Nowadays, we have AI integration in every field. But have you ever considered how cryptocurrency exchanges utilize AI? Artificial Intelligence is reshaping the world of trading. It provides data-based insights for crypto investors, smart risk management, and fast transactions. These are just some key roles of AI in cryptocurrency exchange.

AI tools are developing and can detect cyber scams and offer decision-making insights. Isn’t this amazing? This blog provides information on how AI is transforming the crypto space. Let’s explore the details to keep up with the merging technology.

Key Drivers of AI Adoption in Crypto Trading

AI is changing the way traders use crypto exchange services. It’s not just about automation anymore. AI systems now help make faster decisions, reduce errors, and improve returns. From analyzing price trends to detecting fraud, AI supports both beginners and institutional investors. Today’s exchanges offer smarter tools, thanks to machine learning, NLP, and advanced predictive models.

-

Real-Time Market Analysis and High-Frequency Trading

AI analyzes real-time data as the data increases, the model understands the patterns and provides insightful details. It also helps in executing thousands of transactions per second (TPS). High-frequency trading (HFT) uses powerful algorithms to monitor the price fluctuations across the crypto market. These systems aid in investors’ decision-making across the crypto trade.

-

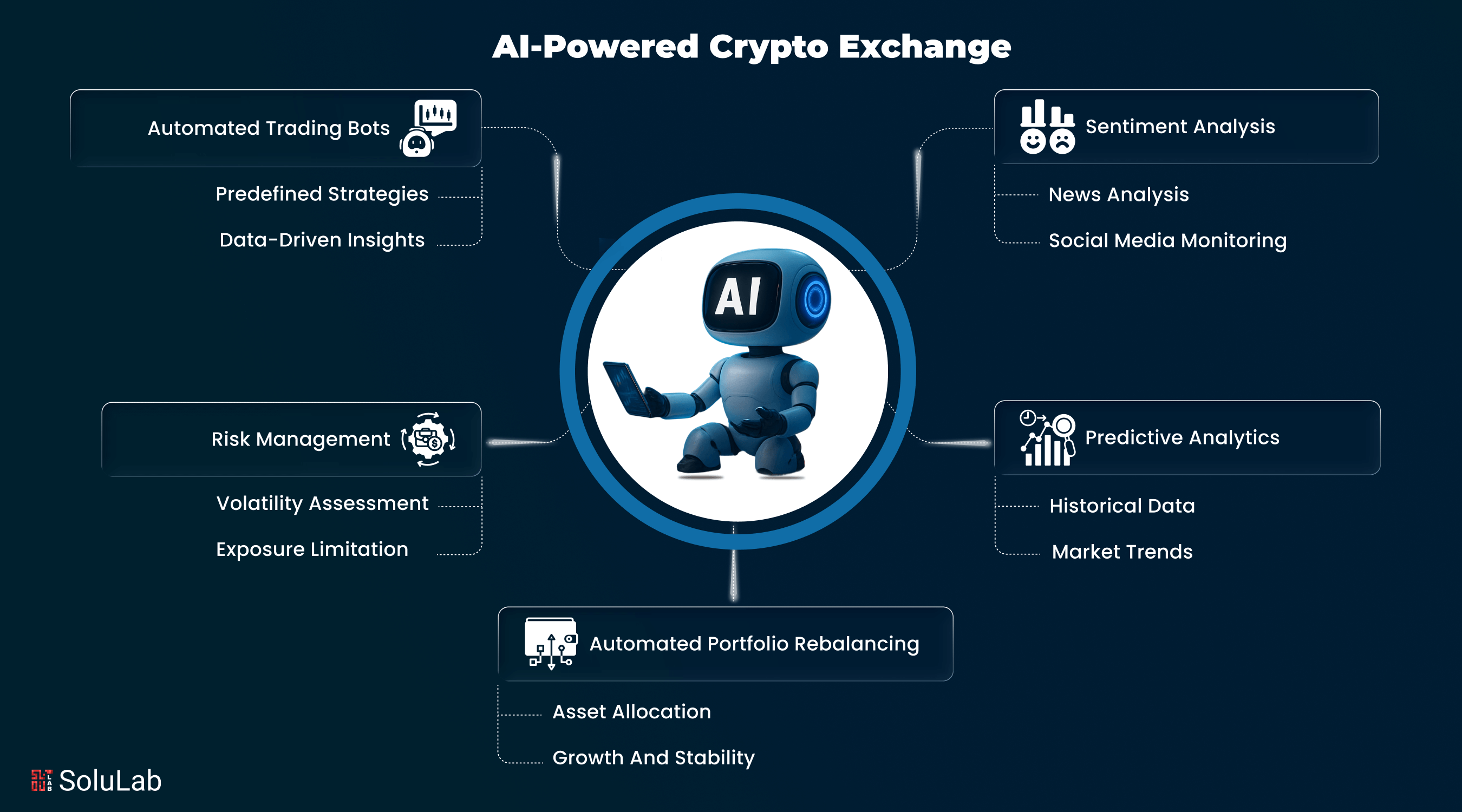

Sentiment Tracking and Predictive Analytics

AI tools scan social media, news, and on-chain data just like X chatbots that gather the latest tweets. NLP is used to identify the mood changes in price moments and investor sentiment. This is how AI in Cryptocurrency exchange plays a key role in providing investors with valuable information.

-

Automated Decision-Making Through Smart Bots

AI-powered trading bots learn from market behavior and adjust trading strategies automatically. They remove emotional bias and execute with discipline. Smart bots improve over time through reinforcement learning. These bots monitor entry/exit points and rebalance portfolios based on risk and reward.

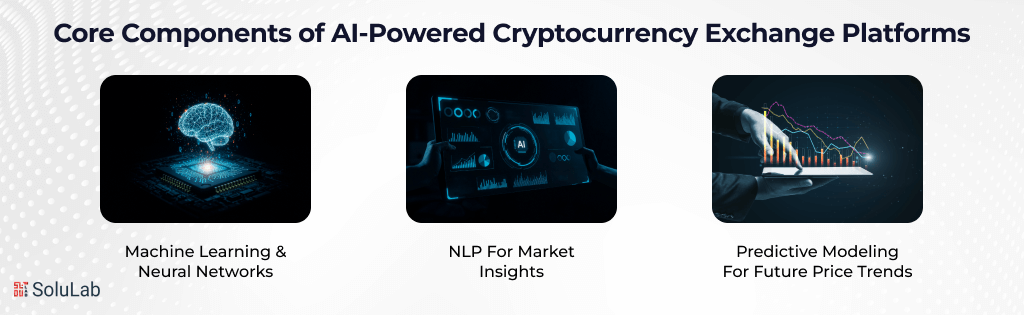

Core Components of AI-Powered Cryptocurrency Exchange Platforms

Modern exchanges use multiple AI components working in sync. These tools provide predictions, analysis, insightful information, data processing, and much more. Let’s check the following for detailed information:

-

Machine Learning & Neural Networks

Machine learning identifies patterns from large data sets. It helps with price forecasting, user behavior, and anomaly detection. Neural networks mimic human thinking and adapt continuously. These systems grow smarter with each data point, improving trading accuracy.

-

Natural Language Processing (NLP) for Market Insights

Natural Language Processing (NLP) allows AI to understand human language. It powers features like chatbots, sentiment analysis, and customer support. NLP also helps detect fake news and false signals. This creates more trustworthy market insights.

-

Predictive Modeling for Future Price Trends

Predictive models use historical trends to guess future moves. AI looks at volume, volatility, and social signals. Unlike manual analysis, AI can spot weak signals hidden in noise. This gives a sharper edge in volatile markets.

Check Out Blog Post: Launch Your Cryptocurrency Exchange Software in the UK

Key Functionalities of AI Trading Systems in Crypto Exchange

AI-based systems offer several features that simplify crypto trading. These tools help with execution, risk management, personalization, and liquidity tracking.

1. Algorithmic Strategy Execution and Portfolio Rebalancing

AI executes trading plans with speed and accuracy. It can rebalance portfolios automatically based on risk preferences. Strategies like grid trading or mean reversion become automated, saving time and effort.

2. Personalized Dashboards and Trading Recommendations

AI customizes dashboards for each user. Based on past activity, it shows alerts, strategies, and asset suggestions. It learns user goals and adjusts the interface for better control. New traders benefit from AI-powered recommendations, while pros get fine-tuned analytics.

3. Margin Optimization and Liquidity Management

AI tracks available capital and borrowing rates in real time. It helps traders use margin smartly without getting liquidated. For exchanges, AI manages liquidity across markets, ensuring smoother trades even during high volatility.

How AI Strengthens Security and Compliance in Crypto Trading?

Security remains a key focus in crypto trading. AI protects users, systems, and data while also managing compliance tasks automatically.

-

Fraud Detection and Anomaly Monitoring

AI spots suspicious behavior like unusual login patterns, abnormal withdrawals, or flash dumps. It alerts users or blocks actions instantly. These systems improve over time, reducing false positives and improving platform safety.

-

Biometric Authentication for Safer Access

AI enables facial recognition, fingerprint login, or behavioral biometrics. These methods replace passwords, lowering the chance of hacks. Exchanges can now verify user identity without needing long authentication steps.

-

AI-Driven KYC/AML and Regulatory Checks

Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are critical. AI scans documents, verifies identities, and flags risky users. It handles large volumes of compliance data in minutes, cutting manual workload.

Institutional-Grade Features for Traders

Institutions demand scale, safety, and compliance. AI makes crypto exchanges ready for professional traders.

-

Compliance Automation for Institutional Onboarding

AI helps automate onboarding for large clients. It verifies documents, runs risk checks, and ensures global regulatory compliance. Institutions can onboard faster, with reduced errors and better oversight.

-

Advanced Risk Management Systems

AI monitors portfolios, leverage ratios, and market volatility. It alerts traders about risk exposure. For exchanges, it prevents flash crashes and manipulative trades. AI acts like a 24/7 risk manager. Hence, AI in crypto exchanges is making a new shift in technology.

-

Scalable Performance Under High Load

AI systems optimize server loads, database access, and transaction queues. During market surges, they adjust in real-time to avoid downtime. This ensures a smooth experience during high-volume days.

Read Also: Build Hack Resistant Crypto Exchange

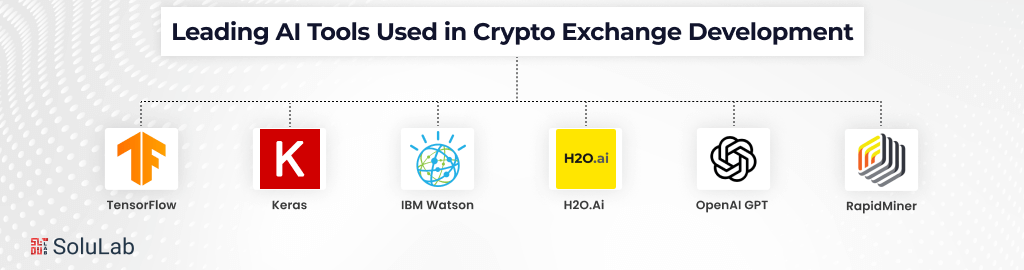

Leading AI Tools Used in Crypto Exchange Development

Behind every AI-powered crypto exchange are advanced tools. These platforms help build, test, and deploy intelligent trading systems.

1. TensorFlow and Keras for Deep Learning Models

Google’s TensorFlow and its companion, Keras, are used to train deep learning models. These tools help build complex AI systems that learn from trading data, optimize performance, and manage risks.

2. IBM Watson and H2O.ai for Market Analytics & Compliance

Watson helps with NLP, compliance, and market research. H2O.ai offers auto-ML tools to build models without coding. Exchanges use these to stay updated with regulatory norms and market shifts.

3. OpenAI GPT for NLP and User Engagement

GPT models, like ChatGPT, power human-like interactions. They handle FAQs, interpret commands, and offer support. GPT also helps write reports and explain trades, making AI more accessible to users.

4. RapidMiner for Drag-and-Drop AI Model Deployment

RapidMiner allows teams to build top AI models without deep coding. It helps deploy models for fraud detection, churn prediction, and pricing strategies.

Read Also: AI in Crypto Banking

Future Trends and Ecosystem Integration

AI in crypto exchanges is reshaping and going beyond trading. It will become part of a much bigger financial ecosystem.

1. Multi-Modal Signal Fusion Across Data Channels: AI will combine multiple signals, price, volume, social buzz, and news, into one decision layer. This offers sharper insights. Instead of using one tool for charts and another for news, traders get a unified signal.

2. Integration with DeFi, Yield Farming, and Blockchain Analytics: AI will soon support DeFi strategies like yield farming, staking, and liquidity mining. It will also analyze on-chain data to spot protocol risks, gas fee changes, and token movements. These features will expand AI’s role from CEXs to DEXs.

3. Explainable AI for Transparent Trade Justification: Traders want to know why AI made a decision. Explainable AI (XAI) breaks down the reasoning behind each action. This improves trust and reduces blind reliance on bots.

Conclusion

As discussed in the blog, AI is transforming the whole world, and cryptocurrency exchange is being part of it. From smart bots to predictive analytics, AI has started to create secure, faster, and reliable trading experiences. If you are also looking for such intelligent AI-powered crypto services, then SoluLab is here to aid you.

SoluLab is one of the top cryptocurrency exchange development companies in the USA. At SoluLab, we offer scalable, regulation-ready platforms built with AI. This enables seamless onboarding, institutional security, and real-time performance. Stay ahead of the curve with a smarter trading infrastructure built by experts.

Contact us today to start your new journey with AI-powered cryptocurrency exchange services.

FAQs

1. How is AI used in cryptocurrency exchanges?

AI helps exchanges make faster decisions, detect fraud, manage risk, and suggest smart trading moves. It keeps trading secure, efficient, and less stressful for users.

2. Can AI predict crypto market trends accurately?

Yes, AI uses past data, social signals, and trading patterns to make predictions. While not perfect, it often spots trends early that humans may miss.

3. What are AI trading bots, and how do they help?

AI trading bots watch the market, learn patterns, and make trades automatically. They avoid emotional decisions and help users trade more consistently with better timing.

4. Is AI safe to use in crypto exchanges?

Absolutely. AI boosts safety by spotting fraud, managing compliance, and using biometric security. It acts like a smart bodyguard for your crypto activities.

5. Will AI completely replace human crypto traders?

No, AI supports traders but doesn’t replace them. It provides insights and automation, while humans still control strategy, emotions, and big decisions.