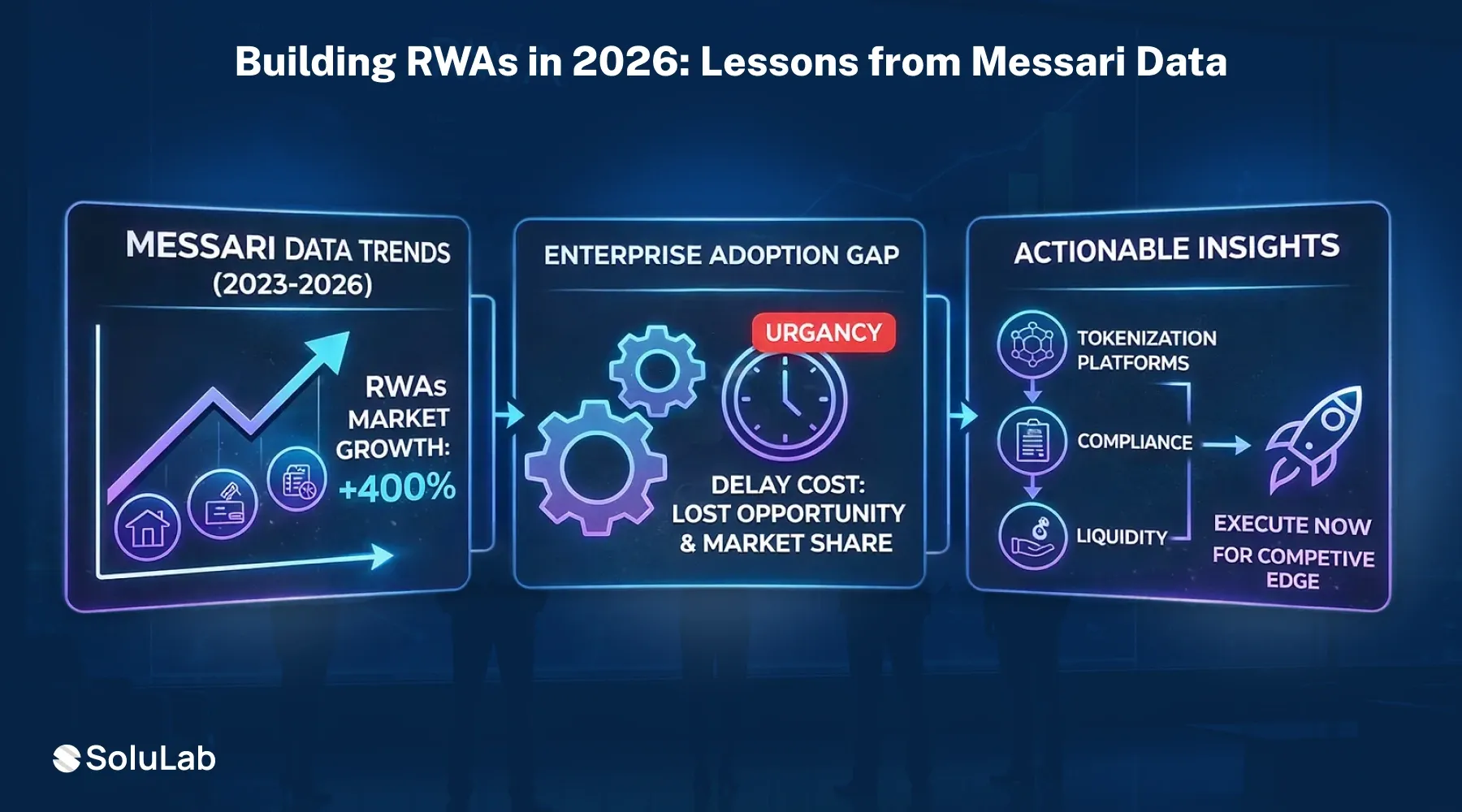

Over the past 18 months, real-world asset (RWA) tokenization has quietly crossed the line from “narrative” to infrastructure. Messari data shows RWA protocols have amassed nearly $8 billion in total value locked (TVL) as of early 2025, with over 90% of that in yield-bearing assets rather than speculative tokens. At the same time, institutional products like BlackRock’s tokenized fund BUIDL have already surpassed $1 billion in AUM, signaling that the world’s largest asset managers now see on-chain RWAs as a permanent part of the capital markets stack.

If your organization still treats tokenization as an experiment, you are already behind. At SoluLab, the conversations with boards, CFOs, and digital transformation leaders have shifted from “Should we tokenize?” to “What’s our RWA roadmap, compliance posture, and interoperability strategy?” This piece distills key lessons from Messari’s RWA research and case studies and shows how enterprises and startups can build RWA platforms that are not just compliant and secure but genuinely composable, liquid, and future-proof.

RWA Market Momentum: From Billions to Trillions

Messari’s RWA analyses converge on a simple truth: demand for stable, off-chain yield sources is driving real capital on-chain. TVL across RWA protocols is approaching $8 billion, and the vast majority of that is flowing into debt-based, yield-bearing products such as tokenized treasuries and private credit rather than volatile tokenized equities.

This is not happening in isolation:

• BlackRock’s BUIDL fund has crossed $1 billion in tokenized AUM, becoming a reference case for how tokenized money market funds can deliver daily on-chain yield and institutional-grade compliance.

• World Economic Forum research indicates that tokenization could unlock $100 trillion in previously illiquid assets by 2030, fundamentally reshaping capital markets architecture.

• Statista forecasts the global tokenized asset market will reach $16 trillion by 2030, representing a compound annual growth rate exceeding 80% from a 2025 baseline.

• Forbes reporting highlights how traditional financial institutions are moving from speculation to implementation, with major institutions allocating capital to RWA infrastructure.

For a CXO, the implication is stark: tokenization is not a niche crypto play; it is a new operating system for capital markets.

Beyond Tokenization: Building Full-Cycle Ecosystems

Messari’s most important conclusion is that early RWA projects failed not because the underlying technology was flawed but because they stopped at digitization. They issued tokens on existing chains without building:

• Native liquidity rails

• Embedded user and developer ecosystems

• Compliance-aware infrastructure

• Composable integration with DeFi and other protocols

The winners are taking a different approach. Projects like Plume Network design for RWAs from first principles, enabling tokenized mineral rights, AI compute yields, and institutional-grade assets to be treated as liquid, usable primitives rather than static representations. Platforms such as Lumia go a step further by managing the entire asset lifecycle from tokenization, to liquidity routing across centralized and decentralized venues to privacy-preserving identity using technologies like PolygonID for compliant onboarding.

Messari’s mapping of the ecosystem shows a distinct category of real world asset tokenization service providers emerging, including specialized networks and middleware focused on oracles, identity, custody, and cross-chain messaging. For enterprises, this means the strategic question is no longer “Which chain?” but “Which ecosystem gives us end-to-end capabilities across issuance, compliance, liquidity, and reporting?”

This is precisely where engineering partners who understand both AI and blockchain become critical. Building a full-cycle RWA stack requires orchestration across smart contracts, data pipelines, KYC/AML flows, risk models, and user-facing applications.

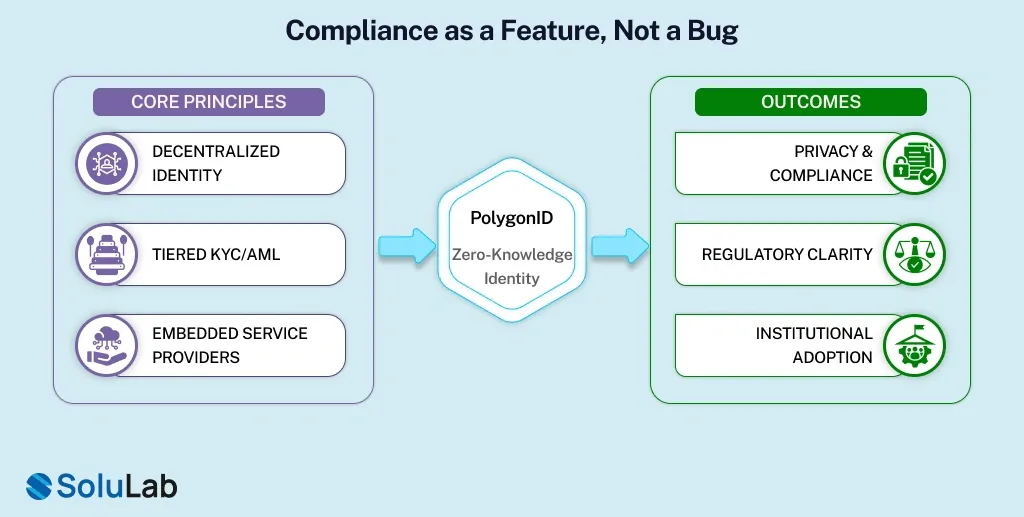

Compliance as a Feature, Not a Bug

Messari’s case studies underline that institutional capital does not move without credible compliance and security infrastructure. RWA protocols that have gained traction do three things well:

• Treat decentralized identity as a first-class primitive, enabling privacy-preserving but regulator-friendly identity verification.

• Embed optional, tiered KYC/AML so retail-friendly UX can coexist with institution-ready access control.

• Integrate specialized service providers – custodians, legal experts, auditors, and on-chain financial reporting platforms into the core architecture rather than bolting them on later.

Experiments like Lumia’s use of PolygonID show how zero-knowledge-based identity can allow users to prove eligibility or jurisdiction without disclosing more data than necessary, supporting both privacy and compliance. At the same time, policy developments and industry frameworks are starting to give more regulatory clarity around tokenized securities and RWA vehicles, which Messari highlights as a tailwind for institutional adoption.

For decision makers, the lesson is clear: your roadmap to build RWA application must start with a compliance architecture, not end with it. The competitive edge will go to platforms that can treat regulations as enablers of market access rather than mere constraints.

Liquidity, Composability, and the End of Siloed Tokens

Messari is blunt about the reasons many early RWA experiments stagnated: illiquidity, isolation, and poor composability. Tokens that could not move across protocols or plug into DeFi primitives quickly became stranded assets with limited secondary markets.

The new generation of RWA designs assumes integration by default:

• Multi-chain support ensures that tokenized assets can live where the liquidity is, instead of being trapped on a single L1 or sidechain.

• Deep integration with DeFi protocols allows RWA tokens to serve as collateral, yield-bearing instruments, and building blocks for structured products.

• Architectures explicitly enable bidirectional flows between TradFi and DeFi, so that on-chain yields and instruments can be exported back into traditional portfolios while off-chain assets are imported on-chain.

Messari emphasizes the importance of yield differentiation in this context. While tokenized U.S. Treasuries have been a powerful early driver, sustainable growth requires:

• Private credit and alternative lending markets

• Diversified collateral beyond government securities

• Tiered risk-return profiles tailored to different investor segments

This creates a design space where AI-driven risk analytics, automated rebalancing, and smart routing can meaningfully enhance performance, making AI–blockchain convergence a practical requirement rather than a buzzword.

Risk, Failures, and the Goldfinch Lesson

The Goldfinch protocol’s default event, centered on a counterparty in the motorcycle taxi financing space, features prominently in Messari’s analysis as a cautionary tale. The default led to a meaningful hit to the protocol’s net asset value and exposed weaknesses in underwriting, risk communication, and diversification.

Key lessons Messari draws from the episode include:

• Technical excellence does not substitute for credit expertise; protocols must embed rigorous, traditional-style underwriting processes.

• Investor education must focus on the realities of the underlying assets, not just the optics of tokenization or interface design.

• Concentration risk and lack of reserves amplify the impact of single-credit events, making diversification and buffer mechanisms non-negotiable.

For any CXO planning an RWA strategy, this is a reminder that building on-chain does not absolve you of offline risk. The strongest architectures marry solid smart contract engineering with institutional-grade credit analysis, portfolio construction, and disclosure frameworks.

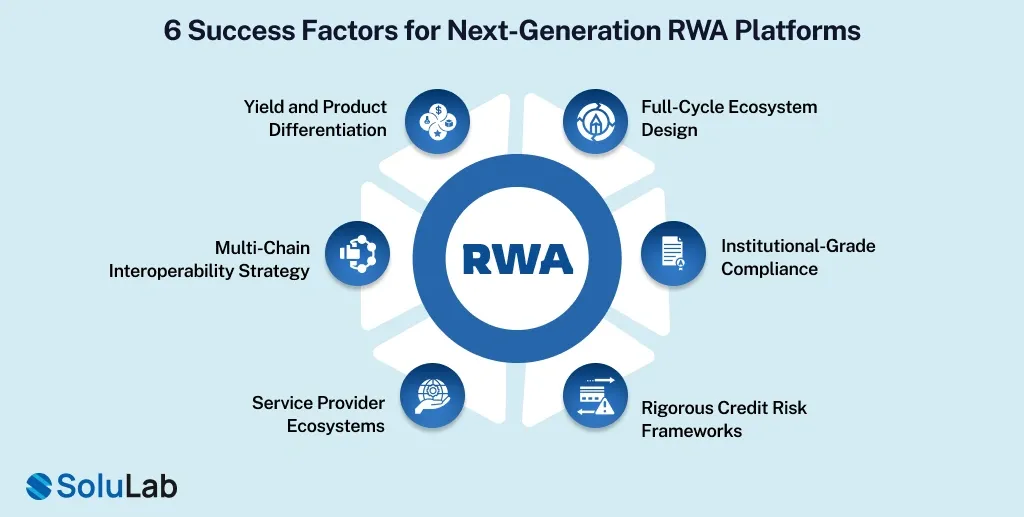

6 Success Factors for Next-Generation RWA Platforms

Synthesizing Messari’s research, several consistent success factors emerge for RWA builders and enterprise adopters:

#1. Full-Cycle Ecosystem Design

Do not stop at token issuance. Design for liquidity, user acquisition, and protocol composability from day one, including integrations with DeFi, custodians, and data providers.

#2. Institutional-Grade Compliance and Identity

Use decentralized identity to make KYC/AML programmable and privacy-preserving. Support multiple regulatory regimes through modular compliance components.

#3. Rigorous Credit and Risk Frameworks

Incorporate traditional credit models, stress testing, and AI-enhanced risk scoring to manage real-world exposures and communicate those risks transparently.

#4. Service Provider Ecosystems

Enable legal, custody, audit, and reporting providers to plug into your platform as first-class citizens rather than external service layers.

#5. Multi-Chain and Interoperability Strategy

Design infrastructures that can bridge assets, messages, and liquidity across multiple chains and L2s to where your users and partners operate.

#6. Yield and Product Diversification

Move beyond monolithic reliance on government securities to build diversified RWA product stacks– private credit, trade finance, real estate, and specialized assets.

These factors are not theoretical checklists; they are the patterns visible in the RWA protocols that are capturing real, institutional capital. If you seek how to build RWA tokenization platform, a clear dive into these 6 tips will help you.

The $1.5 Quadrillion Dollar Question

Messari’s RWA work places current TVL in the high single-digit billions, but it simultaneously points to a vastly larger backdrop: traditional financial assets totaling well over a quadrillion dollars globally, spanning bonds, derivatives, real estate, and more. Even if only a small percentage of this stack becomes tokenized, the resulting market would run into the hundreds of billions or more, which is consistent with projections from large consulting and research firms that foresee tokenized assets in the double-digit trillions by 2030 under conservative scenarios.

At the same time, broader tokenization analyses highlight operational savings and capital efficiency gains from moving settlement, collateral, and lifecycle events on-chain, with estimates of multi-billion dollar annual cost reductions and over $100 billion in capital freed through more efficient collateral management. This is no longer a speculative upside; planning RWA tokenization platform for enterprises is becoming a competitive necessity.

The organizations that win in this environment will not simply “have a token”; they will operate tokenized infrastructure woven into their treasury operations, product lines, and customer experiences.

What This Means for Your RWA Roadmap?

If you are a CXO, founder, or product leader looking at RWAs today, Messari’s data-driven narrative translates into a few concrete imperatives:

• Think in ecosystems, not pilots: structure initiatives around end-to-end platforms that can support multiple asset classes and participants.

• Anchor on compliance and risk: bake KYC/AML, jurisdictional rules, and credit models into your architecture from the outset.

• Design for liquidity and composability: ensure your assets can move where the liquidity is across chains, protocols, and institutional channels.

This is where a dedicated RWA tokenization platform development company becomes more than a vendor. Turning these principles into production-grade systems requires deep familiarity with protocol design, RWA infrastructure, security, data engineering, and regulatory constraints across jurisdictions.

If you are evaluating how to translate Messari’s insights into a concrete RWA platform or how to retrofit RWA capabilities into your existing stack, this is the right moment to move from “watching the market” to architecting your own RWA ecosystem.

Our team has delivered 500+ blockchain projects and brings both technical depth and real-world pragmatism to RWA architecture. Let’s talk about how your enterprise can capture this opportunity.

Key References & Sources

1. Messari RWA Research

“RWAs and Stablecoins Defining the Future” – Qorban Ferrell, Mohamed Allam, Jake Koch-Gallup (March 21, 2025)

Source: https://messari.io/article/rwas-and-stablecoins

2. Messari RWA Market Data

“Welcome to the Real World” – Kinji Steimetz (April 30, 2024)

Source: https://messari.io/report/welcome-to-the-real-world

Key Finding: RWA TVL has reached nearly $8 billion with 90% yield-bearing assets

3. Messari Narrative Analysis

“Narrative Games: Part 1” – Kinji Steimetz, Kunal Goel (June 18, 2024)

Source: https://messari.io/report/narrative-games-part-1

4. Messari RWA Risk Analysis

“Goldfinch Default: The Double-Edged Sword of RWAs” – Toe Bautista (August 11, 2023)

Source: https://messari.io/article/goldfinch-default

Key Case Study: Analysis of Tugende Kenya default and implications for RWA risk management

5. World Economic Forum – Tokenization Report

“The Future of Financial Infrastructure” – WEF Davos 2025

Source: https://www.weforum.org/reports/future-financial-infrastructure

Key Finding: Tokenization could unlock $100 trillion in previously illiquid assets by 2030

6. Statista – Tokenized Asset Market Forecast

“Global Tokenized Assets Market Size 2025-2030”

Source: https://www.statista.com/outlook/dmo/blockchain/tokenized-assets

Key Projection: Market expected to reach $16 trillion by 2030 with 80%+ CAGR

7. Forbes – Institutional RWA Adoption

“BlackRock BUIDL Fund and the Rise of Tokenized Finance”

Source: https://www.forbes.com/sites/digital-assets/

Key Development: Major institutions allocating capital to RWA infrastructure