Gone are the days when banks only dealt in cash and cheques. In today’s fast-moving financial world, even traditional giants like JP Morgan are stepping into crypto — not by becoming crypto exchanges, but by building crypto-friendly services into their banking model.

And here’s the thing: you don’t need to be a global giant to enter this space. Whether you’re a founder, a fintech company, or an infrastructure provider, now is the time to build a crypto-friendly bank that’s actually built for this decade.

In this guide, we’ll break down what makes these banks different, how to build your own in 2026, and why they’re more than just a trend; they’re the future of banking.

Why is There a Need for Crypto-Friendly Banks?

Despite the rapid advancement of blockchain and digital assets, most traditional banks remain cautious or entirely resistant to crypto. They continue to freeze transactions, block access to exchanges, and often treat blockchain-based finance as an operational risk rather than an opportunity.

Meanwhile, demand for regulated crypto banking is increasing across markets. Today’s users, whether individuals, businesses, or institutions, are looking for banking platforms that support both fiat and digital assets in one secure and compliant environment.

Crypto-friendly banks meet this demand by bridging traditional finance and blockchain. They enable users to manage crypto the same way they manage dollars or euros, within the safety of a licensed, professional banking framework. This growing need is why crypto banks are expanding rapidly in jurisdictions such as the USA, Switzerland, and Singapore.

If your goal is to build a crypto-friendly bank, your opportunity lies in addressing the gap that traditional banks have not yet closed.

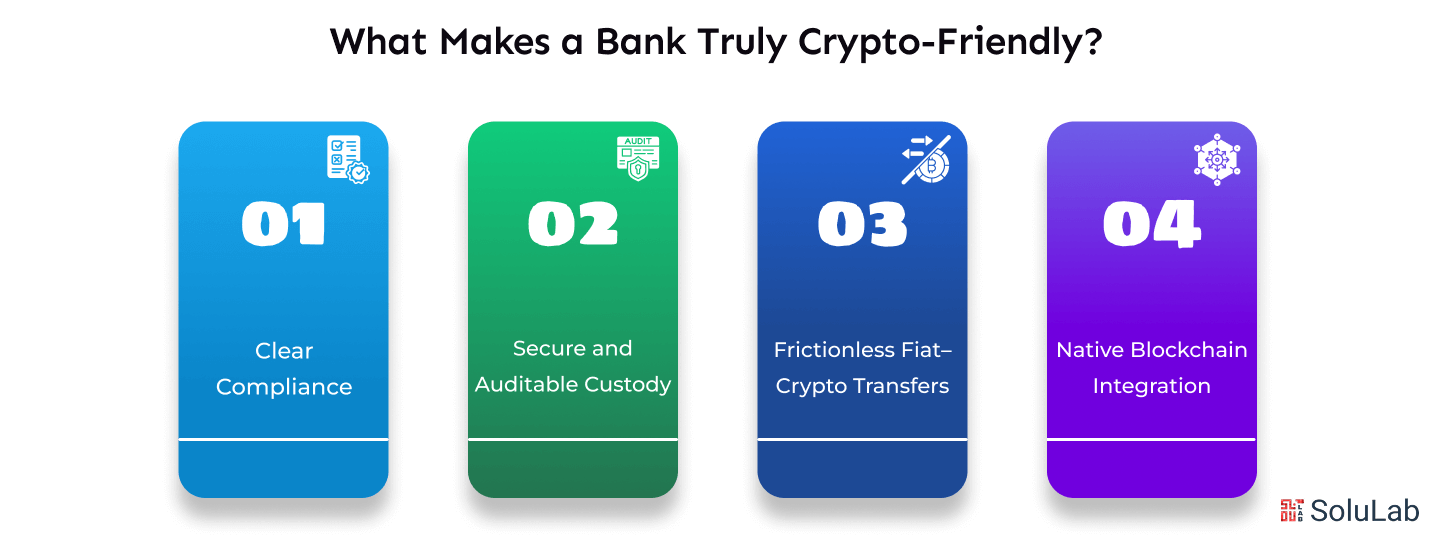

What Makes a Bank Truly Crypto-Friendly?

Creating a crypto-friendly bank requires more than just adding digital assets to a wallet. It involves building a regulated, trusted institution designed to operate in both traditional and blockchain-native environments.

These are the key features that define a successful crypto bank in 2026:

1. Clear Compliance

A crypto bank cannot afford to treat compliance as an afterthought. Regulatory clarity is essential.

Whether you’re operating in the US, Europe, or any other region, you’ll likely need to secure licenses such as an EMI, trust charter, or VASP registration. A fully integrated compliance stack covering KYC, AML, and transaction monitoring should be part of the infrastructure from the very beginning. This is non-negotiable if you aim to operate as a legally recognized and regulated crypto bank.

2. Secure and Auditable Custody

Protecting user funds is the foundation of trust.

You’ll need secure custody infrastructure, including hot wallets for instant transactions and cold storage for long-term asset protection. Proven third-party solutions like Fireblocks or BitGo are often leveraged for this layer. Additionally, insurance coverage for digital assets is essential, particularly when serving high-net-worth clients or institutions.

3. Frictionless Fiat–Crypto Transfers

A key requirement for users is the ability to move between fiat and crypto assets seamlessly.

This means integrating reliable on-ramps and off-ramps, supporting major stablecoins, and ensuring access to local currency rails. Whether a user is converting ETH to USD or sending USDC to a supplier, your system should support fast, low-friction transactions.

4. Native Blockchain Integration

A modern crypto bank should do more than just store digital assets. It should use blockchain technology as part of its core functionality.

This includes programmable payments, tokenized deposits, smart contracts for lending, and secure real-world asset custody. Blockchain should not be an add-on feature but a core component of your banking architecture.

How JP Morgan Is Building a Crypto-Friendly Bank?

JP Morgan provides a real-world example of what it looks like when a traditional financial institution embraces crypto strategically.

Through its Onyx platform, the bank has developed a live blockchain-based system for institutional payments. Onyx enables real-time, programmable money movement between large clients.

JP Morgan also launched JPM Coin, a private, permissioned stablecoin that facilitates daily settlements for billions in transactions. What makes their approach effective is their decision not to abandon traditional banking, but to enhance it by embedding blockchain into their existing systems and creating a compliant and secure hybrid model.

For institutions or startups looking to build a crypto bank, JP Morgan’s execution demonstrates that it is possible to modernize finance without undermining trust or compliance.

Read More: Why the UAE Is the Best Location to Launch a Crypto Neo Bank?

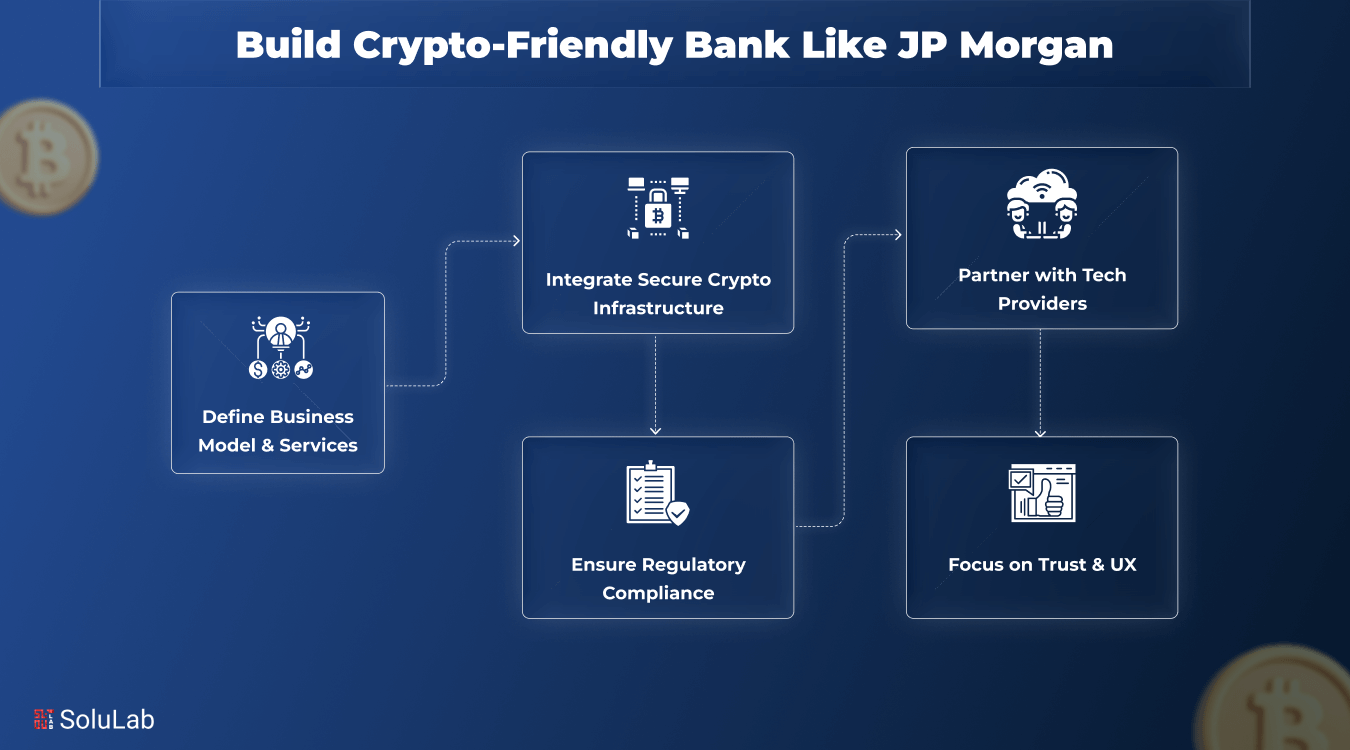

Key Steps to Build a Crypto-Friendly Bank Like JP Morgan in 2026

Building a crypto-friendly bank today requires more than just offering digital assets—it demands full integration of blockchain infrastructure, strong compliance, and customer trust. Here’s how to get started:

1. Define Your Business Model & Services

Decide whether you’ll act as a full-fledged digital bank, a neobank, or a traditional bank offering crypto services. Choose the mix of services: crypto wallets, trading, lending, DeFi access, or fiat-crypto conversion.

2. Integrate a Secure Crypto Infrastructure

Adopt enterprise-grade blockchain infrastructure, including:

- Multi-chain support (e.g., Ethereum, Solana, Bitcoin)

- Built-in wallet systems

- Cold/hot wallet integrations (e.g., Fireblocks)

- Smart contract automation for transactions and compliance

3. Ensure Regulatory Compliance

Stay aligned with local and global crypto regulations. Set up:

- KYC/AML verification systems

- Licenses (e.g., VASP, e-money)

- Legal consultation for ongoing compliance updates

4. Partner with Technology Providers

Collaborate with fintech or blockchain development experts to build:

- A seamless Web3-ready UI/UX

- Secure APIs for real-time trading

- AI-powered risk and fraud detection tools

5. Focus on Trust & User Experience

Offer high transparency, insured custody services, 24/7 customer support, and educational tools to build user confidence—just like JP Morgan does with Onyx and blockchain-backed settlement.

Real Use Cases of Crypto-Friendly Banks

Crypto-friendly banks are not theoretical. They serve real users with very real financial needs. Here are some of the most relevant use cases:

-

Personal Accounts That Support Both Fiat and Crypto

Users expect the convenience of managing all their assets, fiat and digital, in a single account. A crypto bank enables seamless payments, conversions, and transfers in both worlds.

-

Crypto Payment Solutions for Businesses

Web3 companies, DAOs, and digital-first startups need to pay employees, vendors, and contractors, often in stablecoins or native tokens. A crypto bank simplifies this with built-in compliance and reporting.

-

Institutional Custody and Asset Management

From NFTs to tokenized real estate, users are holding a wider variety of digital assets. A crypto bank must be able to securely custody all of these, backed by proper insurance and compliance.

-

Crypto-Backed Lending

Allowing users to borrow against crypto holdings without liquidating their assets is a high-demand service. Additionally, banks can offer stablecoin-based interest accounts and staking options under a regulated umbrella.

-

Treasury Management for Protocols and Funds

DAOs, investment funds and large crypto-native organizations require sophisticated tools to manage their hybrid treasuries. This includes fiat and crypto conversion, reporting, tax documentation and more.

Benefits of Starting a Crypto Bank in 2026

There is a convergence of opportunity and readiness in the current financial landscape.

Regulatory frameworks are becoming more defined. MiCA in the EU, SEC updates in the US, and more jurisdictions are now issuing digital asset licenses. This gives founders and institutions a much clearer path to launch a regulated crypto bank with confidence.

At the same time, demand is accelerating. Individuals want digital-first, crypto-native financial services. Businesses want compliant solutions they can trust. And institutions are looking for partners who understand both traditional finance and blockchain.

Meanwhile, the market remains relatively open. Most legacy banks have yet to adapt, and competition is still low compared to traditional fintech. If you enter now, you’ll not only be early, you’ll be ahead.

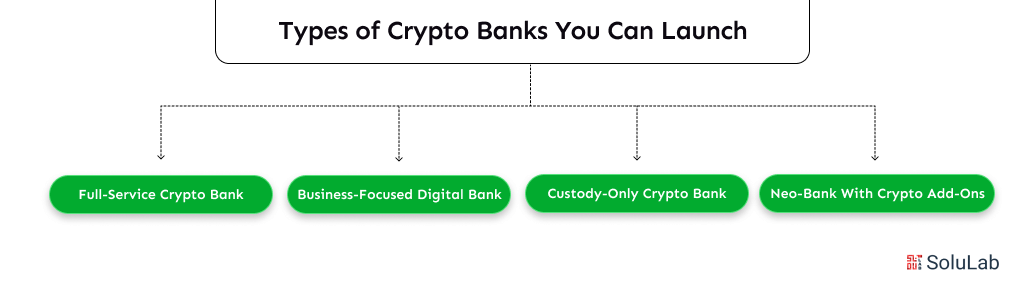

Types of Crypto Banks You Can Launch

You don’t need to be a financial giant to build something valuable. Several practical models depend on your goals and market. Here’s a breakdown:

1. Full-Service Crypto Bank

Offers everything crypto and fiat accounts, trading, lending, on-ramps, and custody.

Best for:

Founders who want to build the full stack or partner with a blockchain development company to create a complete ecosystem.

Why it works:

You become the all-in-one platform for retail and business users who want it all under one login.

2. Business-Focused Digital Bank

Tailored for Web3 startups, DAOs, and crypto-native businesses. Helps them manage treasury, payroll, payments, and compliance.

Best for:

B2B fintechs, agencies, or consultants offering white label crypto solutions for startups.

Why it works:

Web3 companies often struggle to get even basic banking access. You’ll be solving a real, persistent pain point.

3. Custody-Only Crypto Bank

Focuses solely on storing and protecting digital assets Bitcoin, stablecoins, NFTs, tokenized real estate, etc.

Best for:

Teams with deep cybersecurity expertise or targeting institutional clients.

Why it works:

As more real-world assets go on-chain, demand for secure, compliant custody is rising fast.

4. Neo-Bank with Crypto Add-ons

Looks and feels like a regular fintech app but lets users hold, swap, and send crypto alongside fiat.

Best for:

Startups looking to serve mainstream users dipping their toes into crypto.

Why it works:

You lower the barrier to entry by offering familiar banking, with optional crypto on top.

Each model has its own licensing needs, tech stack, and user base, but all are solid paths. Choose one based on your vision, resources, and regulatory strategy. And if you’re not sure where to start, this is where blockchain consulting services can help you map the right path forward.

Conclusion

Building a crypto-friendly bank in 2026 isn’t some distant idea; it’s a real, tangible opportunity. With regulations getting clearer, user demand climbing, and traditional banks still lagging, the space is wide open for innovation. Whether you’re launching a full-service platform, a custody-only solution, or a business-focused digital bank, success comes down to getting the fundamentals right: compliance, security, blockchain integration, and user-first features.

At SoluLab, we help visionaries bring crypto banking ideas to life. Whether you’re looking for white label crypto banking solutions, full-scale product development, or strategic blockchain consulting services, we’ve built it all. From licensing guidance to wallet infrastructure, we’re the technical team behind the next wave of crypto banks.

Ready to launch your own digital bank? Let’s build it together!

FAQs

1. What is a crypto-friendly bank?

It’s a bank that supports both fiat and cryptocurrencies for storage, transfers, and payments. It bridges traditional banking with blockchain technology.

2. How do I start a crypto-friendly bank in the USA?

You’ll need proper licensing, compliance systems, and a solid tech stack. Partnering with a blockchain development company can speed up the process.

3. What are the main features of a crypto bank?

Secure custody, fiat-crypto conversion, KYC/AML compliance, and blockchain integration. All built into a user-friendly banking platform.

4. Can I use white label crypto banking solutions to launch faster?

Yes, they offer ready-made infrastructure so you can go live quickly. Ideal if you want to skip custom development.

5. What are the benefits of starting a crypto bank in 2025?

Clearer regulations, rising demand, and low competition make it the right time. The market is wide open for new players.