracts, and programmable money, propels the advantages of blockchain to new heights. It enables unparalleled levels of connectivity and programmability among products, services, assets, and holdings. These digitized instruments will revolutionize the operations of commercial and financial markets, establishing a paradigm shift where value is generated at every touchpoint. Digital financial instruments provide businesses with the following benefits:

1. Authenticity and Scarcity: Digitization ensures data integrity, establishing a single source of truth for asset provenance and full transaction history.

2. Programmable Capabilities: Governance, compliance, data privacy, identity (KYC/AML attributes), system incentives, and stakeholder participation features can be integrated within the digital assets.

3. Streamlined Processes: Enhanced automation increases operational efficiency, enabling real-time settlement, audit, and reporting, and reducing processing times, errors, and delays.

4. Economic Benefits: Automated and efficient processes lead to decreased infrastructure, operation, and transaction costs.

5. Market Reactivity: Digital securities offer greater customization than standardized securities and can be issued quickly, allowing issuers to create tailored financial instruments that meet investor demand.

6. New Products and Markets: Digital asset tokenization enables secure, scalable, and rapid asset transfers, fractionalized ownership of real-world assets, tokenized micro-economies, and more.

By combining these benefits, governance systems become more transparent and accountable, business models become more efficient, incentive alignment among stakeholders improves, liquidity increases, the cost of capital decreases, counterparty risk is reduced, access to a broader investor and capital base is granted, and the door is opened to all other digital financial instruments.

Uses For Blockchain In The Financial Services Industry

Of the numerous applications of blockchain in finance, a few key uses include:

- Secure and Efficient Money Transfers: Facilitate fast, secure, and low-cost cross-border and domestic money transfers.

- Enhanced Transaction Security: Offer an immutable ledger system, ensuring the integrity and security of financial transactions.

- Automated Smart Contracts: Enable the creation of self-executing contracts, reducing the need for intermediaries and streamlining processes.

- Secure Customer Data Storage: Provide a decentralized and tamper-proof platform for storing sensitive customer data, enhancing privacy and security.

Let’s delve deeper into how financial institutions could integrate blockchain technology to address the aforementioned scenarios and explore the potential motivations driving their adoption.

1. Money Transfers: Blockchain financial services, beginning with Bitcoin, was created to facilitate fund transfers between two parties (point A to point B) without the need for a central authority. As blockchains have developed, they’ve enabled faster and more cost-effective transactions. A notable example is Ripple, a company that utilizes blockchain for financial services for RippleNet, a global payments network. RippleNet processes transactions within five seconds, with a minimal cost of a fraction of a cent. Financial institutions leveraging blockchain technology can offer more efficient money transfer services. International money transfers that could take hours or days using traditional methods can now be completed in seconds at a fraction of the cost.

2. Enhanced Transaction Security: Financial institutions are frequently targeted by fraudulent activities. Digital payments, in particular, pose the risk of information theft during the transaction process as they pass through payment processors and banks. blockchain in the financial industry leverages cryptographic algorithms to process and record transaction blocks. This cryptography offers a potential solution for financial companies to mitigate risks associated with transaction processing.

3. Automated Smart Contracts: The introduction of Ethereum in 2015 marked a significant milestone in blockchain in the financial industry. It was the first blockchain to incorporate smart contracts, which are self-executing contracts triggered when predefined conditions are met. Contracts play a crucial role in the financial services industry, and companies allocate substantial resources to their management. Self-executing smart contracts have the potential to streamline this process significantly. For instance, an insurance company could utilize smart contracts to expedite the claims process. Upon a client’s claim submission, it would be automatically reviewed by the codes programmed into the blockchain for financial services. If the claim is deemed valid, the smart contract will execute and initiate payment to the client.

4. Customer Data Storage: To prevent fraud and money laundering, most financial organizations must conduct identity verification processes with their clients. While this process is vital for business integrity, it can be time-consuming and costly. An alternative solution is to leverage blockchain technology to store customer data securely and transparently. When a company completes the Know-Your-Customer (KYC) process with a new client, it can add the client’s data to the financial services blockchain. Subsequently, other financial institutions can utilize this KYC data rather than repeating the process independently. This approach not only streamlines the process for financial companies but also reduces the burden on clients, eliminating the need for multiple KYC processes for different financial accounts.

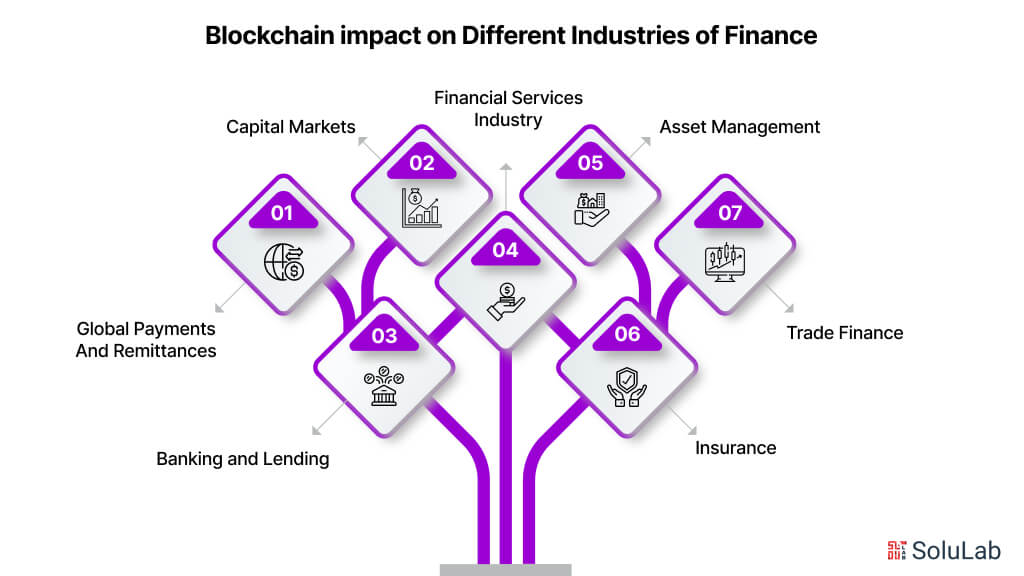

How Does Blockchain Impact Different Industries of Finance

Before delving into the specific industries that can benefit from blockchain technology, let’s briefly explore the foundational concepts and benefits of blockchain.

Capital Markets

Capital markets are a platform for issuers seeking capital to connect with investors who have the appropriate risk and return profiles. Raising capital can be challenging for issuers, including entrepreneurs, startups, and large organizations. Firms must navigate increasingly stringent regulations, longer time to market, interest rate volatility, and liquidity risk. Emerging markets face additional challenges, such as a lack of rigorous monitoring, comprehensive regulation, and sufficient market infrastructure for issuing, settlement, clearing, and trading.

Blockchain for financial services offers several benefits for capital market use cases, including:

- Eliminating single points of failure through decentralized utilities.

- Streamlining capital market activities, reducing costs, and decreasing settlement times.

- Digitizing processes and workflows, reducing operational risks, such as fraud, human error, and overall counterparty risk.

- Digitizing or tokenizing assets and financial instruments, making them programmable and easier to manage and trade. Tokenization also broadens market access through increased connectivity and the possibility of fractionalized ownership, resulting in increased liquidity and reduced cost of capital.

Asset Management

In the face of rising demands for enhanced liability risk management, more agile decision-making frameworks, and navigating the complexities of evolving regulations, venture capital firms, private equity firms, real estate funds, and specialty markets are turning to blockchain in finance industry for innovative solutions. Blockchain’s capabilities can effectively streamline asset and stakeholder management, offering a range of benefits:

- Automated Fund Launch: Streamlined and efficient fund launch processes.

- Seamless Stakeholder Engagement: Digitized assets and services facilitate seamless stakeholder engagement.

- Digitization of Portfolio and Holdings: Wider market access, enhanced liquidity, and fractionalization of assets through digitization.

- Customizable Privacy Settings: Built-in privacy features ensure transaction confidentiality.

- Programmable Rights and Obligations: Voting and shareholder rights and obligations embedded in digital assets for enhanced user experience and reduced human error risks.

- Incentive Mechanisms: Creation and enforcement of incentive mechanisms to encourage participation and deter unethical activities.

- Improved Governance and Transparency: Enhanced governance and transparency for investors and stakeholders.

- Efficient Cap Table Management: Streamlined and efficient management of cap tables.

- Automated Fund Administration: Automated fund administration processes for increased efficiency.

- Automated Transfer Agency: Automated transfer agency services for seamless asset management.

Global Payments And Remittances

In today’s world, global payments and remittances involve numerous intermediaries charging fees for their services. Sending $200 internationally can take 2 to 7 days and cost an average of 6.94%, resulting in a $48 billion reduction in remittances due to fees and intermediaries. Blockchain financial services has the potential to streamline payment and remittance processes, reducing settlement times and significantly lowering costs.

Here are some of the potential benefits of using blockchain for payments and remittances:

- Rapid and secure domestic retail payments

- Rapid and secure domestic wholesale and securities settlement

- Rapid and secure cross-border payments

- Real-time gross settlement between central banks, commercial banks, and independent banks

- Digitized KYC/AML data and transaction history, reducing fraud risks and enabling real-time authentication

- Automated regulatory oversight and auditing

- Multiple forms of payment-enabled on the blockchain, including tokenized fiat, stablecoins, and cryptocurrencies

Banking and Lending

Core banking services encompass transactions, loans, mortgages, and payments, many of which depend on traditional execution processes. For example, it takes 30 to 60 days for individuals to secure a mortgage and 60 to 90 days for small and medium enterprises to obtain a business loan due to processes such as information verification, credit scoring, loan processing, and funds distribution.

Blockchain technology can revolutionize banking and lending services by streamlining processes, minimizing counterparty risk, and reducing issuance and settlement times. It offers several key benefits:

- Authenticated documentation and KYC/AML data: Financial services blockchain enables real-time verification of financial documents, reducing operational risks and allowing for instant verification.

- Streamlined credit prediction and credit scoring markets: By instantaneously gathering user activity and authorized data across a network, blockchain in financial services can improve credit prediction and credit scoring processes.

- Automated syndicate formation, underwriting, and disbursement of funds: Blockchain can automate processes such as syndicate formation, underwriting, and disbursement of funds, including principal and interest payments, reducing costs, delays, and friction associated with syndication.

- Facilitated collateralization of assets: The digitization of assets through blockchain enables real-time asset management, tracking, and enforcement of regulatory controls, facilitating asset collateralization.

Trade Finance

Trade finance encompasses the infrastructure, processes, and funding that facilitate international trade supply chains. However, the industry heavily relies on paper-based processes, which are prone to security vulnerabilities and lengthy transaction times, often taking 90-120 days to process letters of credit, verify documents, and establish trust among stakeholders. Blockchain technology has the potential to upgrade trade finance by digitizing the entire trade finance lifecycle, enhancing security, and improving efficiency. It can enable increased transparency in governance, reduced processing times, lower capital requirements, and mitigate risks associated with fraud, human error, and overall counterparty risk.

Specifically, blockchain can facilitate the following advancements in trade finance:

- Digitized and authenticated documentation, such as letters of credit and bills of lading, as well as KYC/AML data, with real-time verification of financial documents.

- Asset digitization to expedite settlement times.

- Creation of more efficient financing structures through shared secure networks and digitized processes.

- Establishment of a consistent financing vehicle throughout the entire trade lifecycle, eliminating the traditional practice of negotiating independent finance vehicles for each stage of the trade.

Insurance

In property and casualty insurance, fraud is a prevalent concern, and claim assessments often take an extended duration. Blockchain technology offers a solution by securely streamlining data verification, claim processing, and disbursement, resulting in significantly reduced processing times. Here are the key benefits:

- Secure Data Verification: Authentic documentation and KYC/AML data are stored on the blockchain, reducing the risk of fraud and facilitating efficient claim assessments.

- Automated Claims Processing: Smart contracts automate claims processing, eliminating manual intervention and ensuring accuracy and efficiency.

- Parameterized Contracts: Automated parameterized contracts are used to trigger payments upon the occurrence of specific risks, ensuring prompt and seamless claim settlements.

- Automated Disbursement: Insurance payments are automatically disbursed through the blockchain in financial services, ensuring timely and secure transfer of funds to policyholders.

- Tokenized Reinsurance Markets: Tokenized reinsurance markets facilitate policy reinsurance in open marketplaces, moving away from traditional broker-based and relationship-driven systems.

Financial Services Industry

Blockchain technology has the potential to revolutionize the financial services industry by offering several compelling advantages. Here are the main benefits of blockchain in finance:

- Efficient Payment Processing: Blockchain enables fast and cost-effective payment processing, with transactions settling in seconds and fees as low as $0.01. This can result in significant cost savings for both financial institutions and their customers.

- Reduced Costs in International Transactions: Blockchain deployments are projected to save banks a substantial amount of money on cross-border transactions, potentially reaching $27 billion by the end of 2030.

- Secure Recordkeeping and Reporting: Blockchain provides a distributed and tamper-proof record of transactions, allowing financial institutions to use it for recordkeeping and regulatory reporting, ensuring compliance and transparency.

- Accelerated Financial Services: The rapid settlement capabilities of blockchain can enhance various financial services. Lenders can fund loans more swiftly, vendors can receive payments sooner, and stock exchanges can settle securities transactions almost instantaneously.

- Improved Risk Management: The immutability of blockchain records enables more effective risk management in finance. Financial institutions can use blockchain to accurately track and monitor transactions, reducing the risk of fraud and errors.

Challenges Of Implementing Blockchain For Financial Companies

Implementing blockchain in the financial industry presents several challenges:

- Widespread Adoption Requirement: Blockchains need widespread adoption for optimal performance. This is particularly significant in financial services, where numerous companies collaborate and require a shared transaction handling method. For instance, to transfer funds using blockchain, all participating banks must have adopted the technology.

- Lack of Interoperability: Different blockchains often lack interoperability, hindering communication between them. To address this, several blockchain networks focused on interoperability solutions, such as Polkadot, are under development.

- High Cost and Time Investment: Switching to blockchain technology can be expensive and time-consuming, especially due to the scarcity of skilled blockchain developers. Smaller finance companies in particular may hesitate to commit to overhauling existing systems.

- Immutable Data: While the immutability of blockchain data is an advantage, it also poses challenges for financial companies that frequently need to modify stored data. Implementing blockchain would require these companies to adjust their methodologies.

- Regulatory Uncertainty: Given the nascent and rapidly evolving nature of blockchain technology, regulators have yet to catch up. Governments are likely to establish policies that impact blockchain and the companies that use it.

Conclusion

In conclusion, the transformative potential of blockchain in finance is immense. By leveraging blockchain for financial services, the industry can achieve unparalleled levels of transparency, security, and efficiency. The adoption of blockchain in financial services is set to revolutionize traditional banking, insurance, and investment sectors, paving the way for blockchain financial services to become a cornerstone of the modern financial ecosystem. Financial services blockchain solutions offer significant benefits, including reduced fraud, lower costs, and faster transactions. As the blockchain in finance industry continues to evolve, it is clear that blockchain in the financial industry will play a pivotal role in shaping its future.

Companies like SoluLab are at the forefront of this transformation, providing cutting-edge solutions for blockchain and financial services. Their expertise in blockchain technology in finance ensures that businesses can seamlessly integrate blockchain into their operations, enhancing their capabilities and competitiveness. As we look to the future, the collaboration between finance and blockchain will continue to grow, driving innovation and creating new opportunities in the blockchain finance industry. The synergy between blockchain fintech and traditional finance promises a dynamic and resilient financial landscape, underscoring the critical role of blockchain finance in driving progress and prosperity.

FAQs

1. What is the role of blockchain in finance?

Blockchain in finance provides a secure, transparent, and efficient method for recording and verifying transactions, reducing fraud and operational costs.

2. How does blockchain for financial services improve security?

Blockchain for financial services enhances security by using cryptographic methods to protect transaction data, making it tamper-proof and resistant to unauthorized access.

3. What are the benefits of using blockchain in financial services?

The benefits of using blockchain in financial services include faster transaction times, reduced costs, improved transparency, and enhanced security.

4. How are blockchain financial services transforming traditional banking?

Blockchain financial services are transforming traditional banking by streamlining processes, reducing the need for intermediaries, and increasing transaction speed and accuracy.

5. What impact does blockchain technology have on the financial services blockchain?

Blockchain technology significantly impacts the financial services blockchain by providing a decentralized ledger that ensures transparency and security, thereby increasing trust in financial transactions.

6. How is blockchain in the finance industry driving innovation?

Blockchain in the finance industry drives innovation by enabling new financial products and services, such as decentralized finance (DeFi), smart contracts, and real-time cross-border payments.

7. Why is blockchain fintech considered a game-changer for the finance sector?

Blockchain fintech is considered a game-changer for the finance sector because it offers innovative solutions that enhance efficiency, reduce costs, and open up new avenues for financial inclusion.